Global Economy

PSX Bull Run 2025: Why Pakistan’s Market Is Suddenly on Every Global Radar

By any conventional metric, Pakistan should not be leading the pack of global equity returns in 2025. It is a frontier‑to‑emerging‑market hybrid with a long history of fiscal slippage, external vulnerability, and political volatility. Yet the Pakistan Stock Exchange (PSX) has staged one of the most remarkable bull runs in its modern history, turning what was once seen as a high‑beta, crisis‑prone market into a surprising outperformer.

From late 2024 into 2025, the benchmark KSE‑100 index has powered through successive resistance levels, with rallies often accompanied by surging trading volumes and broad‑based sector participation. In December 2025, the index is trading near record territory, with cumulative returns that put it ahead of many larger emerging markets. The question that investors—domestic and foreign alike—are now asking is straightforward: what is really fueling this confidence, and is it sustainable?

The answer lies at the intersection of macroeconomic stabilization, monetary policy recalibration, geopolitical risk repricing, and underappreciated structural changes in market infrastructure and participation. The PSX rally is not just a story of “cheap valuations”; it is a case study in how a market moves from the brink of recurring crisis to a cautiously credible recovery narrative.

From Crisis Narrative to Reform Story

For much of the past decade, Pakistan featured in headlines for all the wrong reasons: balance‑of‑payments stress, repeated IMF engagements, a sliding currency, and a persistent trust deficit between policymakers and markets. The 2022–2023 period in particular cemented perceptions of Pakistan as a perennially fragile economy, with the KSE‑100 under heavy pressure, foreign investors exiting, and the rupee in freefall.

The turning point began when the government—under intense domestic and external pressure—finally embraced orthodox stabilization. Subsidies were cut, energy prices adjusted, tax measures introduced, and a new IMF program negotiated. Painful as they were, these steps helped achieve three critical outcomes:

- Inflation peaked and started to trend lower, reducing the sense of macroeconomic freefall.

- Foreign exchange reserves stabilized, even if at modest levels, helped by concessional inflows, remittances, and controlled imports.

- The rupee found a floor, with volatility subdued relative to the worst of the crisis period.

By late 2024 and into 2025, investors began to see a discernible shift in narrative: from “Pakistan might default” to “Pakistan has bought time and breathing space.” For equity markets, this distinction is enormous. A market that survives the worst‑case scenario often gets repriced, not merely to reflect current fundamentals, but on the expectation that the worst risks have already been realized.

Monetary Policy: From Punishing to Supportive

No bull market in a macro‑fragile country is possible without a visible pivot in monetary policy. Pakistan’s central bank spent years running one of the most aggressive tightening cycles in the region. Policy rates were kept high to rein in inflation, defend the currency, and signal seriousness to international creditors and the IMF.

By 2025, that phase had largely run its course. With inflation finally decelerating—helped by base effects, moderation in global commodity prices, and domestic demand compression—the State Bank had room to shift gears. Even the anticipation of rate cuts was enough to move markets.

For equity investors, particularly those running discounted cash flow (DCF) models, the implication of a lower policy rate is straightforward:

- Lower discount rates increase the present value of future corporate earnings.

- Reduced borrowing costs improve profitability, especially for capital‑intensive firms.

- Portfolio rebalancing favors equities as the relative attractiveness of fixed‑income instruments declines.

Banks, in particular, benefited from a complex but favorable combination: they had enjoyed windfall gains during the high‑rate period via elevated yields, and now stood to gain from an eventual revival in credit growth as rates normalized. The market began to price in this dual advantage.

For foreign investors, a credible path to lower inflation and easing rates was a signal that Pakistan’s macro orthodoxy was returning. It reduced the perceived probability of a disorderly adjustment and improved the risk‑reward profile of the PSX relative to peers.

Earnings, Valuations, and the “Re‑Rating” of Pakistan

The PSX was not simply rising on the back of sentiment; it was rebounding from deeply depressed valuation levels. In the worst periods of the crisis, the KSE‑100 traded at price‑to‑earnings multiples that were not merely low—they were indicative of a market priced for failure.

As macro conditions stabilized, several factors drove a re‑rating:

- Corporate earnings proved more resilient than feared. Exporters benefited from a weaker rupee, remittance‑linked consumption held up reasonably well, and large conglomerates demonstrated cost discipline.

- Banks and energy names, long seen as systemically exposed, adjusted to new regulatory and fiscal realities.

- A handful of listed companies continued to deliver strong free cash flows, even under stress, reinforcing the idea that Pakistan hosts pockets of world‑class businesses despite the macro noise.

When a market trades at distressed multiples for too long, it only takes a modest shift in the macro narrative to trigger a sharp upside move. That is precisely what happened in 2025. Rising earnings, combined with still‑reasonable valuations, created the conditions for a powerful bull run once capital began to return.

Sector‑Wise Drivers: Where the Confidence Is Concentrated

Though broad‑based rallies make better headlines, serious investors know that bull markets are rarely uniform; they are led by sectors with convincing narratives. In the PSX’s 2025 rally, four clusters stand out.

1. Banking and Financials

Banks are at the heart of Pakistan’s financial system and often the first to react to shifts in policy. Investors saw a multi‑layered story:

- High yields on government securities previously padded earnings, providing a cushion through the worst of the crisis.

- Prospects of renewed private‑sector credit growth as rates normalize suggested new revenue opportunities.

- Improving asset quality, once the worst of the economic contraction passed, reassured analysts that non‑performing loans would not spiral out of control.

As risk premiums compressed, financials became core holdings in both domestic and foreign portfolios, amplifying the overall index move.

2. Energy and Utilities

Energy has long been central to Pakistan’s macro vulnerabilities: circular debt, price distortions, and under‑investment. By 2025, incremental steps to rationalize tariffs, streamline subsidies, and improve billing and recovery mechanisms gave investors hope that the sector was finally moving toward a more sustainable model.

Listed energy companies benefited from:

- Clearer tariff regimes

- Better prospects of receivables recovery

- Ongoing discussions on restructuring legacy obligations

This translated into multiple expansion and renewed investor interest—especially among institutions looking for yield and hard‑asset exposure.

3. Export‑Oriented Industrials and Textiles

Pakistan’s textile and export‑oriented sectors found themselves in a position to take advantage of global supply chain reconfiguration. As multinational firms continued to diversify away from over‑reliance on a single geography, countries like Pakistan—offering competitive labor, improving infrastructure, and trade links—stood to gain.

Exporters saw a double benefit: a weaker rupee improved price competitiveness abroad, while local cost structures, despite inflation, remained manageable relative to peers. The equity market responded by rewarding firms that demonstrated the ability to secure orders, move up the value chain, and reinvest in capacity.

4. Technology, Telecom, and the Digital Economy

The story of Pakistan’s tech and telecom sectors is more nascent but no less important. Rising connectivity, a young demographic profile, and government rhetoric around “Digital Pakistan” created a supportive backdrop for listed telecom firms and tech‑adjacent plays.

Although the PSX remains underweight on pure‑play tech relative to regional exchanges, increased interest in digital payments, fintech, and data services added a structural growth narrative to an otherwise traditional market.

The Infrastructure Beneath the Rally: Speed, Uptime, and Market Plumbing

One of the least discussed contributors to the PSX’s bull run has been its own quiet evolution as a trading platform. In the modern equity ecosystem, investor confidence is shaped not only by macro and policy, but by the perceived reliability, transparency, and efficiency of the venue itself.

Over recent years, the PSX has invested in:

- Improved trading engines and matching systems, capable of handling higher order volumes with lower latency.

- Better uptime and system reliability, reducing instances of market disruption, halts, or technical outages.

- Enhanced connectivity and co‑location services, enabling brokers and institutions to execute faster and more efficiently.

- Upgraded surveillance and compliance tools, improving the detection of abnormal trading behavior and bolstering market integrity.

While the PSX does not always broadcast granular metrics such as average execution time in milliseconds or annualized uptime percentages, the lived experience of market participants has changed. Days with exceptionally high volumes—where hundreds of millions of shares change hands—are now processed with fewer technical hiccups than in previous cycles. For sophisticated institutional investors, this matters: they are more willing to deploy large orders into a market whose “plumbing” they trust.

The cumulative effect of these improvements is subtle but powerful: liquidity begets liquidity. As more participants trade with confidence that the system will not fail them mid‑session, spreads tighten, depth improves, and the market becomes more investable for global funds.

Foreign Investors: From Capitulation to Gradual Re‑Entry

Foreign portfolio investors are often caricatured as fickle, but in reality, they respond to a combination of fundamentals, valuation, and global risk appetite. In Pakistan’s case, the 2025 bull run has coincided with several favorable global and local shifts:

- Global search for yield: As major central banks move from aggressive tightening to a more neutral or easing stance, capital begins to flow back into higher‑risk, higher‑return markets.

- Relative valuation appeal: When compared to other emerging and frontier markets, Pakistan’s equities, even after the rally, still look cheap on a historical and cross‑country basis.

- Perception of “risk already priced in”: After years of underperformance, many of the worst‑case scenarios—political disruption, fiscal slippage, external stress—were already reflected in prices. Any move away from the brink justifies re‑entry.

Flows remain measured rather than exuberant; foreign investors have not forgotten how quickly Pakistan can move from calm to crisis. But the direction of travel has shifted. Instead of being incremental net sellers, foreigners are selectively adding exposure in areas where earnings visibility is strong, governance is credible, and liquidity is sufficient.

Geopolitics and Regional Positioning: A Narrow Window of Stability

Markets do not trade in economic isolation. Pakistan’s 2025 rally is playing out against a backdrop of shifting geopolitical alignments and regional recalibration.

On one side, global investors are reassessing supply chains, energy routes, and security commitments in light of conflicts and tensions elsewhere. On the other, South Asia’s demographic and consumption stories continue to attract attention. Pakistan, positioned at the intersection of key trade corridors, is once again being marketed as a “gateway” to multiple regions.

More importantly, the domestic political environment, while hardly tranquil, has been less disruptive than in some recent years. Policy continuity—especially in areas of economic management, energy pricing, and fiscal reform—has improved. For investors with long memories, the absence of fresh shocks sometimes feels as bullish as good news.

All of this is precarious, of course. Pakistan’s political and security risks have not vanished; they have merely receded enough to allow the market to focus on earnings, valuations, and reforms. Whether this window stays open will play a significant role in determining whether the bull run becomes a sustained multi‑year story or just a powerful but finite rebound.

The Psychology of Confidence: From Survival to Strategy

Investor confidence is not solely a function of spreadsheets and macro charts; it is also psychological. The PSX’s 2025 bull run is, in part, a collective exhale after years of living at the edge of crisis.

When investors spend too long in defensive mode—rolling over positions, protecting cash, questioning solvency—there is a pent‑up demand for a more constructive story. As soon as macro stabilization becomes credible and early‑cycle signals appear, positioning can change rapidly:

- Domestic investors rotate from cash and property back into equities.

- Brokers, after years of depressed business, see volumes rise and become vocal advocates of the rally.

- The media narrative shifts from “how bad can it get?” to “have you missed the rally?”

The PSX has benefited from this psychological flip. Once the move began, it reinforced itself: each new high brought sidelined investors back in, while early entrants felt vindicated and emboldened.

SEO‑Visible Themes: How the Market Story Travels Beyond the Ticker

From a digital and editorial perspective, the PSX bull run intersects with several high‑interest themes that naturally attract global and regional readership:

- “Pakistan stock market 2025 performance”

- “PSX bull run analysis”

- “KSE‑100 index outlook”

- “Pakistan IMF program and stock market”

- “Emerging markets opportunity 2025”

- “Is Pakistan investable again?”

These search phrases map onto real investor questions. They also provide a framework through which this narrative is being disseminated to a wider audience. The more Pakistan appears in global financial discourse as a comeback story rather than a crisis case, the more self‑reinforcing the confidence cycle can become.

For seasoned investors, of course, the nuance matters: Pakistan is still a high‑risk market, with deep structural vulnerabilities and institutional constraints. But the recalibration from “uninvestable” to “selectively investable” is significant.

Is the Bull Run Sustainable?

The most important question for any serious investor is not why a rally has occurred, but whether it can last. On that front, Pakistan’s case is neither unequivocally bullish nor inevitably doomed. It is contingent.

Several factors will determine whether the PSX of 2025 is the start of a durable multi‑year trend or merely a powerful cyclical rebound:

- Fiscal Credibility: The government must move beyond budget‑day optics and credibly implement tax reforms, broaden the base, rationalize expenditure, and reduce reliance on unsustainable borrowing. Without this, debt dynamics could again spook markets.

- Monetary Prudence: The central bank’s eventual easing must remain anchored in inflation realities, not political pressure. Cutting too fast or too far could reignite inflation and undermine currency stability—killing the very confidence that underpins the bull run.

- Structural Reforms: Energy sector restructuring, state‑owned enterprise reform, digitalization of tax and payments infrastructure, and improvements in ease of doing business are not optional. They are the foundation on which any credible long‑term bull market must rest.

- External Resilience: Pakistan’s external account remains vulnerable to global shocks. Commodity price spikes, sudden stops in funding, or geopolitical flare‑ups can quickly reverse capital flows. Building buffers—reserves, reliable credit lines, diversified export markets—is essential.

- Institutional Strength and Governance: Markets ultimately thrive in environments where rules are predictable, contracts are respected, and governance is improving. Any regression in these areas will show up, sooner or later, in risk premiums and valuations.

The Final Verdict: A Market Re‑Rated, Not Yet Redeemed

The PSX bull run of 2025 is best understood not as an irrational exuberance, nor as a purely technical rally, but as a re‑rating of Pakistan’s risk profile after a period of extreme pessimism. Macroeconomic stabilization, a credible monetary pivot, incremental fiscal improvements, and better market infrastructure have collectively nudged investors from survival mode into selective optimism.

Yet optimism is not destiny. Pakistan’s stock market has been here before: episodes of strong performance followed by abrupt reversals when politics, policy, or global conditions turned. The challenge now is to avoid replaying that script.

If the country uses this window of market confidence to deepen reforms, strengthen institutions, and build resilience, the PSX of 2025 may mark the beginning of a longer secular story: a frontier market maturing into a more robust, though still volatile, emerging market opportunity.

If, however, complacency sets in—if reform fatigue returns, if fiscal and monetary discipline frays, if governance regresses—the bull run will, in hindsight, be remembered as another missed opportunity: a technically impressive rally that failed to translate into a durable re‑write of Pakistan’s economic trajectory.

For now, the verdict is still being written. What is clear is that investors have given Pakistan another chance. Whether policymakers, corporates, and institutions make good on that chance will determine whether the PSX remains a tactical trade—or finally earns its place as a strategic allocation in global portfolios.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Global Economy

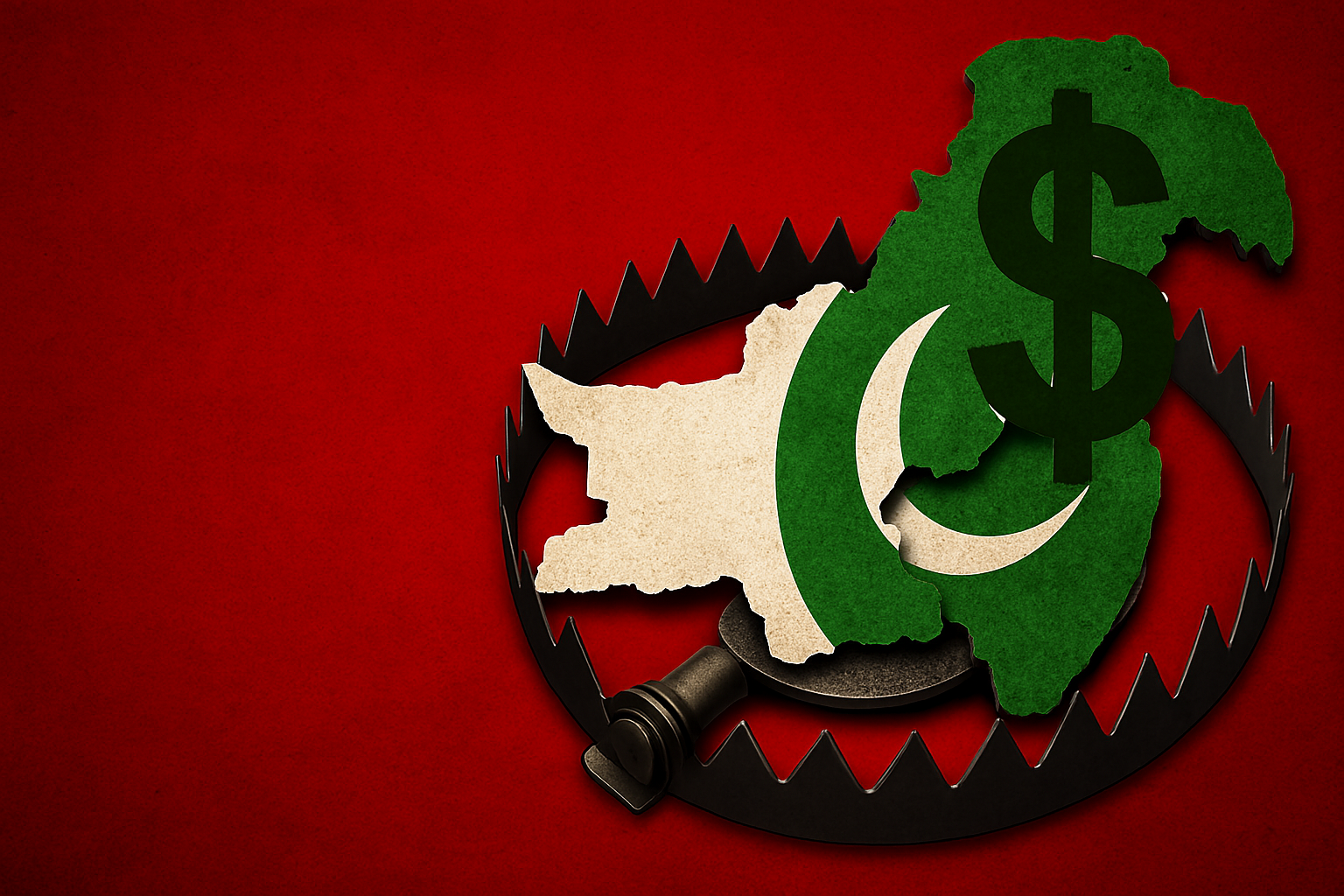

Beyond the Bailout: Dismantling the Machinery of Pakistan’s Debt Trap

Pakistan has returned to the International Monetary Fund twenty-three times. Twenty-three. At some point, the conversation must shift from “how do we secure the next program” to “why does the machinery keep breaking down?”

The answer is not technical. It is not about capacity. It is about choice—specifically, the choice to maintain an economic system that rewards extraction over production, protects incumbents over entrants, and treats governance as a series of ad hoc deals rather than enforceable rules.

The Illusion of Planning

Every few years, a new committee is formed. A blueprint is drafted. Exports will be doubled. Investment will flood in. Growth will accelerate. Then nothing happens, because aspirations are not policies.

The real question is simpler: can a business start, scale, and operate without seeking permission at every turn? In Pakistan, the answer is no. The economy runs on discretion, not rules. Tariffs are negotiated. Tax exemptions are lobbied for. Energy prices are political decisions dressed up as technical adjustments.

This is not an economy designed for growth. It is designed for control. And control, by definition, limits entry. When entry is limited, competition dies. When competition dies, so does productivity.

The Energy Albatross

If there is a single sector that deserves to be called “ground zero” of Pakistan’s fiscal collapse, it is energy. The sector is fragmented across nearly two dozen entities, each with overlapping mandates and conflicting incentives. Prices are set not by cost recovery but by political calculus. The result is circular debt—a euphemism for a subsidy black hole that consumes billions annually and forces the government back to the IMF.

According to the World Bank’s Pakistan Development Update, the energy sector’s inefficiencies contribute significantly to the country’s fiscal imbalances. The problem is not technical complexity. It is governance failure. State-owned distribution companies operate as monopolies with no accountability for losses. Tariffs do not reflect costs. Political actors intervene when bills come due.

The solution is not another bailout. It is a shift to cost-reflective pricing, enforced through transparent contracts and independent regulation. This is not ideological. It is arithmetic. You cannot subsidize your way to solvency.

Taxation: From Predation to Participation

Pakistan’s tax system is broken by design. Rates are high for the few already in the net. Exemptions are widespread for those with influence. The result is a narrow base, crushing compliance costs for formal businesses, and a massive informal sector that operates entirely outside the tax system.

The Pakistan Institute of Development Economics (PIDE) Reform Agenda has consistently argued for what should be obvious: if you want more people to pay taxes, make it easier and cheaper to do so. Lower rates. Broaden the base. Remove exemptions. Digitize enforcement so that compliance becomes automatic, not adversarial.

Instead, the system does the opposite. It punishes formality and rewards informality. Businesses stay small to avoid detection. Transactions move to cash. The state responds by raising rates on those it can reach, which pushes more businesses underground.

This is not a growth strategy. It is a slow bleed.

What Growth Actually Requires

Growth is not engineered. It is not the output of a five-year plan or a committee report. Growth happens when firms can enter markets, compete on merit, and scale without bureaucratic gatekeeping.

The Asian Development Bank’s forecasts for Pakistan consistently note that structural constraints—particularly in trade policy, energy costs, and regulatory unpredictability—hold back potential. These are not external shocks. They are internal choices.

The state does not need to “create” growth. It needs to stop blocking it. That means shifting from a permission-based economy to a rules-based one. It means enforcing contracts rather than negotiating exemptions. It means allowing prices to signal costs rather than political preferences.

None of this is radical. It is what every functional economy does.

The Uncomfortable Truth

The IMF is not the problem. It is a symptom. The real problem is a political economy that depends on discretion, rewards rent-seeking, and treats public resources as bargaining chips.

Exiting the IMF permanently requires dismantling that machinery. It requires accepting that the state cannot subsidize, protect, and plan its way to prosperity. It requires shifting the source of economic dynamism from bureaucratic approval to market competition.

This is not a question of ideology. It is a question of survival. Pakistan can continue to seek programs every few years, each time promising reform and delivering adjustment. Or it can confront the fact that the system itself is the obstacle.

The choice, as always, remains political. But the consequences are already visible in the numbers: twenty-three programs and counting. At some point, pattern becomes policy. And the policy, whether deliberate or not, is dependence.

The alternative is not complicated. It is just uncomfortable. Remove the discretion. Enforce the rules. Let competition do its work. Growth will follow. But first, the machinery that prevents it must be dismantled.

The author is an independent economic analyst.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Geopolitics

Global Cooperation in Retreat? Multilateralism Faces Its Toughest Test Yet

A decade after the SDGs and Paris Agreement peaked, multilateralism confronts financing gaps, climate setbacks, and geopolitical fractures threatening global progress.

Introduction: The Promise of 2015

September 2015 felt like the culmination of humanity’s aspirational instincts. In New York, world leaders adopted the Sustainable Development Goals—17 ambitious targets to end poverty, protect the planet, and ensure prosperity for all by 2030. Weeks later in Paris, 196 parties forged the Paris Agreement, committing to hold global warming well below 2°C. The third pillar, the Addis Ababa Action Agenda on Financing for Development, promised to bankroll this grand vision.

That year represented multilateralism’s apex—a rare moment when geopolitical rivals set aside differences to tackle existential threats collectively. A decade later, that consensus feels like ancient history.

Today, the architecture of global cooperation shows deep fissures. Climate targets drift further from reach, development financing falls catastrophically short, and geopolitical fragmentation undermines collective action. The question isn’t whether multilateralism faces challenges—it’s whether the system can survive its current stress test.

The Golden Age That Wasn’t Built to Last

When Global Unity Seemed Inevitable

The mid-2010s carried an optimism bordering on naïveté. The United Nations SDGs framework promised “no one left behind,” addressing everything from quality education (Goal 4) to climate action (Goal 13). The Paris Agreement’s bottom-up approach—where nations set their own emission reduction targets—seemed politically genius, accommodating diverse economic realities while maintaining collective ambition.

World Bank projections suggested extreme poverty could be eliminated by 2030. Renewable energy costs were plummeting. China’s Belt and Road Initiative promised infrastructure investments across developing nations. The International Monetary Fund reported global growth rebounding from the 2008 financial crisis.

Yet this golden age rested on fragile foundations: stable geopolitics, sustained economic growth, and unwavering political will. Within years, each assumption would crumble.

The Unraveling: Three Crises Converge

1. The Financing Chasm

The numbers tell a brutal story. Developing nations require between $2.5 trillion and $4.5 trillion annually to achieve the SDGs, according to recent UN Conference on Trade and Development estimates. Current financing? A fraction of that figure.

The COVID-19 pandemic obliterated fiscal space across the Global South. Debt servicing now consumes resources meant for hospitals, schools, and climate adaptation. The World Bank reports that 60% of low-income countries face debt distress or high debt vulnerability—up from 30% in 2015.

Promised climate finance remains unfulfilled. Wealthy nations committed $100 billion annually by 2020; they’ve yet to consistently meet that modest target. Meanwhile, actual climate adaptation needs exceed $300 billion yearly by 2030, per Intergovernmental Panel on Climate Change assessments.

2. Climate Targets Slip Away

The Paris Agreement aimed to limit warming to 1.5°C above pre-industrial levels. Current nationally determined contributions place the world on track for approximately 2.8°C of warming by century’s end—a trajectory toward catastrophic climate impacts.

Extreme weather events have intensified: record-breaking heatwaves, devastating floods, and unprecedented wildfires strain national budgets and displace millions. Yet fossil fuel subsidies reached $7 trillion globally in 2022, according to IMF analysis—undermining climate pledges with one hand while making them with the other.

The credibility gap widens. Corporate net-zero commitments often lack interim targets or transparent accounting. Developing nations, contributing least to historical emissions, face adaptation costs spiraling beyond their means while wealthy polluters debate incremental carbon pricing.

3. Geopolitical Fragmentation

The rules-based international order has fractured. US-China strategic competition overshadows cooperative initiatives. Russia’s invasion of Ukraine shattered European security assumptions and redirected resources toward military buildups. Trade wars, technology decoupling, and supply chain nationalism replace the globalization consensus.

Multilateral institutions themselves face paralysis. The UN Security Council, hobbled by veto-wielding permanent members, struggles to address conflicts from Syria to Sudan. The World Trade Organization appellate body remains non-functional since 2019. Even the G20—once the crisis-response mechanism for global challenges—produces communiqués too diluted to drive meaningful action.

The Data Doesn’t Lie: SDGs Progress Report Card

Stark Realities Behind the Targets

A comprehensive UN SDGs progress assessment reveals troubling trends:

- Goal 1 (No Poverty): Progress reversed. Extreme poverty increased for the first time in a generation during the pandemic, affecting 70 million additional people.

- Goal 2 (Zero Hunger): Over 780 million people face chronic hunger—up from 613 million in 2019.

- Goal 13 (Climate Action): Only 15% of tracked targets are on course.

- Goal 17 (Partnerships): Official development assistance as a percentage of donor GNI remains below the 0.7% UN target for most wealthy nations.

The Economist Intelligence Unit projects that at current trajectories, fewer than 30% of SDG targets will be achieved by 2030. The world faces a “polycrisis”—overlapping emergencies that compound rather than offset each other.

Voices From the Fault Lines

What Policy Leaders Are Saying

UN Secretary-General António Guterres recently warned of a “Great Fracture,” where geopolitical rivals build separate technological, economic, and monetary systems. His call for an “SDG Stimulus” of $500 billion annually has gained rhetorical support but little concrete action.

Climate envoys from small island developing states speak bluntly: for nations like Tuvalu or the Maldives, the 1.5°C threshold isn’t symbolic—it’s existential. Rising seas threaten their very existence while multilateral forums offer platitudes.

Development economists point to structural inequities. As World Bank chief economist Indermit Gill notes, today’s international financial architecture reflects 1944’s Bretton Woods priorities, not 2025’s multipolar reality. Reforming institutions designed when many developing nations were still colonies proves politically impossible.

Is Multilateralism Beyond Repair?

Distinguishing Detour From Derailment

The current crisis doesn’t necessarily spell multilateralism’s demise—but it demands urgent reinvention.

Minilateralism offers one path forward: smaller coalitions of willing nations tackling specific challenges. The Beyond Oil and Gas Alliance coordinates fossil fuel phaseouts among committed nations. The International Solar Alliance mobilizes renewable energy deployment across tropical countries. These initiatives bypass the consensus requirements that paralyze larger forums.

Alternative financing mechanisms are emerging. Debt-for-climate swaps, blue bonds, and innovative taxation proposals (digital services, financial transactions, billionaire wealth taxes) could unlock resources without relying solely on traditional development assistance.

Technology transfers accelerate independently of diplomatic channels. Renewable energy deployment in India, electric vehicle adoption in Indonesia, and mobile money systems across Africa demonstrate that development needn’t await global summits.

Yet these piecemeal solutions can’t replace comprehensive cooperation. Climate change, pandemic preparedness, and nuclear proliferation require collective action at scale. The question is whether political leadership exists to rebuild multilateral consensus before crises force more painful adjustments.

The Path Not Yet Taken

What Renewal Requires

Resurrecting effective multilateralism demands acknowledging uncomfortable truths:

- Power has shifted. Institutions must reflect today’s economic and demographic realities, granting emerging economies commensurate voice and representation.

- Trust has eroded. Rebuilding credibility requires wealthy nations fulfilling existing commitments before proposing new ones. Climate finance delivery, debt relief, and vaccine equity matter more than aspirational declarations.

- Urgency has intensified. The 2030 SDG deadline approaches rapidly. Incremental progress won’t suffice—transformative action at wartime speed is necessary.

- Sovereignty concerns are valid. Effective multilateralism respects national circumstances while maintaining collective standards. The Paris Agreement’s bottom-up architecture offers a model; the challenge is enforcement without coercion.

The upcoming UN Summit of the Future and COP30 climate talks in Brazil present opportunities for course correction. Whether leaders seize them depends on domestic politics, economic conditions, and sheer political will.

Conclusion: Retreat or Regroup?

A decade after multilateralism’s zenith, the experiment faces its sternest examination. The SDGs limp toward 2030 with most targets unmet. The Paris Agreement’s 1.5°C ambition slips further from grasp. Financing gaps yawn wider while geopolitical rivalries consume attention and resources.

Yet declaring multilateralism’s death would be premature. The alternative—uncoordinated national responses to global challenges—promises worse outcomes. Climate physics doesn’t negotiate. Pandemics ignore borders. Financial contagion spreads regardless of political preferences.

The infrastructure of cooperation remains intact, however strained. What’s missing is the political imagination to adapt it for a more fractured, multipolar era. The architecture of 2015 won’t suffice for 2025’s challenges—but neither will abandoning the project altogether.

The world stands at a crossroads. One path leads toward fragmented, transactional arrangements where short-term interests trump collective welfare. The other requires reinventing multilateralism for an age of strategic competition, ensuring it delivers tangible benefits quickly enough to maintain legitimacy.

History suggests humans cooperate most effectively when facing existential threats. Climate change, nuclear risks, and pandemic potential certainly qualify. Whether today’s generation of leaders rises to that challenge will determine not just multilateralism’s future, but humanity’s trajectory for decades ahead.

The question isn’t whether we can afford to cooperate. It’s whether we can afford not to.

Sources & Further Reading:

- United Nations Sustainable Development Goals

- IPCC Climate Reports

- World Bank Development Data

- IMF Fiscal Monitor

- The Economist: Global Politics

- Financial Times: Climate Capital

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Global Finance

Federal Constitutional Court upholds Super tax

ISLAMABAD — Pakistan’s Federal Constitutional Court’s, three-judge bench this week delivered a quiet revolution. By upholding the controversial ‘Super Tax’ on the country’s wealthiest entities, the court did more than green-light a potential Rs300 billion (approximately $1.08bn) revenue haul. It etched into constitutional jurisprudence a stark boundary: fiscal policy is the exclusive domain of the legislature, not the judiciary. The ruling, led by Chief Justice Amin-ud-Din Khan, is a landmark reassertion of parliamentary sovereignty in economic governance, setting aside what it termed “judicial overreach” by lower courts. In a nation perennially navigating a crisis of public finance, this is a decisive shift of power back to the tax-writing desks of Parliament and away from the benches of the High Courts.

Why This Ruling Reshapes Pakistan’s Economic Constitution

The core of the dispute was seductively simple: could Parliament, through Sections 4b and 4c of the Income Tax Ordinance, levy a one-off surcharge on companies and individuals with incomes exceeding Rs500 million? High Courts in Karachi and Lahore had struck down or ‘read down’ the provisions, arguing on grounds of equity and policy merit. The Federal Constitutional Court’s reversal is foundational. It hinges on a strict interpretation of the separation of powers, a doctrine as venerable in Western polities as it is often contested in developing democracies. The bench declared that determining “tax slabs, rates, thresholds, or fiscal policy” is not a judicial function. This judicial restraint aligns Pakistan with a global constitutional consensus, echoing principles long established in jurisdictions like the United Kingdom, where parliamentary supremacy over taxation is absolute, and reaffirmed in landmark rulings by constitutional courts worldwide.

The immediate ‘what next’ is fiscal. The Federal Board of Revenue (FBR) can now confidently collect a tax it estimates will bring Rs300 billion into a chronically anaemic public exchequer. For context, that sum nearly equals the entire annual development budget for Pakistan’s infrastructure and social projects. In a country where the tax-to-GDP ratio languishes at around 10.6%—among the world’s lowest—this injection is not merely significant; it is transformative for a government negotiating yet another International Monetary Fund (IMF) programme predicated on enhancing revenue mobilization. The IMF has explicitly called for Pakistan to raise its tax-to-GDP ratio by 3 percentage points to 13% over the 37-month Extended Fund Facility program, making this ruling critically important for fiscal consolidation.

The Doctrine of Judicial Restraint in a Hot Economy

Why did the court rule so emphatically? Beyond the black-letter law, the decision is a strategic retreat from judicial entanglement in macroeconomic management. Pakistan’s courts have historically been activist, even in complex economic matters. This ruling signals a pivot toward a philosophy of judicial restraint, recognizing that judges lack the electoral mandate and technocratic apparatus to micromanage the nation’s balance sheet. As recognized in constitutional scholarship on the limits of judicial review, courts venturing into fiscal policy often create market uncertainty and implementation chaos—precisely what the FCC seeks to avoid.

The ruling also clarifies the temporal application of the tax: Section 4b applies from 2015 and 4c from 2022, ending years of legal limbo for businesses. This provides the certainty that investors and the World Bank consistently argue is critical for economic growth. For the business elite in Karachi’s financial district or Lahore’s industrial hubs, the message is clear: future battles over tax policy must be fought in the parliamentary arena, not the courthouse.

What Next: The Real Test of Governance Begins

The court has handed Parliament and the FBR a powerful tool and, with it, a profound responsibility. The ‘what next’ question now shifts from constitutionality to capacity and fairness. Can the FBR, an institution often criticized for its opacity and broad discretionary powers, administer this super tax efficiently and without political favouritism? Will the revenue truly be deployed for its stated purposes—from rehabilitating displaced persons (the original 2015 rationale) to bridging the general budget deficit? Court observations during hearings revealed that of Rs144 billion collected between 2015 and 2020, only Rs37 billion was spent on rehabilitation of internally displaced persons, raising legitimate questions about fiscal accountability.

Furthermore, Parliament’s exclusive authority is now doubly underscored. This invites, indeed demands, more rigorous legislative scrutiny of future finance bills. The ruling empowers backbenchers and opposition members to engage deeply in tax design, knowing the courts will not provide a backstop for poorly crafted law. Sustainable revenue growth requires not just legal authority but broad-based political legitimacy—a challenge that remains for Pakistan’s democratic institutions.

A Global Signal in an Age of Inequality

Finally, this ruling resonates beyond Pakistan’s borders. In an era of rising wealth inequality and global debates on taxing the ultra-rich, the judgment affirms the state’s constitutional right to enact progressive fiscal measures. The OECD and World Bank have increasingly emphasized the importance of progressive taxation in addressing inequality, with research showing that countries sustainably increasing their tax-to-GDP ratio to 15% experience significantly higher GDP per capita growth compared to countries whose tax ratio stalls around 10%—exactly Pakistan’s predicament.

The court has not endorsed the Super Tax’s wisdom; it has endorsed Parliament’s right to decide. It places Pakistan within a contemporary movement toward progressive wealth taxation, yet grounds it in the ancient principle that only the representatives of the people hold the power to tax—a foundational tenet of parliamentary sovereignty recognized across democratic systems.

The Constitutional Architecture Emerges

The ruling carries particular significance given Pakistan’s recent constitutional evolution. The creation of the Federal Constitutional Court through the 27th Constitutional Amendment, as Arab News analysis suggests, represents an institutional opportunity to resolve longstanding ambiguities in economic governance. When constitutional rules governing taxation, resource allocation, and federal-provincial fiscal relations remain unclear, governments litigate instead of coordinate, and businesses defend rather than invest. The FCC’s decisive stance on parliamentary authority in taxation may signal the court’s broader approach to economic constitutionalism—one that prizes institutional clarity and democratic accountability over judicial management of complex policy questions.

The marble halls of the FCC have thus returned a weighty question to the carpeted chambers of Parliament: having won the constitutional right to tax, can they now craft a fiscal contract with the nation that is both solvent and just? The Rs300 billion figure is a start, but the real accounting of this ruling’s success will be measured in the credibility of the state it helps to build—and whether Pakistan can finally escape the cycle of perpetually low tax collection that has constrained its development aspirations for decades.

This landmark decision arrives at a critical juncture as Pakistan navigates its Extended Fund Facility program with the IMF, with fiscal reforms remaining central to the country’s economic stabilization. The court’s affirmation of parliamentary supremacy in taxation provides the constitutional foundation necessary for sustainable revenue mobilization—but parliamentary action must now match judicial clarity.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance3 weeks ago

Markets & Finance3 weeks agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Global Economy4 weeks ago

Global Economy4 weeks agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Asia4 weeks ago

Asia4 weeks agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Investment3 weeks ago

Investment3 weeks agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy1 month ago

Global Economy1 month ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Economic Outlook 2025: Between Stabilization and the Shadow of Stagnation

-

China Economy4 weeks ago

China Economy4 weeks agoChina’s Property Woes Could Last Until 2030—Despite Beijing’s Best Censorship Efforts