Asia

Will China’s $1.2 Trillion Trade Surplus Overwhelm Global Trade?

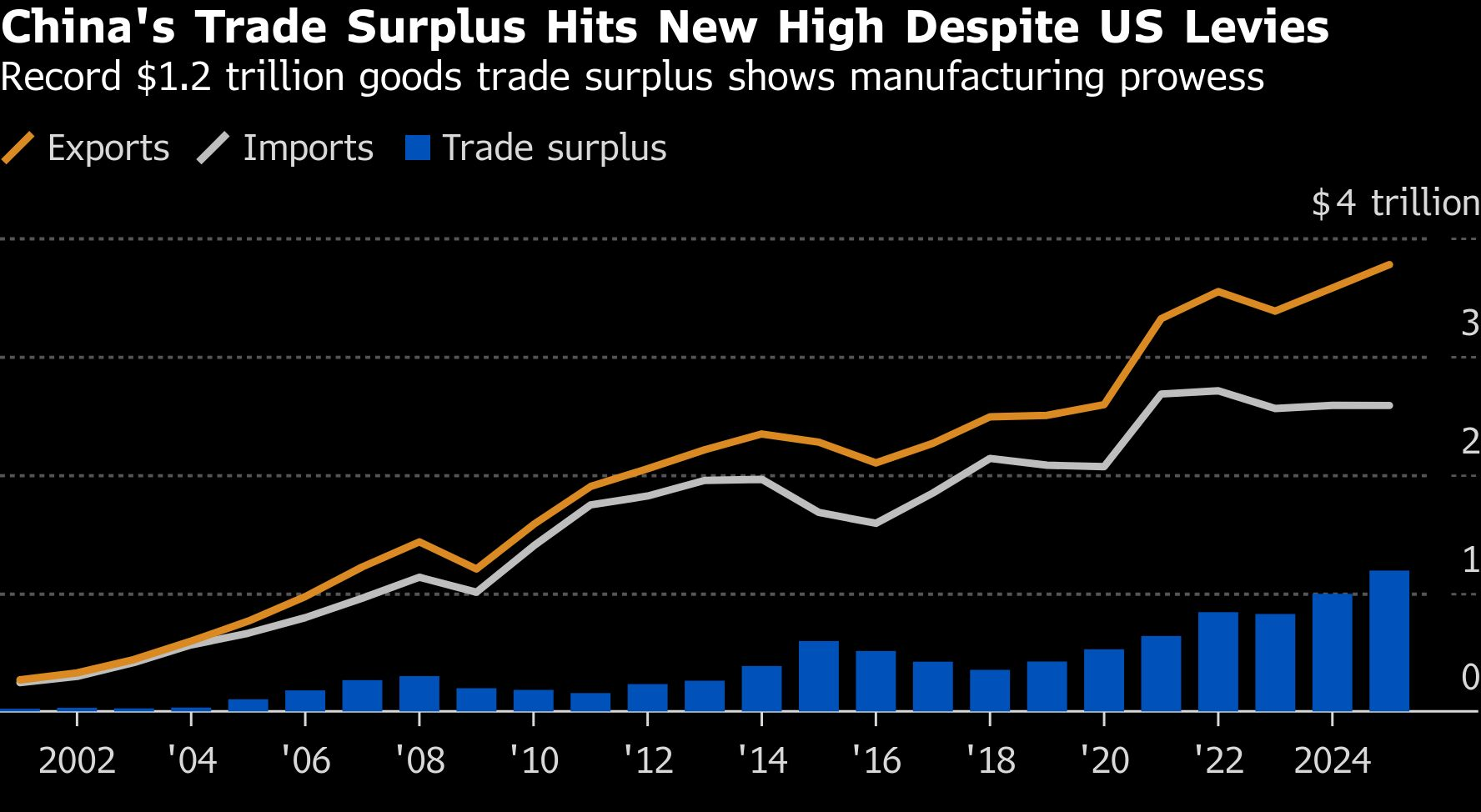

Just weeks into 2026, China’s economic data release has sent shockwaves through global financial markets and policy circles. Despite an escalating tariff war and predictions of export decline, China’s 2025 trade surplus reached an astonishing $1.2 trillion—the largest in modern economic history. This wasn’t supposed to happen. As Washington imposed punitive tariffs and Brussels contemplated countermeasures, conventional wisdom held that China’s export machine would finally slow. Instead, it accelerated, raising profound questions about the future architecture of global commerce and whether the international trading system can absorb such concentrated imbalances without fracturing.

The numbers reveal more than an economic anomaly. They expose a fundamental recalibration of global trade flows, the resilience of China’s manufacturing ecosystem, and the limitations of tariff-based trade policy. For policymakers in Washington, Brussels, and emerging economies alike, China’s record trade surplus represents both a challenge and a mirror—reflecting deeper questions about industrial competitiveness, currency dynamics, and the sustainability of growth models built on either consumption or production extremes.

The Record-Breaking Numbers: What the Data Really Shows

According to official data released by China’s customs authority in mid-January, China’s 2025 trade surplus reached approximately $1.189 trillion, with exports growing 5.9% year-on-year to $3.58 trillion while imports barely budged at $2.39 trillion. The magnitude staggers: this surplus exceeds the entire GDP of most nations and dwarfs previous records, including China’s own pre-pandemic peaks.

Breaking down the numbers reveals the mechanics of this surge. Exports to the United States—the focal point of trade tensions—actually declined sharply by double digits in the final months of 2025, precisely as anticipated. Yet this contraction was more than offset by explosive growth elsewhere. Chinese exports to ASEAN nations surged approximately 15%, to the European Union by 8-10%, and to Latin America and Africa by double-digit percentages, as Bloomberg’s analysis documented. China’s export base, it turns out, had quietly diversified far more effectively than Western analysts appreciated.

The import side tells an equally important story. While export values climbed, import growth flatlined at roughly 1%, reflecting tepid domestic demand and China’s increasing self-sufficiency in key inputs. This asymmetry—surging exports coupled with stagnant imports—transformed what might have been a respectable trade performance into a historic imbalance. China now accounts for approximately 14% of global goods exports but only 11% of imports, creating a structural gap that redistributes demand away from trading partners.

Drivers of the Surge: Deflation, Currency, and Diversification

Three interconnected forces propelled China’s trade performance to record heights, each reinforcing the others in ways that confounded trade policy aimed at a single pressure point.

Production-side deflation emerged as the unexpected catalyst. China’s producer price index remained negative or near-zero throughout 2025, meaning factory-gate prices actually fell even as global inflation persisted elsewhere. This deflationary environment—driven by overcapacity in manufacturing sectors from steel to electric vehicles—made Chinese goods increasingly price-competitive globally. A solar panel, EV battery, or textile manufactured in China cost 10-20% less than a year prior, while competitors in Vietnam, Mexico, or Eastern Europe struggled with rising input costs. For importers worldwide facing inflation-squeezed consumers, Chinese products became irresistible.

The renminbi’s carefully managed depreciation amplified this price advantage. The currency weakened approximately 5% against the dollar in 2025, making exports cheaper in foreign currency terms while raising the cost of imports. Whether this reflected deliberate policy or market forces remains debated, but the effect was unambiguous: Chinese exporters gained a compounding advantage. The Financial Times noted that Beijing walked a tightrope, allowing enough depreciation to support exports without triggering capital flight or Western accusations of currency manipulation.

Perhaps most significantly, China’s geographic diversification strategy matured. The Belt and Road Initiative, RCEP trade agreements, and targeted investment in emerging markets created alternative export corridors precisely when needed. When U.S. tariffs threatened 40% of potential exports, Chinese manufacturers had already cultivated relationships in Jakarta, Lagos, Mexico City, and Warsaw. These weren’t merely replacement markets but growing economies hungry for affordable industrial goods, consumer electronics, and infrastructure inputs that China produces at scale.

This diversification operated at multiple levels. Chinese firms established assembly operations in Vietnam and Mexico to circumvent tariffs—a practice trade officials call “transshipment” but which represents rational supply chain optimization. Meanwhile, exports of intermediate goods to these countries surged, meaning final products bore “Made in Vietnam” labels while value-added remained substantially Chinese. The New York Times analysis highlighted how this “tariff arbitrage” effectively neutralized much of Washington’s trade offensive.

Winners and Losers: Sectoral and Regional Impacts

The record surplus wasn’t evenly distributed across China’s economy. Electric vehicles, batteries, and solar panels emerged as star performers, with exports in these “new three” categories surging by 30-60% to global markets eager for energy transition technologies. Europe’s green transition targets and emerging market electrification created insatiable demand that only China’s manufacturing scale could meet. A European buyer could choose between a €35,000 Chinese EV or a €50,000 European alternative—and increasingly chose the former.

Traditional manufacturing sectors told different stories. Electronics and machinery maintained steady growth of 5-8%, benefiting from global digitalization trends and China’s dominance in semiconductor assembly and consumer electronics. However, textiles and apparel faced headwinds as production continued shifting to Bangladesh, Vietnam, and India, where labor costs remained lower. The surplus in these legacy sectors shrank, even as higher-value manufactured goods compensated.

Regionally, coastal manufacturing hubs in Guangdong, Jiangsu, and Zhejiang captured the lion’s share of export growth, while interior provinces lagged. This geographic concentration reinforced China’s internal economic imbalances—precisely the problem Beijing’s “dual circulation” policy aimed to address. The export surge, paradoxically, may have delayed necessary rebalancing toward domestic consumption.

For China’s trading partners, the impacts varied dramatically. ASEAN nations benefited as both alternative markets and manufacturing partners, seeing Chinese investment and supply chain integration accelerate. European importers gained access to affordable goods that helped contain inflation, though manufacturers voiced growing concerns about unfair competition from subsidized Chinese rivals. The United States experienced the predicted surge in non-Chinese imports that were frequently Chinese in origin—the trade deficit persisted even as bilateral flows declined.

Emerging economies faced a more complex calculus. Affordable Chinese machinery, vehicles, and industrial inputs supported development and infrastructure projects. Yet domestic manufacturers in countries like India, Brazil, and South Africa struggled against Chinese competition, prompting protectionist responses. As one trade economist observed, China’s surplus represented simultaneous opportunity and threat—infrastructure enabler and industrial destroyer.

Geopolitical Ripple Effects: Tariffs, Protectionism, and Retaliation Risks

The record surplus arrives at a geopolitically fraught moment, potentially catalyzing a new wave of protectionist measures that could fragment global trade more decisively than anything witnessed since the 1930s.

Washington’s reaction has been predictably sharp. With the 2025 data confirming that tariffs failed to reduce the bilateral deficit meaningfully, voices across the political spectrum are demanding more aggressive measures. Proposals under discussion include universal tariffs on all Chinese imports, secondary sanctions on countries facilitating transshipment, and restrictions on Chinese investment in strategic sectors. The Wall Street Journal reported that bipartisan congressional coalitions view the surplus as vindication of hawkish trade policy, not evidence of its failure.

The European Union confronts its own dilemma. European consumers benefit from affordable Chinese goods that suppress inflation, yet manufacturers face existential threats from subsidized Chinese EVs and industrial products. Brussels has initiated anti-subsidy investigations and considered carbon border adjustment mechanisms, but internal divisions between manufacturing-heavy Germany and consumption-oriented economies complicate unified action. The surplus forces Europe to choose between consumer welfare and industrial policy—a choice it’s reluctant to make.

For emerging economies, China’s surplus creates a prisoner’s dilemma. Individual countries benefit from Chinese investment and affordable imports, yet collectively they risk long-term deindustrialization. India has imposed targeted tariffs and investment restrictions, while Brazil and South Africa debate similar measures. Yet aggressive countermeasures risk alienating a crucial trading partner and infrastructure financier. The result is a patchwork of inconsistent responses that leaves global trade governance weakened.

The currency dimension adds another layer of complexity. A $1.2 trillion surplus represents enormous downward pressure on the renminbi, which China’s central bank must counteract through intervention or capital controls. This accumulation of foreign exchange reserves—already the world’s largest—raises questions about currency manipulation that could trigger coordinated Western responses. Yet allowing the renminbi to appreciate would devastate export competitiveness, creating a policy trap Beijing may struggle to escape.

Perhaps most concerning is the erosion of multilateral trade governance. The WTO, already weakened, offers no clear mechanism to address such concentrated imbalances. Bilateral negotiations have proven ineffective. The risk is that countries increasingly resort to unilateral measures—tariffs, quotas, subsidies, and sanctions—that fragment global commerce into competing blocs. The record surplus, in this view, isn’t merely an economic statistic but a catalyst for systemic breakdown.

Can This Continue? 2026 Outlook and Policy Dilemmas

Projecting whether China can sustain or expand its record surplus involves weighing contradictory forces, each powerful enough to reshape trade flows dramatically.

Headwinds appear formidable. Global demand growth is slowing as major economies navigate post-pandemic adjustments and elevated interest rates. The tariff offensive will intensify—both from the U.S. and increasingly from Europe and emerging economies concerned about Chinese overcapacity. China’s demographic decline and rising labor costs erode competitiveness in labor-intensive sectors. Most significantly, the political tolerance for such concentrated imbalances is exhausted. Further surplus expansion risks triggering coordinated protectionist responses that could overwhelm even China’s diversification efforts.

Yet countervailing forces remain strong. China’s manufacturing ecosystem offers scale, speed, and cost advantages competitors struggle to match. The energy transition creates massive demand for Chinese-dominated technologies—EVs, batteries, solar panels—where alternatives remain years behind in cost and capacity. Belt and Road and RCEP integration continues deepening, creating trade corridors partially insulated from Western pressure. China’s ability to manage currency and deploy industrial subsidies gives it policy tools competitors lack.

The likely scenario isn’t simple continuation but rather volatility around a persistently high plateau. The surplus may moderate from $1.2 trillion but remain historically elevated—perhaps $800 billion to $1 trillion annually. Geographic composition will shift as some markets impose barriers while others open. Sectoral mix will evolve toward higher-value goods as low-end manufacturing continues migrating elsewhere.

Beijing faces its own policy dilemmas. The export surge masked deeper problems: weak domestic demand, deflation, property sector distress, and mounting local government debt. The record surplus reflects not just export strength but consumption weakness—Chinese households saving rather than spending. Rebalancing toward domestic consumption would reduce the surplus but requires politically difficult reforms: stronger social safety nets, reduced savings incentives, and allowing wages to rise faster than productivity.

There’s also a temporal dimension. China’s surplus may represent a last hurrah before demographic decline, rising costs, and supply chain diversification take their toll. Countries and firms are actively reducing China dependency—”de-risking” in diplomatic parlance. Vietnam, India, Mexico, and others are attracting investment that might have gone to China a decade ago. These shifts take years to materialize, meaning China’s export dominance may persist medium-term before eroding long-term.

Conclusion: A Turning Point for Global Trade?

China’s $1.2 trillion trade surplus represents more than an impressive economic statistic—it’s a stress test of global trade architecture, revealing fractures that may prove irreparable under current frameworks.

The surplus demonstrates that tariffs alone cannot rebalance trade relationships when cost advantages, manufacturing ecosystems, and alternative markets exist. It shows that global value chains have grown complex enough to route around bilateral restrictions. It confirms that concentrated economic power—whether American financial dominance or Chinese manufacturing supremacy—creates systemic risks that multilateral institutions can no longer manage.

Yet it also reveals vulnerabilities. China’s economy remains dangerously dependent on external demand even as trading partners grow hostile. The surplus itself evidence of imbalanced growth—too much production, too little consumption—that stores up future risks. Global tolerance for such concentration has limits, and those limits may be approaching.

The coming years will likely witness competing forces: China’s formidable manufacturing advantages against rising protectionism; globalization’s efficiency gains against geopolitical fragmentation; multilateral governance against unilateral power. Which force prevails will shape not just trade flows but the global economic order itself.

For investors, policymakers, and business leaders, several questions demand attention: Can Western economies rebuild manufacturing competitiveness without prohibitive costs? Will emerging markets become genuine alternatives to China or remain dependent suppliers? Can global trade governance adapt to concentrated power, or will it fracture into competing blocs? And perhaps most fundamentally: Is a $1.2 trillion surplus sustainable economically, or merely sustainable politically until it suddenly isn’t?

The answers will determine whether 2025’s record marks a peak or a plateau—and whether global trade can accommodate such imbalances or will be overwhelmed by them.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Asia

Adapt, Absorb, Act: The Triple-A Mandate for APAC CEOs in 2026

Facing US tariffs, tech disruption & shifting alliances, APAC CEOs’ 2026 mandate is resilient adaptation. Discover the data-driven Triple-A framework for strategic coherence and decisive action.

The call from the logistics center arrived at 3 a.m. Singapore time. A container ship, mid-voyage from Ho Chi Minh City to Long Beach, now faced a labyrinth of newly announced US tariffs. For the CEO on the line, the decision wasn’t just about rerouting cargo; it was a stark preview of the next three years. This is the new dawn for Asia-Pacific leaders: an era where volatility is not an interruption but the operating environment itself.

The old playbooks—optimized for a generation of stable globalization—are obsolete. The mantra for 2026 and beyond crystallizes into a relentless cycle: Assess the shifting landscape with brutal clarity, Adapt your organization with strategic coherence, and Act with a decisiveness that embeds change into your company’s DNA. This isn’t about survival; it’s about forging a decisive competitive advantage from the very forces seeking to disrupt you.

Assess: Mapping the Unstable Geometry of Trade, Tech, and Alliances

The first discipline of the modern APAC CEO is geopolitical and technological triage. The landscape is no longer simply changing; it is fragmenting, creating competing spheres of influence and risk.

The New US Tariff Reality: A Fork in the Road, Not a Speed Bump

Recent policy shifts, including the extension and expansion of Section 301 tariffs, represent a structural reset, not a cyclical adjustment. As noted by the Peterson Institute for International Economics, these measures are compelling a fundamental “supply chain redesign” that goes far beyond finding alternative suppliers. The goal is no longer just cost efficiency, but strategic resilience—building networks that can absorb political, not just logistical, shocks. For CEOs, this means mapping every critical component against a matrix of geopolitical risk and tariff exposure. The question has shifted from “Where is it cheapest?” to “Where is it safest, and what is the true cost of that safety?”

Beyond “Friend-Shoring”: The Nuanced Alliance Calculus

The conversation has moved past simple binaries. It’s not just about aligning with Washington or Beijing. A 2024 report from the Economist Intelligence Unit highlights the rise of “multi-alignment,” where nations like Vietnam, India, and members of ASEAN deftly engage with all powers to maximize sovereignty and economic benefit. For a CEO, this means your partnership in Indonesia might be viewed differently in Brussels than your joint venture in South Korea. Understanding this nuanced map—where alliances are situational and technology standards are battlegrounds—is paramount. Your geopolitical risk management must now be as sophisticated as your financial risk modeling.

Adapt: Building the Organization That Changes Without Unraveling

Once assessed, volatility must be met with adaptation. But here lies the critical flaw in many responses: chaotic, reactive pivots that drain morale and blur strategic focus. True resilience, as outlined by thought leaders at Harvard Business Review, is the ability to “change repeatedly without losing strategic coherence.”

The Resilience Dividend: Shared Purpose as Your Anchor

In this environment, a well-articulated, deeply held corporate purpose is your most valuable asset. It is the keel of your ship. When a new tariff forces a business model adjustment, or a breakthrough in AI demands a service overhaul, teams aligned on why the company exists can navigate how it changes with remarkable agility. This shared purpose transcends quarterly targets; it provides the cultural permission to abandon legacy practices and the gravitational pull to keep new initiatives aligned to a core mission. The resilient organization isn’t a fortress—it’s a purposeful organism.

Act: The Decisive Engine of Learning, Skilling, and Governance

Assessment without action is paralysis. Adaptation without execution is fantasy. The final pillar of the 2026 mandate is building an engine for decisive, embedded change.

From Reskilling to “Upskilling Ecosystems”

Investing in workforce reskilling is table stakes. The leading CEOs are building dynamic upskilling ecosystems. This involves partnering with governments (leveraging Singapore’s SkillsFuture initiative, for example) and edtech platforms to create continuous, just-in-time learning pathways. As McKinsey & Company research stresses, building human capital immunity—the capacity to rapidly redeploy talent to new priorities—may be the ultimate competitive moat. This goes beyond workshops; it requires rethinking career lattices, reward systems, and how you identify potential.

Governance as the Shock Absorber: Embedding New Workflows

Decisive action fails if new strategies die in the echo chamber of the C-suite. Establishing agile, empowered governance structures is the mechanism that translates strategy into operations. This means creating cross-functional “nerve centers” for critical issues like supply chain redundancy, with the authority to cut through bureaucracy. It requires upgrading capabilities not as IT projects, but as core business processes. The test is simple: is the new supply chain redesign workflow fully embedded in your procurement team’s daily rituals? Is the data from your new risk dashboard actively steering monthly investment reviews? If not, the action hasn’t been completed.

The 2026 Vantage Point

For the APAC CEO, the path ahead is not one of bracing for impact, but of steering into the storm with a new navigational system. The Triple-A Framework—Assess, Adapt, Act—is not a sequential checklist but a continuous, reinforcing loop. You assess to inform adaptation, you adapt to enable decisive action, and the outcomes of your actions become the data for your next assessment.

The CEOs who will dominate the latter half of this decade are those who stop asking, “When will things return to normal?” They understand that this is normal. Their mandate is to build organizations that are not just robust, but antifragile—thriving on volatility because their strategic coherence, empowered people, and adaptive engines turn disruption into distance from their competitors. The 3 a.m. call will come. The question for 2026 is: What system have you built to answer it?

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Asia

The Great Singapore Disinflation: Why MAS Will Stand Firm as a Global Storm Abates

Singapore’s core inflation fell to 0.7% in 2025. With price pressures receding, the MAS is expected to hold policy steady in January 2026, marking a new phase for the city-state’s economy.

The late afternoon sun slants through the canopy of the Tiong Bahru Market hawker centre, glinting off stainless steel steamers and the well-worn handles of kopi cups. Here, at the heart of Singapore’s quotidien life, the most consequential economic conversation of the year is being had, not in the jargon of central bankers, but in the simple calculus of daily purchases. An auntie considers the price of char siew before ordering; a taxi driver compares the cost of his teh tarik to last year’s. For the first time in nearly half a decade, that mental math is bringing a faint, collective sigh of relief. The fever of inflation—which spiked to a 14-year high in 2023—has broken. The Monetary Authority of Singapore (MAS), the nation’s powerful central bank, now faces a delicate new reality: not of battling runaway prices, but of navigating a return to profound price stability in a world still rife with uncertainty.

On January 29, 2026, the MAS will release its first semi-annual monetary policy statement of the year. All signs, confirmed by the latest data from the Singapore Department of Statistics (SingStat), point to a unanimous decision: the central bank will keep its exchange rate-centered policy settings unchanged. The full-year data for 2025 is now in, and it tells a story of remarkable disinflation. Core Inflation—the MAS’s preferred gauge, which excludes private transport and accommodation costs—came in at 0.7% for 2025, a dramatic decline from 2.8% in 2024 and 4.2% in 2023.

Headline inflation for the year was 0.9%. December’s figures showed both core and headline inflation holding steady at 1.2% year-on-year, indicating a stable plateau as the economy adjusts to a post-shock norm. This outcome, while slightly above the government’s earlier 2025 forecast of 0.5%, underscores a victory in the battle against imported global inflation. Economists widely anticipate that alongside its stand-pat decision, the MAS and the Ministry of Trade and Industry (MTI) will revise the official 2026 inflation forecast range upward, from the current 0.5–1.5% to a likely 1–2%. This adjustment would not signal a new tightening impulse, but rather a recognition of stabilizing domestic price pressures and base effects, framing a modestly more hawkish guardrail for the year ahead.

The Data Unpacked: A Return to Pre-Pandemic Normality

To appreciate the significance of the 0.7% core inflation print, one must view it through the corrective lens of recent history. Singapore, as a miniscule, trade-reliant economy, is a hyper-sensitive barometer of global price pressures. The supply-chain cataclysm of 2021-2022 and the energy shock following Russia’s invasion of Ukraine were transmitted directly into its domestic cost structure, amplified by robust post-pandemic domestic demand.

Table: Singapore Core Inflation (CPI-All Items ex. OOA & Private Road Transport)

| Year | Core Inflation Rate (%) | Key Driver |

|---|---|---|

| 2022 | 4.1 | Broad-based imported & domestic cost pressures |

| 2023 | 4.2 | Peak passthrough, tight labour market |

| 2024 | 2.8 | MAS tightening, global disinflation begins |

| 2025 | 0.7 | Sustained MAS policy, falling import costs |

| 2026F | 1.0 – 2.0 | Stabilising domestic wages, moderated global decline |

The journey down from the peak has been methodical, reflecting the calibrated tightening by the MAS. Since October 2021, the authority had undertaken five consecutive rounds of tightening, primarily by adjusting the slope, mid-point, and width of the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) policy band. This unique framework, which uses the exchange rate as its primary tool, effectively imported disinflation by strengthening the Singapore dollar, making imports cheaper in local currency terms. The decision to pause this tightening cycle in July 2024 was the first signal that the worst was over.

The 2025 disinflation was broad-based. Key contributors included:

- Food Inflation: Eased significantly from 3.8% in 2024 to an average of 1.8% in 2025, as global supply chains normalized and commodity prices softened.

- Retail & Other Goods: Inflation turned negative in several quarters, reflecting lower imported goods prices and weaker discretionary spending.

- Services Inflation: Moderated but remained stickier, a testament to persistent domestic wage pressures in a tight labour market. However, even here, the pace decelerated markedly by year-end.

The slight overshoot of the 0.7% outcome relative to the official 0.5% forecast is statistically marginal but analytically noteworthy. It likely reflects the residual stickiness in domestic services costs and perhaps a firmer-than-anticipated trajectory for accommodation costs, which are excluded from the core measure but feed into overall economic sentiment.

The MAS Mandate in a New Phase: Vigilance Over Volatility

The MAS operates under a singular mandate: to ensure price stability conducive to sustainable economic growth. Unlike most central banks, it does not set an interest rate but manages the S$NEER. The current expectation of an unchanged policy stance is a statement of confidence that the existing level of the currency’s strength is sufficient to keep imported disinflation flowing while guarding against any premature loosening of financial conditions.

“The current rate of appreciation of the S$NEER policy band is sufficient to ensure medium-term price stability,” the MAS stated in its October 2025 review. The latest inflation data validates this assessment. Holding the policy band steady now achieves two objectives:

- It Anchors Expectations: It signals to businesses and unions that the central bank sees no need for further tightening, but is equally not prepared to risk its hard-won credibility by easing policy while core inflation, though low, is expected to rise modestly through 2026.

- It Provides a Buffer: A stable, moderately strong Singapore dollar acts as a shock absorber against potential renewed volatility in global energy and food prices, which remain susceptible to geopolitical flare-ups.

The anticipated upward revision of the 2026 forecast range to 1–2% is the key nuance in this meeting. This is not a hawkish pivot, but a realistic recalibration. It acknowledges several forward-looking dynamics:

- Base Effects: The very low inflation in late 2024 and early 2025 will create less favourable base effects for year-on-year comparisons in late 2026.

- Domestic Cost Pressures: Wage growth, while moderating, is expected to remain above pre-pandemic trends, supported by structural tightness in the local labour market and ongoing initiatives like the Progressive Wage Model.

- Policy-Driven Price Increases: The scheduled 1%-point GST increase to 10% in January 2026 will impart a one-time upward push to price levels, which the MAS will look through but must account for in its communications.

The Global and Comparative Lens: Singapore as a Bellwether

Singapore’s disinflation narrative is not occurring in a vacuum. It mirrors, and in some respects leads, trends in other small, advanced, open economies. A comparative view is instructive:

- Switzerland: Like Singapore, Switzerland has seen inflation return to target rapidly, aided by a strong currency (the Swiss Franc) and direct government interventions on energy prices. The Swiss National Bank has already shifted to a neutral stance, with discussions of easing emerging.

- Hong Kong: Linked to the US dollar via its currency peg, Hong Kong has had its monetary policy dictated by the Federal Reserve. Its disinflation path has been bumpier, complicated by its unique economic integration with mainland China and a slower post-pandemic recovery in domestic demand.

- New Zealand: The Reserve Bank of New Zealand has maintained a more hawkish stance, with inflation proving stickier due to a less open consumption basket and intense domestic capacity constraints. New Zealand’s cash rate remains restrictive.

Singapore’s experience stands out for the precision of its policy tool. The S$NEER framework allowed it to respond directly to the imported nature of the inflation shock. As Bloomberg Economics noted in a January 2026 analysis, “The MAS’s exchange-rate centered policy has acted as a targeted filter for global inflation, proving highly effective in the post-pandemic cycle.” This successful navigation has bolstered the authority’s international credibility and the Singapore dollar’s status as a regional safe-haven asset.

The Looming Risks: Why Complacency is Not an Option

The path to a sustained 2% inflation environment is not without its pitfalls. The MAS’s steady hand in January belies a watchful eye on several risk clouds:

- Geopolitical Supply Shocks: Any major escalation in the Middle East or renewed disruption in key trade lanes like the Straits of Malacca could trigger a sudden spike in global energy and freight costs. Singapore’s strategic petroleum reserves and diversified supply chains provide a buffer, but the inflationary impact would be swift.

- Wage-Price Spiral Precautions: The slope of Singapore’s Phillips Curve—the historical relationship between unemployment and inflation—has flattened but remains a concern. Robust wage settlements in 2026, if they significantly outstrip productivity growth, could embed inflation in the services sector, which is less sensitive to exchange rate policy.

- Global Monetary Policy Divergence: The timing and pace of interest rate cuts by the US Federal Reserve and the European Central Bank will cause significant currency and capital flow volatility. The MAS must ensure the S$NEER moves in an orderly fashion amidst this global repricing of risk.

- Climate Transition Costs: The green energy transition, while deflationary in the long term, may impose episodic cost pressures through carbon taxes, regulatory costs, and investments in new infrastructure. Singapore’s carbon tax is scheduled to rise significantly in the coming years.

As the Financial Times reported following the release of the 2025 data, analysts caution that “the last mile of disinflation—stabilising at the 2% sweet spot—is often the most treacherous.” The MAS is acutely aware that premature declarations of victory could unanchor inflation expectations.

Conclusion: The Steady Centre in a Churning World

As the hawker centre stalls begin to shutter for the evening, the economic reality they embody is one of cautious normalization. The MAS’s expected decision to hold policy unchanged is a powerful signal of this new phase. It is the policy equivalent of a skilled sailor easing the sails after successfully navigating a storm: the vessel is steady, the immediate danger has passed, but the horizon is still watched for the next shift in the wind.

The recalibration of the 2026 forecast to a 1–2% range is a masterclass in central bank communication—acknowledging progress while managing expectations upward from unsustainably low levels. It leaves the MAS with maximum optionality: it can maintain its stance through much of 2026 if inflation drifts toward the upper end of the band, but it is not locked into any pre-committed path.

For Singaporeans, the profound disinflation of 2025 offers tangible respite. For global investors and policymakers, Singapore’s trajectory serves as a compelling case study in the effective use of an unconventional monetary framework in a crisis. The nation has emerged from the global inflationary maelstrom not just with stable prices, but with reinforced confidence in the institutions that guard its economic stability. The challenge ahead is one of preservation, not conquest. And in that endeavour, a steady hand on the tiller is the most valuable tool of all.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Auto

BYD’s Ambitious 24% Export Growth Target for 2026: Can New Models and Global Showrooms Defy a Slowing China EV Market?

BYD’s auditorium at Shenzhen headquarters that crystallizes the strategic pivot of the world’s largest electric vehicle maker: 1.3 million. This is BYD’s target for overseas sales in 2026, a 24.3% jump from the previous year, as announced by branding chief Li Yunfei in a January media briefing. This figure is more than a goal; it is a declaration. With China’s domestic EV market showing unmistakable signs of saturation and ferocious price wars eroding margins, BYD’s relentless growth engine now depends on its ability to replicate its monumental domestic success on foreign shores. The question echoing through global automotive boardrooms is whether its expanded lineup—including the premium Denza brand—and a rapidly unfurling network of international showrooms can overcome rising geopolitical headwinds and entrenched competition.

The Meteoric Ascent: How BYD Built a Colossus

To understand the magnitude of the 2026 export target, one must first appreciate the velocity of BYD’s ascent. The company, which began as a battery manufacturer, has executed one of the most stunning industrial transformations of the 21st century. In 2025, BYD sold approximately 4.6 million New Energy Vehicles (NEVs), cementing its position as the undisputed volume leader. Crucially, within that figure lay a milestone that shifted the global order: ~2.26 million Battery Electric Vehicles (BEVs), officially surpassing Tesla’s global deliveries and seizing the BEV crown Reuters.

The foundation of this dominance is vertical integration. BYD controls its own battery supply (the acclaimed Blade Battery), semiconductors, and even mines key raw materials. This mastery over the supply chain provided a critical buffer during global disruptions and allows for aggressive cost control. However, the domestic market that fueled this rise is changing. After years of hyper-growth, supported by generous government subsidies, China’s EV adoption curve is maturing. The result is an intensely competitive landscape where over 100 brands are locked in a profit-eroding price war Bloomberg.

BYD’s 2026 Export Blueprint: From 1.05 Million to 1.3 Million

BYD’s overseas strategy is not a tentative experiment but a full-scale offensive, backed by precise tactical moves. The 2025 export base of approximately 1.04-1.05 million vehicles—representing a staggering 145-200% year-on-year surge—provides a formidable launchpad. The 2026 plan, aiming for 1.3 million units, is built on two articulated pillars: product diversification and network densification.

1. New Models and the Premium Denza Push: Li Yunfei explicitly stated the launch of “more new models in some lucrative markets,” which will include Denza-branded vehicles. Denza, BYD’s joint venture with Mercedes-Benz, represents its attack on the premium segment. Launching models like the Denza N9 SUV in Europe and other high-margin markets is a direct challenge to German OEMs and Tesla’s Model X. This move upmarket is essential for improving brand perception and profitability beyond the volume-oriented Seal and Atto 3 (known as Yuan Plus in China) Financial Times.

2. Dealer Network Expansion: The brute-force expansion of physical presence is key. BYD is moving beyond reliance on importers to establishing dedicated dealerships and partnerships with large, reputable auto retail groups in key regions. This provides localized customer service, builds brand trust, and significantly increases touchpoints for consumers. In 2025 alone, BYD expanded its European dealer network by over 40% CNBC.

The Domestic Imperative: Why Overseas Growth is Non-Negotiable

BYD’s export push is as much about necessity as ambition. The Chinese market, while still the world’s largest, is entering a new phase.

- Market Saturation in Major Cities: First-tier cities are approaching saturation points for NEV penetration, pushing growth into lower-tier cities and rural areas where consumer appetite and charging infrastructure are less developed.

- The Relentless Price War: With legacy automakers like Volkswagen and GM fighting for share and nimble startups like Nio and Xpeng launching competitive models, discounting has become endemic. This pressures margins for all players, even the cost-leading BYD The Wall Street Journal.

- Plateauing Growth Rates: After years of doubling, NEV sales growth in China is expected to slow to the 20-30% range in 2026, a dramatic deceleration from the breakneck pace of the early 2020s.

Consequently, overseas markets—with their higher average selling prices and less crowded competition—represent the most viable path for maintaining BYD’s growth trajectory and satisfying investor expectations.

The Global Chessboard: BYD vs. Tesla and the Chinese Cohort

BYD’s international expansion does not occur in a vacuum. It faces a multi-front competitive battle.

vs. Tesla: The rivalry is now global. While BYD surpassed Tesla in BEV volumes in 2025, Tesla retains significant advantages in brand cachet, software (FSD), and supercharging network density in critical markets like North America and Europe. Tesla’s response, including its own cheaper next-generation model, will test BYD’s value proposition abroad The Economist.

vs. Chinese Export Rivals: BYD is not the only Chinese automaker looking overseas. A look at 2025 export volumes reveals a cohort in hot pursuit:

- SAIC Motor (MG): The historic leader in Chinese EV exports, leveraging the MG brand’s European heritage.

- Chery: Aggressive in Russia, Latin America, and emerging markets.

- Geely (Zeekr, Polestar, Volvo): A sophisticated multi-brand approach targeting premium segments globally.

While BYD currently leads in total NEV exports, its rivals are carving out strong regional niches, making global growth a contested space Reuters.

Geopolitical Speed Bumps and Localization as the Antidote

The single greatest risk to BYD’s 2026 export target is not competition, but politics. Tariffs have become the primary tool for Western governments seeking to shield their auto industries.

- European Union: Provisional tariffs on Chinese EVs, varying by manufacturer based on cooperation with the EU’s investigation, add significant cost. BYD’s rate, while lower than some rivals, still impacts pricing.

- United States: The 100% tariff on Chinese EVs effectively locks BYD out of the world’s second-largest car market for the foreseeable future.

BYD’s counter-strategy is localization. By building vehicles where they are sold, it can circumvent tariffs, create local jobs, and soften its political image. Its global factory footprint is expanding rapidly:

- Thailand: A new plant operational in 2024, making it a hub for ASEAN right-hand-drive markets.

- Hungary: A strategically chosen factory within the EU, set to come online in 2025-2026, to supply the European market tariff-free.

- Brazil: A major complex announced, targeting Latin America and leveraging regional trade agreements.

This “build locally” strategy requires massive capital expenditure but is essential for sustainable long-term growth in protected markets Bloomberg.

Risks and the Road Ahead: Brand, Quality, and Culture

Beyond tariffs, BYD faces subtler challenges. Brand perception in mature markets remains a work in progress; shifting from being seen as a “cheap Chinese import” to a trusted, desirable marque takes time and consistent quality. While its cars score well on initial quality surveys, long-term reliability and durability data in diverse climates is still being accumulated.

Furthermore, managing a truly global workforce, supply chain, and product portfolio tailored to regional tastes (e.g., European preferences for stiffer suspension and different infotainment systems) is a complex operational leap from being a predominantly domestic champion.

Conclusion: A Calculated Gamble on a Global Stage

BYD’s 24% export growth target for 2026 is ambitious yet calculated. It is underpinned by a formidable cost structure, a rapidly diversifying product portfolio, and a pragmatic shift to local production. The slowing domestic market leaves it little choice but to pursue this path aggressively.

The coming year will be a critical test of whether its engineering prowess and operational efficiency can translate into brand strength and customer loyalty across cultures. Success is not guaranteed—geopolitical friction is increasing, and competitors are not standing still. However, BYD has repeatedly defied expectations. Its 2026 export campaign is more than a sales target; it is the next chapter in the most consequential story in the global automotive industry this decade—the determined rise of Chinese automakers from domestic leaders to dominant global players. The world’s roads are about to become the proving ground.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance3 weeks ago

Markets & Finance3 weeks agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Global Economy3 weeks ago

Global Economy3 weeks agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Asia4 weeks ago

Asia4 weeks agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Investment2 weeks ago

Investment2 weeks agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Global Economy4 weeks ago

Global Economy4 weeks ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis

-

Global Economy4 weeks ago

Global Economy4 weeks agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Economic Outlook 2025: Between Stabilization and the Shadow of Stagnation

-

China Economy4 weeks ago

China Economy4 weeks agoChina’s Property Woes Could Last Until 2030—Despite Beijing’s Best Censorship Efforts