Opinion

Pakistan Assumes Digital Cooperation Organization Presidency: A Pivotal Moment for Global Digital Inclusion

As Islamabad takes the helm of the DCO in 2026, the world watches to see whether this coalition can bridge the widening digital divide—or simply become another multilateral talking shop.

KUWAIT CITY — Pakistan took control Thursday of a little-known but increasingly influential digital governance coalition, assuming the presidency of the 16-nation Digital Cooperation Organization at a moment when debates over artificial intelligence, data sovereignty and cybersecurity are fracturing the global tech landscape.

The handover at the organization’s fifth General Assembly in Kuwait elevates Shaza Fatima Khawaja, Pakistan’s minister of state for information technology, to the chairmanship of a bloc that represents more than 800 million internet users across the Middle East, South Asia and parts of Africa—a collective attempting to assert technological independence from both Western platforms and Chinese infrastructure.

The transfer of leadership wasn’t merely ceremonial. It represented a calculated bet by the 16-member organization—which now accounts for over 800 million digitally connected citizens across three continents—that Pakistan’s unique position between the developed and developing digital worlds could catalyze meaningful progress on issues ranging from cybersecurity frameworks to artificial intelligence governance. The question now is whether Islamabad can deliver substance to match the symbolism.

The DCO’s Rapid Evolution: From Regional Initiative to Global Digital Force

Founded in November 2020 by just five countries—Bahrain, Jordan, Kuwait, Pakistan, and Saudi Arabia—the Digital Cooperation Organization emerged from a recognition that the architecture of global digital governance was being written without sufficient input from emerging markets. What began as a modest Middle Eastern initiative has metastasized into something far more ambitious: a counterweight to Western-dominated tech policy frameworks that many members believe inadequately address the realities of developing digital economies.

The organization’s expansion tells its own story. From its original quintet, the DCO has grown to encompass 16 member states, creating a sprawling coalition that bridges the Gulf’s petrostate-funded digital ambitions with South Asia’s massive user bases and Africa’s leapfrog innovation ecosystems. According to research published by The Economist, the DCO’s focus on digital public infrastructure—the unsexy but essential backbone of modern digital economies—has positioned it as a serious player in debates about technological sovereignty and data governance.

The timing of Pakistan’s DCO presidency 2026 is particularly significant. As global powers fracture over AI regulation, data localization, and platform governance, middle powers are finding unprecedented leverage. The DCO represents an attempt to create what policy analysts call “regulatory optionality”—the ability for emerging economies to choose frameworks that serve their developmental needs rather than simply importing Silicon Valley’s libertarian ethos or Beijing’s surveillance-enabled model.

Shaza Fatima Khawaja’s Vision: Beyond Digital Rhetoric

In her acceptance remarks at the Kuwait assembly, Shaza Fatima Khawaja DCO leadership began with characteristic pragmatism. “I would like to reaffirm Pakistan’s unwavering support for the DCO,” she stated, her words carefully calibrated to signal both continuity and ambition. “Together through collaboration and shared purpose we can ensure that digital transformation delivers inclusive growth and shared prosperity for all and as a founding member Pakistan is proud to see it growing and see it prospering and working towards a shared future.”

The statement, while diplomatically anodyne, hints at Pakistan’s strategic priorities for its year-long tenure. Unlike previous presidencies that emphasized infrastructure connectivity or e-government platforms, Khawaja’s ministry has signaled that Pakistan’s chairmanship will prioritize what insiders call the “human layer” of digital transformation: education, safety, and genuinely inclusive access.

This focus isn’t accidental. Pakistan’s own digital journey has been characterized by stark contradictions. The country boasts over 125 million internet users and a thriving freelance economy that generates hundreds of millions in annual remittances, yet nearly 40% of its population remains offline, trapped on the wrong side of infrastructure, affordability, and literacy barriers. These domestic realities have made Khawaja’s ministry acutely aware of the gap between digital policy rhetoric and ground-level implementation—a gap the DCO digital economy goals must address if the organization wants to maintain credibility.

Pakistan Digital Transformation 2026: Ambition Meets Implementation Challenges

Pakistan’s assumption of the DCO presidency coincides with its own aggressive domestic digital agenda. The government’s “Digital Nation Pakistan” initiative—a sweeping framework unveiled in late 2025—aims to bring 50 million additional Pakistanis online by 2028 while quadrupling the IT services export sector to $15 billion annually. The DCO chairmanship offers Islamabad an opportunity to beta-test these initiatives on a regional scale while learning from peer countries facing similar challenges.

The priorities Pakistan has outlined for its DCO tenure reflect this dual focus on domestic transformation and regional cooperation:

Digital Education Infrastructure: Pakistan plans to champion the creation of a DCO-wide framework for digital literacy, drawing on successful models like Bangladesh’s “Learning Passport” initiative and adapting them for contexts where internet penetration remains sporadic. The goal is to create portable, standardized digital credentials that allow workers to move seamlessly across DCO member labor markets—a potentially revolutionary shift for regional economic integration.

Cybersecurity and Online Safety: With DCO member states experiencing a 340% increase in ransomware attacks between 2022 and 2025, according to cybersecurity data compiled by Forbes, Pakistan’s presidency will prioritize the establishment of a regional Computer Emergency Response Team (CERT) network. This infrastructure would allow real-time threat intelligence sharing—critical for countries that lack the resources for sophisticated independent cyber defense capabilities.

AI Collaboration and Governance: Perhaps most ambitiously, Pakistan intends to use its DCO platform to advocate for what Khawaja has termed “AI pluralism”—the principle that artificial intelligence development should reflect diverse cultural values and developmental priorities rather than converging on a single Western or Chinese model. This aligns with Pakistan’s own experimentation with large language models trained on Urdu and regional languages, an effort that has attracted interest from other Global South nations frustrated by English-language AI hegemony.

How Pakistan’s DCO Leadership Boosts Global Digital Inclusion: The Geopolitical Calculus

For observers tracking the evolving digital world order, Pakistan’s DCO presidency matters for reasons that transcend the organization’s specific policy agenda. The country occupies a strategic position in multiple overlapping technology ecosystems: it’s a major recipient of Chinese digital infrastructure investment through the Belt and Road Initiative, maintains deep technical partnerships with Turkey and the Gulf states, and retains significant educational and business ties to Western tech ecosystems through its vast diaspora.

This positioning allows Pakistan to serve as what diplomatic theorists call a “hinge state” in digital governance debates—capable of translating between competing visions of internet governance and potentially brokering compromises that pure regional blocs cannot achieve. The DCO digital inclusion agenda that emerges under Pakistan’s leadership will test whether this theoretical advantage translates into practical policy innovation.

Early indications suggest cautious optimism. Pakistan’s Ministry of IT has already convened working groups on three priority areas: establishing minimum standards for algorithmic transparency in government services, creating mutual recognition frameworks for digital identity systems, and developing shared protocols for cross-border data flows that balance privacy protection with economic efficiency. These aren’t revolutionary proposals, but they represent the kind of incremental technical diplomacy that can yield lasting institutional benefits.

The geopolitical implications extend beyond the DCO itself. If Pakistan can demonstrate effective digital multilateralism, it strengthens the case for middle-power leadership on technology governance at venues like the United Nations and the G20. Conversely, a presidency that produces only vague communiqués and unimplemented action plans would reinforce skepticism about whether emerging markets can move beyond grievance-based tech politics to constructive institution-building.

The Economist’s Take: Can Digital Cooperation Overcome Political Fragmentation?

Skeptics—and they are numerous—point to the DCO’s fundamental structural challenge: its members agree on the problem (Western digital dominance) far more than they agree on solutions. Saudi Arabia’s vision of digital development emphasizes state-directed megaprojects and close integration with Western tech giants. Pakistan’s approach favors distributed innovation and regulatory frameworks that empower local entrepreneurs. Jordan prioritizes becoming a regional tech services hub. These aren’t necessarily incompatible visions, but they create coordination problems that no single presidency can fully resolve.

Moreover, the DCO operates in an increasingly hostile geopolitical environment. U.S.-China tech decoupling creates pressure for countries to choose sides in ways that cut across DCO membership. India’s conspicuous absence from the organization—despite its obvious interests in digital governance—reflects concerns about associating too closely with Saudi and Gulf-led initiatives. And domestic political instability in several member states raises questions about whether governments can maintain consistent long-term digital strategies.

Yet these challenges also create opportunities. The very fragmentation of global digital governance—what scholars call the “splinternet”—increases demand for bridge institutions that can facilitate cooperation without requiring full alignment on values or political systems. The DCO’s emphasis on practical, technical cooperation rather than grand ideological projects positions it well for this role, particularly if Pakistan’s presidency can demonstrate tangible deliverables.

Looking Ahead: The 2026 Agenda and Beyond

As Pakistan settles into its DCO chairmanship, several concrete initiatives will test the organization’s effectiveness:

The planned launch of a DCO Digital Skills Certification Program in Q3 2026, designed to create portable credentials for tech workers across member states, will indicate whether the organization can move beyond policy documents to operational programs. Pakistan’s Ministry of IT is already piloting the framework with 5,000 students across three technical universities, with plans to scale to 100,000 participants by year-end if the model proves viable.

A proposed DCO Cybersecurity Fund, capitalized with $200 million in initial commitments, would provide grants and technical assistance to members building out national cyber defense capabilities. Pakistan is lobbying Gulf states to anchor the fund, leveraging its traditional diplomatic ties in the region.

Perhaps most significantly, Pakistan intends to use its presidency to convene the first-ever DCO summit on AI governance in Islamabad during November 2026. The gathering would bring together not just government officials but technologists, civil society representatives, and private sector leaders to hash out common approaches to algorithmic accountability, bias mitigation, and the ethical deployment of AI systems in contexts where regulatory capacity remains limited.

These initiatives operate on different timescales and face varying probability of success. But collectively, they represent an attempt to build what development economists call “institutional thickness”—the layered relationships and shared practices that allow cooperation to persist even when political headwinds shift.

The Bottom Line: Digital Sovereignty Meets Practical Multilateralism

Pakistan’s assumption of the Digital Cooperation Organization presidency arrives at a moment when digital governance feels simultaneously more urgent and more intractable than ever. The promise of technology to accelerate development and empower citizens competes with mounting evidence of surveillance capitalism, algorithmic discrimination, and the consolidation of digital power in the hands of a few platform giants.

The DCO won’t solve these dilemmas. No single organization can. But under Pakistan’s leadership, it has the opportunity to demonstrate that middle powers can craft pragmatic, culturally informed approaches to digital policy that serve their citizens’ needs without simply choosing between Washington’s market fundamentalism and Beijing’s digital authoritarianism.

Shaza Fatima Khawaja’s challenge is to convert the organization’s aspirational rhetoric into measurable progress—whether that’s thousands of newly certified tech workers, reduced cyber vulnerability across member states, or simply more robust dialogue on AI ethics that centers Global South perspectives. These would be modest achievements by the standards of revolutionary digital transformation, but meaningful ones nonetheless.

As the world fragments into competing digital blocs, the success or failure of institutions like the DCO will help determine whether technology becomes a force for global integration or further fragmentation. Pakistan’s year at the helm offers a chance to tip the scales toward cooperation. Whether Islamabad can deliver on that promise will become clear long before the next presidency rotates in February 2027.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Brazil’s Rare Earth Race: US, EU, and China Compete for Critical Minerals as Tensions Rise

Beneath Brazil’s red earth lies a geopolitical powder keg that few Americans are paying attention to. While Washington obsesses over microchip factories and supply chain resilience, a more fundamental struggle is unfolding in South America—one that will determine whether the United States can credibly compete in the clean energy economy it claims to champion.

The prize is rare earth elements, the unglamorous but indispensable minerals that power everything from the iPhone in your pocket to the guidance systems in Patriot missiles. And in this contest for Brazil’s largely untapped reserves, America is discovering an uncomfortable truth: when it comes to securing the resources that will define the 21st century, we’re arriving late, spending reluctantly, and competing against a Chinese government that planned for this moment decades ago while we were distracted by other priorities.

The competition reached a new inflection point in recent months as diplomatic tensions, investment pledges, and competing visions for resource development collided in Brasília. What’s at stake extends far beyond mining rights: control over rare earths means control over the technologies that will define the 21st century, from wind turbines and electric vehicles to advanced weapons systems and renewable energy infrastructure.

Brazil’s Hidden Wealth: A Strategic Asset in Plain Sight

Brazil sits atop approximately 21 million tons of rare earth reserves, making it the world’s second-largest holder of these critical minerals after China’s commanding 44 million tons, according to data compiled by industry analysts. Yet despite this geological fortune, Brazil produces less than one percent of the world’s rare earths—a stark disconnect that has captured the attention of global powers seeking to reduce their dependence on Chinese supply chains.

The irony is not lost on Brazilian officials. “We have the resources beneath our feet that the world desperately needs,” remarked one mining industry executive in Minas Gerais, speaking on condition of anonymity. “The question is whether we can develop them fast enough, and with which partners.”

China currently controls approximately 70 percent of global rare earth mining and a staggering 90 percent of processing capacity, giving Beijing enormous leverage over supply chains that underpin everything from consumer electronics to military hardware. This dominance has prompted what analysts describe as the most significant rush for mineral security since the Cold War scramble for uranium.

America’s Belated Awakening

Washington’s engagement with Brazil rare earth deposits represents a dramatic strategic shift. For years, US policymakers largely ignored the vulnerabilities inherent in relying on Chinese-controlled rare earth supply chains. That complacency evaporated as tensions with Beijing escalated and the pandemic exposed the fragility of global supply networks.

The US has pledged between $465 million and $565 million to support Brazilian rare earth projects, with a particular focus on the Serra Verde operation in Goiás state—one of the largest undeveloped rare earth deposits outside China. This US investment in Brazil rare earths comes through a combination of Export-Import Bank financing, Development Finance Corporation support, and private sector partnerships facilitated by recent diplomatic engagement.

The timing is noteworthy. Relations between former President Trump and Brazilian President Luiz Inácio Lula da Silva were, to put it charitably, frosty. But as geopolitical realities shifted and both nations recognized their mutual interests in rare earth supply chain diversification, pragmatism has prevailed. Recent bilateral meetings have produced agreements on critical minerals cooperation, technology transfer, and environmental standards—though skeptics note that implementation remains uncertain.

“The Americans arrived late to the party,” observed a São Paulo-based geopolitical analyst, “but they’re trying to make up for lost time with checkbooks and promises of technological partnership.”

Europe’s Frustrations and China’s Long Game

The European Union, meanwhile, has found itself repeatedly outmaneuvered in what officials privately describe as a frustrating contest for Brazilian partnerships. Despite early interest and exploratory missions, EU China competition Brazil minerals has tilted toward Washington and Beijing, who have proven more willing to make concrete financial commitments and accept Brazil’s environmental conditions.

European representatives have complained, according to sources familiar with diplomatic exchanges, that US preemption of key deals has left the bloc scrambling for secondary opportunities. The EU’s Critical Raw Materials Act, announced with fanfare in 2023, aimed to secure diverse supply sources—but translating policy into projects has proven challenging when competitors move faster with larger financial packages.

China, for its part, has pursued what analysts call a “patient capital” strategy. Unlike the US with its recent surge of interest, Chinese companies have maintained a presence in Brazilian mining for over a decade. They’ve built relationships, navigated local politics, and positioned themselves as reliable partners unconcerned with the geopolitical lectures that sometimes accompany Western investment.

A recent report by the Center for Strategic and International Studies highlighted China’s methodical approach: securing minority stakes in multiple projects, offering processing technology that Brazil lacks, and coupling mineral investments with broader infrastructure development. “Beijing understands that influence is built through sustained engagement, not just one-off deals,” the report noted.

Brazil’s Delicate Balancing Act

Caught between competing suitors, Brazil has adopted what observers describe as a “multi-alignment strategy”—accepting investments from all sides while committing exclusively to none. President Lula’s administration has signaled openness to partnerships with the US, EU, and China, calculating that competition among external powers serves Brazilian interests by driving up investment and allowing Brasília to set terms.

This approach carries risks. Some Brazilian mining executives worry that trying to please everyone might result in regulatory gridlock or competing standards that slow development. Environmental groups, meanwhile, fear that the rush for Brazil critical minerals will override the country’s forest protection commitments and indigenous rights—concerns that have already slowed permitting for several projects.

Brazil’s Environmental Ministry has imposed stringent requirements on rare earth mining operations, including detailed impact assessments and community consultations. While these safeguards align with international best practices, they’ve frustrated investors accustomed to faster timelines. “Every month of delay is a month China extends its dominance,” warned one American executive working on rare earth supply chain diversification.

Yet Brazil’s cautious approach may prove prescient. The rare earth industry carries significant environmental risks—processing generates radioactive waste and toxic runoff. Moving too quickly could trigger the kind of ecological disasters that have plagued Chinese rare earth operations, undermining both local support and international partnerships.

The Economic and Security Stakes

The implications of this three-way competition extend well beyond quarterly earnings reports. Rare earth elements are essential for manufacturing permanent magnets used in electric vehicle motors, wind turbine generators, and a host of consumer electronics. They’re equally critical for defense applications: precision-guided missiles, jet engines, satellite communications, and radar systems all depend on rare earth components.

A comparison of global rare earth positions illustrates the challenge:

| Country/Region | Reserves (Million Tons) | Production Share | Processing Capacity |

|---|---|---|---|

| China | 44 | 70% | 90% |

| Brazil | 21 | <1% | Minimal |

| United States | 2.3 | ~15% | <10% |

| European Union | 1.2 | <1% | <5% |

This table, based on industry data compiled by Bloomberg and specialist mining analysts, reveals the enormous gap between potential and production. Brazil possesses roughly half of China’s reserves but produces a fraction of one percent of global output—a disparity that both represents opportunity and highlights the scale of investment required.

For the United States and European Union, reducing dependence on China rare earth dominance Brazil represents more than economic efficiency—it’s a national security imperative. Trade tensions between Washington and Beijing have already produced tariff wars, technology export controls, and sanctions that have rattled global markets. The prospect of China restricting rare earth exports as leverage, as it did briefly in 2010 during a territorial dispute with Japan, haunts Western defense planners.

“Imagine a scenario where conflict erupts over Taiwan,” suggested a retired Pentagon official now consulting on critical minerals strategy. “Within days, China could choke off rare earth supplies to the West. Our weapons systems would face severe component shortages within months. Brazil offers a partial solution—if we can help them develop production capacity quickly.”

Challenges on the Ground

Yet transforming Brazil’s geological potential into actual production faces formidable obstacles. Infrastructure remains inadequate in many mining regions, with poor roads and limited power supplies complicating operations. Brazil lacks the processing technology that China has refined over decades, meaning raw materials often need to be shipped abroad for refinement—defeating much of the supply chain diversification purpose.

Labor and expertise shortages present another challenge. Rare earth mining and processing require specialized skills that Brazil’s workforce currently lacks in sufficient numbers. Training programs and technology transfers are part of the US and EU investment packages, but developing expertise takes time.

Then there’s the question of market economics. China’s dominance has allowed it to control pricing, occasionally flooding markets to make competing projects financially unviable. Brazilian operations, with higher startup costs and smaller initial scales, could struggle to compete if Beijing decides to undercut prices strategically.

Environmental regulations, while crucial for sustainable development, add complexity and delay. The Serra Verde project, despite significant US backing, has faced repeated permitting challenges as regulators assess water usage impacts and community displacement concerns. Indigenous groups have filed legal challenges to several proposed mining operations, arguing that consultation processes were inadequate.

Looking Ahead: A Multipolar Mineral Future?

As trade tensions loom and the competition for Brazil’s rare earths intensifies, the ultimate outcome remains uncertain. The most likely scenario, according to geopolitical analysts at the Eurasia Group, involves all three powers maintaining some presence in Brazil’s rare earth sector, with different companies and projects aligned with different external partners.

This multipolar arrangement could serve Brazil’s interests by maximizing investment and limiting any single power’s leverage. But it could also create coordination challenges, competing standards, and political complications as global tensions ebb and flow.

What’s clear is that the quiet race for Brazil’s underground wealth has only just begun. As one Brazilian mining ministry official put it, leaning back in his Brasília office: “The world spent the last decade waking up to the rare earth problem. Now they’re all knocking on our door at once. We intend to answer carefully—but we will answer.”

For the United States, European Union, and China, Brazil represents a crucial test of their respective models for resource diplomacy. Washington offers financial muscle and security partnerships. Brussels promises regulatory alignment and technology standards. Beijing provides patient capital and no-questions-asked engagement.

Brazil, blessed with geological fortune and cursed with the attention it brings, must choose its partners wisely. The decisions made in Brasília over the coming years won’t just determine who extracts minerals from Brazilian soil—they’ll help shape the balance of power for decades to come.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

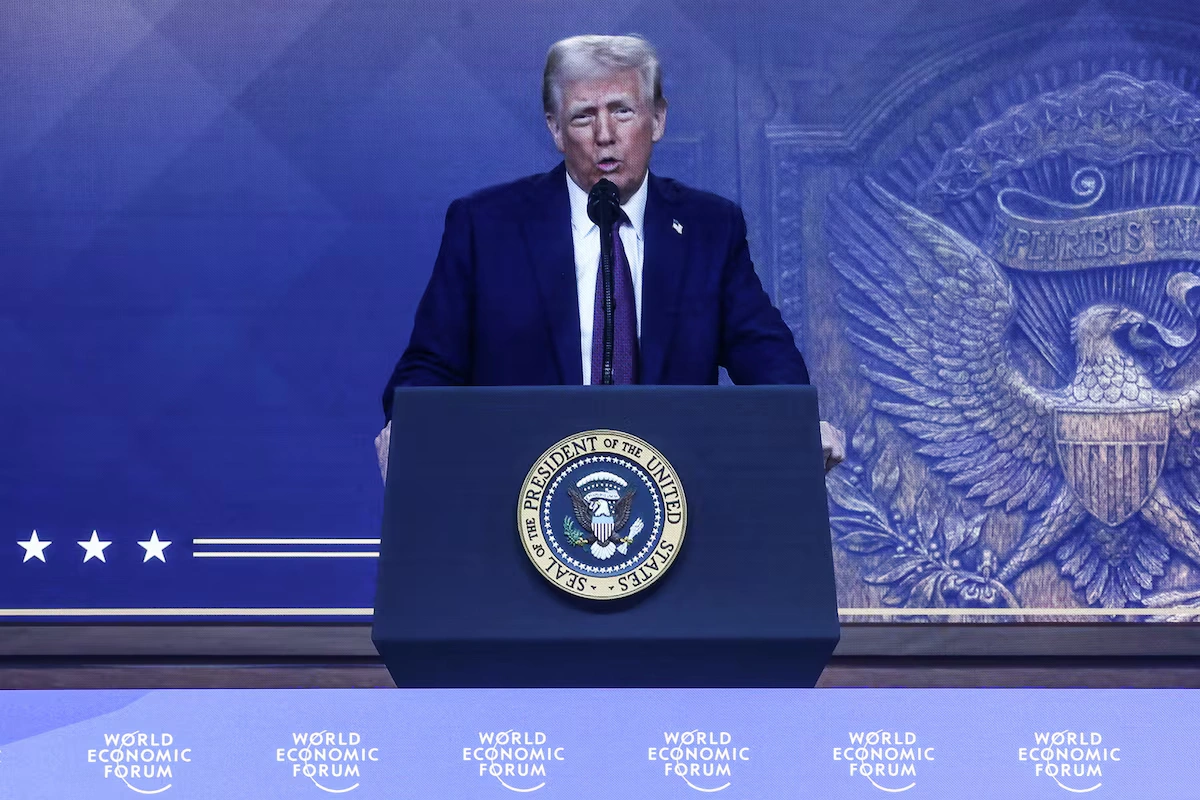

Trump Economy 2026: Americans’ Views Remain Negative on Health Care, Food Costs

One year after Donald Trump’s return to the White House, economic anxiety grips American households as persistent inflation, healthcare costs, and grocery bills dominate kitchen-table conversations—despite administration claims of progress.

Introduction: The Paradox of Perception and Policy

Twelve months into his second term, President Donald Trump confronts a stubborn political reality: Americans remain deeply pessimistic about the economy, even as some traditional indicators show resilience. According to Pew Research Center‘s comprehensive February 2026 survey, 72% of Americans rate current economic conditions as fair or poor—a striking repudiation of the administration’s economic messaging. More troubling for the White House, 52% of respondents say Trump’s policies have actually made economic conditions worse, not better.

This disconnect between presidential rhetoric and public sentiment reveals something fundamental about the American economy in 2026: headline statistics no longer capture the lived experience of working families. While stock markets have shown periods of strength and unemployment remains relatively low, the relentless pressure of everyday costs—healthcare premiums, grocery bills, energy expenses—has created what economists call a “vibecession,” where negative perceptions persist regardless of macroeconomic data.

The numbers tell a compelling story. Seventy-one percent of Americans express serious concern about healthcare costs, while 66% worry intensely about food and consumer goods prices, according to Pew’s findings. These aren’t abstract anxieties; they reflect real household budget pressures that have reshaped American economic behavior and political calculations heading into the 2026 midterm elections.

Persistent Economic Pessimism: The Data Behind the Discontent

The breadth of negative economic sentiment extends across multiple polling organizations, creating a consistent portrait of American dissatisfaction. Gallup‘s latest tracking shows Trump’s economic approval hovering between 36-40%, with a particularly damaging net disapproval rating of -23 specifically on inflation management. The Quinnipiac University Poll reports similar findings, with just 37% approving of the president’s economic handling.

Perhaps most revealing is consumer sentiment data from the University of Michigan, which registered 57.3 in February 2026—near historic lows that typically accompany recessions. This metric, closely watched by economists and policymakers, measures how confident Americans feel about their financial future and willingness to make major purchases. The current reading suggests profound uncertainty about economic prospects.

A CBS News survey underscores this pessimism: only 22% of Americans expect a booming economy in the near term. This contrasts sharply with the optimism that characterized Trump’s first term in early 2017, when consumer confidence surged following his election. The reversal suggests that Americans have adjusted their expectations downward, potentially reflecting accumulated frustration from years of inflation that began during the pandemic and has proven more persistent than experts predicted.

According to The Economist‘s approval tracker, Trump’s net rating stands at -15, a significant deficit that reflects broader dissatisfaction with his economic stewardship. Meanwhile, The Wall Street Journal reported that 57% of Americans view the economy as weak—a damning assessment that undermines the administration’s claims of economic revival.

Rising Costs of Essentials: Where Americans Feel the Squeeze

Healthcare: The Unrelenting Burden

Healthcare costs remain the paramount concern for American families, with 71% expressing serious worry according to Pew Research. This anxiety is well-founded. Insurance premiums have continued their multi-decade climb, with family coverage now averaging over $25,000 annually for employer-sponsored plans—of which workers typically shoulder $7,000-$8,000 in premiums alone, before deductibles and out-of-pocket expenses.

The Trump administration’s approach to healthcare policy—including continued efforts to reshape the Affordable Care Act and proposals to restructure Medicaid—has created additional uncertainty. Prescription drug costs, despite some legislative efforts to cap insulin prices and allow Medicare negotiation, remain substantially higher than in comparable developed nations. For millions of Americans, medical debt continues to be a leading cause of personal bankruptcy, a uniquely American phenomenon among wealthy nations.

Brookings Institution researchers note that healthcare cost anxiety transcends partisan lines, affecting Republicans, Democrats, and independents nearly equally. This universal concern makes it a potent political issue, yet one that has proven notoriously difficult to address through policy reforms that satisfy diverse stakeholders.

Food and Consumer Goods: Grocery Bills as Economic Barometers

Sixty-six percent of Americans express serious concern about food and consumer goods prices—an anxiety rooted in daily experience at checkout counters nationwide. While headline inflation has moderated from 2022-2023 peaks, food prices remain significantly elevated compared to pre-pandemic levels. Common staples like eggs, bread, dairy products, and meat have seen cumulative price increases of 25-35% since 2020, according to Bureau of Labor Statistics data.

This “grocery inflation” has proven particularly stubborn and politically salient. Unlike gasoline prices, which fluctuate visibly and can decline dramatically, food prices rarely decrease in absolute terms; they simply rise more slowly during periods of moderating inflation. This creates a persistent affordability challenge for families, especially those in lower and middle income brackets who spend proportionally more of their budgets on food.

The Washington Post analysis reveals that Americans’ inflation expectations remain elevated, suggesting they anticipate continued price pressures. This psychology can become self-fulfilling, as businesses maintain pricing power when consumers expect increases, and workers demand higher wages to compensate for anticipated cost-of-living jumps.

Consumer goods beyond food—electronics, clothing, household items, vehicles—have experienced variable price trajectories. Supply chain normalization has eased some pressures, yet tariff policies implemented during Trump’s second term have introduced new costs on imported goods, particularly from China and other Asian manufacturing centers. These tariffs, designed to protect American industries and generate revenue, function as consumption taxes that ultimately fall on American households.

Policy Impacts and Public Sentiment: Assigning Responsibility

The most politically damaging finding for the Trump administration may be the attribution of blame. Pew Research found that 52% of Americans believe Trump’s policies have worsened economic conditions—a direct repudiation of the president’s economic agenda. This represents a significant shift from his first term, when economic performance generally received more favorable reviews, at least until the pandemic disrupted commerce in 2020.

What explains this negative assessment? Several policy domains appear to be driving discontent:

Tariff and Trade Policy: Trump’s renewed embrace of tariffs, implemented more aggressively in his second term than his first, has generated both retaliation from trading partners and measurable price increases for consumers. Economic modeling suggests these tariffs have added hundreds of dollars annually to typical household costs.

Tax and Fiscal Policy: While corporate tax rates remain at levels established during Trump’s first term, proposed changes to individual taxation and entitlement programs have generated anxiety, particularly among seniors and near-retirees concerned about Social Security and Medicare sustainability.

Regulatory Approach: Deregulation in financial services, environmental protection, and consumer safeguards has created concerns about corporate accountability and long-term economic stability, even as business groups applaud reduced compliance burdens.

Federal Reserve Relations: Trump’s public criticism of Federal Reserve policies and interest rate decisions—a continuation of behavior from his first term—has raised questions about central bank independence and the credibility of inflation-fighting efforts.

Forbes analysis suggests that the administration’s messaging challenges stem partly from a mismatch between traditional Republican economic priorities (tax cuts, deregulation, reduced government spending) and the immediate concerns of working-class voters who prioritize cost-of-living relief and job security over abstract growth metrics.

Comparative Context: Historical and International Perspectives

To understand the significance of current economic sentiment, historical comparison proves instructive. Consumer confidence at 57.3 ranks among the lowest readings outside official recession periods. During the Great Recession (2008-2009), sentiment plummeted to the 50s and even lower, reflecting genuine economic catastrophe with massive job losses and collapsing home values. The current reading suggests Americans feel comparable anxiety despite relatively stable employment conditions—a testament to inflation’s psychological impact.

Internationally, American economic pessimism stands out. Financial Times reporting indicates that consumer confidence in European Union countries, while below pre-pandemic levels, generally exceeds American sentiment. This suggests that inflation’s political fallout has been particularly severe in the United States, possibly because Americans experienced sharper pandemic-era price spikes and have fewer social safety nets to cushion cost-of-living pressures.

The political consequences of economic sentiment are historically clear: incumbent parties suffer in midterm elections when economic perceptions are negative. The 2026 midterms loom as a potential referendum on Trump’s economic stewardship, with control of Congress hanging in the balance. Democrats have made cost-of-living concerns central to their messaging, while Republicans have attempted to shift focus to immigration, crime, and cultural issues—a tacit acknowledgment of difficult economic terrain.

Demographic Divides: Who Feels the Pain Most Acutely?

Economic anxiety is not evenly distributed across American society. Pew and other surveys reveal important demographic patterns:

Income Stratification: Lower and middle-income households express substantially greater concern about costs than affluent Americans. For families earning under $50,000 annually, healthcare and food costs can consume 40-50% of post-tax income, leaving minimal cushion for emergencies or savings. Upper-income households, while not immune to price increases, face less severe trade-offs.

Age Differences: Younger Americans (18-35) show particular anxiety about housing costs and student debt in addition to healthcare and food concerns. Older Americans (65+) focus intensely on healthcare, prescription drugs, and Social Security sustainability. Middle-aged Americans (35-65) often face compound pressures: supporting children, caring for aging parents, and saving inadequately for their own retirement.

Geographic Variation: Urban and suburban residents face different cost structures than rural Americans. Housing costs dominate urban budgets, while transportation and energy expenses weigh more heavily in rural areas. Regional variation in healthcare access and costs also shapes economic experience significantly.

Partisan Perspectives: Predictably, Democrats express more negative views of economic conditions under Trump than Republicans, but the Pew data shows that even among Republicans, enthusiasm is muted. Only about half of Republican identifiers rate current economic conditions as good or excellent—suggesting that partisan loyalty only partially insulates the president from economic dissatisfaction.

Looking Forward: Economic Prospects and Political Implications

As Trump’s second term reaches its midpoint, several factors will shape economic trajectories and public perceptions:

Inflation Path: The Federal Reserve’s success in sustainably returning inflation to its 2% target without triggering recession remains uncertain. Current projections suggest continued gradual moderation, but geopolitical risks—including energy market volatility and supply chain disruptions—could reignite price pressures.

Labor Market Evolution: Employment strength has provided a floor beneath consumer confidence. Should unemployment begin rising significantly, already-negative sentiment could deteriorate sharply. Conversely, sustained job growth with accelerating wage increases could eventually improve household finances and perceptions.

Policy Adjustments: Whether the Trump administration recalibrates its approach based on negative polling remains to be seen. Politically, the pressure to demonstrate tangible cost-of-living relief will intensify as midterm elections approach. However, presidents have limited short-term tools to reduce prices without triggering other economic disruptions.

Structural Challenges: Beyond immediate policy debates, American economic anxiety reflects deeper structural issues: healthcare system inefficiencies that produce world-leading costs with mediocre outcomes; housing undersupply that has made homeownership increasingly unattainable; educational credentialing that requires debt-financed investment; and wage stagnation relative to productivity growth over decades. No administration can solve these challenges quickly, yet voters understandably demand relief.

The New York Times‘ economic analysis suggests that absent significant policy shifts or unexpected favorable developments, negative economic sentiment is likely to persist through 2026. This creates a challenging political environment for Republicans defending congressional majorities and looking ahead to 2028 presidential positioning.

Conclusion: The Politics of Economic Perception in an Age of Anxiety

One year into Donald Trump’s second term, the verdict from American families is clear: economic conditions remain unsatisfactory, costs continue squeezing household budgets, and presidential policies have not delivered the relief voters anticipated. With 72% rating the economy as fair or poor, 71% worried about healthcare costs, and 66% concerned about food and consumer goods prices, the political foundations of Trump’s economic agenda appear shaky.

This disconnect between administration claims and public experience raises fundamental questions about economic policymaking in contemporary America. Traditional metrics—GDP growth, unemployment rates, stock market performance—no longer reliably predict political success when Americans feel financially insecure in their daily lives. The “vibecession” of 2026 demonstrates that perception is political reality, and that lived experience at grocery stores, pharmacies, and doctor’s offices outweighs abstract economic indicators.

For policymakers across the political spectrum, the message is unmistakable: Americans demand tangible relief from cost-of-living pressures, not statistical reassurances. Whether that relief comes through wage growth, price moderation, enhanced social programs, or some combination remains a central question for American political economy.

As midterm campaigns intensify and voters prepare to render their judgment on Trump’s economic stewardship, one certainty emerges: economic anxiety will drive political outcomes, potentially reshaping congressional power and setting the stage for the 2028 presidential race. The party that convincingly addresses Americans’ cost-of-living concerns may gain decisive political advantage in an era defined by economic uncertainty.

What are your biggest economic concerns right now? Share your perspective on healthcare costs, grocery bills, or financial anxieties in the comments below, and join the conversation about America’s economic future.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

The Great Convergence: Why VASP Governance is the New Frontier of Prudential Risk

If you think your bank isn’t a crypto bank, look closer at your wire transfers. In 2026, every institution is a digital asset institution—whether they want to be or not.

The marriage certificate arrived quietly. No fanfare, no regulatory press conference—just a series of accounting bulletins, cross-border payment upgrades, and custody announcements that, taken together, signaled something profound: traditional finance and digital assets are no longer dating. They’re cohabiting, sharing infrastructure, and—most critically—sharing risk.

For decades, banks treated cryptocurrency as someone else’s problem. A libertarian sideshow. A compliance headache best avoided. Yet by early 2026, the invisible rails connecting Wall Street to Web3 have become impossible to ignore. Tokenized Treasury bills flow through the same clearing systems as sovereign debt. Stablecoin settlements undergird cross-border trade finance. And when a poorly governed Virtual Asset Service Provider (VASP) collapses in Singapore, the contagion doesn’t stay in crypto—it ripples through correspondent banking networks from London to São Paulo.

Welcome to the era of institutional crypto compliance 2026: where prudential risk and digital asset governance are no longer separate disciplines, but two sides of the same regulatory coin.

The Invisible Integration: How Banks Became Crypto Banks

The transformation happened in layers, each one barely perceptible until the whole edifice shifted.

Layer One: The Custody Revolution

When the SEC issued Staff Accounting Bulletin 122 (SAB 122) in late 2023, reversing its earlier SAB 121 guidance, it eliminated a bizarre accounting penalty: banks could finally custody crypto assets without being forced to recognize them as liabilities on their balance sheets. The impact was seismic. Within eighteen months, institutions from BNY Mellon to State Street launched digital asset custody desks. By 2026, custodial crypto holdings at traditional financial institutions exceed $400 billion globally, according to PwC’s Global Crypto Report 2026.

Layer Two: Tokenized Instruments

The second layer arrived through tokenization—not of meme coins, but of mundane financial instruments. BlackRock’s BUIDL fund, launched in 2024, now holds over $1.5 billion in tokenized U.S. Treasuries. Franklin Templeton’s OnChain U.S. Government Money Fund processes settlements on Polygon and Stellar. These aren’t experiments; they’re operational infrastructure. And they’re governed not by DeFi protocols, but by the same prudential frameworks that regulate money market funds—with one crucial difference: the settlement rails involve VASPs.

Layer Three: The Stablecoin Settlement Web

Perhaps most invisibly, stablecoins have become the grease in international trade. A garment manufacturer in Bangladesh receiving payment from a retailer in Texas might never touch USDC directly—but their banks do. Cross-border wire transfers increasingly route through stablecoin rails for speed and cost efficiency, a practice turbocharged by the U.S. GENIUS Act’s regulatory clarity on dollar-backed tokens. The Bank for International Settlements estimates that by Q1 2026, stablecoin-mediated settlements account for 12% of cross-border commercial payments between non-sanctioned jurisdictions.

The implication? Every correspondent bank is now, functionally, exposed to VASP inherent risk assessment questions—even if they’ve never onboarded a single crypto-native client.

From Financial Crime to Prudential Stability: The Risk Paradigm Shift

For years, the regulatory conversation around crypto centered on anti-money laundering (AML) and combating the financing of terrorism (CFT). The Financial Action Task Force’s Travel Rule for VASPs was the regulatory pinnacle: ensure that virtual asset transfers carry the same identifying information as traditional wire transfers.

But 2026 marks a pivot. The new frontier isn’t just crime prevention—it’s prudential risk digital assets introduce to the financial system at large.

Liquidity Risk in Disguise

When a major VASP experiences a bank run—say, due to rumors about reserve adequacy—institutional clients don’t just lose access to crypto. They lose access to fiat liquidity channels. In March 2026, a Tier-2 VASP in the UAE faced withdrawal freezes after a smart contract exploit. Within 48 hours, three European banks flagged delayed settlements on tokenized asset redemptions. The Basel Committee on Banking Supervision is now drafting guidance that treats VASP counterparty exposure with the same capital weighting traditionally reserved for emerging market sovereign debt.

Operational Resilience Concerns

Unlike traditional banks, many VASPs operate on semi-decentralized infrastructure. A compromise in a widely used wallet-as-a-service provider doesn’t just affect retail users—it affects institutional treasuries holding tokenized assets. The European Banking Authority’s 2026 stress-testing framework now includes “VASP operational failure” scenarios alongside traditional market shocks.

Settlement Finality Ambiguity

Here’s the kicker: when does a blockchain transaction achieve legal finality? Six confirmations? Twelve? What if there’s a chain reorganization? Traditional finance has spent centuries perfecting settlement finality through legal frameworks. Digital assets introduce computational finality—and the two don’t always align. This isn’t theoretical. In January 2026, a deep chain reorg on a proof-of-stake network invalidated what institutional traders believed were settled positions, triggering margin calls that propagated through connected prime brokers.

The Regulatory Armory: MiCA, AMLA, and the GENIUS Act

Regulators haven’t been asleep. The twin pillars of Europe’s crypto regulation—the Markets in Crypto-Assets Regulation (MiCA) and the Anti-Money Laundering Authority (AMLA)—reached full implementation by January 2026. MiCA establishes authorization regimes, capital requirements, and investor protections for VASPs operating in the EU. AMLA provides direct supervisory oversight, breaking the previous patchwork of national regulators.

Across the Atlantic, the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) brought federal clarity to stablecoin issuance, requiring reserves be held in high-quality liquid assets and subject to monthly attestations. The result? A proliferation of compliant, bank-grade stablecoins—and an extinction event for shadowy offshore issuers.

Yet despite these advances, a governance gap remains. VASP risk assessment frameworks are maturing, but they’re not standardized. A VASP might pass muster under Singapore’s MAS licensing yet fail basic operational resilience tests under EU standards. For banks with global custody operations, this creates a compliance Rubik’s Cube: which jurisdiction’s standards take precedence when a VASP serves clients in twelve countries?

The VASP Governance Frontier: What Best Practice Looks Like

Leading institutions are getting ahead of the curve by treating VASP relationships with the same rigor they apply to critical outsourcing partners.

Tiered Due Diligence

BNY Mellon’s digital asset unit reportedly maintains a three-tier classification for VASP counterparties:

- Tier 1: VASPs with bank-grade governance, external audits, and regulatory licenses in major jurisdictions.

- Tier 2: Emerging VASPs with solid infrastructure but limited regulatory history.

- Tier 3: Prohibited—VASPs operating in high-risk jurisdictions or with opaque ownership structures.

Real-Time Monitoring

JPMorgan’s Onyx division employs blockchain analytics not just for transaction screening, but for monitoring VASP reserves in real-time. If a VASP’s on-chain reserve ratio falls below thresholds, automated alerts trigger relationship reviews. This represents a paradigm shift: from periodic due diligence to continuous risk assessment.

Contractual Innovations

Legal teams are embedding digital-asset-specific terms into custody agreements. What happens if a hard fork creates two competing versions of an asset? Who bears the risk of smart contract failure? Cutting-edge contracts now include “chain-split protocols” and “immutability warranties”—clauses that would have been science fiction in 2020.

Why This Matters Beyond Banking

The convergence of traditional prudential oversight and crypto-native governance isn’t just a banking story—it’s a story about the architecture of 21st-century finance.

Consider supply chain finance. A multinational’s treasury desk tokenizes receivables, making them tradable on secondary markets via a licensed VASP. If that VASP lacks robust operational controls, the multinational’s working capital liquidity becomes hostage to blockchain uptime. If regulators treat this as equivalent to traditional securitization risk, capital requirements shift. If they don’t, systemic vulnerabilities emerge.

Or consider central bank digital currencies (CBDCs). As sovereigns experiment with digital cash, they’re partnering with—you guessed it—VASPs and banks to build distribution infrastructure. The People’s Bank of China’s e-CNY relies on commercial banks as intermediaries. The European Central Bank’s digital euro pilots involve both banks and supervised VASPs. Prudential oversight of these entities isn’t a nice-to-have; it’s foundational to monetary sovereignty.

The Path Forward: Integration, Not Isolation

The lesson of 2026 is clear: institutional crypto compliance isn’t about building moats between traditional finance and digital assets. It’s about building bridges—secure, well-governed, auditable bridges.

Financial institutions that treat VASP relationships as afterthoughts will find themselves exposed to risks they don’t fully understand. Those that embed tokenized asset governance into their enterprise risk frameworks—treating it as seriously as credit risk or market risk—will be positioned to capture the efficiencies digital infrastructure offers without courting catastrophe.

The great convergence is here. The question isn’t whether your institution is a digital asset institution. It’s whether you’re governing it like one.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

-

Markets & Finance1 month ago

Markets & Finance1 month agoTop 15 Stocks for Investment in 2026 in PSX: Your Complete Guide to Pakistan’s Best Investment Opportunities

-

Global Economy1 month ago

Global Economy1 month agoWhat the U.S. Attack on Venezuela Could Mean for Oil and Canadian Crude Exports: The Economic Impact

-

Asia1 month ago

Asia1 month agoChina’s 50% Domestic Equipment Rule: The Semiconductor Mandate Reshaping Global Tech

-

Investment4 weeks ago

Investment4 weeks agoTop 10 Mutual Fund Managers in Pakistan for Investment in 2026: A Comprehensive Guide for Optimal Returns

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

-

Global Economy1 month ago

Global Economy1 month ago15 Most Lucrative Sectors for Investment in Pakistan: A 2025 Data-Driven Analysis

-

Banks3 weeks ago

Banks3 weeks agoBest Investments in Pakistan 2026: Top 10 Low-Price Shares and Long-Term Picks for the PSX

-

Global Economy1 month ago

Global Economy1 month agoPakistan’s Economic Outlook 2025: Between Stabilization and the Shadow of Stagnation