Analysis

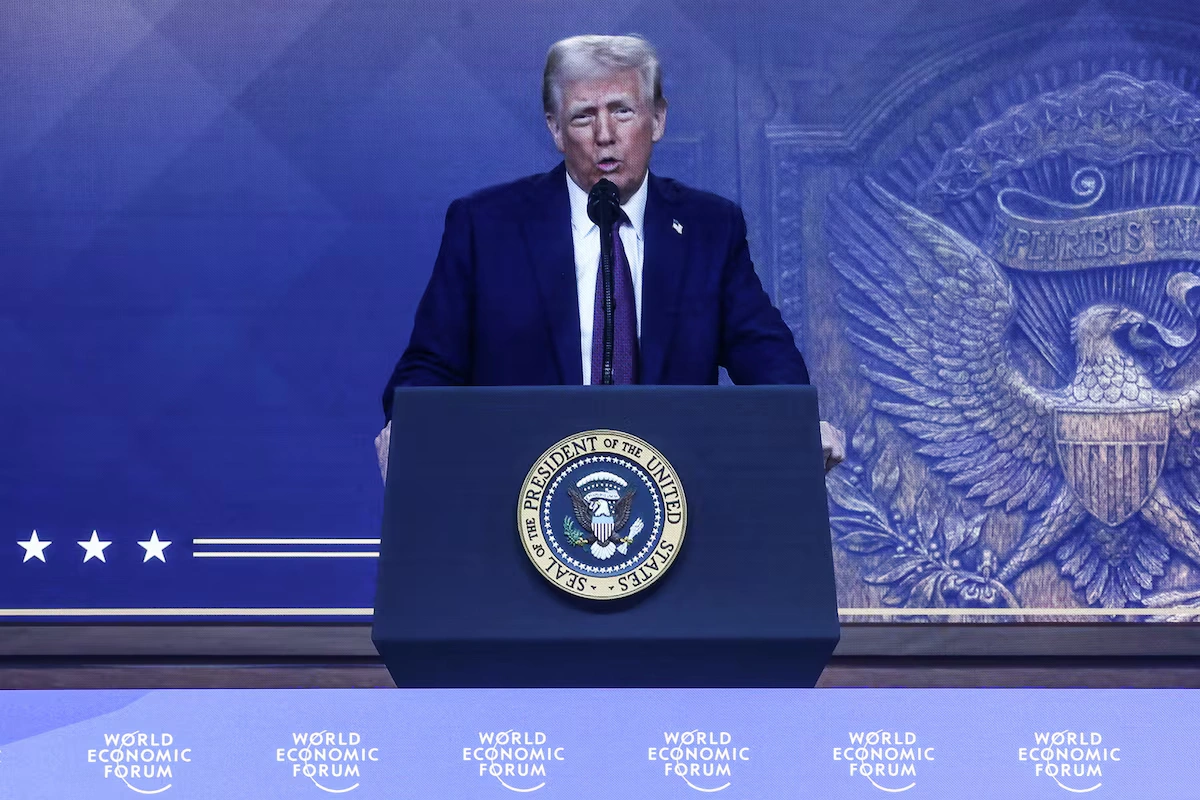

Trump Signs Executive Order Enabling Secondary Tariffs on Iran’s Trade Partners as Nuclear Talks Resume

The framework for sweeping trade penalties arrives amid diplomatic overtures in Oman, raising questions about whether economic coercion can succeed where military pressure has failed

On February 6, 2026, President Donald Trump signed an executive order that could fundamentally reshape global trade architecture around Iran, establishing a legal framework to impose additional tariffs on any nation conducting commerce with the Islamic Republic. The order, which took effect February 7, represents the administration’s most ambitious attempt yet to weaponize America’s economic leverage against Tehran—while simultaneously opening a potential Pandora’s box of diplomatic and commercial complications for US allies and adversaries alike.

The timing is striking: Trump announced the measure even as American and Iranian officials engaged in indirect negotiations in Muscat, Oman—the first substantive dialogue since US involvement in coordinated strikes on Iranian nuclear facilities last June. Speaking to reporters aboard Air Force One en route to Mar-a-Lago, the president characterized the Oman talks as “very good” and indicated further sessions would occur “early next week,” suggesting the tariff framework may serve as both stick and carrot in a renewed campaign of maximum economic pressure.

Yet unlike Trump’s first-term sanctions regime, which primarily targeted Iran directly, this executive order casts a far wider net—one that could ensnare some of America’s most important economic and security partners.

The Mechanics of Secondary Economic Coercion

The executive order does not immediately impose tariffs. Instead, it reaffirms the national emergency declaration concerning Iran and establishes a bureaucratic process through which the Secretaries of State, Commerce, and Treasury can identify countries or entities “directly or indirectly” purchasing, importing, or acquiring goods and services from Iran. Once identified, those nations could face additional import duties—with Trump’s mid-January Truth Social post suggesting a 25% rate as the benchmark.

This framework represents secondary sanctions on steroids, extending beyond traditional financial restrictions to encompass broad trade penalties. The mechanism’s flexibility is both its power and its peril: administration officials retain discretionary authority over implementation, creating significant policy uncertainty for global businesses and governments alike.

The legal architecture builds on emergency powers Congress has granted presidents since the International Emergency Economic Powers Act of 1977, though legal scholars have increasingly questioned the constitutional boundaries of such delegated authority. Still, the Supreme Court has historically deferred to executive discretion in foreign commerce matters, particularly those framed as national security imperatives.

Who Stands in the Crosshairs?

The list of potential targets reads like a roster of the world’s largest economies and most strategically significant nations. China tops the list as Iran’s primary trading partner, with bilateral commerce reaching approximately $32.5 billion in 2024 according to World Trade Organization data—driven predominantly by Chinese oil imports that have sustained Iran’s economy despite Western sanctions.

Beijing’s response will prove critical. Chinese officials have consistently maintained that their economic relationship with Iran complies with international law, and Foreign Ministry spokesperson statements have repeatedly asserted China’s right to conduct “normal trade and economic cooperation.” A 25% tariff on Chinese goods entering the United States—even if selectively applied—would represent a dramatic escalation beyond the Trump administration’s existing tariff regime, potentially triggering retaliatory measures that could spiral into a broader economic confrontation.

The European Union faces its own dilemma. Germany, despite scaling back relations with Tehran, maintains residual trade ties, while several member states have worked to preserve economic channels even under US sanctions pressure. Brussels has historically resisted American extraterritorial sanctions applications, viewing them as violations of international law and European sovereignty. The Trump administration’s approach threatens to force a choice between transatlantic alliance cohesion and principles of trade autonomy.

Turkey presents perhaps the most acute diplomatic complication. As a NATO ally hosting crucial American military installations, Ankara has nevertheless maintained pragmatic economic relations with Iran, driven by geography, energy needs, and President Recep Tayyip Erdoğan’s regional ambitions. Penalizing Turkish trade could undermine alliance cooperation at a moment when NATO faces multiple security challenges from the Black Sea to the Eastern Mediterranean.

The United Arab Emirates occupies equally complex terrain. Despite Abraham Accords normalization with Israel and close security cooperation with Washington, Dubai’s business community has long served as a critical commercial hub for Iranian entities seeking to circumvent sanctions. Abu Dhabi has walked a careful line between American security partnership and regional economic pragmatism—a balancing act this executive order could render untenable.

India, the world’s fastest-growing major economy and an increasingly important US strategic partner in Indo-Pacific competition with China, imports significant Iranian oil when sanctions waivers permit. New Delhi has historically resisted choosing between Washington and Tehran, instead pursuing its national interests through strategic autonomy. Secondary tariffs could test that doctrine’s limits.

Even Russia, already heavily sanctioned over Ukraine, conducts substantial commerce with Iran, including reported arms transfers and energy cooperation. While Moscow has limited vulnerability to additional US trade penalties given existing restrictions, the executive order signals Washington’s willingness to treat the Russia-Iran partnership as an integrated strategic threat.

Economic Ripple Effects and Market Uncertainties

The global economic implications extend well beyond bilateral trade balances. Iran remains a significant oil producer despite sanctions, with exports estimated between 1.5 and 2 million barrels daily—much of it flowing to China through opaque channels. Any disruption to these flows, whether through enhanced enforcement or preemptive cutbacks by nervous buyers, could tighten global energy markets already navigating geopolitical volatility from Ukraine to the South China Sea.

Energy analysts at several investment banks have noted that Brent crude futures showed modest upticks following the executive order’s announcement, reflecting trader concerns about supply disruption risks. While global oil markets currently show adequate spare capacity, the psychological impact of threatening major importers like China could introduce new price volatility, particularly if Beijing responds by accelerating strategic petroleum reserve accumulation or seeking alternative suppliers at premium prices.

Supply chain vulnerabilities present another concern. Many products imported to the United States contain components manufactured in countries that trade with Iran, even if final assembly occurs elsewhere. The “directly or indirectly” language in the executive order creates ambiguity: Would a German automotive manufacturer sourcing steel from a company that also sells to Iranian clients face penalties? The lack of clarity generates compliance nightmares for multinational corporations and could trigger preemptive supply chain reorganizations with associated costs and inefficiencies.

For American consumers, secondary tariffs risk compounding inflation pressures. The US imports substantial volumes from China, the EU, Turkey, and other potential targets. Even selectively applied 25% duties would likely translate to higher retail prices for electronics, automobiles, textiles, and other goods—an awkward political reality for an administration that has emphasized economic strength as a signature achievement.

Diplomatic Calculations and the Oman Talks

The executive order’s announcement concurrent with renewed nuclear negotiations raises fundamental questions about the administration’s strategic theory. Is economic coercion meant to pressure Tehran toward concessions at the negotiating table? Or does it reflect skepticism about diplomacy’s prospects, with commercial warfare pursued as a parallel track?

Historical precedent offers mixed lessons. Trump’s first-term “maximum pressure” campaign succeeded in devastating Iran’s economy—GDP contracted roughly 13% between 2017 and 2020—but failed to produce the comprehensive nuclear agreement the administration sought. Instead, Tehran responded by expanding its nuclear program beyond Joint Comprehensive Plan of Action (JCPOA) limits, enriching uranium to near-weapons-grade levels and accumulating substantial stockpiles.

The June 2025 strikes on Iranian nuclear facilities, in which the United States reportedly provided intelligence and logistical support to regional partners, marked a dramatic escalation beyond economic pressure. Yet six months later, with Iran’s program damaged but not eliminated and regional tensions simmering, both sides appear willing to explore diplomatic off-ramps.

The Muscat talks—hosted by Oman, which has long served as a discreet intermediary between Washington and Tehran—represent the most serious engagement since the strike operations. While details remain closely held, informed observers suggest discussions focus on verifiable constraints on Iran’s nuclear program in exchange for sanctions relief and security assurances.

Into this delicate diplomatic dance, the tariff executive order injects significant complexity. Iranian officials have historically viewed economic pressure as evidence of American bad faith, arguing that Washington uses sanctions to pursue regime change rather than genuine policy modification. The timing could reinforce hardline narratives within Tehran’s political establishment, potentially strengthening voices skeptical of negotiation.

Conversely, the administration likely calculates that threatening third-party trade partners demonstrates resolve and raises the costs of Iranian intransigence, potentially accelerating Tehran’s timeline for concessions. The theory holds that fear of economic isolation—not just for Iran but for its vital commercial partners—creates additional pressure channels unavailable through direct bilateral sanctions alone.

Whether this strategy succeeds depends substantially on execution. Measured application targeting specific sectors or entities might preserve diplomatic space while signaling seriousness. Sweeping implementation against major economies would likely trigger defensive responses that harden positions rather than facilitate compromise.

Alliance Strains and the Broader Strategic Context

Beyond immediate Iran policy, the executive order raises fundamental questions about American alliance management and the sustainability of unilateral economic statecraft. European officials have long complained that US extraterritorial sanctions force compliance with American foreign policy preferences or exclusion from dollar-denominated finance and US markets—a choice they view as coercive and corrosive to transatlantic partnership.

The executive order arrives amid broader tensions over trade policy. Trump has threatened or imposed tariffs on numerous partners over issues ranging from steel production to digital services taxes, treating commerce as a primary tool of geopolitical influence. While this approach enjoys domestic political support, it risks accelerating efforts by allies and competitors alike to reduce dependence on US-dominated financial and commercial systems.

China has invested heavily in payment systems alternatives to SWIFT, Yuan-denominated oil contracts, and bilateral trade arrangements that bypass dollar settlement. Russia has pursued similar de-dollarization strategies. The threat of tariffs on Iran trade could provide additional impetus for developing economies to participate in these alternative frameworks, potentially eroding American economic leverage over the long term.

For regional Middle Eastern partners, the executive order creates difficult choices. The UAE and Saudi Arabia have sought to position themselves as indispensable US security partners while maintaining economic flexibility to pursue national interests, including periodic accommodation with Iran. Forcing stark binary choices risks either alienating partners who resist or creating dependencies that reduce their regional influence.

What Happens Next: The Week Ahead and Beyond

President Trump’s indication that further talks would occur “early next week” suggests the diplomatic track remains active despite economic saber-rattling. The proximity of these events—executive order signing and continued negotiations—may be deliberate sequencing: establish the framework for enhanced pressure while leaving actual implementation as a negotiating variable.

Several scenarios merit consideration. First, negotiations could produce preliminary agreements on nuclear monitoring or enrichment caps, with the United States agreeing to delay or limit tariff implementation as a reciprocal confidence-building measure. This would represent classic coercive diplomacy—threatening pain to secure concessions, then withholding implementation as reward for cooperation.

Second, talks could stall over verification mechanisms or sanctions relief sequencing, leading the administration to begin designating countries for tariffs—likely starting with smaller players rather than China or major European economies, testing international reaction before escalating further.

Third, external events could overtake both negotiation and tariff tracks. Iran’s domestic political calendar, potential Israeli actions, or regional proxy conflicts could shift calculations rapidly, either accelerating diplomatic urgency or rendering negotiations moot.

For global markets and policymakers, the executive order injects substantial uncertainty into an already complex geopolitical environment. Businesses engaged in Iran trade face pressure to demonstrate compliance or risk US market access. Governments must calibrate responses that balance sovereignty principles against economic interests. And all parties must navigate an administration that has demonstrated willingness to rapidly shift tactical approaches while pursuing strategic objectives.

The ultimate question remains whether economic coercion of this scale and scope can achieve outcomes that previous approaches—direct sanctions, military pressure, and diplomatic isolation—have not. History suggests that while economic pressure can inflict costs, translating those costs into desired policy changes requires adversaries to perceive acceptable off-ramps and negotiating partners to maintain credibility through consistent implementation.

As talks resume in Oman this week, the world will watch not only what occurs in closed-door negotiating sessions but also how the Trump administration wields—or restrains—the expansive economic weapon it has just forged. The answer will shape not only the Iranian nuclear issue but the broader international order’s trajectory in an age of renewed great power competition and economic nationalism.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Trump Economy 2026: Americans’ Views Remain Negative on Health Care, Food Costs

One year after Donald Trump’s return to the White House, economic anxiety grips American households as persistent inflation, healthcare costs, and grocery bills dominate kitchen-table conversations—despite administration claims of progress.

Introduction: The Paradox of Perception and Policy

Twelve months into his second term, President Donald Trump confronts a stubborn political reality: Americans remain deeply pessimistic about the economy, even as some traditional indicators show resilience. According to Pew Research Center‘s comprehensive February 2026 survey, 72% of Americans rate current economic conditions as fair or poor—a striking repudiation of the administration’s economic messaging. More troubling for the White House, 52% of respondents say Trump’s policies have actually made economic conditions worse, not better.

This disconnect between presidential rhetoric and public sentiment reveals something fundamental about the American economy in 2026: headline statistics no longer capture the lived experience of working families. While stock markets have shown periods of strength and unemployment remains relatively low, the relentless pressure of everyday costs—healthcare premiums, grocery bills, energy expenses—has created what economists call a “vibecession,” where negative perceptions persist regardless of macroeconomic data.

The numbers tell a compelling story. Seventy-one percent of Americans express serious concern about healthcare costs, while 66% worry intensely about food and consumer goods prices, according to Pew’s findings. These aren’t abstract anxieties; they reflect real household budget pressures that have reshaped American economic behavior and political calculations heading into the 2026 midterm elections.

Persistent Economic Pessimism: The Data Behind the Discontent

The breadth of negative economic sentiment extends across multiple polling organizations, creating a consistent portrait of American dissatisfaction. Gallup‘s latest tracking shows Trump’s economic approval hovering between 36-40%, with a particularly damaging net disapproval rating of -23 specifically on inflation management. The Quinnipiac University Poll reports similar findings, with just 37% approving of the president’s economic handling.

Perhaps most revealing is consumer sentiment data from the University of Michigan, which registered 57.3 in February 2026—near historic lows that typically accompany recessions. This metric, closely watched by economists and policymakers, measures how confident Americans feel about their financial future and willingness to make major purchases. The current reading suggests profound uncertainty about economic prospects.

A CBS News survey underscores this pessimism: only 22% of Americans expect a booming economy in the near term. This contrasts sharply with the optimism that characterized Trump’s first term in early 2017, when consumer confidence surged following his election. The reversal suggests that Americans have adjusted their expectations downward, potentially reflecting accumulated frustration from years of inflation that began during the pandemic and has proven more persistent than experts predicted.

According to The Economist‘s approval tracker, Trump’s net rating stands at -15, a significant deficit that reflects broader dissatisfaction with his economic stewardship. Meanwhile, The Wall Street Journal reported that 57% of Americans view the economy as weak—a damning assessment that undermines the administration’s claims of economic revival.

Rising Costs of Essentials: Where Americans Feel the Squeeze

Healthcare: The Unrelenting Burden

Healthcare costs remain the paramount concern for American families, with 71% expressing serious worry according to Pew Research. This anxiety is well-founded. Insurance premiums have continued their multi-decade climb, with family coverage now averaging over $25,000 annually for employer-sponsored plans—of which workers typically shoulder $7,000-$8,000 in premiums alone, before deductibles and out-of-pocket expenses.

The Trump administration’s approach to healthcare policy—including continued efforts to reshape the Affordable Care Act and proposals to restructure Medicaid—has created additional uncertainty. Prescription drug costs, despite some legislative efforts to cap insulin prices and allow Medicare negotiation, remain substantially higher than in comparable developed nations. For millions of Americans, medical debt continues to be a leading cause of personal bankruptcy, a uniquely American phenomenon among wealthy nations.

Brookings Institution researchers note that healthcare cost anxiety transcends partisan lines, affecting Republicans, Democrats, and independents nearly equally. This universal concern makes it a potent political issue, yet one that has proven notoriously difficult to address through policy reforms that satisfy diverse stakeholders.

Food and Consumer Goods: Grocery Bills as Economic Barometers

Sixty-six percent of Americans express serious concern about food and consumer goods prices—an anxiety rooted in daily experience at checkout counters nationwide. While headline inflation has moderated from 2022-2023 peaks, food prices remain significantly elevated compared to pre-pandemic levels. Common staples like eggs, bread, dairy products, and meat have seen cumulative price increases of 25-35% since 2020, according to Bureau of Labor Statistics data.

This “grocery inflation” has proven particularly stubborn and politically salient. Unlike gasoline prices, which fluctuate visibly and can decline dramatically, food prices rarely decrease in absolute terms; they simply rise more slowly during periods of moderating inflation. This creates a persistent affordability challenge for families, especially those in lower and middle income brackets who spend proportionally more of their budgets on food.

The Washington Post analysis reveals that Americans’ inflation expectations remain elevated, suggesting they anticipate continued price pressures. This psychology can become self-fulfilling, as businesses maintain pricing power when consumers expect increases, and workers demand higher wages to compensate for anticipated cost-of-living jumps.

Consumer goods beyond food—electronics, clothing, household items, vehicles—have experienced variable price trajectories. Supply chain normalization has eased some pressures, yet tariff policies implemented during Trump’s second term have introduced new costs on imported goods, particularly from China and other Asian manufacturing centers. These tariffs, designed to protect American industries and generate revenue, function as consumption taxes that ultimately fall on American households.

Policy Impacts and Public Sentiment: Assigning Responsibility

The most politically damaging finding for the Trump administration may be the attribution of blame. Pew Research found that 52% of Americans believe Trump’s policies have worsened economic conditions—a direct repudiation of the president’s economic agenda. This represents a significant shift from his first term, when economic performance generally received more favorable reviews, at least until the pandemic disrupted commerce in 2020.

What explains this negative assessment? Several policy domains appear to be driving discontent:

Tariff and Trade Policy: Trump’s renewed embrace of tariffs, implemented more aggressively in his second term than his first, has generated both retaliation from trading partners and measurable price increases for consumers. Economic modeling suggests these tariffs have added hundreds of dollars annually to typical household costs.

Tax and Fiscal Policy: While corporate tax rates remain at levels established during Trump’s first term, proposed changes to individual taxation and entitlement programs have generated anxiety, particularly among seniors and near-retirees concerned about Social Security and Medicare sustainability.

Regulatory Approach: Deregulation in financial services, environmental protection, and consumer safeguards has created concerns about corporate accountability and long-term economic stability, even as business groups applaud reduced compliance burdens.

Federal Reserve Relations: Trump’s public criticism of Federal Reserve policies and interest rate decisions—a continuation of behavior from his first term—has raised questions about central bank independence and the credibility of inflation-fighting efforts.

Forbes analysis suggests that the administration’s messaging challenges stem partly from a mismatch between traditional Republican economic priorities (tax cuts, deregulation, reduced government spending) and the immediate concerns of working-class voters who prioritize cost-of-living relief and job security over abstract growth metrics.

Comparative Context: Historical and International Perspectives

To understand the significance of current economic sentiment, historical comparison proves instructive. Consumer confidence at 57.3 ranks among the lowest readings outside official recession periods. During the Great Recession (2008-2009), sentiment plummeted to the 50s and even lower, reflecting genuine economic catastrophe with massive job losses and collapsing home values. The current reading suggests Americans feel comparable anxiety despite relatively stable employment conditions—a testament to inflation’s psychological impact.

Internationally, American economic pessimism stands out. Financial Times reporting indicates that consumer confidence in European Union countries, while below pre-pandemic levels, generally exceeds American sentiment. This suggests that inflation’s political fallout has been particularly severe in the United States, possibly because Americans experienced sharper pandemic-era price spikes and have fewer social safety nets to cushion cost-of-living pressures.

The political consequences of economic sentiment are historically clear: incumbent parties suffer in midterm elections when economic perceptions are negative. The 2026 midterms loom as a potential referendum on Trump’s economic stewardship, with control of Congress hanging in the balance. Democrats have made cost-of-living concerns central to their messaging, while Republicans have attempted to shift focus to immigration, crime, and cultural issues—a tacit acknowledgment of difficult economic terrain.

Demographic Divides: Who Feels the Pain Most Acutely?

Economic anxiety is not evenly distributed across American society. Pew and other surveys reveal important demographic patterns:

Income Stratification: Lower and middle-income households express substantially greater concern about costs than affluent Americans. For families earning under $50,000 annually, healthcare and food costs can consume 40-50% of post-tax income, leaving minimal cushion for emergencies or savings. Upper-income households, while not immune to price increases, face less severe trade-offs.

Age Differences: Younger Americans (18-35) show particular anxiety about housing costs and student debt in addition to healthcare and food concerns. Older Americans (65+) focus intensely on healthcare, prescription drugs, and Social Security sustainability. Middle-aged Americans (35-65) often face compound pressures: supporting children, caring for aging parents, and saving inadequately for their own retirement.

Geographic Variation: Urban and suburban residents face different cost structures than rural Americans. Housing costs dominate urban budgets, while transportation and energy expenses weigh more heavily in rural areas. Regional variation in healthcare access and costs also shapes economic experience significantly.

Partisan Perspectives: Predictably, Democrats express more negative views of economic conditions under Trump than Republicans, but the Pew data shows that even among Republicans, enthusiasm is muted. Only about half of Republican identifiers rate current economic conditions as good or excellent—suggesting that partisan loyalty only partially insulates the president from economic dissatisfaction.

Looking Forward: Economic Prospects and Political Implications

As Trump’s second term reaches its midpoint, several factors will shape economic trajectories and public perceptions:

Inflation Path: The Federal Reserve’s success in sustainably returning inflation to its 2% target without triggering recession remains uncertain. Current projections suggest continued gradual moderation, but geopolitical risks—including energy market volatility and supply chain disruptions—could reignite price pressures.

Labor Market Evolution: Employment strength has provided a floor beneath consumer confidence. Should unemployment begin rising significantly, already-negative sentiment could deteriorate sharply. Conversely, sustained job growth with accelerating wage increases could eventually improve household finances and perceptions.

Policy Adjustments: Whether the Trump administration recalibrates its approach based on negative polling remains to be seen. Politically, the pressure to demonstrate tangible cost-of-living relief will intensify as midterm elections approach. However, presidents have limited short-term tools to reduce prices without triggering other economic disruptions.

Structural Challenges: Beyond immediate policy debates, American economic anxiety reflects deeper structural issues: healthcare system inefficiencies that produce world-leading costs with mediocre outcomes; housing undersupply that has made homeownership increasingly unattainable; educational credentialing that requires debt-financed investment; and wage stagnation relative to productivity growth over decades. No administration can solve these challenges quickly, yet voters understandably demand relief.

The New York Times‘ economic analysis suggests that absent significant policy shifts or unexpected favorable developments, negative economic sentiment is likely to persist through 2026. This creates a challenging political environment for Republicans defending congressional majorities and looking ahead to 2028 presidential positioning.

Conclusion: The Politics of Economic Perception in an Age of Anxiety

One year into Donald Trump’s second term, the verdict from American families is clear: economic conditions remain unsatisfactory, costs continue squeezing household budgets, and presidential policies have not delivered the relief voters anticipated. With 72% rating the economy as fair or poor, 71% worried about healthcare costs, and 66% concerned about food and consumer goods prices, the political foundations of Trump’s economic agenda appear shaky.

This disconnect between administration claims and public experience raises fundamental questions about economic policymaking in contemporary America. Traditional metrics—GDP growth, unemployment rates, stock market performance—no longer reliably predict political success when Americans feel financially insecure in their daily lives. The “vibecession” of 2026 demonstrates that perception is political reality, and that lived experience at grocery stores, pharmacies, and doctor’s offices outweighs abstract economic indicators.

For policymakers across the political spectrum, the message is unmistakable: Americans demand tangible relief from cost-of-living pressures, not statistical reassurances. Whether that relief comes through wage growth, price moderation, enhanced social programs, or some combination remains a central question for American political economy.

As midterm campaigns intensify and voters prepare to render their judgment on Trump’s economic stewardship, one certainty emerges: economic anxiety will drive political outcomes, potentially reshaping congressional power and setting the stage for the 2028 presidential race. The party that convincingly addresses Americans’ cost-of-living concerns may gain decisive political advantage in an era defined by economic uncertainty.

What are your biggest economic concerns right now? Share your perspective on healthcare costs, grocery bills, or financial anxieties in the comments below, and join the conversation about America’s economic future.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Pakistan Poised for Spotlight in JPMorgan’s New Frontier Debt Index Amid High-Yield Boom

As global investors hunt for returns in an era of softening developed-market yields, Pakistan and a cohort of frontier economies are emerging from the shadows—and Wall Street’s most influential index provider is taking notice.

JPMorgan Chase & Co., the architect of benchmark emerging-market indices that steer trillions in institutional capital, is putting the finishing touches on a groundbreaking index dedicated to local-currency debt from frontier markets. The move comes as these once-overlooked economies deliver eye-watering returns that have left traditional emerging-market benchmarks in the dust, with Pakistan positioned among the key beneficiaries of what could become a watershed moment for investor attention.

According to sources familiar with the development, the new index will track local-currency government bonds from 20 to 25 countries, with Pakistan securing a spot alongside heavyweights like Egypt, Vietnam, Kenya, Morocco, Kazakhstan, Nigeria, Sri Lanka, and Bangladesh. The timing couldn’t be more striking: frontier market hard-currency bonds, tracked by JPMorgan’s existing NEXGEM index launched in 2011, delivered a stunning 20% return in 2025—handily outpacing the 14% gains in vanilla emerging-market debt benchmarks.

The Frontier Debt Renaissance: A Market Transformed

The frontier local-currency debt universe has undergone a remarkable metamorphosis over the past decade. What was once a $330 billion niche has ballooned into a $1 trillion asset class, according to data compiled by global index researchers. This threefold expansion reflects not merely market growth but a fundamental shift in how sophisticated investors perceive risk and opportunity beyond the BRIC economies that dominated the 2010s discourse.

The catalyst for this surge? A potent cocktail of macroeconomic tailwinds that began crystallizing in 2024 and accelerated through 2025. The U.S. dollar, long the gravitational force in global currency markets, weakened approximately 7% last year—its sharpest annual decline since 2017. For frontier economies historically burdened by dollar-denominated debt, this depreciation has been nothing short of transformative, easing repayment pressures and making local-currency assets increasingly attractive to international portfolio managers.

But it’s the yield differential that truly captivates. While investors in developed markets scrape for returns amid central bank policy recalibrations, frontier local-currency bonds offer yields exceeding mainstream emerging-market debt by over 400 basis points. More than 60% of potential constituents in JPMorgan’s proposed index currently yield above 10%—a figure that seems almost anachronistic in an era when German bunds and U.S. Treasuries hover in mid-single digits.

Pakistan’s Evolving Investment Narrative

For Pakistan specifically, inclusion in a JPMorgan local-currency frontier index represents far more than symbolic validation. The South Asian nation of 240 million has spent much of the past three years navigating a precarious economic tightrope, oscillating between International Monetary Fund bailout programs and moments of surprising resilience.

The country’s economic managers have made demonstrable progress on several fronts. Foreign exchange reserves, which dipped to perilously low levels in 2022, have been bolstered—partly through conventional monetary policy adjustments and partly through unconventional measures including strategic gold reserve acquisitions. The State Bank of Pakistan has maintained a hawkish stance on inflation, keeping real interest rates in positive territory even as regional peers experimented with premature easing cycles.

This fiscal discipline, however painful for domestic growth in the short term, has created the precise conditions that frontier debt investors prize: high real yields in local currency terms, diminished currency devaluation risks, and a credible policy framework. Pakistan’s local-currency government bonds currently offer yields that, when adjusted for inflation expectations, provide genuine real returns—a rarity in fixed-income markets globally.

Yet the investment case isn’t without complexity. Pakistan remains locked in a multiyear IMF Extended Fund Facility program, with quarterly reviews that can inject volatility into market sentiment. Political transitions and the perennial challenge of broadening an anemic tax base continue to test policymaker resolve. For international investors, these factors transform Pakistani bonds into what traders colloquially term “high beta” assets—offering outsized returns but demanding constant vigilance.

The Mechanics of Frontier Market Exuberance

Understanding why frontier local-currency debt has captured imaginations requires unpacking the mechanics of what’s occurred over the past 18 months. As global interest rate expectations shifted in late 2024—with the Federal Reserve signaling it had reached peak policy restrictiveness—carry trades in frontier markets became increasingly lucrative.

The carry trade, a strategy where investors borrow in low-yielding currencies to invest in high-yielding ones, has historically been the domain of liquid emerging markets like Brazil, Mexico, and South Africa. But as yield spreads compressed in those economies, attention migrated toward the frontier.

Egypt exemplifies both the potential and perils. Egyptian Treasury bills now offer yields exceeding 20% in nominal terms, with real yields (adjusted for inflation) hovering around 8-10%—astronomical by historical standards. Foreign ownership of Egyptian T-bills has surged to 44% of outstanding issuance, up from barely 15% two years ago. Similarly dramatic inflows have characterized markets from Ghana to Zambia, where inflation-adjusted yields exceed 5% despite these nations’ recent sovereign debt restructurings.

Vietnam and Kenya, meanwhile, represent the more stable end of the frontier spectrum—economies with stronger institutional frameworks and more diversified growth models. Vietnam’s integration into global manufacturing supply chains has created steady dollar inflows, while Kenya’s technology sector and regional financial hub status provide ballast against commodity price volatility.

Risk Factors and the Carry Trade Conundrum

For all the enthusiasm, seasoned emerging-market veterans recognize that today’s frontier debt rally carries echoes of previous cycles that ended in tears. The surge in offshore holdings—foreign investors now control significant portions of local-currency debt in countries from Nigeria to Bangladesh—creates structural vulnerabilities.

A sudden shift in global risk appetite, triggered perhaps by an unexpected inflation resurgence in developed markets or geopolitical escalation, could precipitate rapid capital flight. When foreign investors simultaneously exit positions in illiquid markets, the resulting currency depreciation and yield spikes can be violent. The “taper tantrum” of 2013, when the Federal Reserve merely discussed reducing asset purchases, offers a cautionary historical parallel.

Moreover, the very dollar weakness that has fueled frontier market gains could reverse. Should U.S. economic data surprise to the upside or fiscal concerns resurface around American debt sustainability, a flight to dollar safety could quickly unwind carry trades across the frontier complex. Pakistan, with its still-modest foreign exchange buffers relative to GDP, would be particularly exposed to such a reversal.

Local political dynamics add another layer of uncertainty. Elections, policy reversals, or social unrest can materialize with little warning in frontier economies where institutional checks and balances remain works in progress. Nigeria’s recent fuel subsidy reforms, necessary for fiscal sustainability, triggered protests that briefly roiled markets. Sri Lanka’s ongoing economic restructuring, while lauded by international financial institutions, continues to face domestic political headwinds.

The JPMorgan Effect: When Indexes Move Markets

The significance of JPMorgan’s index initiative extends beyond mere measurement. In global fixed-income markets, inclusion in a major benchmark often becomes a self-fulfilling prophecy, as passive funds and index-tracking strategies mechanically allocate capital to constituent countries.

JPMorgan’s existing emerging-market bond indices are tracked by an estimated $500 billion in assets under management. While the frontier index will inevitably start smaller, its launch could channel tens of billions toward countries like Pakistan that have historically struggled to attract stable, long-term foreign investment in local-currency debt.

This “index inclusion premium” manifests through multiple channels. Most directly, passive funds following the benchmark must purchase constituent bonds, creating immediate demand and potentially compressing yields. More subtly, index membership confers a quality signal—a form of international validation that a country has achieved sufficient market depth, liquidity, and policy credibility to warrant serious institutional attention.

For Pakistan’s policymakers, this creates both opportunity and obligation. The opportunity lies in accessing a deeper, more diversified investor base for local-currency financing, potentially reducing reliance on bilateral creditors or multilateral institutions. The obligation involves maintaining the very policy discipline and market infrastructure that made inclusion possible—a challenge when political cycles incentivize short-term spending over medium-term stability.

Broader Implications for Frontier Economies

The frontier debt phenomenon reflects a more fundamental reconfiguration of global capital flows. For decades, the investment landscape was bifurcated: developed markets offered safety and liquidity but minimal returns, while emerging markets provided yield enhancement with manageable risk. Frontier markets, when considered at all, were viewed as speculative outliers.

That taxonomy is dissolving. Demographics favor many frontier economies—Pakistan’s median age is 23, compared to 48 in Japan—creating long-term growth potential that developed markets cannot match. Technological leapfrogging, particularly in mobile connectivity and digital financial services, has accelerated development timelines. And commodity endowments, from Kazakhstan’s oil to Zambia’s copper, remain strategically valuable in an era of energy transition and supply chain reshoring.

The $1 trillion milestone in frontier local-currency debt outstanding signals that these markets have achieved critical mass. Liquidity begets liquidity; as markets deepen, transaction costs fall, bid-ask spreads narrow, and more sophisticated investors can operate comfortably. This virtuous cycle, once established, can persist for years—witness the steady institutionalization of emerging-market debt between 1990 and 2010.

Looking Ahead: Sustainability and Selection

As JPMorgan finalizes its index methodology—expected to be announced formally in coming months—market participants are parsing potential selection criteria and constituent weightings. Egypt’s sheer market size suggests it will command one of the largest allocations, while Vietnam’s liquidity and Morocco’s stability position them as core holdings. Pakistan’s weighting will likely fall somewhere in the middle tier, meaningful but not dominant.

The composition matters because it will shape how global investors perceive frontier markets broadly. An index heavily weighted toward commodity exporters behaves differently from one balanced toward manufacturing hubs or service economies. The inclusion of recent debt restructuring cases like Sri Lanka and Zambia—both offering yields well above 10% as they rebuild credibility—adds a recovery-play dimension absent from traditional benchmarks.

For investors, the question isn’t whether frontier local-currency debt deserves a portfolio allocation—the 2025 performance data answers that affirmatively—but rather how to size that allocation and manage the attendant risks. The most sophisticated approaches will likely involve active overlay strategies: using the index as a baseline while tactically adjusting exposure based on policy developments, currency valuations, and global liquidity conditions.

Pakistan’s journey from near-crisis in 2022 to index contender in 2026 illustrates both the volatility and potential of frontier investing. The country’s local-currency bonds have delivered substantial returns for those who bought during moments of maximum pessimism, yet remain vulnerable to external shocks and domestic policy missteps.

The Verdict: Opportunity Meets Obligation

JPMorgan’s impending frontier local-currency debt index arrives at an inflection point—when yield-starved institutional investors are finally willing to venture beyond traditional emerging markets, and when frontier economies have developed the market infrastructure to accommodate that capital. For Pakistan, inclusion represents validation of painful reforms but also a test of whether the country can sustain policy discipline when external financing becomes easier.

The broader implications extend beyond any single nation. A successful frontier debt index could accelerate financial market development across dozens of economies, providing funding for infrastructure, smoothing consumption during downturns, and gradually reducing dependence on dollar-denominated debt. Conversely, a carry-trade unwind or policy reversal in major constituent countries could discredit the entire asset class for years, much as the Asian Financial Crisis did for earlier generations of investors.

As we move deeper into 2026, the central question isn’t whether frontier markets offer compelling yields—they demonstrably do—but whether those yields adequately compensate for risks that remain imperfectly understood and potentially correlated in ways index diversification doesn’t fully address.

For investors willing to embrace complexity, the frontier beckons with returns that seem almost nostalgic in their generosity. For countries like Pakistan, the challenge lies in proving this isn’t another boom destined to bust, but rather the beginning of a sustained integration into global capital markets. Which narrative prevails may well define the next chapter of emerging-market investment.

What’s your take on frontier market opportunities in 2026? Are high yields sufficient compensation for heightened volatility, or does the combination of dollar weakness and policy reforms represent a structural shift worth betting on? Share your perspective in the comments below.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Acquisitions

GuocoLand’s Strategic Gambit: Privatizing Malaysian Unit at RM1.10 Per Share Amid Southeast Asia’s Real Estate Consolidation Wave

When billionaire Tan Sri Quek Leng Chan moves, Malaysia’s property market pays attention. On February 3, 2026, the 82-year-old tycoon’s GuocoLand delivered a proposal that sent ripples through Bursa Malaysia: a selective capital reduction to privatize GuocoLand (Malaysia) Berhad at RM1.10 per share—a 17.7% premium that values the property developer at approximately RM770.6 million. For minority shareholders holding 34.97% of the company, this represents more than just an exit opportunity. It’s a window into the evolving strategy of one of Southeast Asia’s most powerful business dynasties and a signal of broader consolidation trends reshaping Malaysia’s property landscape.

The Deal Architecture: Premium Pricing in a Challenging Market

The privatization mechanics reveal strategic sophistication. GLL (Malaysia) Pte Ltd, the controlling shareholder owned by Singapore-listed GuocoLand Limited, proposed a selective capital reduction offering RM1.10 cash repayment to all shareholders except itself. According to The Edge Singapore, this translates to a 47.73% premium over the six-month volume-weighted average market price of RM0.7446—a compelling proposition for investors who’ve watched the stock languish.

The premium structure tells a nuanced story. While the 17.7% markup over the January 30, 2026 closing price of RM0.935 appears modest compared to typical Malaysian privatizations, the broader context matters. The Star noted that GuocoLand Malaysia’s shares surged 56% between January 1 and January 30, 2026, suggesting market anticipation. The offer also represents premiums ranging from 25.44% to 54.52% over various historical volume-weighted averages—recognition that the stock has underperformed its asset value.

For the 244.95 million entitled shares, the total capital repayment reaches RM269.44 million. Funding will come from GuocoLand Malaysia’s excess cash reserves, supplemented by advances or equity injections from the parent entities—a cash-efficient structure that avoids external financing costs.

The Quek Dynasty’s Real Estate Calculus

Understanding this move requires examining Quek Leng Chan’s broader empire. The Hong Leong Group Malaysia chairman, with an estimated net worth of $10.2 billion according to Forbes, controls a conglomerate spanning banking, manufacturing, and real estate across 14 listed companies. His real estate strategy has consistently favored quality over quantity, strategic consolidation over public market volatility.

The privatization rationale articulated in the proposal letter is telling. GuocoLand Malaysia hasn’t raised equity capital from public markets in over a decade. Average daily trading volume languished at just 126,923 shares over five years—representing a mere 0.06% of free float. These metrics paint a picture of a company too small to benefit from listing status, yet burdened by compliance costs, disclosure requirements, and market scrutiny that constrain operational flexibility.

This mirrors broader industry trends. Mordor Intelligence research indicates Malaysia’s property sector is experiencing margin compression from volatile construction costs, with material prices fluctuating significantly through 2023-2025. For developers with capped-price projects, particularly in affordable segments, maintaining public listing adds costs without corresponding capital-raising benefits.

Malaysian Property Market Context: Timing Is Everything

The privatization arrives as Malaysia’s property market navigates a complex transition. Economic fundamentals remain solid—GDP growth projected at 4.5-5.5% for 2026, inflation contained at 1.4% as of November 2025, and a strengthening ringgit that appreciated nearly 14% against the US dollar from December 2023 to December 2025, according to Global Property Guide.

Yet the residential market faces structural headwinds. Business Today reports that buyers are increasingly selective, prioritizing transit-oriented developments and well-managed projects over generic suburban sprawl. The luxury segment battles persistent oversupply, while construction cost volatility—with predictions of 4.5-5.5% material price rebounds in 2025-2026—squeezes margins.

Infrastructure development offers selective opportunities. The Johor-Singapore RTS Link, set for 2027 operations, is catalyzing demand in the Iskandar Malaysia corridor. Penang’s urban centers and Klang Valley’s transit hubs show resilience. But these bright spots demand capital allocation flexibility that public market constraints can inhibit.

For GuocoLand Malaysia, privatization offers strategic agility. Without quarterly earnings pressures and stock price volatility, management can pursue longer-term development cycles, selective land acquisitions during market corrections, and project mix optimization without short-term market punishment.

Comparative Context: Malaysia’s Privatization Landscape

This isn’t Malaysia’s first high-profile property privatization. In June 2024, Permodalan Nasional Bhd (PNB) launched a takeover bid for S P Setia at RM2.80 per share, aiming to create Malaysia’s largest property group by market capitalization. These moves reflect a broader recognition: mid-sized listed property developers face structural disadvantages in today’s market.

The GuocoLand Malaysia privatization distinguishes itself through its capital structure simplicity. Unlike leveraged buyouts requiring significant debt, this selective capital reduction minimizes financing risk. The RM269.44 million outlay represents manageable exposure for a group with GuocoLand Limited’s resources—the Singapore-listed parent manages assets across multiple jurisdictions and maintains strong banking relationships through Hong Leong Financial Group.

Shareholder Perspectives: Value or Opportunity Cost?

For minority shareholders, the decision matrix involves several considerations. The 17.7% immediate premium offers certainty in an uncertain market. Those who purchased shares below RM0.935 realize gains; those who bought during the January 2026 rally face different calculus.

The independent board directors—excluding Cheng Hsing Yao and Quek Kon Sean, who are deemed interested parties—have until March 2, 2026, to deliberate and recommend a course of action. This timeline suggests thorough evaluation, potentially including independent fairness opinions and asset valuations.

Alternative scenarios warrant consideration. Could GuocoLand Malaysia unlock greater value remaining public? The answer likely hinges on development pipeline quality and execution capability. With the Malaysian property market entering what Hartamas Real Estate characterizes as a transition from buyer’s market to balanced market by late 2025-2026, patient capital could theoretically capture upside.

However, that assumes the company can access growth capital, maintain market attention, and execute developments that outperform the offered premium. Given the anemic trading volumes and decade-long capital market absence, that path appears increasingly unlikely.

Regulatory and Execution Roadmap

The privatization process under Malaysian company law involves multiple steps:

- Independent Director Evaluation (deadline: March 2, 2026): The board must assess fairness and recommend approval or rejection.

- Independent Advisor Appointment: Typically, independent financial advisors conduct fairness opinions and valuation analyses.

- Shareholder Approval: Requires disinterested shareholder approval, typically at extraordinary general meeting.

- Regulatory Clearances: Bursa Malaysia and Securities Commission review ensures compliance.

- Capital Reduction Execution: Court-approved capital reduction and payment to entitled shareholders.

- Delisting: Upon completion, GuocoLand Malaysia becomes wholly owned subsidiary and delists from Bursa Malaysia.

Historical precedent suggests a 6-9 month timeline from proposal to completion, placing the potential delisting in Q3-Q4 2026.

Strategic Implications: Real Estate Consolidation Accelerates

The broader narrative transcends one company. Southeast Asia’s real estate sector is experiencing consolidation driven by several forces:

Scale Economics: Larger developers secure better financing terms, contractor rates, and land acquisition opportunities.

Regulatory Complexity: Environmental regulations, green building certifications (Malaysia’s carbon tax implementation scheduled for 2026), and compliance burdens favor organizations with dedicated legal and regulatory teams.

Technology Integration: PropTech adoption, AI-driven sales platforms, and digital marketing require capital investment that smaller listed entities struggle to justify.

Capital Efficiency: Private ownership eliminates public market costs while maintaining access to banking relationships and private equity when needed.

For Hong Leong Group, the move reinforces focus on core strengths. Rather than managing a small listed Malaysian property entity, resources can concentrate on higher-return opportunities across the group’s diversified portfolio.

Market Reactions and Forward Outlook

Initial market response suggests approval probability. GuocoLand Limited’s Singapore-listed shares rose 23% between January 1 and February 2, 2026, according to The Edge Singapore—indicating investor confidence in the strategic rationale. The Malaysian subsidiary’s 56% surge over the same period reflects arbitrage positioning and takeover speculation.

For Malaysia’s property sector, implications ripple outward. Other mid-cap developers with similar characteristics—limited free float, minimal capital market activity, controlling shareholders—may evaluate similar paths. The success of this privatization could catalyze further consolidation, particularly as construction costs and regulatory complexity continue rising.

Investors should monitor several indicators: independent director recommendations (due March 2, 2026), fairness opinion conclusions, and shareholder approval votes. Regulatory precedent suggests approval likelihood exceeds 70% given the substantial premium and limited alternative value-creation paths.

Conclusion: Strategic Clarity in Uncertain Times

Quek Leng Chan’s privatization proposal reflects strategic clarity forged over decades building one of Southeast Asia’s premier business empires. At RM1.10 per share, GuocoLand Malaysia shareholders receive meaningful premium over recent trading while the Hong Leong Group gains operational flexibility to navigate an evolving property landscape.

For minority investors, the decision involves weighing immediate certainty against speculative upside. The 17.7% premium, coupled with broader market challenges facing mid-sized developers, suggests acceptance represents rational outcome for most holders.

More broadly, this transaction signals maturation of Malaysia’s property sector. As markets reward scale, operational excellence, and capital efficiency, the era of numerous small listed developers gives way to consolidated entities with resources to compete globally. In that context, GuocoLand’s Malaysian privatization isn’t just corporate housekeeping—it’s strategic positioning for the real estate industry’s next chapter.

For investors seeking exposure to Malaysian property development, the consolidation trend suggests focusing on larger, diversified developers with strong balance sheets, infrastructure-linked projects, and proven execution capabilities. The mid-cap space, exemplified by GuocoLand Malaysia’s journey, faces structural headwinds that make public listing status increasingly untenable.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance1 month ago

Markets & Finance1 month agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Global Economy1 month ago

Global Economy1 month agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Asia1 month ago

Asia1 month agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Investment4 weeks ago

Investment4 weeks agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy1 month ago

Global Economy1 month ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis

-

Banks3 weeks ago

Banks3 weeks agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Economic Outlook 2025: Between Stabilization and the Shadow of Stagnation