Investment

Consumer Discretionary Stocks Face Q4 Reckoning: Winners, Losers, and Where Smart Money Is Flowing

Consumer discretionary stocks enter Q4 earnings with stark divergence. Our expert analysis reveals top-rated winners, struggling laggards, and actionable investment strategies for this pivotal earnings season.

The consumer discretionary sector stands at a crossroads that most retail investors aren’t seeing clearly.

As Q4 earnings season accelerates, I’m watching a fascinating divergence unfold—one that separates the companies genuinely thriving from those merely surviving on borrowed time and hopeful press releases. After fifteen years analyzing market cycles and political-economic intersections, I can tell you this: the current setup in consumer discretionary stocks represents one of the most asymmetric risk-reward environments I’ve witnessed since the post-pandemic reopening trade.

Here’s what’s keeping me up at night—and what’s got me genuinely excited.

The Consumer Discretionary Select Sector SPDR Fund (XLY) has delivered impressive returns, yet beneath that headline number lies a tale of two markets. A handful of mega-cap names have dragged the index higher while dozens of mid-cap retailers and leisure companies struggle with margin compression, inventory gluts, and a consumer who’s growing increasingly selective about where discretionary dollars flow.

According to FactSet’s latest earnings analysis, Q4 earnings growth expectations for the consumer discretionary sector hover around 13%—notably above the S&P 500’s blended estimate. But averages deceive. The spread between winners and losers in this sector has widened to levels that demand your attention.

Let me walk you through exactly where I see opportunity, where I see danger, and how I’m thinking about positioning for what comes next.

The Macroeconomic Landscape: Reading the Consumer’s Mind

Before diving into individual stocks, we need to understand the economic backdrop shaping consumer behavior. And frankly, the picture is more nuanced than the bulls or bears want to admit.

The U.S. economy has demonstrated remarkable resilience. Bureau of Economic Analysis data shows GDP growth maintaining momentum, defying the recession predictions that dominated headlines throughout 2023 and much of 2024. Consumer spending—which drives roughly 70% of economic output—has remained robust, though the composition of that spending tells a more complex story.

Here’s what I find particularly telling: consumers are spending, but they’re trading down within categories and becoming ruthlessly value-conscious. The Conference Board’s Consumer Confidence Index has stabilized, yet the “present situation” component consistently outperforms the “expectations” component. Translation? People feel okay about today but harbor genuine concerns about tomorrow.

The Federal Reserve’s policy trajectory adds another layer of complexity. After the aggressive rate-hiking cycle, the central bank has pivoted toward a more accommodative stance, with rate cuts providing tailwinds for consumer credit and big-ticket purchases. Federal Reserve economic projections suggest a continued easing bias, which historically benefits consumer discretionary stocks—particularly those in housing-adjacent categories and durable goods.

But here’s where my political economy lens becomes crucial: we’re navigating a post-election environment with significant policy uncertainty. Trade policy, tax policy, and regulatory frameworks remain in flux. Companies with domestic supply chains and pricing power hold structural advantages over those dependent on complex international logistics or razor-thin margins.

Unemployment remains historically low, but the labor market has cooled from its white-hot 2022-2023 levels. Wage growth has moderated, and while that’s disinflationary (positive for Fed policy), it also suggests consumers face constraints that weren’t present eighteen months ago.

The net effect? A bifurcated consumer. High-income households continue spending on experiences, luxury goods, and premium products. Middle and lower-income consumers are stretching budgets, hunting for deals, and deferring discretionary purchases when possible. The companies positioned to serve both segments—or dominating one definitively—will outperform. Those stuck in the middle face brutal margin pressure.

Top-Rated Consumer Discretionary Stocks: Where Strength Meets Opportunity

After analyzing earnings estimates, analyst revisions, fundamental metrics, and qualitative competitive positioning, these consumer discretionary stocks stand out as Q4 winners with continued upside potential.

Amazon (AMZN): The Undisputed Category Killer

I’ll start with the obvious one because ignoring Amazon in any consumer discretionary analysis would be analytical malpractice.

Amazon’s Q4 setup looks exceptionally strong. Bloomberg Intelligence estimates project AWS revenue growth reaccelerating, while the core e-commerce business benefits from holiday seasonality and improved fulfillment efficiency. The advertising segment—often overlooked—has become a high-margin cash machine that subsidizes competitive pricing in retail.

What excites me most isn’t the headline numbers but the margin trajectory. Amazon’s North American retail segment has swung to consistent profitability after years of investment-phase losses. Operating leverage is finally materializing, and Q4’s volume surge should amplify this dynamic.

Current analyst consensus shows overwhelming buy ratings, with price targets suggesting 15-25% upside. At roughly 35x forward earnings, Amazon isn’t cheap by traditional metrics—but traditional metrics miss the AWS optionality and advertising growth runway.

My Take: Amazon remains a core holding for any growth-oriented investor. Q4 earnings should catalyze the next leg higher. I’m particularly watching management commentary on AI infrastructure spending and international profitability improvements.

Costco Wholesale (COST): The Recession-Proof Compounder

Costco defies easy categorization. Yes, it’s a consumer staples business at its core. But the discretionary upside from membership fees, ancillary services, and big-ticket items like electronics and furniture warrants inclusion here.

The membership model creates one of the most durable competitive moats in retail. Morningstar analysis highlights Costco’s 93% membership renewal rate—a staggering figure that speaks to genuine customer loyalty rather than mere convenience.

Q4 typically delivers Costco’s strongest comparable sales growth, driven by holiday entertaining, gift purchases, and seasonal merchandise. The company’s treasure-hunt shopping experience generates the kind of excitement that drives traffic even when consumers claim they’re cutting back.

Valuation gives me pause—Costco trades at a premium that prices in considerable future growth. But premium businesses deserve premium valuations, and Costco’s execution consistency justifies investor confidence.

My Take: Costco belongs in portfolios as a quality compounder. Don’t expect explosive upside, but do expect steady outperformance and downside protection during market turbulence.

Royal Caribbean Group (RCL): The Experience Economy Winner

Here’s where I break from consensus caution.

Cruise lines remain under-owned by institutional investors scarred by pandemic-era balance sheet destruction. But Royal Caribbean’s transformation has been remarkable. CNBC reported record booking levels and yield growth that’s exceeding pre-pandemic peaks on a real basis.

The demand story is simple: consumers—especially affluent Boomers—are prioritizing experiences over things. Cruising offers exceptional value compared to land-based vacations, with all-inclusive pricing that resonates in an inflationary environment. Royal Caribbean’s private island investments and fleet modernization have elevated the product while competitors struggle with older ships and weaker balance sheets.

Q4 earnings should reflect strong Wave Season booking momentum (the January-March period when cruise lines book 60%+ of annual capacity). Management’s pricing power commentary will be closely watched.

My Take: Royal Caribbean offers compelling risk-reward at current levels. The stock has run significantly, but earnings power continues expanding. I’m overweight cruise lines generally and RCL specifically.

Chipotle Mexican Grill (CMG): Fast-Casual Excellence

Chipotle has become the template for fast-casual success, and Q4 should demonstrate why.

Traffic growth—not just price increases—drives Chipotle’s comparable restaurant sales. That’s rare in the current environment and speaks to genuine brand strength. Wall Street Journal coverage noted Chipotle’s successful navigation of ingredient cost inflation while maintaining quality—a balancing act most competitors failed.

The Chipotlane drive-through format expansion addresses the convenience gap that historically limited occasion growth. Digital sales penetration remains elevated post-pandemic, improving order accuracy and labor efficiency.

New unit growth provides the compounding engine: each new restaurant generates returns on invested capital that justify aggressive expansion. Management’s guidance suggests sustained 8-10% annual unit growth, with newer formats delivering improved economics.

My Take: Chipotle deserves its premium multiple. Q4 should reinforce the thesis. My only concern is valuation—at 45x+ forward earnings, execution must remain flawless. Any comparable sales miss would punish the stock severely.

Home Depot (HD): Housing Recovery Beneficiary

Home Depot’s Q4 setup reflects a sector rotation opportunity.

The housing market is stirring. Mortgage rates have declined from cycle highs, and Reuters reported improving homebuilder sentiment and existing home sales stabilization. Every housing transaction generates thousands of dollars in home improvement spending—and Home Depot captures disproportionate share.

The professional contractor segment provides stability through housing cycles, while the DIY consumer responds to interest rate relief and accumulated home equity wealth. Home Depot’s supply chain investments during the pandemic created competitive advantages that persist.

Analyst estimates have begun revising higher after extended negativity. The stock has outperformed in anticipation, but earnings confirmation could drive continued rerating.

My Take: Home Depot represents a quality cyclical at reasonable valuations. I prefer it over Lowe’s given superior execution and professional segment strength. Accumulate on pullbacks.

Lowest-Rated Consumer Discretionary Stocks: Where Caution Is Warranted

Not every consumer discretionary stock deserves your capital. These companies face structural challenges that Q4 earnings are unlikely to resolve.

Nike (NKE): The Fallen Giant

It pains me to write this. Nike is an iconic American brand—and a stock I owned for years. But the company’s competitive position has deteriorated in ways that demand acknowledgment.

Yahoo Finance analyst coverage highlights Nike’s market share losses to upstarts like On Running, Hoka, and resurgent competitors like New Balance and Adidas. The direct-to-consumer pivot, initially celebrated, has alienated wholesale partners without delivering promised margin benefits.

China exposure compounds problems. The Chinese consumer discretionary market has struggled with property sector contagion and youth unemployment, pressuring a region that historically delivered outsized growth.

Innovation has stalled. When was Nike’s last genuinely exciting product launch? The running community has largely abandoned the brand, and basketball—Nike’s heritage sport—increasingly features athletes in competitor footwear.

Q4 earnings may stabilize sentiment temporarily, but the fundamental challenges require years of reinvestment and cultural change to address.

My Take: Nike is a value trap until proven otherwise. The dividend provides modest support, but capital appreciation potential appears limited. I’m avoiding the stock despite apparent valuation support.

Dollar General (DG): Structural Deterioration

Dollar General’s challenges transcend cyclical weakness.

The thesis was simple: inflation-pressured consumers would trade down to dollar stores. Reality proved more complicated. Seeking Alpha analysis documented comparable sales weakness, inventory management failures, and execution stumbles that forced management turnover.

Shrinkage (theft) has become an existential issue for discount retailers operating in urban and semi-urban locations. Dollar General’s store count growth—previously a competitive advantage—now looks like overexpansion into marginal locations.

Competition from Walmart’s aggressive everyday low pricing and Amazon’s expanding household essentials presence squeezes Dollar General from above and below simultaneously.

My Take: Dollar General requires a proven turnaround before warranting investment. The stock appears cheap, but cheap can become cheaper when fundamental trends deteriorate. There are better places to hunt for value.

Tesla (TSLA): Volatility Without Commensurate Reward

I’ll catch criticism for this one. Tesla inspires passionate devotion among shareholders who view any skepticism as blasphemy.

But let’s examine the consumer discretionary fundamentals objectively.

Tesla’s automotive gross margins have compressed significantly as price cuts defend market share against Chinese EV manufacturers and legacy automakers’ accelerating electrification efforts. MarketWatch noted the company’s sequential delivery growth has decelerated, raising questions about demand elasticity.

Elon Musk’s distraction with other ventures creates governance concerns that institutional investors increasingly acknowledge. The robotaxi narrative, while potentially transformative, remains speculative with uncertain timelines.

Valuation assumes perfection. Any execution stumble—demand weakness, production issues, competitive pressure—punishes the stock disproportionately given elevated expectations embedded in the current price.

My Take: Tesla is a trading vehicle, not an investment for most portfolios. The risk-reward at current valuations skews negatively for Q4 and beyond. I’m neutral-to-bearish and would consider short exposure on rallies.

Starbucks (SBUX): Identity Crisis Brewing

Starbucks faces a problem money can’t easily solve: brand perception decay.

The new CEO inherits a company that has lost its way. Is Starbucks a premium experience or a convenient caffeine dispensary? The mobile order surge transformed stores into chaotic pickup locations that alienate the customers willing to pay premium prices for ambiance.

China, which was supposed to become Starbucks’ largest market, has disappointed consistently. Local competitors offer comparable quality at lower prices, and nationalism has created headwinds for American brands broadly.

Labor relations have become contentious, with unionization efforts creating operational uncertainty and potential cost pressures. Financial Times coverage documented the extent of worker grievances and their potential impact on store-level execution.

My Take: Starbucks requires patience I’m not prepared to exercise. The turnaround thesis depends on execution from a management team still defining its strategy. Better opportunities exist elsewhere.

Peloton (PTON): The Cautionary Tale Continues

Peloton serves as a reminder that pandemic beneficiaries weren’t necessarily good businesses—just temporary demand surges mistaken for sustainable competitive advantages.

The connected fitness company continues bleeding cash, losing subscribers, and searching for a viable path forward. Various strategic alternatives have been explored and abandoned. The hardware business faces commoditization while the subscription content competes with free YouTube workouts and lower-cost alternatives.

Recent quarters have shown stabilization, but stabilization at depressed levels isn’t victory. Investopedia analysis questioned whether Peloton can generate sustainable profitability even under optimistic scenarios.

My Take: Peloton is uninvestable for anyone focused on fundamental value. Speculative short-covering rallies create short opportunities rather than buying opportunities. Avoid.

Sector Comparison Table

| Stock | Ticker | Rating | P/E (Fwd) | Q4 EPS Est. | Analyst Target | Risk Level |

|---|---|---|---|---|---|---|

| Amazon | AMZN | Strong Buy | 35x | $1.82 | $230 | Moderate |

| Costco | COST | Buy | 52x | $3.79 | $1,050 | Low |

| Royal Caribbean | RCL | Buy | 14x | $1.45 | $250 | Moderate-High |

| Chipotle | CMG | Buy | 47x | $0.28* | $70 | Moderate |

| Home Depot | HD | Buy | 24x | $3.02 | $425 | Low-Moderate |

| Nike | NKE | Hold | 27x | $0.85 | $82 | Moderate |

| Dollar General | DG | Hold | 14x | $1.58 | $95 | High |

| Tesla | TSLA | Hold | 85x | $0.75 | $285 | Very High |

| Starbucks | SBUX | Hold | 25x | $0.80 | $105 | Moderate-High |

| Peloton | PTON | Sell | N/A | -$0.28 | $5 | Very High |

*Post-split adjusted

Investment Strategy and Outlook: Positioning for What Comes Next

Let me synthesize these individual assessments into an actionable framework.

The consumer discretionary sector offers genuine opportunity—but selection matters enormously. The days of rising-tide-lifts-all-boats sector allocation ended when easy monetary policy gave way to higher rates and discriminating consumers.

Quality Over Value: This isn’t the environment to bottom-fish in struggling retailers hoping for mean reversion. Companies with pricing power, strong balance sheets, and differentiated offerings will capture share from weakened competitors. Pay up for quality and sleep better.

Barbell Your Exposure: I’m simultaneously overweight premium experiences (cruises, travel) and defensive growth (Costco, Amazon). The middle—moderately priced discretionary goods without brand differentiation—faces the most competitive pressure.

Watch the Consumer Credit Data: Consumer credit card delinquencies have ticked higher, though from low bases. If this trend accelerates, discretionary spending will compress faster than optimistic Q4 estimates assume. Federal Reserve consumer credit data deserves monthly monitoring.

Respect Earnings Season Volatility: Individual stock moves of 10-15% post-earnings are common in this environment. Size positions appropriately, and consider using options strategies to define risk around binary events.

Think Beyond Q4: The most compelling opportunities emerge when short-term challenges create long-term entry points. I’m building watchlists of quality companies that might stumble—not because their businesses are impaired, but because expectations grew excessive.

My twelve-month outlook for consumer discretionary remains constructive but selective. The sector offers alpha generation potential for active investors willing to do the work distinguishing winners from losers. Passive XLY exposure captures the sector beta but misses the dispersion opportunity.

Conclusion: The Earnings Season That Separates Pretenders From Contenders

Q4 earnings season will reveal truths that year-to-date performance has obscured.

Some consumer discretionary stocks trading at premium valuations will justify those multiples with blowout results and confident guidance. Others will stumble, exposing the fragility beneath headline numbers. The gap between expectations and reality drives stock prices—and that gap appears wider in consumer discretionary than any other sector I’m tracking.

I’ve shared my highest-conviction ideas: Amazon and Costco for foundational quality, Royal Caribbean and Home Depot for cyclical exposure, Chipotle for growth. I’ve flagged my concerns: Nike’s competitive erosion, Tesla’s valuation risk, Dollar General’s execution failures, Starbucks’ identity crisis, Peloton’s existential uncertainty.

Your job now is to stress-test these conclusions against your own research, risk tolerance, and portfolio construction needs. No analyst gets every call right—humility about uncertainty is essential to long-term investing success.

What I know with confidence: the consumer discretionary stocks that emerge from Q4 earnings season as winners will compound that advantage through 2025 and beyond. Those that disappoint will face extended periods of multiple compression and investor skepticism.

Choose wisely. The market is offering a clarifying moment—don’t waste it chasing yesterday’s winners or averaging down into deteriorating businesses.

The consumer is speaking through their spending choices. Are you listening?

Frequently Asked Questions (FAQ)

What are consumer discretionary stocks?

Consumer discretionary stocks represent companies selling non-essential goods and services that consumers purchase when they have disposable income. This sector includes retailers, restaurants, hotels, automakers, entertainment companies, and luxury goods manufacturers. Performance typically correlates with economic cycles and consumer confidence levels.

Which consumer discretionary stocks are best for Q4 earnings?

Based on current analyst ratings, earnings revisions, and fundamental strength, Amazon (AMZN), Costco (COST), Royal Caribbean (RCL), Chipotle (CMG), and Home Depot (HD) appear best-positioned for Q4 earnings outperformance. Each demonstrates pricing power, strong execution, and favorable demand trends heading into the holiday quarter.

Why do consumer discretionary stocks perform differently in Q4?

Q4 represents peak seasonality for consumer discretionary stocks due to holiday shopping, travel, and entertainment spending. Companies generate disproportionate revenue and earnings during this quarter, making year-over-year comparisons particularly meaningful. Weather, consumer confidence, and promotional intensity all influence Q4 performance variance.

What economic factors affect consumer discretionary stocks?

Consumer discretionary stocks respond to employment levels, wage growth, consumer confidence, interest rates, inflation, housing market conditions, and overall GDP growth. Federal Reserve policy significantly impacts financing costs for big-ticket purchases. Political and trade policy uncertainty can also influence consumer and business spending decisions.

Should I buy consumer discretionary stocks before earnings?

Buying before earnings introduces binary event risk—stocks can move sharply in either direction regardless of fundamental quality. Consider building positions gradually, using limit orders on pullbacks, or employing options strategies to define risk. Long-term investors focused on quality companies can use earnings volatility as entry opportunities rather than timing events.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

How Singapore’s Global Investor Programme Attracted 450 High-Net-Worth Investors and S$930 Million from 2015–2025

Imagine you are a founder who has spent two decades building a logistics technology company across Southeast Asia. Your business is profitable, your networks span a dozen countries, and you are quietly contemplating where to plant your family’s permanent roots. Hong Kong’s political climate gives you pause. Dubai is compelling but feels transactional. Then Singapore enters the conversation — not as a tax haven or a geographical convenience, but as a node where capital, talent, and institutional stability converge with remarkable precision. Within eighteen months, you have secured permanent residency through the Global Investor Programme, your holding company is registered in one-north, and you are attending Economic Development Board (EDB) roundtables alongside engineers, venture capitalists, and government ministers who actually return emails.

This is not a hypothetical unique to one entrepreneur. It is a pattern that has played out, in varying forms, roughly 450 times over the past decade.

The Numbers Behind Singapore’s Quiet Wealth Migration

As disclosed in Parliament on February 27, 2026, Minister of State for Trade and Industry Gan Siow Huang confirmed that approximately 450 high-net-worth investors were granted permanent residency under Singapore’s Global Investor Programme (GIP) between 2015 and 2025. Their combined capital deployment reached S$930 million — S$500 million invested directly into Singapore-based businesses, and another S$430 million channelled through GIP-select funds targeting local companies.

The disclosure came in response to a parliamentary question from Workers’ Party MP Fadli Fawzi, and while the numbers may appear modest against Singapore’s trillion-dollar financial ecosystem, their sectoral concentration tells a more consequential story. More than half of the direct investments flowed into professional services, info-communications, and financial services — precisely the knowledge-intensive sectors Singapore has prioritised in its successive economic restructuring blueprints.

The Straits Times noted the EDB’s broader framing: GIP investors contribute not merely capital, but market networks and operational know-how — the connective tissue that formal investment metrics rarely capture.

The Economic Ripple Effects of GIP Investments

The headline figure that warrants the most scrutiny is jobs. According to Minister Gan, GIP investors created over 30,000 positions in Singapore between 2010 and 2025, concentrated in engineering, research, and consulting roles within the same high-value sub-sectors that absorbed most direct investment.

Thirty thousand jobs across fifteen years averages to 2,000 annually — a figure that sounds incremental until one considers the quality dimension. These are not warehouse or hospitality roles. They are the kind of positions that anchor Singapore’s ambition to remain a centre of gravity for Asia-Pacific’s knowledge economy. For a city-state of 5.9 million, the multiplier effects of high-density, skills-intensive employment are disproportionate.

Business Times contextualised this within Singapore’s broader effort to attract substantive business activity rather than passive wealth parking — a distinction that has sharpened considerably in the programme’s post-2023 iteration.

Breaking Down the GIP Qualification Paths

The GIP is not a single instrument. It offers three distinct pathways, each calibrated to attract a different profile of investor:

- Direct Business Investment: Invest at least S$10 million into a new or existing Singapore-incorporated company.

- GIP-Select Fund: Place at least S$25 million in an approved fund that invests in Singapore-based businesses.

- Single Family Office: Establish a family office with a minimum of S$200 million in assets under management, with at least S$50 million deployed in EDB-specified investment categories.

The family office route deserves particular attention. Singapore now hosts over 1,100 single family offices — a number that has grown dramatically since 2020 — and the GIP’s S$200 million AUM threshold positions the programme squarely at the intersection of wealth management and productive investment. The S$50 million deployment requirement is the mechanism by which Singapore ensures these structures generate genuine economic activity rather than functioning as sophisticated tax minimisation vehicles.

Forbes Business Council has described Singapore’s framework as among the most rigorously structured investor residency pathways in Asia, noting that the combination of institutional transparency, rule of law, and targeted sector focus differentiates it meaningfully from competing regional programmes.

Singapore vs. the Global Field: How Does GIP Compare?

Investor residency programmes have proliferated globally, yet few have managed the balance between capital attraction and economic substance with Singapore’s consistency.

The United States EB-5 programme — the best-known benchmark — has been plagued by backlogs, fraud controversies, and legislative reforms that stretch processing times to a decade or more for certain nationalities. The minimum investment threshold sits at US$1.05 million for targeted employment areas, lower than Singapore’s equivalent entry points, but the programme’s structural dysfunctions have eroded its comparative advantage for Asian applicants.

Portugal’s Golden Visa, once a European favourite, effectively closed its real estate route in 2023 under pressure from housing affordability concerns. The UK’s Tier 1 Investor Visa was scrapped entirely in 2022 amid national security reviews. Hong Kong’s Capital Investment Entrant Scheme was relaunched in 2024 with a HK$30 million threshold, but the city’s shifting institutional landscape continues to weigh on its appeal to investors seeking long-term stability.

Singapore, by contrast, has raised its thresholds rather than retreating. The 2023 GIP revisions significantly increased investment minimums and tightened eligibility criteria — a counterintuitive move that has, if anything, reinforced the programme’s premium positioning. As one regional economist observed privately: “Singapore is not competing for volume. It is competing for the top decile of the top decile.”

IMI Daily noted that while 450 approvals over a decade appears selective compared to programmes in the Middle East or Caribbean that process thousands annually, Singapore’s preference for depth over breadth reflects a deliberate policy philosophy — one that prioritises integration into the productive economy over residency-as-a-service.

The Challenges: Selectivity, Scrutiny, and the S$3 Billion Shadow

Singapore’s GIP operates in the long shadow of the 2023 money laundering scandal, in which S$3 billion in assets were seized from a network of foreign nationals — some of whom had obtained residency through investment pathways. The episode prompted a sweeping review of anti-money laundering frameworks across the financial sector and accelerated due diligence requirements for investor residency applications.

The EDB has been emphatic that GIP applicants undergo rigorous background checks and that the programme’s business track record requirement — investors must demonstrate an established entrepreneurial history, not merely liquid wealth — provides a structural filter absent in many competing schemes. Nevertheless, the reputational dimension lingers, and Singapore’s authorities have had to balance openness to global capital with heightened vigilance about its provenance.

The revised 2023 criteria, which raised thresholds and introduced stricter sector requirements, can be read partly as a response to these concerns. Fewer approvals, higher quality, greater scrutiny: the architecture of a programme recalibrating its risk-reward calculus in real time.

Looking Forward: GIP’s Role in Singapore’s 2026 Economic Landscape

The geopolitical environment of 2026 is, in many respects, the ideal backdrop for Singapore’s value proposition. US-China technological decoupling has intensified corporate restructuring across Asia, with multinationals seeking neutral jurisdictions for regional headquarters, intellectual property holding structures, and treasury functions. The ASEAN economic corridor is attracting renewed attention from European and American firms diversifying supply chains. Singapore sits at the intersection of all these flows.

Channel NewsAsia’s coverage of Minister Gan’s parliamentary statement emphasised the forward-looking framing: GIP is not simply a residency programme but a mechanism for curating a cohort of investors whose businesses and networks actively deepen Singapore’s economic connective tissue.

The data supports cautious optimism. S$930 million in a decade is not a transformative sum for an economy of Singapore’s scale, but its concentration in strategic sectors — and the 30,000 jobs that accompanied it — suggests that the programme’s design is functioning broadly as intended. The question for the next decade is whether Singapore can sustain this selectivity while remaining genuinely competitive as rivals sharpen their own offerings and as ultra-high-net-worth individuals become increasingly sophisticated in comparing jurisdictions.

A Hub Built on More Than Tax Efficiency

What Singapore has constructed through the GIP is not merely an investor residency programme. It is a carefully engineered signal to the global wealth community: that permanent residency here is earned through substantive economic contribution, confers genuine institutional stability, and places the recipient inside one of the world’s most effective small-state economic ecosystems.

For the logistics entrepreneur who arrived eighteen months ago, the value is not the red passport booklet. It is the EDB roundtable, the talent pipeline from NUS and NTU, the contract enforceability, and the quiet confidence that the rules will not change arbitrarily by Tuesday morning.

That proposition — boring in the best possible way — may prove to be Singapore’s most durable competitive advantage in a world where predictability has become the scarcest luxury of all.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

AI

OpenAI’s $110 Billion Funding Mega-Deal: Reshaping the AI Landscape in 2026

How a single financing round is redrawing the map of global technology, capital markets, and the race to artificial general intelligence

What does it take to change the world? If you ask the investors who just signed off on the largest private technology funding round in history, the answer is apparently $110 billion—and a shared conviction that artificial intelligence is no longer a moonshot, but a civilizational infrastructure project.

On February 27, 2026, OpenAI announced it had secured up to $110 billion in new funding at a pre-money valuation of $730 billion, pushing its post-money valuation to approximately $840 billion. To put that in perspective: OpenAI is now worth more than ExxonMobil, Goldman Sachs, and Netflix combined. The generative AI funding boom that began with ChatGPT’s 2022 debut has arrived at a destination that, even a year ago, would have seemed fantastical.

As someone who has tracked AI development since the earliest public-facing days of ChatGPT—back when the question was whether anyone would actually use a chatbot for serious work—this moment feels less like a milestone and more like a rupture. The industry isn’t iterating. It’s transforming.

The Record-Breaking Funding Details

The $110 billion OpenAI funding round 2026 surpasses every prior benchmark in private technology finance. To understand its scale, consider that SoftBank’s storied Vision Fund—once the defining symbol of venture excess—raised $100 billion across its entire flagship vehicle. OpenAI has now exceeded that in a single raise.

Key facts at a glance:

- Total raise: Up to $110 billion

- Pre-money valuation: $730 billion

- Post-money valuation (OpenAI valuation $840B): ~$840 billion

- Weekly active users (ChatGPT): 900 million

- Consumer subscribers: 50 million

- Business users: 9 million

- Lead investors: Amazon ($50B), Nvidia ($30B), SoftBank ($30B)

As reported by The New York Times, the deal reflects not only investor confidence in OpenAI’s commercial trajectory but also a structural shift in how Big Tech perceives AI—not as a product feature, but as a foundational layer of the economy, akin to electricity or the internet.

The round was not simply a financial event. It was a statement of intent by three of the most powerful technology entities on the planet, each betting that the company behind ChatGPT will define how humanity interacts with machine intelligence for the next decade.

Strategic Partnerships Driving the Deal

Amazon’s $50 Billion Commitment and the AWS Expansion

The most consequential element of the OpenAI Amazon partnership is not the headline investment figure—it is what lies beneath it. Amazon’s $50 billion stake comes bundled with an expanded cloud infrastructure agreement worth $100 billion over eight years, cementing Amazon Web Services as a primary compute backbone for OpenAI’s operations.

This is AI infrastructure investment at a scale that strains comprehension. AWS will provide the raw computational horsepower needed to train and serve increasingly powerful models. For Amazon, the strategic logic is equally compelling: OpenAI’s 900 million weekly active users represent one of the largest and fastest-growing software audiences on Earth—an audience that will consume cloud compute voraciously.

Bloomberg characterized the AWS expansion as one of the most significant enterprise cloud contracts in history, noting it effectively locks OpenAI into Amazon’s ecosystem while giving AWS a marquee AI client to anchor its competitive positioning against Microsoft Azure and Google Cloud.

Nvidia’s $30 Billion and the Compute Architecture

The OpenAI Nvidia collaboration is equally telling. Nvidia’s $30 billion participation comes with commitments around inference and training capacity—specifically, 3 gigawatts of inference capacity and 2 gigawatts of training capacity. These are not software metrics. They are measurements of physical infrastructure: chips, power, cooling, facilities.

Nvidia’s investment is also strategically self-reinforcing. Every dollar OpenAI spends scaling its models translates, in substantial measure, into demand for Nvidia’s GPU architecture. As Reuters observed, Nvidia’s participation in OpenAI’s round blurs the line between supplier and investor in ways that will draw regulatory scrutiny—but also illustrates how deeply intertwined the AI supply chain has become.

SoftBank’s $30 Billion Return to Form

SoftBank’s $30 billion commitment marks Masayoshi Son’s most ambitious AI infrastructure investment since the Vision Fund era. Having weathered high-profile write-downs from WeWork and other overextended bets, SoftBank is positioning OpenAI as its generational redemption trade. Son has spoken publicly about artificial superintelligence as an inevitability; this investment is his wager that OpenAI will be the vehicle through which it arrives.

Implications for the AI Industry

The Competitive Landscape Intensifies

The AI record funding deal does not exist in a vacuum. OpenAI’s primary rivals—Anthropic, Google DeepMind, xAI, and Meta AI—must now reckon with a competitor that has secured resources at a scale that could prove structurally decisive.

| Company | Latest Valuation | Latest Funding | Key Backer |

|---|---|---|---|

| OpenAI | ~$840B | $110B (2026) | Amazon, Nvidia, SoftBank |

| Anthropic | ~$60B | $7.3B (2024) | Google, Amazon |

| xAI | ~$50B | $6B (2024) | Private investors |

| Google DeepMind | Alphabet-owned | N/A (internal) | Alphabet |

| Meta AI | Alphabet-scale | Internal R&D | Meta Platforms |

The funding gap between OpenAI and its nearest independent rival has now widened to an almost unbridgeable degree in the short term. CNBC noted that Anthropic—backed by both Amazon and Google—has so far raised roughly $7 to $8 billion in total, a figure that now represents less than 7% of OpenAI’s latest raise alone.

What does this mean practically? Compute is the limiting reagent of AI progress. More capital means more chips, more data centers, more researchers, more experiments run in parallel. The ChatGPT investment boom is, at its core, a bet that scale still matters—that the company with the most compute will build the most capable models.

AGI Development Moves from Vision to Infrastructure

OpenAI’s stated mission—developing artificial general intelligence that benefits all of humanity—has always been philosophically ambitious and practically vague. This funding round begins to give that mission material substance. AGI development requires not just algorithmic breakthroughs but the kind of sustained capital investment normally associated with semiconductor fabrication plants or space programs.

The 3GW of inference capacity tied to the Nvidia partnership is particularly significant. Inference—the process of running trained AI models to generate outputs—is where the economics of AI actually live. Every ChatGPT query, every API call, every enterprise automation workflow runs on inference infrastructure. Scaling this capacity by multiple orders of magnitude is a prerequisite for serving the next billion users.

Challenges and Future Outlook

The IPO Question

Wall Street is watching. OpenAI’s $840 billion post-money valuation places it in rarefied company: above Saudi Aramco’s recent market cap fluctuations, within striking distance of Meta, and not entirely implausible as a $1 trillion public company. The question of an OpenAI IPO has moved from speculative chatter to active boardroom consideration.

The structural complexity of OpenAI—a “capped-profit” company transitioning toward a more conventional corporate structure—has been a persistent obstacle to public market ambitions. But at $840 billion, the pressure from early investors to establish a liquid exit pathway will only intensify. The Wall Street Journal has reported ongoing discussions about corporate restructuring as a precondition for any eventual public offering.

An OpenAI IPO would be the defining technology market event of the decade. For context, it would likely exceed Alibaba’s 2014 record-setting $25 billion IPO by a factor that makes historical comparisons almost meaningless.

The Ethics and Concentration Risk

No analysis of this funding round is complete without confronting the uncomfortable questions it raises. When three companies—Amazon, Nvidia, and SoftBank—collectively deploy $110 billion into a single AI organization, the concentration of influence over transformative technology becomes a legitimate policy concern.

The impact of OpenAI’s $110 billion funding on the AI industry is not purely economic. It shapes research priorities, talent allocation, and the standards by which AI systems are built and deployed. If OpenAI’s models become the de facto infrastructure of global information processing, questions about governance, accountability, and bias become urgent public interest issues—not just academic ones.

There is also the question of over-reliance on Big Tech. Amazon’s expanded AWS agreement effectively ties critical AI infrastructure to a single cloud provider. Nvidia’s dual role as chip supplier and equity investor creates incentive misalignments that regulators in Brussels, Washington, and Beijing will scrutinize carefully. The Guardian has raised pointed questions about whether such concentrated AI investment is compatible with meaningful market competition.

Sector Applications: Healthcare, Education, and Beyond

The optimistic case for this funding—and it is genuinely compelling—centers on what OpenAI’s future of AI after its mega funding could deliver in applied domains. Healthcare is the most obvious candidate: AI systems capable of accelerating drug discovery, interpreting medical imaging, and personalizing treatment protocols at scale. Education represents another frontier, where AI tutoring systems could democratize access to high-quality learning in ways that physical institutions cannot match.

OpenAI has already signaled intent in both sectors. With 9 million business users and growing API adoption, the commercial pipeline for enterprise AI applications is substantial. The question is not whether these applications will emerge—it is whether the benefits will be broadly distributed or concentrated among organizations with the capital to access premium AI services.

Global Economic Impact

The ripple effects of the OpenAI valuation milestone extend well beyond Silicon Valley. In a meaningful sense, the $840 billion figure recalibrates what private technology companies can be worth—and what institutional investors are willing to pay for that potential.

This dynamic has already influenced valuations across the private technology ecosystem. Companies like SpaceX and ByteDance, which have traded at multiples that once seemed exceptional, now exist in a valuation landscape where OpenAI has established a new ceiling. Sovereign wealth funds, pension managers, and family offices that missed OpenAI’s earlier rounds are recalibrating their AI allocation strategies accordingly.

For emerging economies, the implications are double-edged. On one hand, AI tools developed with this capital will eventually diffuse globally, potentially accelerating productivity in markets that lack existing technological infrastructure. On the other, the concentration of AI capability in a handful of American technology companies raises genuine questions about digital sovereignty—questions that governments in India, Brazil, the EU, and Southeast Asia are actively grappling with.

The macroeconomic dimension is equally significant. Goldman Sachs has estimated that generative AI could add $7 trillion to global GDP over a decade. OpenAI’s funding round is, in one reading, the single largest private sector bet on that projection ever made.

Conclusion: The Age of AI Infrastructure Has Arrived

History rarely announces itself cleanly. But on February 27, 2026, something genuinely historic happened: the largest private technology funding round ever assembled coalesced around a single company and a single bet—that artificial intelligence will be the defining infrastructure of the 21st century.

OpenAI’s $110 billion raise, its $840 billion valuation, and the strategic commitments of Amazon, Nvidia, and SoftBank are not simply financial events. They are a declaration that the AI infrastructure investment supercycle is no longer a future phenomenon. It is here, now, being built at gigawatt scale and billion-user reach.

The questions that remain—about competition, ethics, governance, and equitable access—are the most important questions in technology policy today. They deserve the same seriousness of analysis that the funding itself commands.

What is certain is this: the AI industry after this deal is structurally different from the one that preceded it. For researchers, policymakers, investors, and anyone who uses a smartphone or searches the internet, that difference will become impossible to ignore.

The future of AI is no longer a question of whether. It is a question of who governs it, who benefits from it, and whether humanity proves equal to the opportunity it has created.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

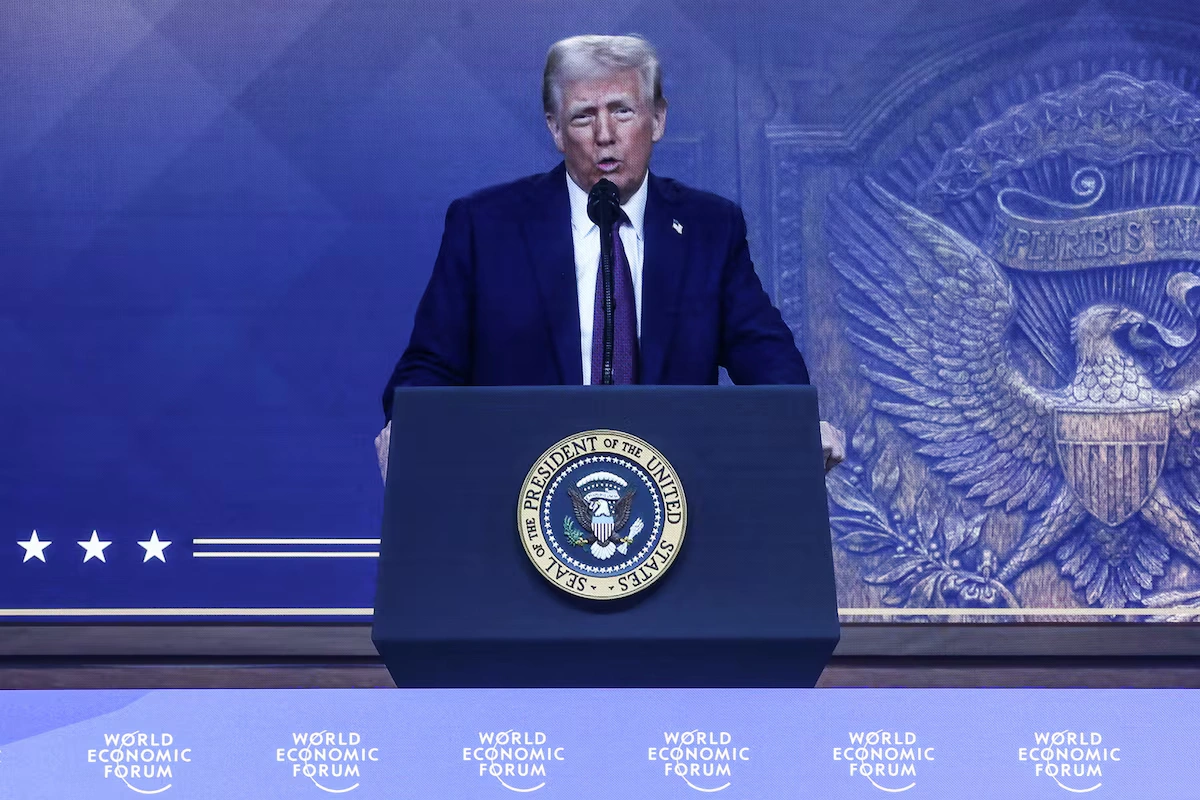

Trump’s 2026 State of the Union: Navigating Low Polls, Shutdowns, and Divisions in a Fractured America

Explore President Trump’s upcoming 2026 SOTU address amid record-low approval and political turmoil—insights on the US economy, immigration, and foreign policy shifts.

A year after reclaiming the White House in a historic political comeback, President Donald Trump will step up to the House rostrum on Tuesday at 9 p.m. ET to deliver his State of the Union address. The political climate he faces, however, is one of unusual fragility. Midway between his inauguration and the critical November midterm elections, this 2026 SOTU preview reveals a commander-in-chief confronting a partial government shutdown, rare judicial rebukes, and deep fractures within his own coalition.

When Trump last addressed Congress in March 2025, his approval rating hovered near a career high, buoyed by the momentum of his return to power. Today, he faces an electorate thoroughly fatigued by persistent inflation and systemic gridlock. Tuesday’s address is intended to showcase a leader who has unapologetically reshaped the federal government. Yet, as the Trump State of the Union amid low polls approaches, the spectacle will inevitably be weighed against the stark economic and political realities defining his second act.

Sagging Polls and Economic Realities

Historically, Trump has leveraged economic metrics as his strongest political shield. But the US economy under Trump 2026 presents a complicated picture for international economist researchers and everyday voters alike. According to recent data from the Bureau of Economic Analysis, while the stock market has seen notable rallies, 2025 marked the slowest year for job and economic growth since the pandemic-induced recession of 2020.

A recent Gallup tracking poll places his overall approval rating near record lows. Furthermore, roughly two-thirds of Americans currently describe the nation’s economy as “poor”—a sentiment that mirrors the frustrations felt during the latter half of the Biden administration. Grocery, housing, and utility costs remain stubbornly high. Analysts at The Economist note that the US labor market has settled into a stagnant “low-hire, low-fire” equilibrium, heavily exacerbated by sweeping trade restrictions.

| Economic & Polling Indicator | March 2025 (Inauguration Era) | February 2026 (Current) |

| Overall Approval Rating | 48% | 39% |

| Immigration Handling Approval | 51% | 38% |

| GDP Growth (Quarterly) | 4.4% (Q3 ’25) | 1.4% (Q4 ’25 Advance) |

| Economic Sentiment (“Poor”) | 45% | 66% |

Trump has vehemently defended his record, insisting last week that he has “won” on affordability. In his address, he is widely expected to blame his predecessor, Joe Biden, for lingering systemic economic pain while claiming unilateral credit for recent Wall Street highs.

Immigration Backlash and Shutdown Stalemate

Adding to the drama of the evening, Tuesday will mark the first time in modern US history that a president delivers the annual joint address amid a funding lapse. The partial government shutdown, now in its second week, centers entirely on the Department of Homeland Security.

Funding for DHS remains frozen as Democratic lawmakers demand stringent guardrails on the administration’s sweeping immigration crackdown. The standoff reached a boiling point following the deaths of two American citizens by federal agents during border protests in January. This tragic incident sparked nationwide outrage and eroded what was once a core political advantage for the President. An AP-NORC poll recently revealed that approval of Trump’s handling of immigration has plummeted to just 38%. The political capital he once commanded on border security is now deeply contested territory.

The Supreme Court Rebuke and Congressional Dynamics

Trump will be speaking to a Republican-led Congress that he has frequently bypassed. While he secured the passage of his signature tax legislation last summer—dubbed the “Big, Beautiful Bill,” which combined corporate tax cuts and immigration enforcement funding with deep reductions to Medicaid—he has largely governed via executive order.

This aggressive use of executive authority recently hit a massive judicial roadblock. Last week, the Supreme Court struck down many of Trump’s sweeping global tariffs, a central pillar of his economic agenda. In a pointed majority opinion, Trump-nominated Justice Neil Gorsuch warned against the “permanent accretion of power in the hands of one man.”

This ruling has massive implications for global trade. Financial analysts at The Financial Times suggest that the removal of these tariffs could ease some inflationary pressures, though Trump has already vowed to pursue alternative legal mechanisms to keep import taxes active, promising prolonged uncertainty for international markets.

Simultaneously, Trump’s coalition is showing signs of fraying:

- Demographic Shifts: Americans under 45 have sharply turned against the administration.

- Latino Voters: A demographic that shifted rightward in 2024 has seen steep drops in approval following January’s border violence.

- Intra-Party Apathy: Nearly three in 10 Republicans report that the administration is failing to focus on the country’s most pressing structural problems.

Trump Foreign Policy Shifts and Global Tensions

Foreign policy is expected to feature heavily in the address, highlighting one of the most unpredictable evolutions of his second term. Candidate Trump campaigned heavily on an “America First” platform, promising to extract the US from costly foreign entanglements. However, Trump foreign policy shifts over the last twelve months have alarmed both critics and isolationist allies.

The administration has dramatically expanded US military involvement abroad. Operations have ranged from seizing Venezuela’s president and bolstering forces around Iran to authorizing a lethal campaign of strikes on alleged drug-smuggling vessels—operations that have resulted in scores of casualties. For global observers and defense analysts at The Washington Post, this muscular, interventionist approach contradicts his earlier populist rhetoric, creating unease among voters who favored a pullback from global policing.

What to Expect: A Trump Midterm Rally Speech

Despite the mounting pressures, Trump is unlikely to strike a chastened or conciliatory tone. Observers should expect a classic Trump midterm rally speech.

“It’s going to be a long speech because we have a lot to talk about,” Trump teased on Monday.

Key themes to watch for include:

- Defending the First Year: Aggressive framing of the “Big, Beautiful Bill” and an insistence that manufacturing is successfully reshoring.

- Attacking the Courts and Democrats: Expect pointed rhetoric regarding the Supreme Court’s tariff ruling and the ongoing DHS shutdown.

- Political Theater: Democratic leader Hakeem Jeffries has urged his caucus to maintain a “strong, determined and dignified presence,” but several progressive members have already announced plans to boycott the speech in silent protest. For details on streaming the event, see our guide on How to Watch Trump’s State of the Union.

Conclusion: A Test of Presidential Leverage

For a president who has built a global brand on dominance and disruption, Tuesday’s State of the Union represents a profoundly different kind of test. The visual of Trump speaking from the dais while parts of his own government remain shuttered and his signature tariffs sit dismantled by his own judicial appointees is a potent symbol of his current vulnerability.

The core question for international markets and domestic voters alike is no longer whether Trump can shock the system, but whether he can stabilize it. To regain his footing ahead of the November midterms, he must persuade a highly skeptical public that his combative priorities align with their economic needs—and prove that his second act in the White House is anchored by strategy rather than adrift in grievance.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance2 months ago

Markets & Finance2 months agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Analysis4 weeks ago

Analysis4 weeks agoBrazil’s Rare Earth Race: US, EU, and China Compete for Critical Minerals as Tensions Rise

-

Investment2 months ago

Investment2 months agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Banks2 months ago

Banks2 months agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Asia2 months ago

Asia2 months agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Global Economy2 months ago

Global Economy2 months agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Global Economy2 months ago

Global Economy2 months agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy2 months ago

Global Economy2 months ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis