Asia

10 Ways to Boost Pakistan’s Tourism Economy in 2026 by Unlocking the Deserts of Cholistan and Thar

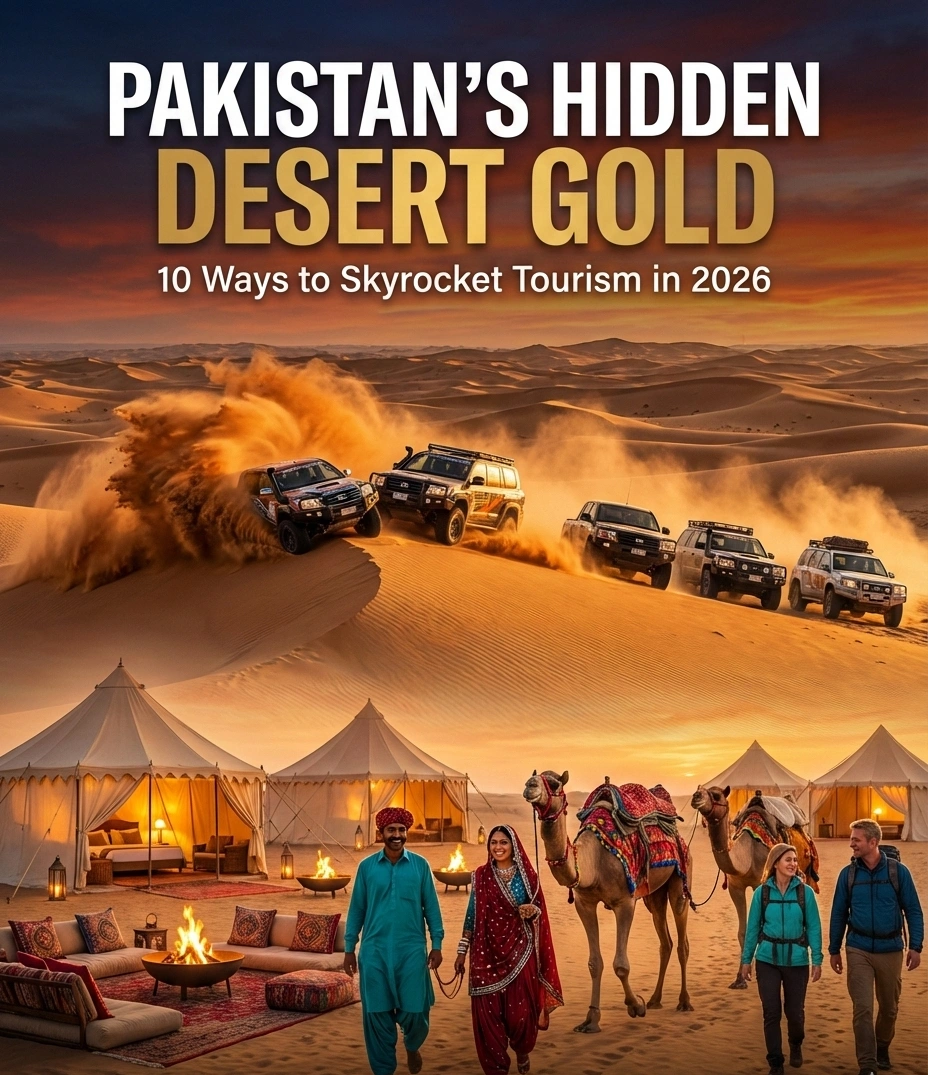

The sun rises over the Cholistan Desert, painting endless dunes in shades of amber and gold. A convoy of modified 4x4s kicks up plumes of sand as they race toward the horizon, while nearby, a camel caravan winds its way past ancient Derawar Fort, its 40 towering bastions standing sentinel over centuries of history. Meanwhile, 400 kilometers to the east, the Thar Desert’s “Rohi”—the land of shifting sands—comes alive with the rhythmic beats of traditional music as villagers prepare for the annual Tharparkar Cultural Festival.

These scenes aren’t from some distant fantasy. They’re the untapped reality of Pakistan’s desert economy in 2026—a sector that could transform the country’s tourism landscape if properly leveraged.

Pakistan’s tourism industry generated approximately USD 4.4-4.9 billion in 2025, welcoming around 965,000 international arrivals according to recent government estimates. Yet this represents merely a fraction of the country’s potential. The government has set an ambitious target of reaching $30-40 billion in annual tourism revenue—a goal that seems distant until you consider what neighboring regions have accomplished. Rajasthan’s desert tourism alone contributes over $12 billion annually to India’s economy, while Dubai transformed barren sands into a $45 billion tourism powerhouse.

Pakistan possesses comparable—arguably superior—raw materials: the 26,300 square kilometers of Cholistan (larger than Israel) and the 22,000 square kilometers of Thar (comparable to Slovenia). These deserts contain architectural marvels, biodiversity hotspots, vibrant indigenous cultures, and adventure tourism potential that remains criminally underutilized.

The question isn’t whether Pakistan’s deserts can drive economic growth. It’s how quickly stakeholders can implement the strategies to make it happen. Here are ten evidence-based, actionable approaches to unlock this sleeping giant in 2026.

1. Expand and Internationalize the Cholistan Desert Rally

The Cholistan Desert Rally returned in February 2026 after years of inconsistency, drawing thousands of domestic spectators and adventure enthusiasts to Derawar Fort. This annual motorsport event, organized by the Tourism Development Corporation of Punjab, represents Pakistan’s most established desert tourism brand—yet it operates at perhaps 20% of its potential.

Compare this to the Dakar Rally, which generates over $100 million in direct economic impact for host countries, or the Abu Dhabi Desert Challenge, which attracts 50+ international teams and global media coverage worth millions in destination marketing value. The Cholistan Rally, despite featuring challenging terrain that rivals any international desert race, remains largely unknown outside Pakistan.

The economic opportunity: Transforming Cholistan Rally into an FIA-sanctioned international motorsport event could generate $15-25 million annually in direct spending (participant fees, accommodation, logistics) plus exponentially greater media value. The infrastructure already exists—the 480-kilometer desert track, proximity to Bahawalpur’s hotels, and local support systems.

2026 action steps: The Punjab government should pursue FIA Desert Rally Championship accreditation, offer prize purses competitive with regional events ($500,000+), and create multi-day festival programming around the race (desert camps, cultural performances, food festivals). Partner with international motorsport brands like Red Bull or regional sponsors seeking market entry. The February timing positions it perfectly as the season-opener before Middle Eastern heat sets in.

Early evidence suggests momentum: the 2026 rally saw increased participation from Karachi and Lahore’s motorsport clubs, and social media engagement reportedly tripled compared to previous years. With proper investment, this could become South Asia’s premier desert motorsport destination within three years.

2. Launch Year-Round Luxury Desert Camp Experiences

The Middle East’s success formula for desert tourism centers on high-value, low-volume luxury experiences. Dubai’s Al Maha Desert Resort commands $1,200+ per night. Oman’s desert camps attract affluent travelers seeking authentic Bedouin experiences with five-star amenities. Morocco’s Sahara luxury camps generate hundreds of millions annually.

Pakistan’s deserts offer comparable (often superior) cultural authenticity, night skies, and landscapes—without the premium pricing or tourist crowds. Yet permanent luxury camp infrastructure remains virtually nonexistent in Cholistan and Thar.

The economic rationale: Luxury desert tourism generates 5-10x more revenue per visitor than budget travel while minimizing environmental impact. A single 20-tent luxury camp in Cholistan could generate $2-3 million annually with strong margins, employing 40-60 local staff year-round. Scale this to 10-15 camps across both deserts, and you’re approaching $40-50 million in new high-value tourism revenue.

What this looks like: Private camps near Derawar Fort, Islamgarh Fort, and Mirpur Khas offering climate-controlled tents with en-suite bathrooms, gourmet cuisine featuring regional specialties, guided heritage tours, stargazing programs led by astronomers, and cultural immersion with local communities. Target international travelers willing to pay $400-800 per night—Chinese honeymooners, European adventure travelers, and wealthy Gulf visitors seeking new experiences.

The infrastructure playbook exists: partner with established luxury hospitality groups (Serena, Movenpick, or international brands like Six Senses exploring Pakistan), ensure sustainable water/waste management, and train local communities in hospitality. The Pakistan Tourism Development Corporation could offer investment incentives—tax holidays, expedited permitting—to attract private capital.

Companies like Concordia Expeditions and Karakoram Club have successfully pioneered luxury adventure tourism in Northern Pakistan. The model works; it simply needs desert application.

3. Establish the Thar Desert Train Safari

Rail-based desert tourism represents one of the most underutilized tools in Pakistan’s arsenal. India’s Palace on Wheels and Maharaja Express generate over $30 million annually, offering week-long luxury rail journeys through Rajasthan’s deserts, with tickets ranging from $4,000-15,000 per person.

Pakistan Railways operates routes directly through Thar Desert via the Mirpur Khas-Khokrapar line and near Cholistan via the Bahawalpur network—yet no tourist-oriented service exists.

The transformative potential: A Thar Desert Train Safari—even a modest 2-3 day service—could attract 10,000-15,000 passengers annually at $300-800 per ticket, generating $5-10 million in direct revenue while catalyzing hotel, guide, and craft sales along the route. Unlike road-based tourism, rail journeys appeal to older, wealthier demographics uncomfortable with desert driving.

2026 implementation blueprint: Pakistan Railways could refurbish 3-5 vintage carriages (dining car, sleeping cars with air conditioning, observation car) for weekend service from Karachi to Mirpur Khas and Nagarparkar, with stops for fort visits, desert walks, cultural performances, and local cuisine. Partner with private tour operators for off-train programming.

The timing aligns perfectly with Pakistan Railways’ reported focus on heritage tourism initiatives and the government’s infrastructure modernization agenda. Modest investment ($2-4 million for carriage refurbishment) could yield significant returns.

Successful models exist globally: Australia’s Ghan, Namibia’s Desert Express, and India’s multiple luxury trains prove the concept’s viability. Pakistan simply needs execution.

4. Develop Sustainable Agritourism and Eco-Villages

Thar Desert supports approximately 1.5 million people, primarily engaged in subsistence agriculture, livestock rearing, and traditional crafts. Rather than viewing tourism as separate from local livelihoods, integrated agritourism and eco-village models could generate income while preserving cultural authenticity.

Countries like Jordan and Morocco have successfully implemented desert community tourism that empowers local populations. Jordan’s Dana Biosphere Reserve generates $8-10 million annually while employing local Bedouins as guides, cooks, and craftspeople. Morocco’s Berber villages attract hundreds of thousands of tourists seeking authentic cultural immersion.

Pakistan’s advantage: Thari and Cholistan communities maintain living traditions—embroidery, pottery, music, cuisine—that appeal enormously to cultural tourism markets, especially Asian travelers valuing authenticity. The Thari horse breeding tradition, famous camel breeding, and indigenous agricultural techniques (traditional wells, drought-resistant farming) offer unique experiential tourism hooks.

Economic model: Establish 15-20 certified eco-villages across both deserts where tourists stay in traditional homes (modernized with basic amenities), participate in daily activities (bread-making, livestock care, craft workshops), and purchase handicrafts directly. Each village could host 500-1,000 visitors annually at $50-100 per day, generating $750,000-2 million directly into local pockets—distributed across 50-100 households per village.

The Thardeep Rural Development Programme has demonstrated success with sustainable development models in Thar. Scaling this with tourism components requires coordination between the Sindh Tourism Development Corporation, local NGOs, and communities to establish quality standards, training programs, and booking platforms.

Critical success factors: respect for local customs, women-led craft cooperatives controlling revenue, and strict environmental standards preventing overtourism. The goal is sustainable, high-value tourism that enriches rather than displaces.

5. Position Derawar Fort as a UNESCO World Heritage Site

Derawar Fort stands as one of Pakistan’s most visually spectacular historical sites—40 massive bastions rising 30 meters from Cholistan’s sands, visible from kilometers away. Yet international awareness remains minimal compared to India’s Jaisalmer Fort or Jordan’s Petra, both UNESCO World Heritage Sites generating hundreds of millions in tourism revenue.

UNESCO designation transforms tourism economics. According to research by Oxford Economics, World Heritage status increases visitor numbers by 30-50% on average and enables premium pricing for experiences. Jaisalmer alone attracts over 800,000 annual visitors, generating an estimated $150 million for local economies.

The Derawar opportunity: UNESCO inscription would legitimize international marketing, attract high-value travelers seeking World Heritage experiences, and justify increased investment in site conservation and visitor infrastructure. Current annual visitors are estimated at 50,000-80,000, primarily domestic day-trippers. UNESCO status could realistically push this to 150,000-200,000 within five years, with per-visitor spending increasing from $20-30 to $80-120.

2026 roadmap: Pakistan’s Department of Archaeology should prioritize preparing the UNESCO nomination dossier, emphasizing Derawar’s unique architecture (influenced by Rajput, Mughal, and local desert traditions), historical significance as a major Abbasi and later princely state stronghold, and the broader Cholistan cultural landscape. Include nearby Jamgarh, Islamgarh, and Maujgarh forts as a serial nomination representing desert fortress architecture.

Parallel investments required: improved road access from Bahawalpur (currently rough desert tracks), visitor center with interpretation facilities, conservation of fragile mud-brick structures, and community engagement ensuring local benefits. The return on investment is substantial—UNESCO sites become tourism anchors around which entire regional economies develop.

6. Create Desert Conservation and Wildlife Tourism

Beyond cultural and adventure tourism, Pakistan’s deserts harbor surprising biodiversity that could support lucrative conservation tourism markets. The Thar Desert supports the critically endangered Great Indian Bustard (fewer than 150 worldwide), blackbucks, desert foxes, and unique reptilian species. Cholistan’s Lal Sohanra National Park contains one of South Asia’s last remaining desert forest ecosystems.

Global conservation tourism generates over $120 billion annually, with travelers paying premiums to observe rare wildlife. Kenya’s conservancies demonstrate how community-based conservation creates economic incentives for wildlife protection while generating $350-500 million annually.

Pakistan’s conservation tourism potential: Develop premium wildlife safaris focusing on endangered species observation, birdwatching tours (Thar hosts significant migratory bird populations), and nighttime desert wildlife experiences. Price these at $150-300 per person daily—targeting serious wildlife enthusiasts, photographers, and eco-conscious travelers.

Establish community conservancies where local populations receive direct payments for wildlife protection and earn income from guiding, hospitality, and handicrafts. This model aligns conservation with economic development—when wildlife is worth more alive than dead, communities become fierce protectors.

2026 immediate actions: The Sindh Wildlife Department and Punjab Wildlife & Parks Department should partner with international conservation organizations (WWF, IUCN) to develop wildlife tourism products, train local communities as wildlife guides and trackers, and market Pakistan’s desert ecosystems to international nature tourism operators. Investment in research stations that welcome eco-tourists could generate funding while promoting conservation.

Recent reports indicate the Sindh government has shown renewed interest in Thar biodiversity conservation. Monetizing this through high-value tourism creates sustainable funding for conservation programs.

7. Invest in Digital Infrastructure and Virtual Previews

Pakistan’s tourism marketing suffers from a fundamental problem: expectation gap. International perceptions of Pakistan (security concerns, lack of tourism infrastructure) diverge dramatically from on-ground reality (improving security, stunning undiscovered sites). For desert tourism specifically, potential visitors simply don’t know these destinations exist.

Digital infrastructure solves this through immersive previews that overcome skepticism. Virtual reality tours, 360-degree videos, high-quality documentary content, and strategic influencer partnerships can showcase Pakistan’s deserts to global audiences at minimal cost.

The business case: Digital marketing delivers extraordinary ROI for emerging destinations. Tourism Australia’s “$150 million campaign” generated over $430 million in incremental tourism revenue. Jordan’s strategic digital marketing helped grow tourism from $3 billion (2012) to over $5.5 billion (2019).

Pakistan’s 2026 digital strategy:

- Virtual reality previews: Create VR experiences of Cholistan Rally, Derawar Fort sunset, Thar village stay, and desert camping. Distribute through Google Expeditions, travel platforms, and international tourism exhibitions.

- Influencer partnerships: Invite 50-100 international travel influencers, bloggers, and YouTubers (combined following 100+ million) for subsidized desert experiences. Their authentic content reaches demographics unreachable through traditional advertising.

- Professional video content: Produce BBC/Netflix-quality mini-documentaries on desert culture, wildlife, and adventure opportunities. License to streaming platforms and leverage for tourism marketing.

- Interactive booking platform: Develop a centralized booking system for desert experiences (luxury camps, homestays, guided tours) with secure payment, reviews, and customer support—addressing the “how do I actually book this?” problem.

The Pakistan Tourism Development Corporation should partner with Pakistani tech talent (leveraging the country’s strong digital services sector) and international tourism marketing agencies. Investment of $3-5 million in professional digital content could realistically generate $30-50 million in new tourism bookings within 18-24 months.

8. Establish Desert Adventure Tourism Certifications

Adventure tourism—one of the fastest-growing segments globally, worth over $680 billion—requires safety, quality standards, and professional certification to attract international markets. Currently, Pakistan’s desert adventure offerings (dune bashing, camel treks, sandboarding, desert trekking) lack standardized safety protocols and operator certification.

This isn’t merely bureaucratic; it’s economic. International travelers and tour operators require proof of safety standards before booking. Professional certification enables premium pricing—certified guides command 2-3x higher rates than uncertified operators.

Implementation model: The Pakistan Tourism Development Corporation, in partnership with international adventure tourism associations (Adventure Travel Trade Association), should establish:

- Desert guide certification programs: 200-hour training covering navigation, first aid, cultural sensitivity, environmental ethics, and customer service. Certify 500-1,000 guides across both deserts by end of 2026.

- Operator licensing standards: Safety equipment requirements, insurance mandates, environmental protocols, and regular inspections for companies offering desert tours.

- Equipment rental regulations: Certified 4×4 vehicles for dune bashing, safety-compliant sandboarding equipment, and standardized camel welfare protocols.

Economic impact: Professionalized adventure tourism enables marketing to international operators who pre-book group tours. A single UK or European adventure travel company might send 500-1,000 clients annually at $1,500-3,000 per person—but only to certified, insured operators. Certification unlocks $20-40 million in potential international adventure tourism revenue.

New Zealand’s adventure tourism industry—worth $4.2 billion annually—demonstrates how rigorous safety standards become a competitive advantage rather than a burden. Pakistan should follow this playbook.

9. Develop Desert Arts, Crafts, and Cultural Festivals

Cultural tourism represents Pakistan’s most authentic competitive advantage. Thari and Cholistan communities produce exceptional handicrafts—embroidered textiles, pottery, traditional jewelry, leather goods—and possess rich musical traditions (folk songs, instruments like the morchang) that are completely unknown internationally.

Global cultural tourism generates over $280 billion annually. India’s Pushkar Camel Fair attracts 200,000+ visitors and generates $40-50 million for local economies. Morocco’s cultural festivals drive billions in tourism spending.

Pakistan’s cultural festival opportunity:

- Cholistan Cultural Festival (February, aligned with Desert Rally): Week-long celebration featuring traditional music, dance, camel exhibitions, craft bazaars, culinary festivals showcasing Seraiki and Punjabi desert cuisine, and fort illuminations. Target: 50,000-75,000 attendees generating $8-12 million.

- Thar Heritage Festival (November-December, cooler season): Similar model celebrating Thari culture, featuring folk music competitions, women’s craft cooperatives, traditional sports (camel racing, horse exhibitions), and food courts. Target: 30,000-50,000 attendees generating $5-8 million.

Beyond festivals, establish permanent craft villages where tourists observe artisans at work and purchase directly—similar to Rajasthan’s craft villages that generate hundreds of millions annually. Ensure women control craft cooperative revenues, as they’re primary artisans in many traditional crafts.

Quality control critical: Establish Geographical Indication (GI) status for Thari embroidery and Cholistan textiles (like India’s GI-protected crafts), enabling premium pricing and preventing cheap imitations. Market these internationally through partnerships with ethical fashion brands and luxury retailers.

Recent initiatives like the Tharparkar Cultural Festival demonstrate grassroots momentum. Government support—funding, marketing, infrastructure—could scale these to economically significant levels.

10. Implement Solar-Powered Sustainable Tourism Infrastructure

Infrastructure challenges—water scarcity, electricity unreliability, road access—represent primary barriers to desert tourism development. Traditional infrastructure solutions (grid extension, water pipelines) are cost-prohibitive for remote desert regions.

Solar-powered, sustainable infrastructure offers economically viable solutions while positioning Pakistan as a leader in eco-tourism. International travelers increasingly seek sustainable destinations—66% of travelers would pay more for sustainable options according to Booking.com research.

Practical applications:

- Solar microgrids: Power luxury desert camps, homestays, and facilities without grid dependency. Cost: $50,000-100,000 per installation. Already proven at remote tourism sites in Jordan, Namibia, and Chile.

- Solar water pumps and conservation: Efficient water management for tourism facilities using solar-powered desalination (brackish water treatment) and greywater recycling. Reduces water consumption by 60-70%.

- Solar-powered electric safari vehicles: For wildlife tourism and site visits, eliminating diesel generators’ noise and emissions. Tesla and BYD now produce affordable electric 4x4s suitable for desert conditions.

- Sustainable road access: Use innovative materials (recycled plastics mixed with aggregate) for all-weather desert roads, proven in Middle Eastern deserts.

Investment case: Solar infrastructure reduces operating costs by 40-60% versus diesel generators over 10 years, while “sustainable tourism” branding enables 15-20% premium pricing. A $30-40 million investment in sustainable infrastructure across 20-30 tourism sites could support an industry generating $150-200 million annually within five years.

The Asian Development Bank and World Bank have expressed interest in financing Pakistan’s sustainable tourism infrastructure. The funding exists; execution requires coordinated proposals from provincial tourism departments.

The Economic Road Ahead

Pakistan’s desert tourism potential isn’t speculative—it’s proven by comparable success stories globally. Rajasthan’s deserts contribute over $12 billion annually. Dubai built a $45 billion tourism economy on less dramatic desert landscapes. Jordan’s desert regions generate billions while hosting similar security challenges Pakistan once faced.

The mathematics are compelling: if Pakistan captured merely 10% of Rajasthan’s desert tourism market, that would add $1.2 billion annually—25-30% growth over current total tourism revenue. Scale to Dubai-comparable levels (accounting for Pakistan’s larger population and equivalent infrastructure), and you’re approaching $5-8 billion in desert-driven tourism revenue potential by 2030.

These ten strategies require coordinated implementation across federal and provincial governments, private sector investment, and community engagement. The total capital investment needed—approximately $150-250 million across all initiatives—is modest compared to potential returns. Tourism multiplier effects (every $1 in tourism generates $2-3 in broader economic activity) mean actual economic impact could reach $10-20 billion over five years.

The 2026 moment is critical. Global tourism is recovering strongly post-pandemic, with travelers seeking new destinations. Pakistan’s improved security environment, growing international engagement (hosting international cricket, diplomatic reengagement), and infrastructure improvements create unprecedented opportunities.

Political will remains the primary requirement. The federal government’s stated commitment to tourism development must translate into policy reforms: simplified visa procedures (e-visa expansion), tourism infrastructure investment, public-private partnership frameworks, and sustained marketing budgets.

For investors—both Pakistani and international—desert tourism offers exceptional returns in an undervalued market. For local communities, it represents sustainable income diversification from agriculture. For Pakistan’s national economy, it’s a foreign exchange generator requiring minimal imports.

The deserts of Cholistan and Thar have patiently waited centuries to reveal their economic potential. In 2026, with strategic vision and coordinated execution, Pakistan can finally unlock the prosperity hidden in the sands.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Hong Kong Is Beijing’s New ‘Vanguard’ in the Contest for Financial Sovereignty

Beijing is formally repositioning Hong Kong from a neutral intermediary between Chinese and global capital into a ‘vanguard’ of the state’s financial security architecture — and the infrastructure to do exactly that is already operational.

For decades, the working assumption in global finance was that Hong Kong’s value lay in its studied neutrality. It was the threshold between two monetary worlds — a place where mainland capital could breathe the same air as Western institutional money without either being contaminated by the other. That assumption is now obsolete.

The Hong Kong Beijing vanguard financial sovereignty dynamic crystallised quietly across a string of policy announcements that, viewed individually, read as routine bureaucratic coordination. Viewed together, they mark one of the more consequential strategic reorientations in contemporary Asian finance. Under Xi Jinping’s “strong financial nation” doctrine, Beijing is no longer content to treat Hong Kong as a convenient pass-through. It is redesigning the city as an active instrument — a forward position in what Chinese state media and senior officials now explicitly call the construction of a “financially strong nation.” The word in circulation among pro-Beijing commentators is no longer “bridge.” It is vanguard.

The Ideological Turn: From Bridge to Vanguard

The language shift matters enormously. A bridge is passive infrastructure; it serves whoever crosses it. A vanguard has a mission, an adversary, and a direction of march. The semantic pivot reflects an ideological evolution at the highest levels of Chinese statecraft that arguably began crystallising at the Central Financial Work Conference in October 2023, where Xi articulated the ambition of building China into a qiánjìn guójiā — a strong financial nation. That formulation elevated monetary sovereignty and payment infrastructure from commercial concerns to instruments of national security.

Beijing financial sovereignty Hong Kong — the concept is no longer abstract. By late 2025, senior officials were writing in People’s Daily that China’s forthcoming 15th Five-Year Plan must “accelerate the construction of a financially strong nation” and explicitly support Hong Kong in consolidating its offshore renminbi hub function. The 15th Five-Year Plan, expected to receive formal National People’s Congress endorsement imminently, will set China’s strategic coordinates through 2030 — and Hong Kong figures with unusual prominence in the financial architecture chapters.

What emerges from a careful reading of that framework, alongside Hong Kong’s 2026-27 Budget speech delivered by Financial Secretary Paul Chan on February 25, is a document of strategic alignment that goes well beyond typical intergovernmental coordination. The Budget commits Hong Kong to contribute to the national objective of accelerating the construction of a financially strong nation. More strikingly, it is the first time Hong Kong has committed to producing its own five-year plan in coordination with the national blueprint — a structural embedding of the SAR into Beijing’s planning cycle with no precedent under “One Country, Two Systems.”

The Infrastructure Already in Place

mBridge, CIPS, and the Architecture of Dollar Independence

The most consequential developments are not rhetorical. They are engineered. The mBridge multilateral CBDC platform, developed through a collaboration between the HKMA, the People’s Bank of China, and the central banks of the UAE and Thailand, processed over US$55.5 billion in cross-border transactions by late 2025 — with the digital yuan accounting for roughly 95 percent of settlement volume. That figure represents a system at operational scale, not a proof-of-concept experiment.

Simultaneously, the PBoC’s Cross-Border Interbank Payment System (CIPS) continues its expansion in Hong Kong, deepening a renminbi-denominated settlement infrastructure that, in aggregate with mBridge, constitutes the foundations of a payments architecture capable of operating independently of dollar-denominated correspondent banking. This is not speculative. It is the explicit design intention behind what Beijing describes as its Hong Kong financial security architecture — a redundant settlement layer that can route Chinese trade and financial flows without touching the SWIFT-dollar nexus if geopolitical conditions ever demand it.

The RMB Liquidity Doubling and What It Actually Signals

On January 26, the HKMA announced that its RMB Business Facility — the mechanism through which onshore renminbi liquidity is channelled into offshore markets via a “hub-and-spoke” model with Hong Kong at the centre — would double from RMB 100 billion to RMB 200 billion (approximately US$27.8 billion), effective February 2. The expansion followed overwhelming demand: all 40 participating banks had exhausted their initial quotas within three months of the facility’s October 2025 launch.

HKMA Chief Executive Eddie Yue described the expansion as designed to “provide timely and sufficient RMB liquidity to meet market development needs.” What the statement elides, but the architecture makes explicit, is the geographic reach of that liquidity. According to the HKMA, participating banks are not merely recycling yuan within Hong Kong. They are channelling it to corporate clients across ASEAN, the Middle East, and Europe — precisely the corridors that the offshore RMB hub vanguard model was designed to penetrate. A Hong Kong bank can now funnel cheaper RMB liquidity to its Singapore or London subsidiaries, extending Beijing’s monetary infrastructure into the deepest capillaries of Western finance.

Complementing the facility doubling, the 2026-27 Budget outlined measures to construct an offshore RMB yield curve through regular bond issuances across maturities, facilitate RMB foreign exchange quotations against regional currencies, and accelerate research into incorporating RMB counters into the Southbound Stock Connect. Together, these constitute what analysts at FOFA Group describe as “systemic measures to reduce corporate exchange rate risks and increase the proportion of RMB invoicing and settlement” — currently around 30 percent of China’s goods trade, a figure Beijing intends to raise materially.

The IPO Revival as Strategic Capital Mobilisation

Hong Kong Reclaims the Global Crown

The numbers are striking enough to arrest even the most seasoned equity strategist. According to KPMG’s 2025 IPO Markets Review, Hong Kong reclaimed the top spot in global IPO rankings for the first time since 2019, driven by a record number of A+H share-listings that contributed over half of total funds raised. The London Stock Exchange Group confirmed that 114 companies raised US$37.22 billion on the HKEX main board in 2025 — a 229 percent increase from US$11.3 billion in 2024, placing Hong Kong well ahead of Nasdaq’s US$27.53 billion. Four of the world’s ten largest IPOs that year were Hong Kong listings. As of December 7, 2025, HKEX had an all-time high of over 300 active IPO applications in its pipeline, including 92 A+H listing applicants.

The CATL moment. When Contemporary Amperex Technology Co. — the world’s largest electric vehicle battery maker — raised US$4.6 billion on debut in June 2025, its H-share tranche priced at a premium to its A-shares, a rare occurrence that signalled something deeper than sentiment recovery. International institutional investors were expressing, through price discovery, confidence in Hong Kong’s continued capacity to deliver credible valuations on China’s most strategically important industrial companies. That confidence has since been replicated across Hengrui Pharmaceutical, Haitian Flavouring & Food, and Sanhua Intelligent Controls — collectively accounting for four of the world’s ten largest IPOs.

The “Going Global” Strategy Hardens Into Architecture

The commercial logic of this IPO surge is inseparable from Beijing’s political economy. The Hong Kong 15th Five-Year Plan coordination framework explicitly designates the city as the primary offshore platform for mainland enterprises pursuing international expansion under the “going global” strategy. The GoGlobal Task Force, established under the 2025 Policy Address and coordinated by InvestHK, now operates as a one-stop platform marshaling legal, accounting, and financial advisory functions to position Hong Kong as the base from which Chinese firms access global markets. The 2026-27 Budget entrenched this with a cross-sectoral professional services platform and targeted promotional campaigns.

For international investors, the implication is nuanced but important: the Hong Kong international financial centre 2026 is not a market recovering its pre-2019 identity. It is a market acquiring a new one — one in which the dominant issuer class is strategically aligned mainland enterprises, the dominant growth sectors are those embedded in China’s 15th Five-Year Plan priorities (AI, biotech, new energy, advanced manufacturing), and the dominant policy imperative is Beijing’s, not the SAR’s.

The Virtual Asset Divergence: A Regulatory Laboratory

Nowhere is Hong Kong’s new function as Beijing’s financial laboratory more transparent than in the city’s treatment of virtual assets. Since its comprehensive ban on cryptocurrency trading in 2021, the PBoC has maintained an adversarial posture toward privately issued digital assets. In February 2026, the PBoC together with seven central authorities issued a joint notice classifying most virtual currency activity and real-world asset tokenization as illegal absent explicit state approval — extending liability to intermediaries and technology providers and imposing strict supervision over cross-border issuance structures.

Hong Kong, simultaneously, has moved in precisely the opposite direction: licensing crypto exchanges, issuing regulatory frameworks for stablecoin issuers, and advertising itself as Asia’s virtual asset hub. This regulatory divergence is so deliberate it can only be read as coordinated. Hong Kong acts as the state’s controlled experiment — piloting the integration of digital asset infrastructure with RMB payment rails in a jurisdiction where failure can be contained and success can be replicated. The longer-term implication — a Hong Kong-licensed stablecoin operating as an offshore RMB proxy, connecting RMB internationalization Hong Kong with emerging digital finance corridors — is not speculative fiction. It is the logical terminus of the current regulatory architecture.

Singapore, the West, and the Impossible Middle Ground

The Divergence With Singapore

The comparison with Singapore illuminates Hong Kong’s trajectory by contrast. Singapore has spent the post-2020 period consolidating what might be called studied ambiguity: a financial centre that is deeply integrated into both Western and Chinese capital flows without being directionally committed to either. According to InCorp’s 2025-2026 analysis, Singapore’s economy grew 4.2 percent year-on-year in Q3 2025, with predictable inflation at 0.5-1.5 percent for 2026 — a macroeconomic profile that appeals precisely to Western multinationals seeking stable regional headquarters removed from US-China friction.

Singapore’s weakness, as the Anbound Think Tank has noted, is structural: as a city-state with a population of several million and no hinterland of the scale China offers, it cannot generate IPO pipelines of comparable depth or provide the kind of renminbi liquidity infrastructure that Hong Kong’s PBoC-backed facilities now deliver. Singapore competes on neutrality. Hong Kong is now competing on alignment — and betting that, in a bifurcating world, alignment with the world’s second-largest economy is the stronger hand.

What Western Banks Face

For global banks — HSBC, Standard Chartered, Citigroup, JPMorgan — the repositioning of Hong Kong creates a structurally uncomfortable operating environment. Over 70 of the world’s top 100 banks maintain a presence in Hong Kong. That presence was premised on the city’s capacity to intermediate between two capital systems without imposing a political tariff on the transaction. As that neutrality erodes, Western institutions face a binary they have been studiously avoiding: participate in Hong Kong’s deepening integration into Beijing’s financial architecture and accept the associated secondary sanctions exposure, or reduce their footprint and cede one of Asia’s richest revenue pools to Chinese and regional competitors.

The Bloomberg Professional analysis on Hong Kong’s wealth management outlook put it with characteristic precision: more Western investors may continue shifting assets to Singapore and elsewhere as geopolitical risks persist, leaving the city’s private wealth growth constrained in the near term. The risk is asymmetric. If US-China tensions escalate toward financial decoupling, the cost of having both a large Hong Kong operation and robust SWIFT-dollar compliance infrastructure could become prohibitive. The question is not whether that scenario will arrive but how quickly institutions are building contingency capacity for when it does.

The Structural Constraint Beijing Cannot Resolve Without Hong Kong

The extraordinary thing about Beijing’s China 15th Five-Year Plan Hong Kong finance ambitions is that they are driven as much by vulnerability as by confidence. Despite more than a decade of active promotion, the renminbi’s share of global foreign exchange reserves has declined, from approximately 2.8 percent in early 2022 to roughly 1.9 percent by late 2025, according to IMF COFER data. China’s capital account remains substantially closed. A fully open renminbi is structurally incompatible with the Communist Party’s political economy — it would require subordinating monetary policy to market forces and accepting the wealth transfer mechanisms that full convertibility entails.

Hong Kong resolves this dilemma with elegant precision. As an offshore platform under Chinese jurisdiction with residual common law credibility — enough, at least, to maintain international institutional confidence in its clearing and custody infrastructure — it can pilot instruments that cannot be tested on the mainland without exposing the domestic financial system to associated risks. The Hong Kong renminbi offshore hub function is not merely a commercial service. It is a controlled decompression valve through which Beijing can internationalise its currency, its payment infrastructure, and its capital market access without conceding the internal monetary sovereignty that the Party regards as existential.

The RMB internationalization Hong Kong pipeline is thus a geopolitical instrument dressed in the clothing of financial services — and increasingly, even the disguise is being shed. The 2026-27 Budget’s explicit alignment with the 15th Five-Year Plan’s financial sovereignty objectives is the first time a Hong Kong budget document has openly acknowledged this dual function.

The Investor Verdict: What the Numbers Cannot Fully Capture

Featured snippet: Beijing is repositioning Hong Kong as a ‘vanguard’ of its financial security architecture by embedding the city’s regulatory, monetary, and capital market infrastructure into the 15th Five-Year Plan framework — a shift that transforms Hong Kong from a neutral intermediary into an active instrument of RMB internationalization and dollar-independent settlement architecture.

The headline figures — Hong Kong ranked first globally in IPO fundraising in 2025, the HKEX pipeline at over 300 applicants, RMB Business Facility doubled to RMB 200 billion, mBridge processing over US$55.5 billion in settlements — create an impression of unambiguous momentum. And in commercial terms, that impression is not wrong. Deloitte forecasts Hong Kong will raise at least HK$300 billion in IPO proceeds in 2026. UBS’s vice-chairman in Hong Kong describes the pipeline as “very strong.”

But the momentum is directional in a way that has not fully priced into Western institutional thinking. The Hong Kong international financial centre 2026 that is emerging from this policy moment is a significantly more capable financial hub than its 2020-2023 nadir — but it is a hub serving a strategic agenda that differs from the open, neutral intermediary model on which its original international reputation was built.

For international investors and multinational financial institutions, this creates a set of questions that are not yet fully embedded in standard risk frameworks. How will secondary sanctions exposure evolve as Hong Kong’s mBridge and CIPS participation deepens? How will US-China financial decoupling scenarios affect the liquidity of H-share positions held by Western institutional funds? How should capital allocation between Hong Kong and Singapore — or Hong Kong and Tokyo, or Hong Kong and London — be recalibrated in a world where Hong Kong’s regulatory architecture is increasingly coordinates with Beijing’s security priorities rather than responding to market forces alone?

None of these questions have clean answers today. But the framework for thinking about them has permanently shifted. The “bridge” model that gave global finance its comfortable relationship with Hong Kong is being methodically replaced by something far more purposeful — and far more geopolitically consequential.

Conclusion: The Vanguard Doctrine and Its Implications

The word vanguard has a specific meaning in the Chinese political tradition. It is the term Mao reserved for the Communist Party itself — the leading force that preceded the masses into territory not yet secured. Its application to Hong Kong’s financial role under the 15th Five-Year Plan is not accidental. It signals that Beijing no longer views the city’s international financial function as a legacy arrangement to be managed but as an active instrument to be deployed.

For policymakers in Washington, Brussels, and London — and for the compliance officers, risk committees, and board directors of every major financial institution with a Hong Kong presence — the strategic reconfiguration underway demands a correspondingly strategic response. Incremental adjustments to existing frameworks will not suffice. The “strong financial nation” doctrine has graduated from slogan to architecture, and Hong Kong is where that architecture is being built.

The city’s financial mojo, to borrow the Economist’s phrase, is not in question. What is in question is whose agenda that mojo now serves — and at what cost to those who assumed the answer would always be: everyone’s.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Coupang’s Data Breach: From Seoul’s Courtrooms to Washington’s Trade War

When a former employee quietly began extracting data from Coupang’s servers on June 24, 2025, the act looked, on its face, like a textbook insider-threat case—disgruntled, technically savvy, geographically mobile. What nobody in Seoul or Seattle anticipated was that the Coupang data breach would, within six months, detonate inside one of the most consequential bilateral trade relationships in the Asia-Pacific.

By early 2026, the episode had dragged in the White House, the U.S. Trade Representative, a bipartisan congressional hearing, five American hedge funds, and a potential tariff hike that rattled South Korea’s fragile currency. The Coupang South Korea data breach exposed not merely the personal information of 33.7 million customers—nearly two-thirds of the country’s entire population—but a structural fault line in how democratic allies govern data, enforce privacy law, and resolve disputes when corporate accountability crosses national borders.

That fault line, it turns out, is deep enough to swallow a trade relationship.

The Anatomy of a Breach: Five Months of Silence, One Smashed MacBook

The intrusion, as reconstructed by South Korean government investigators and third-party forensic firms Mandiant and Palo Alto Networks, was neither sophisticated nor spectacular. A former Coupang engineer—later identified as a Chinese national who had worked on the company’s authentication systems—used unrevoked access credentials to connect to customer data repositories through overseas servers. The breach continued, undetected, from late June to November 8, 2025: approximately 137 days of unauthorized access to names, phone numbers, email addresses, delivery addresses, and partial order histories belonging to 33.7 million Korean accounts.

The discovery came not from Coupang’s own security monitoring but because the perpetrator sent threatening, anonymous emails to the company and individual users. Only then did internal teams identify the compromise—initially estimating just 4,500 affected accounts. The true scale, confirmed via forensic investigation, was roughly 7,500 times larger.

Key Timeline of Events

| Date | Event |

|---|---|

| June 24, 2025 | Unauthorized access begins via overseas servers |

| November 6, 2025 | Coupang detects unusual access at 6:38 PM KST |

| November 8, 2025 | Last date of unauthorized access |

| November 18, 2025 | Full identification; KISA, PIPC, and National Police Agency notified—53+ hours after internal detection, violating the 24-hour reporting rule |

| November 29, 2025 | Coupang publicly discloses the breach |

| December 15, 2025 | Coupang files SEC 8-K; former CEO Park Dae-jun resigns |

| December 29, 2025 | Company announces 1.685 trillion won ($1.17B) compensation plan |

| January 13, 2026 | U.S. House Ways and Means Trade Subcommittee holds bipartisan hearing |

| January 23, 2026 | Greenoaks and Altimeter file ISDS notice with South Korea’s Ministry of Justice |

| January 26, 2026 | Trump administration raises tariffs on South Korea from 15% to 25% |

| February 12, 2026 | Three more U.S. investors—Abrams Capital, Durable Capital, Foxhaven—join ISDS action |

The cover-up attempt was equally cinematic: authorities recovered a MacBook Air the perpetrator had submerged in a canvas bag weighted with bricks. Forensic analysis of the retrieved device confirmed that while data from over 33 million accounts had been accessed, only approximately 3,000 records were retained, none of which appear to have circulated on the dark web. That distinction—between access and retention—would become one of the most contested technical arguments in the ensuing international dispute.

Management Failure, Not Sophisticated Attack: Seoul’s Damning Verdict

South Korean regulators delivered a judgment that was unsparing in its directness. The Coupang management failure data breach finding, published in a government-led investigation in February 2026, concluded that the breach was not the product of a nation-state cyberattack or advanced persistent threat. It was, in the investigators’ framing, an organizational failure: a company that had not properly revoked authentication credentials upon an employee’s departure, had failed to encrypt non-payment customer data despite having the capacity to do so, and had not fully implemented a data preservation order issued upon breach disclosure—resulting in the deletion of critical web and app access logs before outside parties could examine them.

The Personal Information Protection Commission (PIPC), South Korea’s principal privacy watchdog, further demanded that Coupang correct its public communications: the company had described the incident as data “exposure,” a characterization regulators rejected in favor of “leak”—a distinction laden with legal consequence under the country’s information network law.

For a company that had spent years presenting itself as the crown jewel of Korean e-commerce—an Amazon-equivalent with $34.5 billion in 2025 revenue and a NYSE listing that generated euphoric headlines in 2021—the regulatory verdict was stinging. South Korean President Lee Jae-myung publicly called for heavy penalties, describing personal data protection as “a key asset in the age of AI and digitalization” during a cabinet meeting. One Democratic Party lawmaker floated the possibility of punitive fines through special parliamentary legislation, an idea the PIPC endorsed publicly.

Under existing law, penalties are capped at 3% of annual revenue—a figure that, for a company of Coupang’s scale, could exceed $800 million. Some lawmakers were seeking to raise that ceiling to 10%.

Why the Coupang Breach Became an International Trade Issue

The escalation from domestic regulatory matter to international flashpoint followed a logic that, in retrospect, looks almost inevitable—though it required a specific convergence of corporate structure, investor geography, and geopolitical temperature.

Coupang’s corporate identity is inherently binational. Although the company operates as South Korea’s largest e-commerce platform—employing 95,000 people and serving consumers through its celebrated “Rocket Delivery” logistics network—its global headquarters sits in Seattle, Washington. It trades on the NYSE. Its largest shareholders are American. When South Korean regulators moved against the company, they were, from the investors’ perspective, effectively moving against a U.S.-headquartered enterprise operating in a foreign market.

U.S. investors activated treaty mechanisms that Seoul had not anticipated. On January 23, 2026, investment firms Greenoaks and Altimeter—together holding approximately $1.5 billion in Coupang stock—filed a formal notice of intent with South Korea’s Ministry of Justice, invoking the investor-state dispute settlement (ISDS) provisions of the U.S.-Korea Free Trade Agreement (KORUS FTA). Their central claim: that the Korean government’s response to the Coupang data breach was disproportionate, discriminatory, and designed to benefit domestic and Chinese competitors at the expense of an American company. By February 12, 2026, three additional U.S. investors—Abrams Capital, Durable Capital Partners, and Foxhaven Asset Management—had joined the action, according to a report by TechCrunch.

ISDS arbitration, for the uninitiated, is a provision embedded in most modern trade agreements that allows foreign investors to sue sovereign governments before international arbitral tribunals—bypassing domestic courts entirely. The mechanism was designed to protect cross-border investment from arbitrary government interference. In the Coupang case, the investors are alleging that South Korea violated the treaty’s guarantees of fair and equitable treatment, most-favored-nation status, and protection against expropriation. If the mandatory 90-day consultation period fails to produce resolution, the dispute proceeds to formal arbitration, with damages potentially running into billions of dollars charged against Seoul’s government.

Washington amplified the pressure through multiple channels. The U.S. investors also petitioned the U.S. Trade Representative to investigate under Section 301 of the Trade Act of 1974, requesting that “appropriate trade remedies”—including tariffs—be applied if Korea’s conduct was found to constitute discriminatory enforcement. The Korea Herald reported that U.S. Vice President J.D. Vance personally warned South Korean Prime Minister Kim Min-seok that the investigation appeared discriminatory. At a January 13 House Ways and Means Trade Subcommittee hearing, Republican Chair Adrian Smith characterized Korean regulators as pursuing “legislative efforts explicitly targeting U.S. companies,” with fellow lawmaker Rep. Scott Fitzgerald describing the government’s conduct as a “politically motivated witch hunt.”

On January 26, 2026, the Trump administration announced a tariff increase on South Korean goods from 15% to 25%—officially attributed to Seoul’s slow ratification of the bilateral trade deal reached the previous year. But the timing was precise enough that the official House Judiciary Committee account posted on X: “This is what happens when you unfairly target American companies like Coupang.” The Diplomat’s analysis concluded that while Trump’s tariff calculus encompasses broader investment commitments, the Coupang episode had provided political and rhetorical scaffolding for the escalation.

The Discrimination Argument: A Contested Ledger

The investors’ discrimination claim hinges on comparative enforcement: they argue that Korean and Chinese companies involved in comparable data incidents faced significantly lighter regulatory responses. This contention deserves scrutiny rather than uncritical acceptance, because the record is genuinely mixed.

CPO Magazine documented that South Korea’s largest mobile carrier, SK Telecom, received a record ₩134.5 billion ($97 million) fine following a breach of USIM identity data for approximately 27 million subscribers—a penalty that regulators imposed only after finding that SK Telecom “did not even implement basic access controls.” The SK Telecom enforcement, then, was itself unprecedented for a Korean incumbent. The Coupang investors counter that the scope of regulatory intervention—including executive travel restrictions, operational suspension threats, and parliamentary summons—far exceeded what any domestic Korean company had faced for equivalent or larger breaches.

There is no clean answer here. Regulatory severity is shaped by political context, media coverage, the identity of the company, and the temperament of individual legislators. What is demonstrably true is that Coupang’s delayed reporting (53-plus hours against a 24-hour requirement), its failure to implement the data preservation order, and the sheer demographic scale of the breach (affecting 65% of the national population) would have attracted intense scrutiny in any jurisdiction operating under modern data protection law.

The Data Governance Gap: Comparing South Korea to Its Peers

The Coupang episode has crystallized a conversation that South Korean policymakers have deferred for years: their data protection framework, while nominally robust, contains structural gaps that both enabled the breach and complicated the regulatory response.

Comparative Data Governance Frameworks

| Jurisdiction | Law | Max Penalty | Encryption Mandate | Breach Notification |

|---|---|---|---|---|

| European Union | GDPR (2018) | 4% of global revenue | Risk-based requirement | 72 hours to authority |

| China | PIPL (2021) | ¥50 million / 5% revenue | Mandatory for sensitive data | Immediate notification |

| California, USA | CPRA (2020) | $7,500 per intentional violation | Required for sensitive data | “Expedient” notification |

| South Korea | PIPA (2011, amended) | 3% of revenue | Required for financial data only | 24 hours |

The gap is instructive: South Korea does not mandate encryption for non-payment personal data. Had Coupang been operating under GDPR, the absence of encryption for names, addresses, and order histories would have constituted an aggravating factor attracting enhanced penalties—and a legal requirement, not merely a best-practice recommendation. The PIPC’s investigation explicitly cited this absence as a contributing factor to the breach’s impact.

The South Korea data privacy law reform after Coupang is now a live legislative debate. President Lee’s call for stronger penalties, the PIPC’s support for punitive fines, and the 3%-to-10% penalty ceiling proposal all represent pressure for alignment with international norms. But the investors’ ISDS action complicates that reform: any retroactive application of harsher penalties would, in the investors’ view, compound the treaty violation rather than resolve it.

Coupang’s Washington Wager

The company’s political footprint in Washington has added a dimension that South Korean civic groups find troubling—and that American trade lawyers find legally consequential. Since its 2021 NYSE listing, Coupang has reportedly spent more than $10.75 million on federal lobbying, targeting agencies across the executive branch and Congress. Following Donald Trump’s reelection in November 2024, the company donated $1 million to the Trump-Vance inaugural committee and positioned itself as a conduit for American export interests through a partnership with the Commerce Department’s International Trade Administration.

Coupang has publicly stated it has no connection to the investors’ ISDS filings, insisting it has been “fully complying with the Korean government’s requests.” Yet the political infrastructure built over five years has, at minimum, created the architecture through which investor grievances could be amplified into government-level intervention. Whether this constitutes sophisticated stakeholder management or a structural conflict of interest for a company operating under Korean regulatory jurisdiction is a question Seoul’s policymakers are beginning to ask with increasing urgency.

Financial Fallout: A $8 Billion Market Cap Erasure

The breach’s financial consequences have been severe. Following public disclosure in late November 2025, Coupang’s stock (NYSE: CPNG) fell sharply, erasing more than $8 billion in market capitalization, with shares declining roughly 50% from their pre-breach highs. The company swung from a Q4 2024 net income of $156 million to a Q4 2025 net loss of $26 million, missing analyst consensus estimates, as active customers slipped and December growth decelerated to approximately 4% in constant currency terms—down from 16% in the prior three months.

The 1.685 trillion won ($1.17 billion) compensation package—issued as 50,000-won platform-use vouchers to all 33.7 million affected users—has been criticized by lawmakers as a mechanism that recirculates money within Coupang’s own ecosystem rather than providing genuine restitution. It is, simultaneously, the largest corporate data breach compensation in South Korean history. Coupang’s full-year 2025 revenue nonetheless reached $34.5 billion, and the company retains over $7 billion in cash—a balance sheet that provides resilience, if not immunity, from the regulatory and legal storm surrounding it.

In Taiwan, where Coupang has been aggressively expanding, the forensic investigation confirmed that one user account was accessed—though earlier reports suggested a spillover affecting approximately 200,000 Taiwanese accounts, a figure Coupang has disputed.

What Reform Looks Like: A Policy Agenda for Seoul and Beyond

The Coupang case offers several policy imperatives that extend beyond Korea’s borders:

First, South Korea must close the encryption gap. The absence of a mandatory encryption standard for non-financial personal data is an anachronism in a country that hosts some of the world’s most sophisticated digital infrastructure. Alignment with GDPR-equivalent standards is not merely a trade relations gesture—it is an essential infrastructure investment in the age of AI data dependency.

Second, ISDS provisions must be examined for fitness-of-purpose in the digital economy context. The original ISDS architecture was designed to protect physical-asset investments—factories, mines, infrastructure—from expropriation by host governments. Applying that framework to data enforcement actions against technology companies creates perverse incentives: it effectively allows investors to convert regulatory pressure into trade litigation, circumventing the very domestic accountability mechanisms that consumers require. The KORUS FTA’s digital trade provisions were cited in both investor filings and congressional testimony; renegotiating their scope deserves attention from both trade ministries.

Third, breach notification timelines must have teeth. Coupang reported the breach to authorities more than 53 hours after internal identification—more than double the 24-hour requirement. That delay destroyed evidentiary logs. Any reformed framework should mandate automated, cryptographically verifiable notification to regulators at the moment of internal breach confirmation, not at the company’s discretion.

Fourth, the distinction between “access” and “harm” requires legislative clarity. The central factual dispute in the Coupang case—33.7 million accounts accessed versus approximately 3,000 records retained—has no clean resolution under current Korean law. A mature data governance framework would define the spectrum between these poles and prescribe proportionate enforcement accordingly, reducing both regulatory overreach and corporate minimization.

The Broader Geopolitical Resonance

The Coupang episode is not an isolated incident. It belongs to a wider pattern in which digital companies—structurally transnational but operationally concentrated in single markets—are caught between the sovereign enforcement prerogatives of their host nations and the financial interests of their investor base, which is increasingly cross-border, treaty-protected, and politically connected.

South Korea is not alone in navigating this terrain. France has faced analogous tensions over GDPR enforcement against American platforms. India’s data localization rules have generated investor concern under its bilateral investment treaties. China’s PIPL, despite its severity on paper, has been selectively enforced in ways that draw diplomatic complaints. The Coupang data governance reform South Korea conversation is, at its core, a version of a global argument: in a world where data is the primary asset of the digital economy, whose law governs it, who enforces that law, and what recourse exists when the answers conflict?

Seoul has a specific reason to resolve this question urgently. Its status as a trusted partner for foreign investment—particularly American capital—depends on the perception of consistent, proportionate, and non-discriminatory enforcement. President Lee’s calls for heavy penalties may play well in domestic politics. But if they are perceived internationally as retroactive, targeted, or politically motivated, the reputational cost will be measured not only in arbitration awards but in the long-term trajectory of foreign direct investment into one of Asia’s most dynamic economies.

Conclusion: The Governance Dividend

The Coupang case will likely be resolved through negotiation—the 90-day consultation period, political back-channels, and the mutual interest both governments have in de-escalation suggest that formal ISDS arbitration, with its multi-year timeline and uncertain outcomes, is a last resort rather than a destination. The tariff issue is governed by economics larger than any single company. Trade ministers on both sides have urged restraint.

But resolution of the immediate dispute should not be confused with resolution of the underlying problem. South Korea has a data governance framework that is partially adequate for the digital economy it has built. It lacks mandatory encryption standards for the most commonly collected personal data. It has penalty caps that, paradoxically, invite both regulatory maximalism and investor challenges. It has notification timelines that exist on paper and evaporate under corporate pressure.

The citizens whose data was accessed—not sold, perhaps, but accessed without consent, for 137 days, by someone who then submerged a laptop in a river to escape accountability—did not generate this geopolitical drama. They were its precondition. Any reform that emerges from the Coupang episode owes its first obligation to them: not to Washington, not to Seoul’s trade ministry, and certainly not to the shareholders whose portfolio values informed the language of “expropriation.”

Data governance, in the end, is not a trade issue. It is a social contract. South Korea, one of the world’s most digitally sophisticated societies, has the institutional capacity to write that contract properly. The Coupang breach made the cost of delay unmistakably visible.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Opinion

Boeing’s 500-Jet China Deal: Trump-Xi Summit’s $50B Game-Changer

On a Friday afternoon in early March, Boeing’s stock did something it hadn’t done in months: it surged. Shares of the aerospace giant jumped as much as 4 percent — the best performance on the Dow Jones Industrial Average that day — after Bloomberg reported that the company is closing in on one of the largest aircraft sales in its 109-year history. The prize: a 500-aircraft order for 737 Max jets from China, to be unveiled when President Donald Trump makes his first state visit to Beijing since 2017 — scheduled for March 31 to April 2.

If confirmed, the deal would represent nothing less than Boeing’s formal re-entry into the world’s second-largest aviation market after years of diplomatic cold-shouldering, safety-related groundings, and trade-war turbulence. It would also cement a pattern that has quietly defined Trump’s second term: the systematic use of America’s largest exporter as a diplomatic sweetener in geopolitical negotiations.

The Numbers Behind the Boeing 737 Max China Deal

Let’s be precise about what is reportedly on the table. According to people familiar with the negotiations cited by Bloomberg, the headline figure is 500 Boeing 737 Max jets — narrowbody, single-aisle workhorses that form the backbone of Chinese domestic aviation. Separately, the two sides are in advanced discussions over a widebody package of approximately 100 Boeing 787 Dreamliners and 777X jets, though that portion of the deal is expected to be announced at a later date and would not feature in the Trump-Xi summit communiqué.

At current list prices — the 737 Max 8 carries a sticker price of roughly $101 million per aircraft — the narrowbody package alone would approach $50 billion in nominal terms before the standard deep discounts that large airline orders attract. Factor in the widebody tranche, and the full package could eventually represent the single largest bilateral aviation deal ever struck between the United States and China.

Boeing itself declined to comment. China’s Ministry of Commerce did not respond to requests outside regular hours. The White House offered no immediate statement. But the market spoke clearly enough.

A Decade of Order Drought — and Why China Needs Boeing Now

To appreciate the magnitude of this potential agreement, consider the context. China once made up roughly 25 percent of Boeing’s order book. Today, Boeing holds only 133 confirmed orders from Chinese airlines — approximately 2 percent of its total book. Investing.com That collapse in Chinese demand was not accidental. It was the deliberate consequence of a cascade of crises: the global grounding of the 737 Max following two fatal crashes in 2018 and 2019, the trade tensions of Trump’s first term, and the pandemic-era freeze on civil aviation procurement.

Yet Chinese airlines have been quietly suffocating under constrained fleet capacity. Aviation analysts and industry sources say China needs at least 1,000 imported planes to maintain growth and replace older aircraft. WKZO The country’s carriers — Air China, China Eastern, China Southern — are operating aging fleets while passenger demand has rebounded sharply. The arithmetic of Chinese aviation is unforgiving: a country of 1.4 billion people, a rapidly expanding middle class, and a domestic network that still relies heavily on Western-certified jet technology cannot simply wait indefinitely for political stars to align.

Beijing has also been hedging. China is simultaneously in talks for another 500-jet order with Airbus that would be in addition to any Boeing deal — negotiations that have been in on-off discussions since at least 2024. WKZO But Airbus has its own capacity constraints and delivery backlogs. The reality is that both European and American planemakers are needed to feed China’s aviation appetite, which gives Boeing considerable strategic leverage — if it can navigate the politics.

Trump’s Boeing Diplomacy: A Playbook Refined

There is a recognizable pattern here, and it is worth naming explicitly. Trump has used Boeing as a tool to sweeten accords with other governments Yahoo Finance, and the China deal fits squarely within that framework. Earlier in his second term, large Boeing orders from Gulf carriers and Southeast Asian airlines followed Trump diplomatic visits — deals that generated political headlines and tangible employment commitments in American manufacturing states.

The Beijing summit, however, would be the most significant deployment of this strategy yet. US-China trade tensions have been acute in early 2026. Trump threatened to impose export controls on Boeing plane parts in Washington’s response to Chinese export limits on rare earth minerals. Yahoo Finance During earlier trade clashes, Beijing ordered Chinese airlines to temporarily stop taking deliveries of new Boeing jets — before resuming later that spring. WKZO

That on-off pattern illustrates the extraordinary vulnerability of commercial aviation to geopolitical temperature. Unlike soybeans or semiconductors, a Boeing 737 Max is not a fungible commodity. It requires years of certified maintenance infrastructure, pilot training, and regulatory framework built around American aviation standards. Both sides know this, which is precisely why aircraft orders have become such potent bargaining chips.

The planned summit structure — Trump in Beijing from March 31 to April 2, followed by Xi visiting Washington later in the year — also suggests a two-stage negotiation architecture. The 737 Max order would serve as a confidence-building gesture at the first meeting; the widebody 787 and 777X tranche would follow as trust is consolidated.

Boeing’s Recovery Trajectory: Why Timing Matters

For Boeing CEO Kelly Ortberg, the timing of a China breakthrough could scarcely be more critical. Boeing’s total company backlog grew to a record $682 billion in 2025, primarily reflecting 1,173 commercial aircraft net orders for the year, with all three segments at record levels. Boeing Yet the Chinese market has remained conspicuously absent from that recovery story.

Boeing has achieved FAA approval to increase 737 Max production to 42 jets per month, a significant step toward restoring manufacturing capacity, and the company plans to raise 787 Dreamliner output to 10 aircraft per month during 2026. Investing.com In short, for the first time in several years, Boeing actually has the industrial capacity to absorb a massive new order. Management has targeted approximately 500 737 deliveries in 2026 and 787 deliveries of roughly 90–100 aircraft, while targeting positive free cash flow of $1–3 billion for the year. TipRanks

A confirmed China order of this scale would not merely boost the backlog — it would validate the entire recovery narrative. It would signal to Wall Street that the 737 Max safety rebound is complete, that Chinese regulators have definitively recertified the aircraft, and that geopolitical risk has sufficiently receded to justify multi-year procurement commitments. As Reuters reported, Boeing’s share price rose 3.7 percent on the news — but analysts caution that several sticking points remain unresolved, and a deal is not yet assured.

Aviation Ripple Effects: What a China Mega-Deal Means for Global Travelers

The significance of a Boeing 737 Max China order in 2026 extends well beyond corporate balance sheets. Chinese carriers operating newer, more fuel-efficient 737 Max jets would dramatically expand route networks — both domestically and internationally. The 737 Max 10, capable of flying roughly 3,300 nautical miles at maximum range, opens trans-regional routes that older Chinese narrowbody fleets cannot economically serve.

For the global travel industry — and for the Expedia-era traveler booking multi-stop itineraries across Asia — this translates into more competitive airfares, denser flight schedules out of Chinese hub airports, and expanded connectivity between Chinese secondary cities and international destinations. Tourism economists estimate that each percentage point increase in seat capacity on a major international corridor correlates with a 0.6 to 0.8 percent increase in inbound tourist arrivals. A Chinese aviation expansion of this magnitude, fuelled by 500 new-generation jets, would register meaningfully in global travel demand forecasts through the late 2020s.

The geopolitical calculus cuts the other way too. Should talks collapse — perhaps due to escalation over Taiwan, renewed rare-earth export controls, or a postponement of the Trump visit, which Bloomberg noted could occur if the ongoing US-Iran situation deteriorates — Boeing’s China exposure remains an open wound rather than a healed scar.

Historical Context: The Ghosts of Boeing-China Deals Past

This would not be the first time a US presidential visit to China generated a headline Boeing order. In 2015, during Barack Obama’s final engagement with Xi Jinping, Chinese carriers placed orders for over 300 Boeing jets — a deal that at the time was celebrated as a pillar of the bilateral commercial relationship. It took less than four years for that relationship to unravel under the dual pressures of the MAX crisis and Trump’s first-term tariffs.

The lesson is not that such deals are illusory. It is that they are fragile by design — deeply dependent on the political weather. A Boeing 500-plane order tied to Trump’s Beijing summit is, in that sense, simultaneously a genuine commercial transaction and a diplomatic performance. Its durability will depend less on what is signed in Beijing in April than on what is negotiated, month by month, in the trade relationship that follows.

Forward Outlook: Promise, Risk, and the Long Game

Boeing’s aircraft stand to feature prominently in whatever trade framework emerges from the Trump-Xi summit. But seasoned observers of US-China commercial aviation will note that a similar mega-deal euphoria surrounded Airbus last year — and ultimately failed to materialize. Given the fraught geopolitical backdrop, Boeing’s order bonanza is not assured, and two people familiar with the talks have specifically cautioned that deal completion remains uncertain. Yahoo Finance

What is certain is this: the structural demand is real, the production capacity is finally in place, and the political incentive on both sides has rarely been stronger. For Boeing, recapturing even a fraction of what was once a market that constituted a quarter of its order book would represent a transformation of its strategic position. For China’s airlines, new Boeing jets mean competitive fleets, lower operating costs, and the capacity to serve a travelling public that has never stopped wanting to fly.

The planes, as ever, are ready. The question is whether the politics will let them take off.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance2 months ago

Markets & Finance2 months agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Analysis4 weeks ago

Analysis4 weeks agoBrazil’s Rare Earth Race: US, EU, and China Compete for Critical Minerals as Tensions Rise

-

Banks2 months ago

Banks2 months agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Investment2 months ago

Investment2 months agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Asia2 months ago

Asia2 months agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Global Economy2 months ago

Global Economy2 months agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy2 months ago

Global Economy2 months agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Global Economy2 months ago

Global Economy2 months ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis