Geopolitics

Trafigura’s Venezuelan Oil Gambit: When Geopolitics Meets Market Mechanics

How a landmark crude sale from Caracas signals the collision of energy pragmatism, sanctions architecture, and hemispheric power dynamics

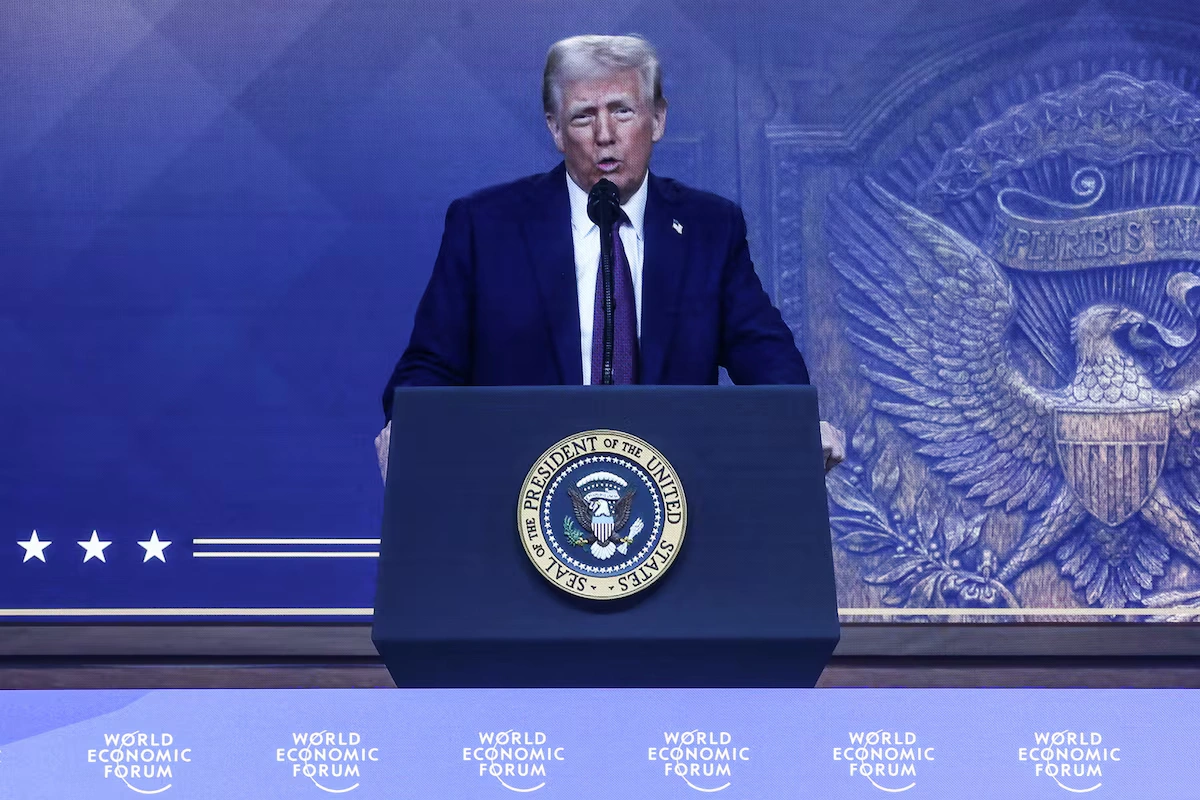

The commodity trading world rarely produces moments of genuine geopolitical significance. Yet when Trafigura Group CEO Richard Holtum stood before President Donald Trump at the White House on January 9, 2026, announcing preparations to load the first Venezuelan crude shipment “within the next week,” he was signaling far more than a routine commercial transaction. This landmark sale represents the most consequential shift in Western Hemisphere energy flows since sanctions severed direct Venezuelan crude trade with the United States seven years ago.

What unfolded in that White House gathering—with nearly 20 industry representatives present—was nothing less than the reconfiguration of Atlantic Basin petroleum markets. The implications ripple across refinery economics in Louisiana and Texas, Canadian heavy crude pricing, geopolitical calculations in Beijing, and the future trajectory of a nation holding the world’s largest proven oil reserves yet producing barely one million barrels daily.

For students of political economy and commodity markets alike, this development offers a masterclass in how commercial incentives, regulatory frameworks, and strategic interests intersect—and occasionally collide.

The Commercial Architecture of an Unprecedented Deal

Trafigura, the world’s third-largest physical commodities trading house behind Vitol and Glencore, has spent decades cultivating expertise in jurisdictional complexity. Operating across 150 countries with revenues exceeding $230 billion annually, the Geneva-based trader has built its reputation on navigating precisely the kind of regulatory labyrinths that Venezuela now presents.

The company’s approach to this Venezuelan engagement reveals sophisticated risk management. According to Reuters, Trafigura and rival Vitol have secured preliminary licenses from the U.S. government authorizing Venezuelan oil imports and exports for an 18-month period. These authorizations, structured through the Treasury Department’s Office of Foreign Assets Control (OFAC), represent a calibrated shift in sanctions enforcement rather than wholesale relief.

The trading houses are not purchasing Venezuelan crude for their own account in the traditional sense. Instead, they’re providing logistical and marketing services at the U.S. government’s request—a crucial legal distinction. This structure allows Washington to maintain nominal control over Venezuelan oil flows and revenue distribution while leveraging private sector expertise in shipping, blending, and market placement.

Industry sources familiar with the arrangements suggest initial shipment volumes in the range of 400,000 to 600,000 barrels per Very Large Crude Carrier (VLCC), with Venezuelan grades including Merey 16, BCF-17, and potentially upgraded Hamaca crude from the Orinoco Belt. These extra-heavy grades, with API gravity below 16 degrees and sulfur content exceeding 2.5%, require specialized refinery configurations—precisely what Gulf Coast facilities were designed to handle.

Venezuela’s Petroleum Paradox: Abundance Without Capacity

The disconnect between Venezuela’s resource endowment and production reality represents one of the starkest industrial collapses in modern energy history. With 303 billion barrels of proven reserves—surpassing even Saudi Arabia’s 267 billion—Venezuela theoretically controls nearly 18% of global recoverable petroleum resources, according to the U.S. Energy Information Administration.

Yet current production hovers around 1.1 million barrels per day, down from 3.5 million bpd achieved in the late 1990s. This represents a 68% decline from peak capacity—a deterioration driven by chronic underinvestment, workforce attrition, infrastructure decay, and the compounding effects of U.S. sanctions imposed since 2019.

Rystad Energy, a leading petroleum research firm, estimates that approximately $53 billion in upstream and infrastructure investment would be required over the next 15 years merely to maintain current production levels. Restoring output to 3 million bpd by 2040—the level Venezuela last sustained in the early 2000s—would require approximately $183 billion in total capital expenditure, or roughly $12 billion annually.

The Orinoco Belt region, containing the densest concentration of reserves, has seen production plummet from 630,000 bpd in November to 540,000 bpd in December 2025, reflecting systemic infrastructure vulnerabilities. Upgraders designed to convert extra-heavy crude into more marketable synthetic grades operate far below capacity or lie completely idle. According to industry assessments, PDVSA’s pipeline network has received virtually no meaningful updates in five decades.

For context, Venezuela’s deteriorated production infrastructure means that even with political stability and sanctions relief, energy analytics firm Kpler projects output could reach only 1.2 million bpd by end-2026—a modest 400,000 bpd increase requiring mid-cycle investment and repairs at facilities like the Petropiar upgrader operated by Chevron.

The Refinery Calculus: Why Gulf Coast Operators Are Paying Attention

Louisiana’s 15 crude oil refineries, accounting for one-sixth of total U.S. refining capacity with processing ability near 3 million barrels daily, were engineered with one primary feedstock in mind: heavy sour crude from Latin America, particularly Venezuela. Most facilities were constructed in the 1960s and 1970s, then retrofitted with advanced coking capacity and corrosion-resistant metallurgy to handle the high-sulfur, low-API gravity crudes that Venezuelan fields produce.

The economics are compelling. Bloomberg analysis indicates that highly complex refiners with substantial coking capacity—including Valero Energy, Marathon Petroleum, Phillips 66, and PBF Energy—can achieve 33% distillate yields versus 30% for medium-complexity plants. Venezuelan Merey crude from the Orinoco Belt, among the highest in sulfur content globally, maximizes the competitive advantage of these specialized facilities.

The U.S. Gulf Coast currently imports approximately 665,000 bpd of heavy crude with API gravity below 22 degrees from sources including Canada (Western Canadian Select), Mexico (Maya), and Middle Eastern producers. Energy Intelligence estimates that U.S. refiners could absorb an additional 200,000 bpd of Venezuelan crude relatively quickly, with potential to increase that figure substantially after equipment adjustments and supply contract renegotiations.

At the start of this century, U.S. refiners were importing approximately 1.2 million bpd of Venezuelan oil—much of it upgraded bitumen. Current infrastructure and refinery configurations could theoretically support a return to those volumes, though logistics, pricing, and regulatory clarity would need to align.

For refiners, Venezuelan crude offers several advantages. First, proximity translates to freight economics: shipping from Venezuelan terminals to Gulf Coast ports requires roughly 5-7 days versus 30-45 days from Middle Eastern sources. Second, Venezuelan grades typically trade at discounts to benchmark crudes, potentially widening crack spreads—the difference between crude costs and refined product values. Third, these heavy grades yield higher proportions of diesel and fuel oil, products currently commanding premium pricing due to renewable diesel conversions reducing traditional distillate supply.

The counterargument, however, involves operational adjustments. Many Gulf Coast refiners have spent the past 15 years optimizing their configurations for the glut of light sweet shale crude produced domestically. Pivoting back toward heavier feedstocks requires time and capital—industry sources suggest 3-6 months per processing unit, with costs potentially exceeding $1 per barrel in margin improvement to justify the investment.

Trafigura’s Strategic Positioning in Complex Markets

What distinguishes Trafigura in this Venezuelan engagement extends beyond balance sheet capacity. The company has cultivated a decades-long specialization in jurisdictionally difficult environments—precisely the combination of political risk, infrastructure constraints, and regulatory complexity that Venezuela epitomizes.

Trafigura’s historical Venezuela operations predate sanctions. Before 2019, the trader was among the most active marketers of Venezuelan crude, establishing relationships with PDVSA and building operational knowledge of loading terminals, crude quality variations, and blending requirements. That institutional memory proves invaluable now.

The company’s approach to compliance has been tested repeatedly. Trafigura has faced scrutiny over operations in sanctioned jurisdictions before, including settlements with the U.S. Department of Justice for bribery allegations related to Brazilian operations and with the Commodity Futures Trading Commission for gasoline market manipulation in Mexico. These experiences have necessitated robust compliance infrastructure—a prerequisite for operating under OFAC licenses where violations carry severe civil and criminal penalties.

Trafigura’s business model—focused on logistics, blending, and market arbitrage rather than production assets—aligns well with the current Venezuelan opportunity. The company can deploy expertise in vessel chartering, crude quality analysis, and customer matching without requiring the massive upstream capital that would deter integrated oil majors.

Competitor Vitol, the world’s largest independent oil trader, brings similar capabilities. Vitol’s participation signals industry-wide assessment that Venezuelan crude flows, under U.S. oversight, present acceptable risk-adjusted returns despite ongoing political uncertainty.

The Sanctions Architecture: Calibrated Control, Not Wholesale Relief

Understanding the current regulatory framework requires precision. The Trump administration has not lifted Venezuelan oil sanctions. Rather, OFAC has issued specific licenses to selected trading houses, creating a controlled channel for Venezuelan crude to reach international markets under explicit conditions.

This represents a dramatic evolution from the sanctions regime imposed in January 2019, when OFAC designated PDVSA for operating in Venezuela’s oil sector pursuant to Executive Order 13850. That designation froze all PDVSA property subject to U.S. jurisdiction and prohibited American entities from transacting with the company without authorization.

Treasury Department statements emphasize that current arrangements aim to “control the marketing and flow of funds in Venezuela so those funds can be used to better the conditions of the Venezuelan people.” This framing positions the U.S. government as de facto revenue manager rather than sanctions enforcer—a subtle but significant shift.

The legal mechanism involves General Licenses and specific licenses issued through OFAC. General License 41, which had authorized Chevron to resume restricted operations since November 2022, was amended in March 2025 requiring the company to wind down operations. Most other specific licenses expired concurrently. The new licenses to Trafigura and Vitol represent a different model: government-directed marketing rather than production partnerships.

The Treasury’s recent actions underscore that enforcement remains vigorous against non-authorized actors. In December 2025, OFAC sanctioned six shipping companies and identified six vessels as blocked property for operating in Venezuela’s oil sector without authorization. These companies were part of the “shadow fleet” that has historically moved Venezuelan crude to China and other buyers at steep discounts.

The sanctions architecture creates market segmentation: licensed traders operating under U.S. oversight versus shadow fleet operators facing interdiction risk. This bifurcation should theoretically compress discounts for licensed flows while maintaining sanctions pressure on regime-linked networks.

Geopolitical Dimensions: Rebalancing Hemispheric Energy Flows

The strategic implications extend far beyond commercial calculations. For decades, China has absorbed the lion’s share of Venezuelan oil exports through opaque arrangements involving state-owned enterprises and lesser-known intermediaries. These flows, estimated at 400,000 bpd in 2025 according to Kpler, often occurred at significant discounts and through non-transparent payment structures linked to debt repayment.

Redirecting Venezuelan crude to U.S. Gulf Coast refiners accomplishes several objectives simultaneously. It provides Washington with leverage over Venezuelan revenue streams, reduces Beijing’s monopsony position in Venezuelan petroleum markets, and offers Gulf Coast refiners access to feedstocks compatible with their infrastructure at potentially attractive pricing.

The timing coincides with broader Trump administration efforts to reshape hemispheric relationships. Following the controversial detention of Venezuelan officials and increased naval presence in Caribbean waters, the Venezuelan oil arrangement represents the economic component of a multi-dimensional strategy toward Caracas.

For Canada, the implications prove more ambiguous. Western Canadian Select (WCS) crude competes directly with Venezuelan heavy grades in Gulf Coast markets. If Venezuelan volumes increase substantially, WCS could face pricing pressure—though Canadian producers might compensate by redirecting flows westward through the expanded Trans Mountain pipeline to Pacific markets serving Asian buyers.

OPEC dynamics add another layer. Venezuela remains an OPEC member despite production far below its quota. Restoration of Venezuelan output, even to 1.5-2 million bpd, would introduce additional heavy crude supply into global markets already experiencing oversupply conditions. Brent crude has been trading near $60 per barrel, with analysts projecting potential pressure toward $50 if Venezuelan production ramps significantly.

The International Energy Agency projects that global oil demand growth will decelerate through 2026, driven by electric vehicle adoption, efficiency improvements, and economic headwinds. In this context, additional Venezuelan supply could pressure prices—benefiting consumers and refiners while challenging higher-cost producers.

Infrastructure Realities: The Time Dimension of Production Recovery

Commodity traders and refinery executives can move relatively quickly. Geopolitics shifts in weeks or months. But petroleum infrastructure operates on a different timeline entirely.

Venezuela’s production capacity deterioration reflects decades of deferred maintenance, equipment failures, workforce departures, and technological obsolescence. Restoring output isn’t a matter of flipping switches—it requires systematic well workovers, pipeline repairs, upgrader rehabilitations, and power system stabilization.

Industry assessments suggest that approximately 300,000 bpd of additional supply could be restored within 2-3 years with limited incremental spending, primarily through well intervention in the Maracaibo Basin and completion of deferred maintenance at existing facilities. This represents the “low-hanging fruit”—production that can be recovered through operational optimization rather than major capital deployment.

Reaching 1.7-1.8 million bpd by 2028 would require substantial upstream capital spending and the restart of idled upgraders in the Orinoco Belt, according to Kpler. Without sweeping institutional reform at PDVSA and new upstream contracts with foreign operators, output exceeding 2 million bpd appears unlikely within this decade.

The investment calculus hinges on political risk assessment. American oil companies—despite White House encouragement—have shown limited appetite for committing billions to Venezuelan operations absent legal framework certainty, property rights clarity, and political stability guarantees. Chevron, currently the only U.S. major with meaningful Venezuelan presence, has tempered expansion plans given regulatory uncertainty.

International operators face additional considerations. Environmental, Social, and Governance (ESG) commitments have become central to institutional investor relations. Venezuelan exposure—given corruption perceptions, human rights concerns, and environmental track records—creates reputational risks that many companies find difficult to justify regardless of commercial returns.

Market Mechanics: Pricing, Logistics, and Competitive Dynamics

The petroleum markets pricing Venezuelan crude provides crucial context. Venezuelan grades trade on a netback basis from Gulf Coast values, with adjustments for quality differentials, freight costs, and risk premiums. Historically, Merey crude traded at discounts of $8-15 per barrel versus West Texas Intermediate benchmark, reflecting its inferior quality and higher processing costs.

Under the new arrangement with U.S. government oversight, several factors should theoretically compress discounts. First, removal of sanctions risk reduces the premium required to compensate buyers for regulatory exposure. Second, official sales channels eliminate the opacity and logistical complications associated with shadow fleet operations. Third, greater volume certainty allows refiners to optimize processing schedules rather than treating Venezuelan crude as opportunistic.

However, Venezuelan crude must still compete with established alternatives. Western Canadian Select typically trades at $15-20 discounts to WTI. Mexican Maya, another heavy sour grade, trades at $3-6 discounts. Middle Eastern grades like Arab Heavy and Basrah Heavy carry their own pricing dynamics based on quality and freight economics.

The logistics dimension proves equally complex. Venezuela’s export infrastructure has deteriorated alongside production capacity. Loading terminals at Jose and Bajo Grande have experienced periodic outages. VLCC (Very Large Crude Carrier) availability fluctuates based on insurance market willingness to cover Venezuelan waters. Blending requirements—mixing extra-heavy crude with diluents to achieve transportable viscosity—add operational complexity and cost.

For Trafigura and Vitol, success requires optimizing each dimension: sourcing crude at competitive prices, securing appropriate tonnage, blending to meet refinery specifications, timing deliveries to match refinery turnaround schedules, and managing counterparty credit risk. These trading houses excel precisely because they’ve built systems to coordinate these moving parts across global supply chains.

Refinery Sector Response: Cautious Interest, Conditional Commitment

Gulf Coast refinery executives express measured enthusiasm tempered by pragmatic concerns. Conversations with industry sources reveal a consistent pattern: interest in Venezuelan crude availability exists, but commitment requires clarity on volume reliability, price competitiveness, and regulatory stability.

Valero Energy, one of the Gulf Coast’s largest independent refiners with significant heavy crude coking capacity, has historical experience processing Venezuelan grades. The company’s complex refineries in Texas and Louisiana could theoretically absorb substantial volumes. Similarly, Marathon Petroleum, Phillips 66, and PBF Energy—all identified by Bloomberg as having advantaged positions—have begun preliminary discussions with traders.

The private calculus involves margin analysis. Refiners model crack spreads—the difference between crude acquisition costs and refined product revenue—under various scenarios. Venezuelan crude must offer sufficient discounts to justify the operational adjustments required to process it relative to current feedstock slates.

One refinery consultant suggested that processing Venezuelan heavy sour could improve margins by more than $1 per barrel for optimally configured facilities—a meaningful improvement in an industry where quarterly earnings often hinge on single-digit margin shifts. However, realizing those economics requires locking in regular supplies and completing equipment modifications.

The other consideration involves alternative destinations. If Venezuelan crude doesn’t offer competitive economics to Gulf Coast refiners, it could flow to Indian or Spanish facilities—both have historical experience with Venezuelan grades and could potentially absorb volumes. This global optionality constrains how aggressively refiners can negotiate, as traders maintain leverage through alternative placement channels.

Forward-Looking Scenarios: Mapping Possible Trajectories

Projecting Venezuelan oil’s trajectory requires scenario planning across multiple dimensions. Consider three plausible pathways:

Scenario One: Controlled Ramp (Most Probable) Venezuelan crude exports to U.S. Gulf Coast increase gradually to 300,000-400,000 bpd by end-2026, facilitated by licensed traders under government oversight. Production reaches 1.2 million bpd through operational optimization without major capital deployment. Revenues flow through supervised channels, with incremental stability allowing limited foreign investment. This scenario implies modest pressure on Canadian heavy crude pricing, marginal tightening of heavy-light differentials, and sustainable if unspectacular commercial returns for trading houses.

Scenario Two: Accelerated Recovery (Optimistic) Political consolidation and institutional reform unlock significant foreign investment. Production accelerates toward 1.7-1.8 million bpd by 2028 as upgraded infrastructure comes online. U.S. and international oil companies commit tens of billions in upstream capital, viewing Venezuelan reserves as strategic long-term assets. In this pathway, Venezuelan crude becomes a major factor in Atlantic Basin markets, materially impacting WCS pricing and potentially displacing Middle Eastern imports. However, this scenario requires sustained political stability—historically elusive in Venezuela.

Scenario Three: Partial Reversal (Bearish) Operational challenges, infrastructure failures, or political instability constrain production recovery. Volumes remain below 1 million bpd despite initial optimism. Sanctions enforcement against non-licensed actors proves inconsistent, allowing shadow fleet operations to continue. Limited revenue transparency and governance failures deter major investment. In this scenario, Venezuelan crude remains a niche supply source rather than transformative market factor, with Trafigura and Vitol managing modest volumes under challenging conditions.

The probability-weighted outcome likely falls between scenarios one and three—meaningful but constrained growth, subject to political volatility and infrastructure limitations that prevent full potential realization.

The Institutional Question: Can PDVSA Be Reformed?

Perhaps the most fundamental uncertainty involves Petróleos de Venezuela (PDVSA) itself. The state oil company, once among Latin America’s premier petroleum enterprises, has become synonymous with mismanagement, corruption, and operational dysfunction.

PDVSA’s decline predates sanctions, as noted by Carole Nakhle, CEO of Crystol Energy: “The collapse predates sanctions. Chronic mismanagement, politicization and underinvestment weakened the industry long before restrictions were imposed.” Sanctions accelerated deterioration but didn’t originate it.

Restructuring PDVSA would require addressing systemic issues: depoliticizing hiring and operations, implementing transparent financial reporting, establishing commercial rather than political decision-making processes, and potentially restructuring approximately $190 billion in outstanding debt obligations owed to creditors including China, Russia, and bondholders.

Without comprehensive institutional reform, foreign companies remain reluctant to commit capital. Joint ventures and service contracts require enforceable legal frameworks and predictable fiscal terms—precisely what Venezuela has lacked for two decades. Some analysts suggest that meaningful recovery might require PDVSA’s effective dismantling and reconstruction from first principles—a politically fraught proposition that successive governments have proven unwilling to undertake.

Broader Implications: Lessons for Energy Geopolitics

This Venezuelan oil saga offers several insights applicable beyond the immediate case:

First, sanctions prove most effective when they change incentive structures rather than simply imposing costs. The current approach—using licensed trading as a control mechanism—represents an evolution from blanket prohibition toward calibrated engagement. Whether this proves more effective at achieving policy objectives remains to be seen.

Second, commodity trading houses occupy a unique position in global energy systems. Their expertise in logistics, risk management, and market arbitrage makes them valuable intermediaries when geopolitical objectives intersect with commercial imperatives. Trafigura and Vitol aren’t merely profit-seekers; they’re providing functionality that governments and national oil companies cannot easily replicate.

Third, infrastructure constraints impose real limits on geopolitical flexibility. Regardless of political developments, Venezuelan production cannot snap back quickly. The physical reality of deteriorated wells, corroded pipelines, and idled upgraders defines what’s possible over relevant timeframes.

Fourth, global oil markets have evolved toward abundance, reducing the strategic leverage that petroleum once provided. With U.S. shale production, Canadian oil sands, Brazilian deepwater, and Guyana offshore fields all contributing supply, Venezuelan barrels matter less than they did when the country produced 3.5 million bpd. This reduces the urgency from both commercial and geopolitical perspectives.

Conclusion: Pragmatism Ascendant, With Caveats

Trafigura’s preparation to load Venezuelan crude represents pragmatism superseding ideology in energy policy—at least provisionally. The arrangement acknowledges that Gulf Coast refiners can utilize Venezuelan heavy crude efficiently, that managed engagement might generate better outcomes than isolation, and that commodity trading expertise can facilitate complex transactions that governments struggle to execute directly.

Yet pragmatism operates within constraints. Infrastructure realities limit how quickly production can recover. Political uncertainties create investment hesitancy. Institutional dysfunction at PDVSA poses ongoing operational challenges. Global supply abundance reduces commercial urgency. These factors collectively suggest that Venezuelan crude will return to international markets, but gradually and conditionally rather than transformatively.

For market observers, several variables warrant monitoring: actual loading volumes versus projections, refinery uptake rates and processing economics, OFAC enforcement consistency against unauthorized actors, and infrastructure investment commitments from international oil companies. These indicators will reveal whether this Venezuelan engagement represents substantive change or merely incremental adjustment at the margins.

The intersection of energy markets and geopolitics rarely produces clean narratives. What unfolds in Venezuela over coming months will test whether commercial incentives can overcome institutional dysfunction, whether controlled engagement proves more effective than isolation, and whether pragmatism in energy policy can be sustained amid inevitable political turbulence.

For now, Trafigura prepares to load crude. Refiners evaluate economics. Policymakers calibrate oversight mechanisms. And the fundamental tension persists: between Venezuela’s immense petroleum potential and its demonstrated inability to realize it. That tension—not any single shipment—defines the Venezuelan oil story. Everything else is execution detail.

The author analyzes commodity markets and energy geopolitics with expertise in petroleum economics, sanctions policy, and hemispheric trade dynamics. Views expressed represent independent analysis informed by premium sources and industry consultation.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Volodymyr Zelenskyy Says Ukraine War is at the ‘Beginning of the End’: Why He’s Urging Trump to See Through Russia’s Peace ‘Games’

Four years ago today, the world held its breath as Russian armor rolled toward Kyiv, expecting a sovereign nation’s rapid collapse. Today, on February 24, 2026, the geopolitical narrative has fundamentally shifted from sheer survival to the brutal, complex mechanics of a resolution. Standing in Independence Square near a makeshift memorial of flags honoring fallen soldiers, Ukrainian President Volodymyr Zelenskyy cast a profound look toward the future. But it was his candid, newly published Financial Times Zelenskyy interview that sent immediate ripples through the corridors of power in Washington, Brussels, and Moscow. The Ukraine war end is no longer a distant abstraction. We are, in his exact words, at the “beginning of the end.”

However, this final chapter is fraught with diplomatic landmines. As the world digests the latest Ukraine war updates, Zelenskyy’s core message wasn’t just directed at his weary citizens or European allies; it was a targeted, urgent plea to U.S. President Donald Trump. His goal? To ensure Washington doesn’t fall for the Russia games Trump might be tempted to entertain in his quest for a historic diplomatic victory.

“The Beginning of the End”: Decoding Zelenskyy’s Strategy

In international diplomacy, vocabulary is everything. By declaring the conflict is at the “beginning of the end,” Zelenskyy is signaling a transition from indefinite attrition to the tactical positioning that precedes an armistice. He is acknowledging the realities of a war-weary globe while firmly attempting to dictate the terms of the endgame.

In his extensive interview, Zelenskyy clarified that the “beginning of the end” does not equate to an immediate surrender or a hasty territorial compromise. Instead, it marks the phase where military stalemates force genuine structural negotiations. The recent trilateral Geneva negotiations on February 18, 2026, underscored this shift. Zelenskyy described the talks as arduous, noting that while political consensus remains out of reach, tangible progress was achieved on military de-escalation protocols.

“Putin is this war. He is the cause of its beginning and the obstacle to its end. And it is Russia that must be put in its place so that there is real peace.” — Volodymyr Zelenskyy, February 24, 2026

Seeing Through Putin’s “Games”: A Warning to Washington

The return of Donald Trump to the White House has undeniably accelerated the push for a negotiated settlement. Following the highly scrutinized Trump-Putin summit in Anchorage, Alaska, in late 2025, anxiety has permeated Kyiv. The underlying fear is that Washington might broker a transactional deal over Ukraine’s head, exchanging Ukrainian sovereignty for a perceived geopolitical win against the backdrop of rising U.S.-China tensions.

Zelenskyy’s challenge to the U.S. President is blunt: come to Kyiv. “Only by coming to Ukraine and seeing with one’s own eyes our life and our struggle… can one understand what this war is really about,” Zelenskyy stated during his anniversary address.

He explicitly warned that Trump Russia Ukraine tripartite dynamics are being actively manipulated by Moscow. During Putin peace talks, the Kremlin’s proposals are not olive branches but tactical Trojan horses—designed to weaken Kyiv’s negotiating position and exploit the new U.S. administration’s desire for a swift resolution. “The Russians are playing games,” Zelenskyy noted, stressing that the Kremlin has no serious, good-faith intention of ending the war unless forced by overwhelming leverage.

[Map of the current line of contact in Eastern Ukraine and proposed ceasefire monitoring zones]

The Mechanics of Peace: Security Guarantees and Ceasefire Monitoring

A ceasefire without enforcement is merely a tactical pause for rearmament—a painful lesson Ukraine learned between 2014 and 2022. This is the crux of the current diplomatic deadlock. However, the February 18 Geneva talks highlighted that military pragmatism is slowly taking shape.

Crucially, the sides have reportedly resolved the logistical framework for monitoring a prospective ceasefire, which would include direct US participation ceasefire oversight. This represents a massive geopolitical pivot, particularly given the Trump administration’s historical reluctance to commit American resources abroad, though it stops short of deploying U.S. combat troops.

To prevent a future invasion, Kyiv is demanding ironclad Ukraine ceasefire guarantees before any guns fall silent. As analyzed by foreign policy experts at The Washington Post, vague promises will not suffice.

Proposed Security Frameworks vs. Historical Precedents

| Framework | Core Mechanism | Deterrence Level | Sticking Points in 2026 Negotiations |

| NATO Membership | Article 5 Mutual Defense | Absolute | Russia’s ultimate red line; lingering U.S./German hesitation. |

| “Coalition of the Willing” | Bilateral defense pacts (UK, France, Germany) | High | Robust, but lacks a unified, legally binding U.S. enforcement mandate. |

| U.S.-Monitored Ceasefire | Armed/unarmed monitors along the Line of Contact | Moderate | Highly vulnerable to domestic political shifts in Washington; “mission creep” fears. |

| Budapest Memorandum 2.0 | Diplomatic assurances & promises | Low | Wholly rejected by Kyiv due to the catastrophic failures of 2014 and 2022. |

The Economic Battlefield: Tariffs, Sanctions, and EU Accession

You cannot divorce the geopolitical reality of the conflict’s resolution from the ongoing global macroeconomic shifts. As of February 2026, the international economy is digesting President Trump’s newly implemented 10% global tariff, creating a complex web of leverage and friction among Western allies.

For Ukraine, the endgame is not merely about drawing lines on a map; it is about securing the economic viability required to rebuild its shattered infrastructure and advance its European Union accession. According to insights from The New York Times, Western aid must now transition from emergency military provisions to long-term economic reconstruction capital.

[Chart illustrating the comparative economic contraction and recovery projections of Russia and Ukraine from 2022 to 2026]

Russia, meanwhile, continues to operate a hyper-militarized war economy. While Moscow projects resilience, the structural rot is becoming impossible to hide. The Bloomberg commodities index reflects how Western sanctions have forced Russia to pivot its energy exports to Asian markets at steep discounts, fundamentally restructuring the global energy grid and slashing the Kremlin’s long-term revenue streams.

The Economic Attrition of the War (2022–2026)

| Economic Metric | Ukraine | Russia | Global Macro Fallout |

| GDP Impact | Stabilizing with EU/US aid, but fundamentally altered. | Masked by unsustainable state war production; civilian sector starved. | Lingering supply chain shifts; restructuring of global defense budgets. |

| Energy Exports | Near-total loss of transit revenue; grid heavily damaged. | Forced pivot to Asia at heavy discounts; loss of premium European market. | Accelerated European transition to renewables and U.S. LNG. |

| Labor Force | Severe strain due to mobilization and refugee displacement. | Mass exodus of tech/skilled labor; severe labor shortages across industries. | European demographic shifts due to integration of Ukrainian refugees. |

Expert Analysis: The Realities of Global Geopolitics in 2026

When we analyze the Zelenskyy beginning of the end statement through the lens of geopolitics 2026, it is clear this is a calculated narrative pivot. As international relations researchers at The Economist note, Zelenskyy is preemptively framing the narrative. By calling out Russia’s “games” publicly, he is boxing the Trump administration into a corner where any concession to Putin looks like American weakness rather than diplomatic pragmatism.

Europe, meanwhile, is stepping up. The “coalition of the willing”—spearheaded by the UK, France, and a re-arming Germany—recognizes that the continent can no longer rely solely on the American security umbrella. If the U.S. forces a bitter peace, Europe will be left dealing with the fallout of an emboldened, revanchist Russia on its borders.

Conclusion: Forging a Durable Peace

The fourth anniversary of the full-scale invasion is a somber reminder of the staggering human cost of this conflict. As Zelenskyy urges Trump to visit Independence Square and witness the “sea of pain” firsthand, the message is unmistakable: peace cannot be signed on a spreadsheet or dictated from a summit in Alaska. It must be forged in reality, backed by unshakeable security guarantees, and grounded in the acknowledgment that rewarding aggression only guarantees future wars.

The “beginning of the end” is here. The question now is whether the Western alliance, led by a highly transactional U.S. administration, has the strategic patience to ensure that the end results in a lasting, just peace—or merely a countdown to the next conflict.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Trump’s 2026 State of the Union: Navigating Low Polls, Shutdowns, and Divisions in a Fractured America

Explore President Trump’s upcoming 2026 SOTU address amid record-low approval and political turmoil—insights on the US economy, immigration, and foreign policy shifts.

A year after reclaiming the White House in a historic political comeback, President Donald Trump will step up to the House rostrum on Tuesday at 9 p.m. ET to deliver his State of the Union address. The political climate he faces, however, is one of unusual fragility. Midway between his inauguration and the critical November midterm elections, this 2026 SOTU preview reveals a commander-in-chief confronting a partial government shutdown, rare judicial rebukes, and deep fractures within his own coalition.

When Trump last addressed Congress in March 2025, his approval rating hovered near a career high, buoyed by the momentum of his return to power. Today, he faces an electorate thoroughly fatigued by persistent inflation and systemic gridlock. Tuesday’s address is intended to showcase a leader who has unapologetically reshaped the federal government. Yet, as the Trump State of the Union amid low polls approaches, the spectacle will inevitably be weighed against the stark economic and political realities defining his second act.

Sagging Polls and Economic Realities

Historically, Trump has leveraged economic metrics as his strongest political shield. But the US economy under Trump 2026 presents a complicated picture for international economist researchers and everyday voters alike. According to recent data from the Bureau of Economic Analysis, while the stock market has seen notable rallies, 2025 marked the slowest year for job and economic growth since the pandemic-induced recession of 2020.

A recent Gallup tracking poll places his overall approval rating near record lows. Furthermore, roughly two-thirds of Americans currently describe the nation’s economy as “poor”—a sentiment that mirrors the frustrations felt during the latter half of the Biden administration. Grocery, housing, and utility costs remain stubbornly high. Analysts at The Economist note that the US labor market has settled into a stagnant “low-hire, low-fire” equilibrium, heavily exacerbated by sweeping trade restrictions.

| Economic & Polling Indicator | March 2025 (Inauguration Era) | February 2026 (Current) |

| Overall Approval Rating | 48% | 39% |

| Immigration Handling Approval | 51% | 38% |

| GDP Growth (Quarterly) | 4.4% (Q3 ’25) | 1.4% (Q4 ’25 Advance) |

| Economic Sentiment (“Poor”) | 45% | 66% |

Trump has vehemently defended his record, insisting last week that he has “won” on affordability. In his address, he is widely expected to blame his predecessor, Joe Biden, for lingering systemic economic pain while claiming unilateral credit for recent Wall Street highs.

Immigration Backlash and Shutdown Stalemate

Adding to the drama of the evening, Tuesday will mark the first time in modern US history that a president delivers the annual joint address amid a funding lapse. The partial government shutdown, now in its second week, centers entirely on the Department of Homeland Security.

Funding for DHS remains frozen as Democratic lawmakers demand stringent guardrails on the administration’s sweeping immigration crackdown. The standoff reached a boiling point following the deaths of two American citizens by federal agents during border protests in January. This tragic incident sparked nationwide outrage and eroded what was once a core political advantage for the President. An AP-NORC poll recently revealed that approval of Trump’s handling of immigration has plummeted to just 38%. The political capital he once commanded on border security is now deeply contested territory.

The Supreme Court Rebuke and Congressional Dynamics

Trump will be speaking to a Republican-led Congress that he has frequently bypassed. While he secured the passage of his signature tax legislation last summer—dubbed the “Big, Beautiful Bill,” which combined corporate tax cuts and immigration enforcement funding with deep reductions to Medicaid—he has largely governed via executive order.

This aggressive use of executive authority recently hit a massive judicial roadblock. Last week, the Supreme Court struck down many of Trump’s sweeping global tariffs, a central pillar of his economic agenda. In a pointed majority opinion, Trump-nominated Justice Neil Gorsuch warned against the “permanent accretion of power in the hands of one man.”

This ruling has massive implications for global trade. Financial analysts at The Financial Times suggest that the removal of these tariffs could ease some inflationary pressures, though Trump has already vowed to pursue alternative legal mechanisms to keep import taxes active, promising prolonged uncertainty for international markets.

Simultaneously, Trump’s coalition is showing signs of fraying:

- Demographic Shifts: Americans under 45 have sharply turned against the administration.

- Latino Voters: A demographic that shifted rightward in 2024 has seen steep drops in approval following January’s border violence.

- Intra-Party Apathy: Nearly three in 10 Republicans report that the administration is failing to focus on the country’s most pressing structural problems.

Trump Foreign Policy Shifts and Global Tensions

Foreign policy is expected to feature heavily in the address, highlighting one of the most unpredictable evolutions of his second term. Candidate Trump campaigned heavily on an “America First” platform, promising to extract the US from costly foreign entanglements. However, Trump foreign policy shifts over the last twelve months have alarmed both critics and isolationist allies.

The administration has dramatically expanded US military involvement abroad. Operations have ranged from seizing Venezuela’s president and bolstering forces around Iran to authorizing a lethal campaign of strikes on alleged drug-smuggling vessels—operations that have resulted in scores of casualties. For global observers and defense analysts at The Washington Post, this muscular, interventionist approach contradicts his earlier populist rhetoric, creating unease among voters who favored a pullback from global policing.

What to Expect: A Trump Midterm Rally Speech

Despite the mounting pressures, Trump is unlikely to strike a chastened or conciliatory tone. Observers should expect a classic Trump midterm rally speech.

“It’s going to be a long speech because we have a lot to talk about,” Trump teased on Monday.

Key themes to watch for include:

- Defending the First Year: Aggressive framing of the “Big, Beautiful Bill” and an insistence that manufacturing is successfully reshoring.

- Attacking the Courts and Democrats: Expect pointed rhetoric regarding the Supreme Court’s tariff ruling and the ongoing DHS shutdown.

- Political Theater: Democratic leader Hakeem Jeffries has urged his caucus to maintain a “strong, determined and dignified presence,” but several progressive members have already announced plans to boycott the speech in silent protest. For details on streaming the event, see our guide on How to Watch Trump’s State of the Union.

Conclusion: A Test of Presidential Leverage

For a president who has built a global brand on dominance and disruption, Tuesday’s State of the Union represents a profoundly different kind of test. The visual of Trump speaking from the dais while parts of his own government remain shuttered and his signature tariffs sit dismantled by his own judicial appointees is a potent symbol of his current vulnerability.

The core question for international markets and domestic voters alike is no longer whether Trump can shock the system, but whether he can stabilize it. To regain his footing ahead of the November midterms, he must persuade a highly skeptical public that his combative priorities align with their economic needs—and prove that his second act in the White House is anchored by strategy rather than adrift in grievance.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

The Asymmetric Stakes: Decoding the US China AI Race in 2026

The atmosphere at the India AI Impact Summit in New Delhi this February 2026 made one reality unavoidably clear: the US China AI race is no longer a straightforward sprint to a singular finish line. Instead, we are witnessing the entrenchment of an asymmetric bipolarity. For global economists, corporate strategists, and policymakers, the AI competition US China has evolved from a theoretical technology battle into a grinding, multipolar war over supply chains, energy grids, and the economic allegiance of the Global South.

To understand the true stakes of US vs China AI supremacy, we must discard the simplistic, moralizing narratives of Cold War 2.0. As an analyst watching the tectonic plates of the global economy shift, the reality is far more nuanced. The question of AI leadership US China is not merely about who builds the smartest chatbot; it is about who controls the underlying thermodynamics of the future economy.

In this comprehensive analysis, we will demystify the geopolitics of AI race dynamics, cutting through the hype to examine the real-time tradeoffs, capital constraints, and data-driven realities defining 2026.

The Illusion of a Single Finish Line in the US China AI Race

Western media often frames the US China AI race as a zero-sum game of frontier models. However, Time’s recent February 2026 analysis correctly notes that there are, in fact, multiple overlapping races. While the United States continues to dominate closed-source, highly capitalized frontier models, China has pivoted toward a radically different theory of value: rapid, low-cost diffusion.

The AI competition US China shifted permanently with the “DeepSeek shock” and the subsequent surge of open-source models. When Alibaba released Qwen 2.5-Max—surpassing 1 billion downloads globally—it proved that Chinese developers could achieve near-parity with US models at a fraction of the computational cost. As CNN reported in February 2026, China’s AI industry is utilizing algorithmic efficiency to circumvent hardware limitations.

This dynamic explains the pragmatic, if politically fraught, decision in January 2026 to loosen US export controls on Nvidia H200 chips. The move was a stark acknowledgment of global interconnectedness: starving China of chips entirely risks accelerating their indigenous semiconductor ecosystem while severely denting the bottom lines of American tech champions. In the battle for US vs China AI supremacy, capital requires market access just as much as it requires compute.

Key Divergences in the AI Competition US China

- US Strategy (Innovation & Capital): High-end chips, hyperscale data centers, closed-source models (OpenAI, Anthropic), and massive capital concentration.

- Chinese Strategy (Diffusion & Application): Open-source models (DeepSeek, Qwen), industrial deployment, legacy chip scale, and aggressive pricing to capture emerging markets.

The Core Battlegrounds: Compute, Chips, and Energy Bottlenecks

You cannot discuss the geopolitics of AI race dynamics without discussing thermodynamics. Artificial intelligence is, fundamentally, electricity transformed into computation. Here, the US vs China AI supremacy narrative takes a politically incorrect but entirely substantiated turn.

The US undeniably leads in compute. According to the Federal Reserve’s late-2025 data, the US commands a staggering 74% global share of advanced compute capacity. Furthermore, as Reuters reported, US AI investments are projected to hit $700 billion in 2026. However, American capital advantages face a severe domestic bottleneck: regulatory holdups and grid limitations. Building a hyperscale data center in the US requires navigating localized zoning, environmental reviews, and grid interconnection queues that can take years.

Conversely, China’s state-controlled model enables faster scaling of physical infrastructure. While the Brookings Institution’s January 2026 report highlights the contrasting energy strategies, the raw numbers are sobering. By 2030, China is projected to have 400 GW of spare energy capacity, heavily subsidized by state directives (Bloomberg, Nov 2025).

The Asymmetric Matrix: US vs China Advantages

| Strategic Domain | United States Advantage | Chinese Advantage |

| Silicon & Compute | 74% global compute share; unmatched dominance in leading-edge architecture and design. | Overwhelming scale in legacy chip manufacturing; highly optimized algorithmic efficiency to bypass hardware bans. |

| Model Ecosystem | Dominates closed-source, reasoning-heavy frontier models (e.g., GPT-4o, Gemini). | Dominates lightweight, open-source models (DeepSeek R1, Qwen) tailored for global diffusion. |

| Energy & Grid | Massive private capital influx ($700B) for next-gen nuclear and SMRs, but hindered by grid regulations. | State-backed grid expansion; projecting 400 GW spare capacity by 2030 to power decentralized industrial AI. |

| Capital & Scaling | World’s deepest capital markets driving astronomical firm-level valuations. | State industrial policy suppressing tech valuations but rapidly building real, physical productive capacity. |

The Geopolitics of AI Race: Courting the Global South

The geopolitics of AI race extends far beyond Silicon Valley and Shenzhen. As highlighted at the New Delhi summit, the Global South is actively refusing to be relegated to mere consumers in the US China AI race.

For middle powers and developing economies, the AI leadership US China paradigm offers a stark choice. US closed-source models are highly capable but computationally expensive and heavily paywalled. In contrast, China is weaponizing open-source AI as a form of geopolitical diplomacy. By flooding the Global South with highly capable, free, or hyper-cheap models like Qwen and DeepSeek, Beijing is embedding its digital architecture into the foundational infrastructure of developing nations.

As Foreign Affairs noted in its February 2026 “The AI Divide” issue, this dynamic creates a new non-aligned movement. Countries like India, Saudi Arabia, and the UAE are hedging their bets. They purchase US hardware where possible but eagerly adopt Chinese open-source models to build “sovereign AI” capabilities. To win the geopolitics of AI race, the US cannot simply sanction its way to the top; it must offer a compelling, cost-effective alternative to Chinese digital infrastructure.

Capital Flow vs. Regulatory Bottlenecks: A Politically Incorrect Reality

To truly understand US vs China AI supremacy, we must look at how each system translates capital into productive capacity. A recent CSIS geoeconomics report provides a sobering multiperspective analysis: the US is optimized for a pathway dependent on high-end chips and continuous model scaling, heavily indexed to stock market expectations.

In the AI competition US China, America’s greatest strength—its free-market capital—is concurrently its Achilles’ heel. Trillions of dollars in market capitalization rely on the promise of Artificial General Intelligence (AGI) and sustained productivity gains. If regulatory holdups prevent the physical building of power plants to support this compute, the capital bubble risks deflating.

Meanwhile, China’s industrial policy suppresses firm-level valuations (to the detriment of its stock market) but excels at embedding AI into its leading industrial sectors, such as robotics and electric vehicles. As the Council on Foreign Relations (CFR) emphasized late last year, China’s approach guarantees that even if its frontier models lag by a few months, its factories will not. The US China AI race is therefore a test of whether America’s financialized innovation can outpace China’s state-directed diffusion.

The Path Forward: Redefining AI Leadership US China

The AI leadership US China debate is ultimately about resilience. The global supply chain is too interconnected to fully de-risk. America relies on TSMC in Taiwan, which relies on ASML in the Netherlands, to produce the chips that fuel the US China AI race.

For the United States to secure long-term AI leadership US China, it must transcend a purely defensive posture of export controls and tariffs. True US vs China AI supremacy will belong to the power that not only innovates at the frontier but scales those innovations globally. As Forbes analysts have routinely pointed out, democratic techno-alliances must move beyond rhetorical agreements and start co-investing in physical compute infrastructure, energy grids, and open-source ecosystems tailored for the Global South.

The AI competition US China will define the economic hierarchy of the 21st century. But victory will not be declared in a single moment of algorithmic breakthrough. It will be won in the trenches of grid interconnections, the boardrooms of middle powers, and the quiet diffusion of productivity across the global economy.

Next Steps for Democratic Alliances: To maintain relevance and leadership, Western coalitions must prioritize “compute diplomacy”—subsidizing energy-efficient AI infrastructure and accessible models for emerging markets, rather than ceding the open-source landscape entirely to Beijing. Would you like me to dive deeper into the specific policy frameworks the US could use to counter China’s open-source diplomacy in the Global South?

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance2 months ago

Markets & Finance2 months agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Analysis3 weeks ago

Analysis3 weeks agoBrazil’s Rare Earth Race: US, EU, and China Compete for Critical Minerals as Tensions Rise

-

Investment2 months ago

Investment2 months agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Banks1 month ago

Banks1 month agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Asia2 months ago

Asia2 months agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Global Economy2 months ago

Global Economy2 months agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Global Economy2 months ago

Global Economy2 months agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy2 months ago

Global Economy2 months ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis