Opinion

Are America’s Tariffs Here to Stay? One Year Into Trump’s Second Term

One year into President Donald Trump’s second term, the landscape of global trade has undergone a profound transformation. The United States, long the steward of the post-1945 liberal economic order, has pivoted decisively toward a protectionist stance. Tariffs—once deployed selectively—have become a central instrument of economic statecraft, applied broadly to adversaries and allies alike. Average effective tariff rates have risen to levels not seen in over a century, generating substantial federal revenue while prompting retaliatory measures, supply-chain reconfiguration, and heightened geopolitical friction.

Policymakers, researchers, and think tank analysts now confront a pivotal question: are Trump tariffs permanent, or do they represent negotiable leverage that could recede with shifting political or economic pressures? As of mid-January 2026, the evidence points toward entrenchment, though important caveats remain.

Are America’s Tariffs Here to Stay? A Preliminary Assessment

The short answer is yes, in substantial part—with meaningful qualifications. Indicators strongly suggest that many of Trump’s second-term tariffs are likely to endure beyond the current administration:

- Fiscal entrenchment — Tariff revenue has emerged as a significant budgetary resource, with collections exceeding $133 billion under IEEPA-based measures alone through late 2025 .

- Bipartisan acceptance of China-specific measures — Restrictions on Chinese imports enjoy broad support across the U.S. political spectrum and are increasingly viewed as permanent features of national security policy .

- Legal and institutional path dependence — Once imposed under executive authorities like the International Emergency Economic Powers Act (IEEPA), tariffs create domestic constituencies—protected industries and revenue-dependent programs—that resist rollback .

- Geopolitical recalibration — The tariffs signal a lasting shift toward “America First” realism, prioritizing bilateral deals over multilateral rules .

Countervailing risks include ongoing Supreme Court litigation over IEEPA’s scope . What’s striking is how quickly tariffs have moved from campaign rhetoric to structural reality.

The Evolution of Tariffs in Trump’s Second Term

Trump’s second-term trade policy builds on—but dramatically expands—first-term actions. Where Section 301 and Section 232 authorities dominated previously, the administration has leaned heavily on IEEPA to justify sweeping measures .

Legal Foundations and IEEPA Expansion

In early 2025, President Trump invoked IEEPA to declare national emergencies tied to trade deficits, fentanyl inflows, and unfair practices, enabling broad tariff implementation .

Key Tariff Actions by Country and Issue

The administration has calibrated tariffs variably:

| Trading Partner/Issue | Initial Rate (2025) | Current Rate (Jan 2026) | Rationale & Status |

|---|---|---|---|

| China | Up to 60-145% on many goods | High rates persist with some adjustments | National security, fentanyl, trade practices; partial deals in place |

| Canada & Mexico | 25% on select goods | Largely moderated after negotiations | Migration and fentanyl; most trade under USMCA exemptions |

| European Union | Reciprocal + additional layers | Reduced in some sectors post-talks | Trade imbalances |

| Countries trading with Iran | 25% additional | Active secondary measures | Pressure on Iran |

| Global baseline | 10-20% universal/reciprocal | Partial exemptions remain | Persistent deficits |

These actions reflect a strategic blend of punishment and leverage .

Economic Impacts: Revenue Gains Versus Broader Costs

The most immediate outcome has been revenue. Customs duties have reached historic highs, with projections of sustained hundreds of billions annually .

Revenue Projections (Selected Estimates)

Yet costs are nontrivial. Economists note higher consumer prices and regressive impacts .

Geopolitical Consequences: Reshaping Alliances and Global Order

The tariffs have accelerated fragmentation of the rules-based system. Allies are diversifying ties, while adversaries adapt .

The Iran-related secondary tariffs exemplify broader economic coercion .

Key Indicators of Permanence

Several factors favor longevity:

- Revenue dependence — Hard to forgo sustained fiscal inflows .

- National security framing — Especially versus China .

- Domestic winners — Protected sectors investing in capacity .

- Precedent — Fallback authorities beyond IEEPA .

Potential Counterforces and Risks

Challenges include Supreme Court review .

Implications for the Global Economic Order

Permanent elevated tariffs would cement fragmentation, with higher costs and bifurcated chains .

Policy Recommendations for Stakeholders

- U.S. policymakers — Complement tariffs with industrial incentives.

- Allied governments — Accelerate diversification .

- Corporations — Build resilience.

- Researchers — Study long-term distributional and comparative effects.

In conclusion, while adjustments are likely, the core of Trump’s second-term tariffs appears structurally entrenched. This economic nationalism offers fiscal and strategic payoffs—but substantial risks. Navigating it will shape global governance for decades.

References

Brookings Institution. (n.d.). Back to the brink: North American trade in the 2nd Trump administration. https://www.brookings.edu/articles/back-to-the-brink-north-american-trade-in-the-2nd-trump-administration

Brookings Institution. (n.d.). Key takeaways on Trump’s reciprocal tariffs from recent Brookings event. https://www.brookings.edu/articles/key-takeaways-on-trumps-reciprocal-tariffs-from-recent-brookings-event

Brookings Institution. (n.d.). Recent tariffs threaten residential construction. https://www.brookings.edu/articles/recent-tariffs-threaten-residential-construction

Brookings Institution. (n.d.). Tariffs are a particularly bad way to raise revenue. https://www.brookings.edu/articles/tariffs-are-a-particularly-bad-way-raise-revenue

Brookings Institution. (n.d.). Trump’s 25% tariffs on Canada and Mexico will be a blow to all 3 economies. https://www.brookings.edu/articles/trumps-25-tariffs-on-canada-and-mexico-will-be-a-blow-to-all-3-economies

Council on Foreign Relations. (n.d.). National security costs of Trump’s tariffs. https://www.cfr.org/article/national-security-costs-trumps-tariffs

Council on Foreign Relations. (n.d.). Tariffs on trading partners: What can the president actually do? https://www.cfr.org/report/tariffs-trading-partners-can-president-actually-do

Council on Foreign Relations. (n.d.). Trade trends to watch 2026. https://www.cfr.org/article/trade-trends-watch-2026

Council on Foreign Relations. (n.d.). Trump imposes new Iran tariffs. https://www.cfr.org/article/trump-imposes-new-iran-tariffs

Council on Foreign Relations. (n.d.). Trump’s new tariff announcements. https://www.cfr.org/article/trumps-new-tariff-announcements

Foreign Affairs. (n.d.). America needs economic warriors. https://www.foreignaffairs.com/united-states/america-needs-economic-warriors

Foreign Affairs. (n.d.). The case for a grand bargain between America and China. https://www.foreignaffairs.com/united-states/case-grand-bargain-between-america-and-china

Foreign Affairs. (n.d.). How Europe lost. https://www.foreignaffairs.com/united-states/how-europe-lost-matthijs-tocci

Foreign Affairs. (n.d.). How multilateralism can survive. https://www.foreignaffairs.com/south-america/how-multilateralism-can-survive

Foreign Affairs. (n.d.). The new supply chain insecurity. https://www.foreignaffairs.com/united-states/new-supply-chain-insecurity-shannon-oneil

Reuters. (2026, January 6). U.S. tariffs that are at risk of court-ordered refunds exceed $133.5 billion. https://www.reuters.com/world/us/us-tariffs-that-are-risk-court-ordered-refunds-exceed-1335-billion-2026-01-06

Reuters. (2026, January 8). Importers brace for $150 billion tariff refund fight if Trump loses Supreme Court. https://www.reuters.com/legal/government/importers-brace-150-billion-tariff-refund-fight-if-trump-loses-supreme-court-2026-01-08

Reuters. (2026, January 8). Market risk mounts as Supreme Court weighs Trump’s emergency tariff powers. https://www.reuters.com/legal/government/market-risk-mounts-supreme-court-weighs-trumps-emergency-tariff-powers-2026-01-08

Tax Foundation. (n.d.). IEEPA tariff revenue, Trump, debt, economy. https://taxfoundation.org/blog/ieepa-tariff-revenue-trump-debt-economy

Tax Foundation. (n.d.). Trump tariffs revenue estimates. https://taxfoundation.org/blog/trump-tariffs-revenue-estimates

Tax Foundation. (n.d.). Trump tariffs: The economic impact of the Trump trade war. https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war

Tax Foundation. (n.d.). Universal tariff revenue estimates. https://taxfoundation.org/research/all/federal/universal-tariff-revenue-estimates

The Economist. (2025, November 12). America is going through a big economic experiment. https://www.economist.com/the-world-ahead/2025/11/12/america-is-going-through-a-big-economic-experiment

The Economist. (2025, November 12). Global trade will continue but will become more complex. https://www.economist.com/the-world-ahead/2025/11/12/global-trade-will-continue-but-will-become-more-complex

The Economist. (2026, January 6). America’s missing manufacturing renaissance. https://www.economist.com/finance-and-economics/2026/01/06/americas-missing-manufacturing-renaissance

The Economist. (2026, January 8). Do not mistake a resilient global economy for populist success. https://www.economist.com/leaders/2026/01/08/do-not-mistake-a-resilient-global-economy-for-populist-success

The Economist. (n.d.). Are America’s tariffs here to stay? https://www.economist.com/insider/inside-geopolitics/are-americas-tariffs-here-to-stay

The New York Times. (2026, January 3). Trump tariffs prices impact. https://www.nytimes.com/2026/01/03/business/economy/trump-tariffs-prices-impact.html

The New York Times. (2026, January 13). China trade surplus exports. https://www.nytimes.com/2026/01/13/business/china-trade-surplus-exports.html

The New York Times. (2026, January 13). Trump Iran tariffs trade. https://www.nytimes.com/2026/01/13/world/middleeast/trump-iran-tariffs-trade.html

The New York Times. (2026, January 14). Trump tariffs economists. https://www.nytimes.com/2026/01/14/us/politics/trump-tariffs-economists.html

The Wall Street Journal. (n.d.). Trump predicts strong economic growth in 2026 during speech in Detroit. https://www.wsj.com/politics/policy/trump-predicts-strong-economic-growth-in-2026-during-speech-in-detroit-71a5a19d

The Wall Street Journal. (n.d.). What to know about Trump’s latest tariff policy moves. https://www.wsj.com/economy/trade/what-to-know-about-trumps-latest-tariff-policy-moves-8d9f8b37

BBC News. (n.d.). Article on Trump tariffs and global trade. https://www.bbc.com/news/articles/cwynx4rerpzo

BBC News. (n.d.). Article on Trump tariffs economic effects. https://www.bbc.com/news/articles/czejp3gep63o

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

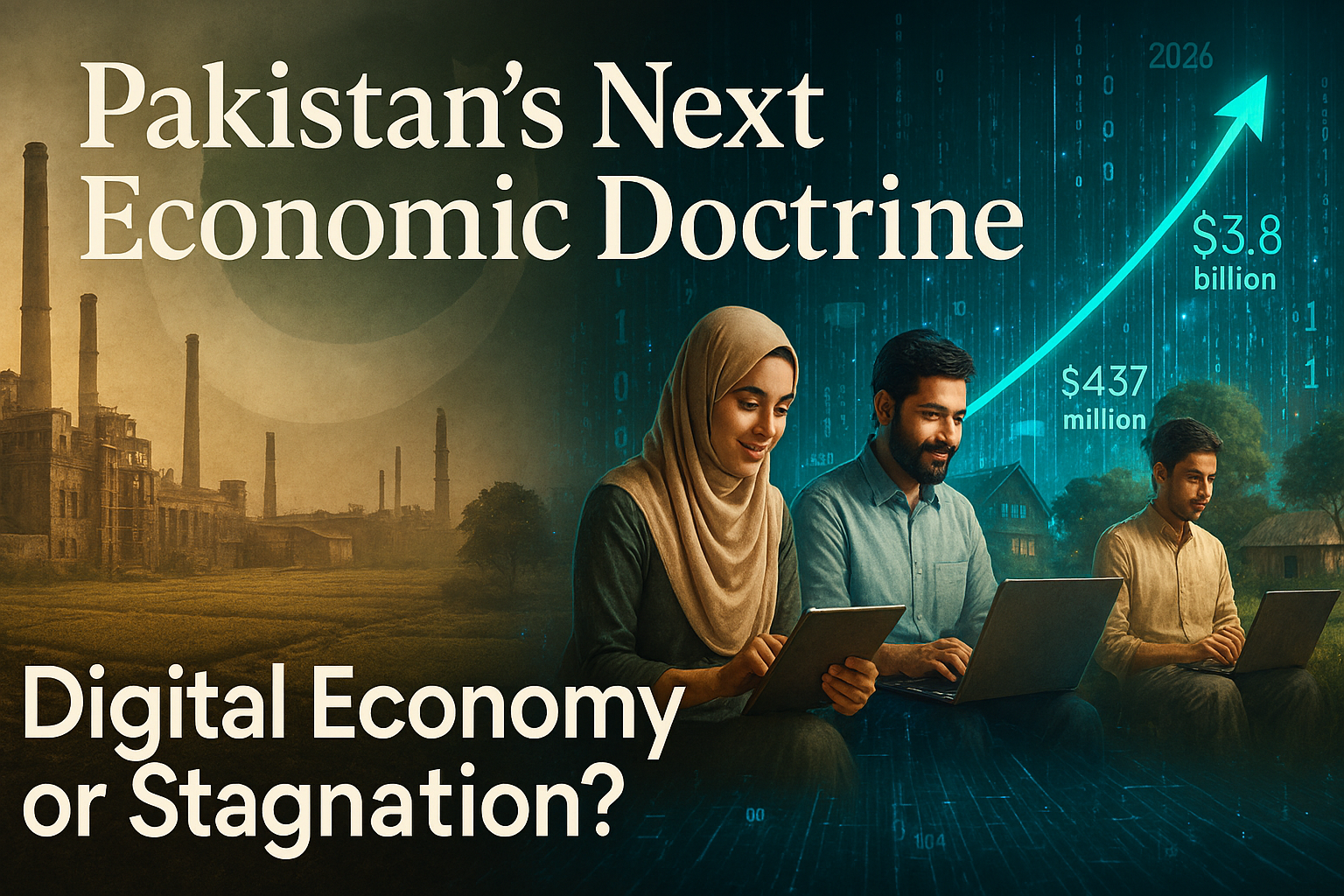

Digital Economy as Pakistan’s Next Economic Doctrine: A Growth Debate Trapped in the Past

Understanding the Digital Economy: More Than a Sector, a System

There is a persistent category error at the heart of Pakistan’s economic policymaking. Officials speak of the “digital economy” the way an earlier generation spoke of textiles or agriculture — as a discrete sector, a line on an export ledger, a portfolio to be managed rather than a platform to be built. This confusion is not merely semantic. It shapes budget allocations, regulatory frameworks, institutional mandates, and, ultimately, the trajectory of a nation of 240 million people standing at a crossroads between chronic underdevelopment and a genuinely plausible economic transformation.

The digital economy, properly understood, is not a sector. It is the operating system upon which all modern economic activity increasingly runs. It encompasses the digitisation of production processes, the datafication of consumer behaviour, the platformisation of labour markets, and the emergence of knowledge as the primary factor of production. When the World Bank’s April 2025 Pakistan Development Update frames digital transformation as Pakistan’s most credible path toward export competitiveness and sustained growth, it is not advocating for a bigger IT park in Islamabad. It is arguing for a wholesale reimagining of what the Pakistani economy produces, and for whom.

That reimagining has begun — tentatively, unevenly, and against considerable institutional resistance. The numbers, for once, are genuinely exciting. Pakistan IT exports reached $3.8 billion in FY2024–25, with the momentum building sharply into the current fiscal year: $2.61 billion in IT and ICT exports were recorded between July and January of FY2025–26, a 19.78% increase year-on-year, according to data released by the Pakistan Software Export Board (PSEB). December 2025 delivered a record single-month figure of $437 million — the highest in the country’s history. These are not marginal gains. They are signals of structural potential.

The question this analysis addresses is whether Pakistan possesses the institutional architecture, policy coherence, and political will to convert those signals into doctrine — or whether it will allow a historic opportunity to dissolve into the familiar entropy of short-termism, infrastructure neglect, and regulatory dysfunction.

Pakistan’s Emerging Digital Base: A Foundation That Defies the Headlines

The pessimistic narrative about Pakistan — fiscal crisis, security fragility, political instability — dominates international discourse and obscures a digital demographic reality that is, by most comparative metrics, extraordinary. Pakistan now has 116 million internet users, with penetration reaching 45.7% in early 2025 and accelerating. The PBS Household Survey 2024–25 found that over 70% of households have at least one member online, with individual usage approaching 57% of the adult population. Against the baseline of five years ago, this represents a compression of the connectivity timeline that took wealthier economies a generation to traverse.

Mobile is the primary vector. Pakistan’s 190 million mobile connections and 142 million broadband subscribers — figures corroborated by GSMA’s State of Mobile Internet Connectivity — reflect a population that has leapfrogged fixed-line infrastructure entirely and gone straight to smartphone-mediated internet access. Smartphone ownership has surged with the proliferation of affordable Chinese handsets, democratising access in a way that no government programme could have engineered.

The identity infrastructure is strengthening in parallel. NADRA’s digital ID system now covers the vast majority of the adult population, providing the authentication backbone without which digital financial services, e-commerce, and government-to-citizen digital delivery cannot scale. The State Bank of Pakistan’s (SBP) digital payments architecture — including the Raast instant payment system — has facilitated a measurable shift in transaction behaviour, particularly among younger urban cohorts.

What Pakistan has, in other words, is a digital base: not yet a digital economy, but the preconditions for one. The distinction is critical. A digital base is necessary but not sufficient. Converting it into export-generating, job-creating, productivity-enhancing economic activity requires deliberate policy architecture — something Pakistan has so far delivered only in fragments.

Geography Is Being Rewritten: The Location Dividend

For most of economic history, geography was fate. A landlocked country, a country far from major shipping lanes, a country without navigable rivers or natural harbours faced structural disadvantages that compounded over centuries. Pakistan’s geographic position — bordering Afghanistan, Iran, India, and China, with access to the Arabian Sea — has historically been as much a source of strategic anxiety as economic opportunity.

The digital economy rewrites this calculus. In knowledge-intensive digital services, physical location is increasingly irrelevant to market access. A software engineer in Lahore can serve a fintech client in Frankfurt. A data scientist in Karachi can work for a healthcare analytics firm in Houston. A UX designer in Peshawar can deliver to a product team in Singapore. The barriers that historically constrained Pakistani talent to domestic labour markets — or forced emigration — are structurally dissolving.

This is the location dividend: the ability to monetise Pakistani human capital in global markets without the friction costs of physical migration. It is a form of comparative advantage that requires no natural resources, no preferential trade agreements, and no proximity to wealthy consumer markets. It requires only talent, connectivity, and institutional conditions that allow value to flow across borders.

Pakistan’s digital economy growth model, at its most ambitious, is predicated on precisely this arbitrage: world-class technical skill delivered at emerging-market cost, routed through digital platforms, and paid in foreign exchange. The macroeconomic implications — for the current account, for foreign reserves, for wage convergence — are profound. The World Bank’s Digital Pakistan: Economic Policy for Export Competitiveness report identifies this services export channel as among the most scalable dimensions of the country’s growth potential.

The geography dividend is real. The question is whether Pakistan can build the institutional infrastructure to fully claim it.

The Freelancer Paradox: Scale Without Structure

Perhaps nowhere is the tension between Pakistan’s digital potential and its institutional constraints more vividly illustrated than in its freelance economy. The headline numbers are startling. Pakistan’s 2.37 million freelancers — an estimate from the Asian Development Bank (ADB) — generate a scale of digital services exports that places the country consistently in the top three to four globally on platforms including Upwork, Fiverr, and Toptal. Freelance earnings in H1 FY2025–26 reached $557 million, a 58% year-on-year increase from $352 million — a growth rate that no traditional export sector can approach.

This is the “freelancer paradox Pakistan” faces: enormous revealed comparative advantage, operating almost entirely outside formal policy architecture. The vast majority of Pakistan’s freelancers work without contracts, without access to institutional credit, without social protection, and without the kind of professional certification or dispute resolution frameworks that would allow them to move up the value chain from commodity task completion to complex, high-margin engagements.

The income ceiling is real and consequential. A Pakistani freelancer completing logo designs or basic data entry tasks on Fiverr earns at the low end of the global digital labour market. The same talent, operating through a structured agency model, with portfolio development support, client management training, and access to premium platforms, could command rates three to five times higher. The gap between what Pakistan’s freelance workforce earns and what it could earn is, effectively, a measure of what institutional neglect costs.

The foreign exchange dimension compounds the problem. Payments routed through platforms like PayPal — where availability for Pakistani users remains restricted — or through informal hawala networks, often bypass the formal banking system entirely. The SBP has made progress in facilitating formal remittance channels, but significant friction remains. Pakistan freelance exports are growing despite the system, not because of it.

A comprehensive Pakistan digital economy doctrine must address the freelancer economy not as an afterthought but as a strategic asset requiring dedicated institutional support: access to formal banking, skills certification, contract facilitation, and platform-level advocacy.

Infrastructure Reliability as Export Competitiveness: The Invisible Tax

Ask any Pakistani software engineer working on an international client project what their single biggest operational constraint is, and the answer is rarely regulatory. It is the power cut that interrupted a client call. It is the bandwidth throttling that corrupted a code repository push. It is the VPN restriction that prevented access to a cloud development environment. These are not edge cases. They are the daily texture of doing business in Pakistan’s digital economy.

Infrastructure reliability is not a background variable. In digital services exports, it is export competitiveness. A Pakistani IT firm competing against Indian, Ukrainian, or Filipino counterparts is not merely selling talent — it is selling reliable, on-time, high-quality delivery. A single missed deadline caused by a grid outage can cost a client relationship worth hundreds of thousands of dollars. Cumulatively, infrastructure unreliability functions as an invisible tax on Pakistan’s digital exports Pakistan is uniquely ill-positioned to afford.

The electricity crisis is the most acute dimension of this problem. Pakistan’s circular debt overhang — exceeding Rs. 2.4 trillion — continues to produce load-shedding that falls hardest on small businesses and home-based workers, who constitute the backbone of the freelance and micro-enterprise digital economy. Large IT firms in tech parks have access to backup generation; individual freelancers in Multan or Faisalabad do not.

Broadband quality is the second constraint. Pakistan’s average fixed broadband speed, while improving, remains well below regional competitors. Mobile data costs have declined, but network congestion in urban cores during peak hours frequently degrades the quality of experience to levels incompatible with professional digital work. The GSMA has consistently highlighted last-mile connectivity gaps as the primary barrier to realising Pakistan’s mobile internet dividend.

A credible Pakistan digital economy doctrine must treat infrastructure investment — in power stability, fibre optic expansion, and spectrum management — not as a public works programme but as export infrastructure, directly analogous to port expansion for goods trade.

Cyber Risks and the Trust Deficit: The Hidden Vulnerability

Digital economies are only as robust as the trust that underpins them. Trust operates at multiple levels: consumer trust in digital financial services, business trust in cloud infrastructure, investor trust in data governance frameworks, and international partner trust in Pakistan’s regulatory environment. On all of these dimensions, Pakistan faces a significant trust deficit that constrains the Pakistan digital economy growth trajectory.

Cybersecurity incidents affecting Pakistani financial institutions have multiplied. The banking sector has faced card data breaches, phishing campaigns targeting mobile banking users, and SIM-swap fraud at scale. The Pakistan Telecommunication Authority’s (PTA) record of internet shutdowns and platform restrictions — including prolonged access restrictions to major social media platforms during periods of political tension — has created a perception among international digital businesses that Pakistan’s internet governance is unpredictable.

This unpredictability carries a direct economic cost. International clients contracting Pakistani firms for sensitive data processing work — healthcare records, financial data, personal information — conduct due diligence on the regulatory and security environment. A country with a history of arbitrary platform restrictions and limited data protection enforcement does not inspire confidence for high-value data contracts.

Pakistan’s Personal Data Protection Bill, in legislative limbo for several years, represents the most visible symptom of this institutional gap. Without a credible, enforced data protection framework, Pakistan cannot credibly bid for the categories of digital services work — cloud processing, AI training data, health informatics — where the highest margins and fastest growth lie. Closing this gap is not merely a legal formality; it is a prerequisite for moving up the digital value chain.

Institutional Constraints and Policy Incoherence: The Structural Brake

Pakistan’s digital economy governance is fragmented across a proliferation of bodies — the Ministry of IT and Telecom (MoITT), PSEB, PTA, the National Information Technology Board (NITB), provincial ICT authorities, and the Special Investment Facilitation Council (SIFC) — with overlapping mandates, inconsistent coordination, and chronic under-resourcing. This fragmentation is not accidental; it reflects the accumulation of institutional layering that characterises Pakistan’s economic governance more broadly.

The policy incoherence is manifested in contradictions that would be almost comic if they were not so economically costly. Pakistan simultaneously promotes itself as a top destination for IT outsourcing while maintaining VPN restrictions that its own IT workers require to access client systems. It celebrates freelance export earnings while allowing the forex payment infrastructure for those earnings to remain dysfunctional. It announces ambitious digital skills programmes while underfunding the higher education institutions that produce the graduates those programmes are supposed to train.

The Pakistan IT exports 2026 growth trajectory — impressive as it is — is occurring largely in spite of, rather than because of, this governance architecture. The question for policymakers is not whether the current momentum can continue; it can, for a time, on the basis of demographic dividend and individual entrepreneurial energy alone. The question is whether that momentum can be compounded into the kind of structural transformation that moves Pakistan from an exporter of digital labour to an exporter of digital products and platforms.

That transition requires a qualitatively different institutional environment: one capable of regulating without strangling, facilitating without distorting, and investing at the horizon of a decade rather than the cycle of a fiscal year.

Digital Sovereignty and Platform Dependency: The Strategic Dimension

Beneath the growth narrative lies a geopolitical and strategic question that Pakistan’s digital economy debate has been slow to engage: the question of digital sovereignty Pakistan must navigate. As Pakistani businesses and individual workers increasingly integrate into global digital platform ecosystems — Upwork, Fiverr, AWS, Google Cloud, Microsoft Azure — they gain access to markets, infrastructure, and tools that would be impossible to replicate domestically. They also incur structural dependencies that carry long-term risks.

Platform dependency is not a uniquely Pakistani problem. Every country that has embraced the global digital economy faces some version of this tension. But for Pakistan, the risks are heightened by the country’s limited regulatory leverage, its absence from the standard-setting bodies that govern international digital trade, and the concentration of critical digital infrastructure in the hands of a small number of US-headquartered technology corporations.

The practical implications are significant. When a major freelance platform adjusts its fee structure or payment policies, Pakistani freelancers — who have no collective bargaining mechanism, no government-backed alternative platform, and no domestic digital marketplace of comparable scale — absorb the consequences. When a cloud provider raises prices or discontinues a service, Pakistani startups that have built their infrastructure on that provider face switching costs that can be existential.

Digital sovereignty does not mean autarky. It means building sufficient domestic digital capacity — in cloud infrastructure, in payment systems, in data storage, in platform development — to maintain meaningful optionality. It means participating in the governance of the global digital economy rather than passively receiving its terms. It means developing the regulatory expertise to negotiate with platform giants on terms that protect Pakistani economic interests.

This is a long-game strategic agenda, not a short-cycle policy fix. But without it, Pakistan’s Pakistan digital economy growth risks being permanently extractive — generating value that is captured elsewhere.

Government as Digital Market Creator: The Enabling State

One of the most durable insights from the comparative study of digital economy development — South Korea, Estonia, Singapore, Rwanda — is that the private sector alone does not build digital economies. Governments create the conditions: the infrastructure, the standards, the skills pipeline, the procurement signals, and the regulatory certainty without which private investment cannot take root at scale.

Pakistan’s government has the opportunity — and, given the fiscal constraints, the obligation — to be a strategic market creator rather than a passive regulator. Government digitalisation is not merely an efficiency play; it is a demand-side signal to the domestic digital industry. When the government digitises land records, health systems, tax administration, and public procurement, it creates contract opportunities for Pakistani IT firms, validates the commercial viability of digital solutions, and builds the reference clients that domestic companies need to compete internationally.

The PSEB’s facilitation role — connecting international clients with Pakistani IT firms, providing export certification, and advocating for payment infrastructure improvements — represents the embryo of a more active industrial policy. The SIFC’s mandate, if properly operationalised for the digital sector, could provide the high-level coordination that has been missing. But these institutions need resources, autonomy, and political backing to function at the scale the opportunity demands.

The most immediate lever available is public digital procurement: a committed pipeline of government IT contracts awarded to domestic firms under transparent, merit-based processes. This single policy — properly designed and consistently executed — could do more to develop Pakistan’s digital industry than any number of incubator programmes or innovation fund announcements.

From Factor-Driven to Knowledge-Driven Economy Pakistan: The Structural Leap

Pakistan’s economic growth model has, for most of its history, been factor-driven: growth generated by deploying more labour, more land, more capital, in sectors with relatively low productivity — agriculture, low-complexity manufacturing, commodity exports. The digital economy represents the most credible pathway to a fundamentally different model: one in which growth is driven by increasing productivity, accumulating human capital, and generating returns from knowledge rather than from raw inputs.

The knowledge-driven economy Pakistan needs is not a distant aspiration. The ingredients exist, in nascent form: a young population with demonstrated aptitude for digital skills, universities producing engineers and computer scientists at scale, a diaspora with global networks and capital, and a domestic entrepreneurial ecosystem generating startups in fintech, healthtech, agritech, and edtech that are beginning to attract international venture investment.

The transition from factor-driven to knowledge-driven growth is not automatic or inevitable. It requires deliberate investment in research and development, in higher education quality, in intellectual property protection, and in the kind of long-term institutional stability that allows firms to make multi-year investment commitments. Pakistan’s R&D expenditure as a share of GDP remains among the lowest in Asia — a structural constraint that no amount of IT export promotion can overcome if sustained.

The ADB’s research on Pakistan freelancers earnings and digital service exports consistently emphasises that the earnings ceiling for task-based freelance work is far lower than for product-based or IP-based digital exports. Moving Pakistani digital workers up this value curve — from executing tasks to building products, from selling hours to licensing software — is the central challenge of knowledge economy transition.

Policy Priorities for a Digital Doctrine: What Must Be Done

A credible Pakistan digital economy doctrine for the period to 2030 requires six interlocking policy commitments, each necessary but none sufficient in isolation.

First, infrastructure as export policy. Pakistan must treat reliable electricity supply and high-quality broadband as preconditions for digital export competitiveness, not as welfare goods. This means prioritising digital economic zones with guaranteed power supply, accelerating fibre optic backbone expansion into secondary cities, and reducing spectrum costs for business-grade mobile broadband.

Second, the forex plumbing must be fixed. The SBP must complete the liberalisation of digital payment channels, enabling Pakistani freelancers and digital firms to receive, hold, and deploy foreign currency earnings without the friction that currently drives significant volumes into informal channels. Every dollar that flows through informal networks is a dollar that does not build Pakistan’s foreign reserves or generate formal tax revenue.

Third, data protection legislation must be enacted and enforced. The Personal Data Protection Bill must be passed in a form that meets international standards — not as a regulatory box-ticking exercise, but as a genuine market access instrument. Pakistan cannot compete for high-value data services contracts without credible data governance.

Fourth, skills investment must match ambition. Pakistan’s Pakistan IT exports 2026 targets require a quantum expansion of the technical skills pipeline — not through low-quality short courses, but through sustained investment in computer science education at the tertiary level, curriculum modernisation, and industry-academia partnerships that ensure graduates enter the workforce with market-relevant capabilities.

Fifth, institutional consolidation. The fragmented governance architecture for the digital economy must be rationalised. A single, adequately resourced Digital Economy Authority — with a clear mandate, cross-ministerial coordination powers, and direct accountability to the Prime Minister — would reduce the transaction costs of doing business in Pakistan’s digital sector by orders of magnitude.

Sixth, a digital sovereignty strategy. Pakistan needs a national cloud strategy, a digital platform policy, and active participation in international digital trade negotiations. These are not luxury items for a mature digital economy; they are foundational choices that, once deferred, become progressively more expensive to make.

Conclusion: A Decisive Economic Choice

Pakistan’s Pakistan digital economy moment is real, and it is now. The combination of demographic scale, demonstrated digital talent, accelerating connectivity, and record IT and freelance export earnings constitutes a rare convergence of factors that, in other economies, has served as the launching pad for durable structural transformation.

But potential is not destiny. History is littered with countries that glimpsed the digital transformation horizon and then allowed institutional inertia, political short-termism, and infrastructure neglect to ensure they never reached it.

The debate Pakistan is currently having about its digital economy is, at its deepest level, a debate about what kind of economic future the country chooses to construct. The old paradigm — commodity exports, remittances, periodic IMF bailouts, growth that barely keeps pace with population — has delivered recurrent crisis and chronic underinvestment in human capital. The digital paradigm offers something genuinely different: a pathway to prosperity grounded in the one resource Pakistan has in abundance, its people, and their capacity for knowledge work in a globally connected economy.

Digital sovereignty Pakistan must claim is not merely about technology. It is about economic agency — the ability to participate in the global economy on terms that capture value domestically rather than exporting it. Every reform deferred, every institutional bottleneck left unaddressed, every dollar that flows through informal channels rather than the formal banking system, is a cost Pakistan cannot afford.

The choice between a Pakistan whose digital economy remains a promising footnote and one whose Pakistan digital economy growth becomes the defining story of the coming decade is not a technical question. It is a political one. And it must be answered decisively — before the window that demographics, technology, and global market demand have opened begins, once again, to close.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

KOSPI Record Crash: South Korea’s Stock Market Suffers Its Worst Day in History as the US-Iran War Detonates a Global Sell-Off

At 9:03 a.m. Korean Standard Time, the screens inside the Korea Exchange trading hall in Yeouido, Seoul, turned a uniform, searing red. Within minutes, the sell orders were not arriving in waves — they were arriving like a flood breaking through a dam. Algorithms fired. Margin calls cascaded. Retail investors, who only weeks ago were borrowing money to buy Samsung Electronics at record highs, watched years of gains dissolve in real time. By 9:17 a.m., trading had been suspended for twenty minutes: the circuit breaker, a mechanism designed for exactly this kind of controlled catastrophe, had triggered for just the seventh time in the KOSPI’s 43-year history.

By the closing bell, South Korea’s benchmark index had shed 12.06 percent — 698.37 points — to close at 5,093.54. It was the worst single day in the KOSPI’s recorded history, surpassing even the paralysing shock of September 11, 2001. The world’s hottest major stock market, up more than 40 percent in just two months, had just been broken — not by a domestic crisis, not by a company scandal, but by missiles fired 6,000 kilometres away in the Persian Gulf.

What Happened: A Minute-by-Minute Collapse

The trigger was a week in the making. On the morning of February 28, 2026, US and Israeli forces launched a coordinated series of airstrikes against Iran, an operation that reportedly included the assassination of Supreme Leader Ali Khamenei. Iran’s response was swift and economically calculated: the Islamic Revolutionary Guard Corps announced a closure of the Strait of Hormuz, the narrow chokepoint through which roughly 20 million barrels of crude oil transit daily — accounting for approximately 20 percent of global supply.

South Korean markets were closed on Monday, March 2, for Independence Movement Day. When trading reopened Tuesday morning, the pent-up global selling pressure — two full days of deteriorating sentiment compressed into a single session — hit simultaneously. The KOSPI fell 7.24 percent on Tuesday, closing at 5,791.91, its largest single-session point drop on record at that time.

Wednesday brought something far worse.

The timeline:

- 09:00 KST — KOSPI opens at 5,592.29, already down sharply from Tuesday’s close.

- 09:08 KST — Circuit breaker triggered on the KOSDAQ after losses exceed 8 percent; trading suspended 20 minutes.

- 09:14 KST — KRX activates sidecar mechanism on the KOSPI as sell orders overwhelm buy-side liquidity.

- 09:17 KST — KOSPI circuit breaker fires. At the time of the halt, the index is down 469.75 points — 8.11 percent — to 5,322.16.

- 09:37 KST — Trading resumes. Selling immediately intensifies.

- 11:20 KST — KOSPI reaches intraday low of 5,059.45, down 12.65 percent — the worst intraday reading in 25 years and 11 months.

- 15:30 KST — Official close: 5,093.54, down 12.06 percent. Of the more than 800 stocks on the benchmark, just 10 finish in the green.

The KOSDAQ, South Korea’s technology-heavy secondary index, fared even worse, closing down 14 percent at 978.44 — its largest single-day decline since its founding in January 1997. The combined two-day equity wipeout erased an estimated $430 billion in market value.

Why South Korea Was Hit Hardest: The Anatomy of a Perfect Storm

Every major economy felt the tremor of the Iran conflict on March 4. But none — not Japan, not Taiwan, not China — fell anything close to what Seoul experienced. The gap is not coincidental. It is structural.

Energy dependence, extreme and existential. South Korea imports approximately 98 percent of its fossil fuels, with around 70 percent of its crude oil sourced from the Middle East, much of it transiting the Strait of Hormuz. According to the US Energy Information Administration, South Korea ranks among the top importers of Hormuz-transit crude globally. When Iran threatened to close — and partially did close — that chokepoint, the calculus for Korean manufacturers and energy utilities changed instantly. Higher oil does not merely raise input costs; it compresses margins across the entire export-driven economy, stokes inflation, and pressures the current account. Nomura estimates that South Korea’s net oil imports represent 2.7 percent of GDP — among the highest of any major economy and a stark vulnerability flag in any energy shock scenario.

Semiconductor concentration, a double-edged sword. The KOSPI’s extraordinary 2026 rally — up more than 40 percent in the first two months of the year, touching an all-time high above 6,347 in late February — was almost entirely the story of two companies: Samsung Electronics and SK Hynix. Together, the two memory chip giants account for close to 50 percent of the index by market capitalisation, according to Morningstar equity research. When sentiment turned, that concentration did not merely reflect the market’s decline — it amplified it. Samsung Electronics fell 11.74 percent to 172,200 won. SK Hynix dropped 9.58 percent to 849,000 won. Hyundai Motor collapsed 15.80 percent. Kia Corp shed 13.82 percent. Shipping stocks Pan Ocean, HMM, and KSS Line — directly exposed to Hormuz route disruption — plunged between 16 and 19 percent.

As Lorraine Tan, Asia director of equity research at Morningstar, noted, “The decline in the KOSPI can broadly be attributable to the single-name concentration that we see in Korean markets.” She added that the drop also implied growing concern that AI data-centre adoption could slow due to significantly higher energy costs — a double hit for chips stocks caught between geopolitical risk and demand uncertainty.

Margin debt: the accelerant. Before the conflict erupted, South Korean retail investors had borrowed heavily to ride the bull market. Margin debt and broker deposits had surged to record highs. When prices began to fall, those leveraged positions triggered forced liquidations, turning an orderly retreat into a rout. “There’s been a lot of buying on credit, especially in the heavyweight stocks,” Kim Dojoon, chief executive of Zian Investment Management, told Bloomberg. “If there’s another drop on Thursday, nobody will catch a falling knife.”

The holiday amplifier. Monday’s market closure meant that South Korean markets absorbed two full days of global deterioration in a single session on Tuesday — and then suffered a second cascading wave on Wednesday, with no circuit of relief between them.

Historical Benchmark: Into Uncharted Territory

To understand the magnitude of what happened in Seoul on March 4, 2026, consider the events it eclipses.

The KOSPI has recorded a decline of 10 percent or more in a single session on only four occasions in its 43-year history. According to the Korea Herald and historical KRX data, those occasions are:

| Date | Event | KOSPI Decline |

|---|---|---|

| April 17, 2000 | Dot-com bubble peak | -11.63% |

| September 12, 2001 | Post-9/11 shock | -12.02% |

| October 24, 2008 | Global Financial Crisis | -10.57% |

| March 4, 2026 | US-Iran War | -12.06% |

The September 12, 2001 session had stood for nearly 25 years as the single worst day in South Korean market history — a day when global commerce froze and the world reoriented around fear. Wednesday’s close eclipsed it by a margin of 0.04 percentage points. The intraday low — 12.65 percent — was the deepest since April 17, 2000.

The KOSDAQ’s 14 percent plunge, meanwhile, surpassed its previous worst session: the 11.71 percent rout of March 19, 2020, at the nadir of the COVID-19 pandemic panic. What happened this week in Seoul did not merely set a record. It rewrote the category entirely.

What makes the comparison to 2001 particularly sobering is context. On September 12, 2001, markets around the world fell together. In 2026, Wall Street is barely flinching: the S&P 500 fell approximately 1 percent overnight. The KOSPI’s collapse is not a global synchronised shock — it is something more targeted, and in some ways more alarming: a geopolitical vulnerability unique to South Korea’s economic structure being stress-tested in real time.

Global Contagion: Oil, Currencies, and the Hormuz Premium

Seoul was the epicentre, but the aftershocks radiated across the region and beyond.

Oil. Brent crude surged 10–13 percent in the days following the initial strikes, trading around $80–82 per barrel by March 2–4, according to energy analysts cited by Reuters. Analysts warned that if the Hormuz disruption proves sustained, prices could breach $100 per barrel — a level that would add an estimated 0.8 percentage points to global inflation, according to projections cited in the economic impact assessment published by Wikipedia. Natural gas prices in Europe surged 38 percent following reported attacks on Qatari LNG export facilities.

The Korean won. The currency markets told the same story in different decimal places. The won briefly pierced 1,500 per dollar on Wednesday — a level not seen since March 10, 2009, at the nadir of the global financial crisis. It was, psychologically, an enormous threshold. Yan Wang, chief of emerging markets at Alpine Macro, told the Korea Herald that the Korean won is historically “one of the most sensitive emerging market currencies to global risk sentiment,” while cautioning that fundamentals do not justify such weakness unless the conflict drags on significantly.

Asian markets. The contagion spread, though nowhere matched Seoul’s severity:

- Japan Nikkei 225: -3.61% to 54,245.54

- Taiwan TAIEX: -4.40% to 32,829

- Hong Kong Hang Seng: -2.00% to 25,249.48

- Shanghai Composite: -1.00% to 4,082.47

The asymmetry is instructive. China, a major oil importer, absorbed the shock with relative composure — partly due to its diversified energy sourcing and partially because domestic policy responses appeared pre-positioned. Japan and Taiwan, similarly dependent on Middle East energy, fell meaningfully but remained far above Korean levels, their indices lacking the same speculative leverage overhang.

Travel and supply chains. Iran’s airspace was closed to civilian aircraft following the initial strikes on February 28. Multiple carriers suspended Middle East routes, with knock-on effects for travel and tourism across the Gulf. Shipping insurance costs for Hormuz-transit tankers surged, with analysts suggesting the “war premium” could add $5–15 per barrel to delivered oil costs regardless of military escort arrangements — a persistent, structural cost increase for energy importers like South Korea.

Three Scenarios: What Comes Next

The trajectory of South Korea’s markets now depends almost entirely on one variable: how long the conflict lasts, and whether the Strait of Hormuz reopens to normal commercial traffic.

Scenario 1 — Rapid Resolution (probability: 30%) The US achieves its stated military objectives within four to five weeks, as President Trump publicly signalled. Iranian counter-retaliation is contained. Oil retreats to sub-$80. In this scenario, the structural case for Korean equities reasserts itself quickly — AI memory demand remains intact, Samsung and SK Hynix resume margin expansion, and the KOSPI, still up approximately 21 percent year-to-date even after the crash, stages a sharp technical rebound. Forced liquidations reverse. Analysts at Seoul-based brokerages place a 10 percent rebound in the first week post-ceasefire as the base case for this outcome.

Scenario 2 — Prolonged Stalemate (probability: 50%) The conflict extends beyond one month. The Strait of Hormuz remains partially disrupted. Oil stabilises in the $85–95 range. South Korea’s current account balance deteriorates. The Bank of Korea is forced to weigh currency intervention against inflation pressures — a familiar but painful dilemma for an open economy. The KOSPI finds a floor in the 4,800–5,000 range as earnings revisions bite. Recovery is slow, uneven, and dependent on semiconductor demand holding firm even as energy costs rise. Foreign investors remain cautious.

Scenario 3 — Full Energy Shock (probability: 20%) The conflict escalates into a sustained regional war. Hormuz closes effectively for multiple months. Crude reaches $100 or beyond. In this scenario, Hyundai Research Institute’s earlier estimate — that sustained $100 crude could shave 0.3 percentage points from South Korea’s 2026 GDP growth — becomes conservative. The KOSPI potentially tests 4,000. The Bank of Korea is forced into emergency rate decisions. The IMF revises Asian growth projections downward across the board. Global stagflation risks — higher energy prices coinciding with slower growth — re-enter the policy conversation for the first time since 2022.

Investor Playbook and Policy Response

What regulators and institutions are doing. The Bank of Korea issued a statement vowing to “respond to herd-like behaviour” in financial markets and pledged liquidity support measures if volatility persisted. The Korea Exchange activated circuit breakers and sidecar mechanisms as designed, but market participants noted that the tools slowed rather than stopped the cascade. Foreign investors, after dumping more than 12 trillion won in equities over the two-session period, ended Wednesday as modest net buyers — 231.2 billion won in net purchases — a tentative signal that some institutional money saw the dislocation as an entry point.

BofA’s take. “The sharp decline reflects the outsized leverage in long positions heading into February 28, 2026, when market sentiment was highly bullish on Korean tech due to the aggressive shortage of memory chips used in AI server production,” BofA strategist Chun Him Cheung told Investing.com. The implication: this was not a fundamental repricing of Korea’s economic future — it was a positioning purge, painful but potentially creating opportunity.

Where rational capital might look. For investors with a six-to-twelve-month horizon, the crash has produced a rare dislocation between price and fundamental value in high-quality names. Samsung Electronics and SK Hynix — despite their catastrophic session — retain structural leadership positions in AI-grade memory chips, a market with no near-term substitute suppliers. Analysts at IM Securities and Renaissance Asset Management both noted that if the conflict resolves within one month, a rebound toward 5,500–5,800 on the KOSPI is plausible. Defensive plays in South Korean energy utilities, domestic-demand retailers, and defence contractors — which have benefited from the same geopolitical tension that crushed the broader market — offer asymmetric positioning.

For retail investors caught in forced liquidations, the message is sobering but familiar: leverage borrowed at the peak of euphoria is the most reliable way to transform a geopolitical shock into a personal financial crisis.

Conclusion: The Price of Being the World’s Hottest Market

There is a painful irony at the heart of what happened to South Korea’s stock market this week. The KOSPI was, by virtually every measure, the world’s best-performing major equity index in early 2026. It rose on the back of genuine structural tailwinds — AI memory demand, corporate governance reforms, a re-rating of Korea’s innovation economy by global fund managers. The 40-percent rally in two months was not pure speculation; it was grounded in earnings.

But markets running that fast accumulate fragility. Leverage builds. Concentration intensifies. The margin for error narrows. When an external shock arrives — not a Korean shock, not a chip-sector shock, but a missile fired in the Persian Gulf — there is no buffer. The circuit breakers fired at 9:17 a.m. and could not stop what came afterward.

The KOSPI’s record-breaking crash is not, in isolation, a verdict on South Korea’s economic future. The structural case for its semiconductor giants remains intact. The reforms that re-rated the market over the past year have not been reversed. What has changed is the risk premium: an economy that earns its export surplus in silicon must pay for its energy in oil, and oil now carries a war premium that markets cannot price with confidence.

The Strait of Hormuz is 39 kilometres wide at its narrowest point. For South Korea, that passage has never felt smaller.

FAQs (FREQUENTLY ASKED QUESTIONS)

Q1: Why did South Korea’s stock market fall more than any other country’s during the US-Iran war? South Korea’s extreme vulnerability stems from three intersecting factors: it imports approximately 98 percent of its fossil fuels, with around 70 percent sourced from the Middle East via the Strait of Hormuz; its benchmark KOSPI index is heavily concentrated in semiconductor stocks (Samsung and SK Hynix account for close to half the index’s market cap) that had rallied more than 40 percent in early 2026 on margin debt; and a public holiday on Monday March 2 compressed two days of global selling into a single catastrophic Tuesday session.

Q2: How does the March 4, 2026 KOSPI crash compare to the September 11, 2001 drop? The KOSPI fell 12.06 percent on March 4, 2026, narrowly eclipsing the 12.02 percent decline recorded on September 12, 2001, the day after the 9/11 attacks. The intraday low of 12.65 percent was the deepest since April 17, 2000. It is now the worst single-day session in the KOSPI’s 43-year recorded history, surpassing four prior instances of 10-percent-plus declines including those during the dot-com bubble, 9/11, and the 2008 global financial crisis.

Q3: What happened to the Korean won during the KOSPI crash? The Korean won fell sharply during the two-day rout, briefly breaching 1,500 per dollar on Wednesday March 4 — a level not seen since March 2009 at the depth of the global financial crisis — before closing around 1,466 per dollar. The Bank of Korea vowed to respond to “herd-like behaviour” in currency markets and signalled readiness for intervention if volatility persisted.

Q4: Will South Korea’s stock market recover from the US-Iran war selloff? The outlook depends heavily on the duration of the conflict and whether the Strait of Hormuz reopens to normal commercial shipping. Most Seoul-based analysts see two primary scenarios: a quick resolution (within four to five weeks) that triggers a sharp technical rebound toward 5,500–5,800 on the KOSPI, or a prolonged stalemate that sees the index finding a floor near 4,800–5,000 as earnings are revised downward. The structural bull case — driven by AI memory chip demand and corporate governance improvements — has not been invalidated, but the energy-price risk premium has risen substantially.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Insurance

Gulf Insurance Costs Soar 12-Fold Despite Trump Guarantee: The Global Energy Crisis No One Saw Coming

War risk premiums for Strait of Hormuz transits have surged from a pre-crisis baseline of roughly 0.08% to as high as 1% of hull value — a near-12-fold explosion in cost that is quietly strangling global energy trade, even as President Trump promises an insurance backstop through the U.S. Development Finance Corporation.

The Quote That Stops a Ship

Imagine you are the operations director of a midsize Greek tanker company. Your very large crude carrier — a VLCC laden with two million barrels of Saudi crude, worth roughly $160 million at today’s prices — is sitting at anchor in the Gulf of Oman. It was bound for Ningbo. Your broker in London calls Tuesday morning. The hull war risk premium to transit the Strait of Hormuz, if you can get one at all, has just hit 1% of the vessel’s insured value — for a single seven-day period. On a ship valued at $120 million, that is $1.2 million. For one voyage. Last month, the same premium was $96,000.

You tell the captain to hold position.

That decision, replicated by hundreds of operators across the global tanker fleet since the United States and Israel launched joint strikes against Iran on February 28, 2026, is the quiet mechanism behind the most severe disruption to global energy flows since the 1979 Iranian Revolution. It is not missiles or mines that have effectively closed the Strait of Hormuz — it is a spreadsheet, a reinsurer’s risk model, and a 12-fold surge in the price of a specialized insurance policy that most people have never heard of.

The Surge Explained: From 0.08% to Uninsurable

War risk insurance is the unglamorous but indispensable plumbing of global trade. Standard marine policies exclude losses arising from armed conflict; a separate war risk policy fills that gap, and without it, port authorities refuse entry, charterers void contracts, and banks decline to finance cargo. As David Smith, head of marine at insurance broker McGill & Partners, put it bluntly: if you walked into the hull war market right now and said you had a tanker bound through the Strait of Hormuz, there is a genuine possibility you would struggle to find any underwriter prepared to quote terms at all.

The numbers behind the collapse are stark. Before the U.S.-Israeli air campaign against Iran began — what American planners have codenamed “Operation Epic Fury” — war risk premiums for Persian Gulf transits sat at roughly 0.08% to 0.1% of a vessel’s insured hull value on a standard seven-day basis, a baseline consistent with the relatively stable threat environment that followed the 2025 Houthi ceasefire. By March 3, 2026, premiums had surged to as much as 1% of vessel value, even for ships not planning to breach the Strait itself — and underwriters were in some cases declining to quote at all. For a VLCC valued at $120 million, that translates into a single-voyage war risk bill of $1.2 million, versus roughly $96,000 three weeks ago.

The structural driver of this repricing is reinsurance. London’s wholesale marine market does not carry that exposure on its own books — it cedes most of the risk upward to a small group of global reinsurers. When those reinsurers withdrew their support for Gulf war risk extensions in the 72 hours following the February 28 strikes, the primary market followed instantly. The Joint War Committee of Lloyd’s Market Association moved swiftly to expand its list of designated high-risk areas to include Bahrain, Djibouti, Kuwait, Oman, and Qatar — a designation that automatically triggers reset clauses in thousands of charter party agreements and financing contracts worldwide.

The Insurer Exodus: A 72-Hour Cancellation Wave

The mechanics of what happened over March 1 and 2 deserve examination, because they reveal a structural vulnerability that no political guarantee — however loudly announced — can easily override.

All 12 members of the International Group of P&I Clubs, the mutual insurance cooperatives that together cover liability risks for approximately 90% of the world’s ocean-going merchant fleet, simultaneously issued 72-hour notices of cancellation for war risk extensions attached to their Gulf policies. Among the prominent names announcing cancellations effective March 5: Gard, Skuld, NorthStandard, the London P&I Club, and the American Club. Japan’s MS&AD Insurance Group separately suspended new underwriting across a broader range of war risk policies covering waters near Iran, Israel, and neighboring countries.

Skuld stated it was working on a buy-back option to reinstate cover at higher premiums. But the key phrase is “higher premiums” — the market was not withdrawing because the risk was uninsurable in principle. It was withdrawing because reinsurers needed to reset pricing to a level that reflected a genuine war environment, not a residual geopolitical tension premium. The parallel to 2022 is instructive: after Russia invaded Ukraine, insurers cancelled Black Sea war risk extensions before new cover was eventually negotiated — at vastly higher cost — as grain exports resumed months later under new terms. The Hormuz situation is structurally similar, but geographically more consequential.

What distinguishes this moment from previous Gulf shipping crises is the breadth of the insurer pullback. During the 1987–1988 Tanker Wars, the market stayed open — pricing adjusted but never fully closed. Today, the combination of advanced Iranian drone technology, demonstrated willingness to target vessels from multiple flags, and an IRGC commander’s declaration that the Strait is “closed” and any vessel attempting passage would be set ablaze has created what Munro Anderson of Vessel Protect, a war insurance specialist within Pen Underwriting, described as a “de facto closure of the strait based primarily on perception of threat rather than tangible blockade.” Perception, in insurance markets, is reality.

Industry leaders at BIMCO, the global shipping association, have additionally warned that vessels with business connections to the United States or Israel may face difficulty obtaining coverage at any price, introducing a politically discriminatory dimension to coverage decisions that no previous Gulf crisis has featured.

Trump’s Guarantee — Bold But Operationally Thin

On Tuesday, March 3, President Trump responded with the blunt instrument of executive authority. In a post on Truth Social, he announced that he had ordered the U.S. Development Finance Corporation (DFC) to provide, “at a very reasonable price, political risk insurance and guarantees for the Financial Security of ALL Maritime Trade, especially Energy, traveling through the Gulf.” He added that the U.S. Navy would begin escorting tankers through the Strait of Hormuz “if necessary.”

The announcement produced an immediate, if partial, market response. Brent crude pulled back from its intraday high following Trump’s post, trading around $79 to $82 a barrel rather than testing the $90 threshold analysts had feared, though the price still represented a 13% surge from the pre-conflict level of approximately $68 in early February. U.S. stocks trimmed their steepest losses of the session. The Dow, which had been down more than 1,200 points at its low, recovered to a decline of around 300.

But the relief was fragile, because the details behind the headline are deeply problematic.

The DFC is a development finance agency — its mandate is to mobilize private capital in emerging markets, and it offers political risk insurance primarily to protect U.S. companies from losses due to expropriation or political violence in developing countries. Trump’s announcement would require the DFC to sell insurance to shipping companies of all nationalities — a scope of coverage far beyond what the agency has ever underwritten, for risks far beyond its existing actuarial expertise. No mechanism was announced. No pricing was offered. No implementation timeline was given. The White House press office did not respond to requests for further detail.

The Navy escort dimension is, if anything, even more constrained. According to Lloyd’s List, U.S. Navy officials have already privately told tanker executives that the sea service does not currently have the operational availability to provide Hormuz escorts. An estimated one-third of the deployed U.S. fleet is already committed to Middle East operations, engaged in Tomahawk strike missions and air defense of Gulf states that have themselves been targeted by Iranian missiles. The word “if necessary” in Trump’s post is doing considerable heavy lifting.

Economic Fallout: From Gulf to Gasoline Pump

The damage to the broader global economy is unfolding along several distinct channels, and the speed of transmission is faster than in any previous oil shock.

Shipping rates have collapsed into records — in the wrong direction. The benchmark freight rate for VLCCs hauling crude from the Middle East to China climbed to $423,736 per day, more than double the level from the previous session — an all-time record — even as vessels decline to actually make the voyage. Hapag-Lloyd has imposed war risk surcharges of $1,500 per standard container for Arabian Gulf cargo; CMA CGM has introduced an Emergency Conflict Surcharge of $2,000 per container. These costs will be passed to cargo owners, then to manufacturers, then to consumers.

Oil prices are embedding a new floor. Brent crude has risen approximately 13% since February 28, touching $82 per barrel. With roughly 20 million barrels per day transiting the Strait in normal times — equivalent to 20% of global petroleum consumption — analysts at Goldman Sachs and Barclays have warned that a sustained closure could push Brent toward $100 and beyond. Gregory Daco, chief economist at EY-Parthenon, has placed his outer-range forecast at $110 per barrel if the disruption persists through year-end.

American consumers are already feeling the sting. The national average price for a gallon of regular gasoline rose 11 cents overnight to $3.11 — the largest single-day increase since Russia invaded Ukraine in March 2022 — reversing what the Trump administration had spent months celebrating as an energy-price success story heading into midterm election season. Mark Zandi, chief economist at Moody’s Analytics, offered the macro arithmetic: a $10 per barrel increase in oil prices translates into a 25-cent rise in the average gallon of gasoline, $50 billion in additional annual consumer spending, and a 15-basis-point drag on real GDP.

Asia faces an existential energy reckoning. In 2024, 84% of the crude oil and condensate flowing through the Strait of Hormuz was destined for Asian markets, with China, India, Japan, and South Korea accounting for roughly 69% of all Hormuz crude flows. Japan sources close to three-quarters of its crude oil via the Strait. South Korea sources roughly 60%. India sources approximately half its crude and a significant proportion of its LNG through the same waterway. Thailand, with net oil imports equivalent to 4.7% of GDP, faces perhaps the most acute near-term current account shock among major Asian economies, with every 10% rise in oil prices worsening its current account balance by around 0.5 percentage points of GDP.

Qatar, meanwhile, has halted LNG production at Ras Laffan, one of the world’s largest natural gas production and export terminals, cutting off 20% of global LNG supply and triggering emergency price spikes in European gas markets that had only recently stabilized from the post-Ukraine disruptions.

Hamad Hussain, climate and commodities economist at Capital Economics, has warned that oil prices sustained at $100 per barrel would add 0.6 to 0.7 percentage points to global inflation. Analysts at various institutions estimate a prolonged Hormuz closure could shave approximately 0.8% from global GDP through cascading energy, freight, and trade channel effects — a contraction equivalent to wiping out the annual economic output of a medium-sized European economy.

What Happens Next: Three Scenarios

Scenario One: Military Suppression Reopens the Strait Within Weeks. If U.S. and Israeli strikes succeed in degrading Iran’s anti-ship missile, drone, and mining capabilities, and if diplomatic back-channels produce an informal understanding within three to four weeks, war risk premiums could retreat to 0.3–0.4% — elevated but not prohibitive. The DFC insurance mechanism, however imperfect, may provide enough of a bridge to keep some tankers moving, supplemented by Saudi Arabia diverting crude through its East-West pipeline to Red Sea ports. The pipeline can handle approximately 2.6 million barrels per day — meaningful relief, but far short of the 20 million barrels per day that Hormuz normally carries.

Scenario Two: Protracted Conflict, Partial Rerouting. A war lasting two to three months would force a fundamental restructuring of Asian energy sourcing. China would aggressively compete for Atlantic and West African crude cargoes, tightening supply across the entire Pacific basin and pushing prices sharply higher. Cape of Good Hope rerouting adds roughly 12 to 14 days to a Middle East-to-China voyage, absorbing vessel capacity and compounding freight rates. Insurance markets would gradually reopen at a new, permanently higher risk premium — probably 0.4 to 0.6% — as the reinsurance market prices in a structurally more volatile Gulf environment.

Scenario Three: Full Strategic Closure. If Iran successfully deploys naval mines in the Strait’s shipping lanes — a tactic it rehearsed extensively in its 2026 military exercises — and if mining operations survive U.S. suppression efforts, the disruption could extend for months. In this scenario, oil prices reaching $110 to $130 per barrel becomes the base case, not the tail risk. Ali Vaez, director of the Iran project at the International Crisis Group, has described this as a scenario where prices would “gap violently upward on fear alone,” with financial conditions tightening globally, inflation surging by 2 to 4 percentage points, and fragile economies sliding toward recession “in a matter of weeks.”

Expert Voices: What the Market Is Actually Saying

“The underwriters are waiting to see what happens, and I think most sensible shipowners are waiting to see,” David Smith of McGill & Partners told S&P Global. “No shipowner wants to put either his asset, and more importantly his crew, in danger. They’ll look for every alternative.”

Peter Sand, chief analyst at freight pricing platform Xeneta, described the situation as “the further weaponisation of trade,” adding that the crisis had shattered any remaining hopes of a large-scale return of container shipping to the Red Sea in 2026 — plans that had been cautiously rebuilding after the Houthi ceasefire.

Dylan Mortimer, marine hull UK war leader at Marsh McLennan, wrote in a client advisory that the primary risks centre on vessel boarding and seizure by Iranian forces and the potential closure of the Strait — risks that standard commercial reinsurance models are simply not calibrated to price in a sustained, active-war scenario.

The Deeper Structural Question

The 2026 Hormuz crisis has exposed something more troubling than any single insurance rate: the fragility of a global energy system built on the assumption that the Strait would remain perpetually open. For 40 years, planners, economists, and geopoliticians treated Hormuz closure as a theoretical extreme scenario — a catastrophic tail risk too costly for any rational actor to actually pursue. That assumption has now been shattered.

Trump’s DFC guarantee, however symbolically powerful, cannot substitute for the decades of diplomatic architecture — the JCPOA framework, the UN nuclear monitoring regime, the back-channel communications between Washington and Tehran — that collapsed over the past several years. The hard truth is that political risk insurance from a development finance agency is not a substitute for geopolitical stability. It is, at best, a tourniquet.

What markets and policymakers are finally being forced to confront is a question that energy security analysts have raised for years: how long can the world’s most critical chokepoint be treated as a geopolitical externality, managed through deterrence alone, without investing in the diplomatic, infrastructure, and energy-transition alternatives that would genuinely reduce its leverage? The insurance market already has its answer. It is priced at 1% of hull value, per week, with cover increasingly hard to find.

The tankers remain at anchor. The gasoline pumps are turning.

Sources & Further Reading

- S&P Global Market Intelligence: “Marine War Insurance for Hormuz Dries Up” — Primary source for insurer pullback mechanics and premium rates

- CNBC: “US-Iran War Live Updates” — VLCC freight rate records, oil price data, market reaction to Trump’s announcement

- Al Jazeera: “Maritime Insurers Cancel War Risk Cover in Gulf” — Insurer names, 72-hour cancellation notices, premium data

- Maritime Executive: “Trump: U.S. Will Provide Risk Insurance for All Shipping in the Gulf” — DFC mandate scope, Navy escort limitations, Operation Earnest Will comparison

- USNI News: “Trump: U.S. Navy May Escort Tankers Through Strait of Hormuz” — Navy capacity constraints, fleet disposition

- Axios: “Trump Offers U.S. Insurance, Military Escorts to Energy Tankers” — Gasoline price data, political risk framing

- CNBC: “Strait of Hormuz Closure: Which Countries Will Be Hit the Most” — Country-by-country exposure analysis, Kpler data, Nomura framework

- Seatrade Maritime: “The Strait of Hormuz Crisis and Its Devastating Impact on Asia-Gulf Trade” — Asian import exposure data, LNG halt at Ras Laffan

- ABC News: “Why Unrest in the Strait of Hormuz Is Leading to Rising Oil Prices” — Zandi/Moody’s macro multipliers, GasBuddy gasoline data

- U.S. Energy Information Administration: “Amid Regional Conflict, the Strait of Hormuz Remains Critical Oil Chokepoint” — Authoritative baseline data on Hormuz flows and bypass infrastructure

- Windward Maritime AI: “Strait of Hormuz Shipping Falls After Insurance Pullback” — 80% traffic decline data, P&I club mechanics

- Wikipedia: “2026 Strait of Hormuz Crisis” — Consolidated event timeline and oil price data

- Claims Journal / Bloomberg: “Trump Says U.S. Will Escort, Insure Oil Tankers Amid the Iran War” — Bob McNally quote, DFC implementation uncertainty

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance2 months ago

Markets & Finance2 months agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Analysis4 weeks ago

Analysis4 weeks agoBrazil’s Rare Earth Race: US, EU, and China Compete for Critical Minerals as Tensions Rise

-

Investment2 months ago

Investment2 months agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Banks2 months ago

Banks2 months agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Asia2 months ago

Asia2 months agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Global Economy2 months ago

Global Economy2 months agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy2 months ago

Global Economy2 months agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Global Economy2 months ago

Global Economy2 months ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis