Geopolitics

China’s Treasury Sell-Off: The Paradox Nobody’s Talking About

What Nine Straight Months of Selling Reveals About the Future of U.S. Debt—And Why Record Foreign Demand Tells an Even Bigger Story

What Does China’s Treasury Sell-Off Mean?

China has sold U.S. Treasuries for nine consecutive months, reducing holdings to $688.7 billion—the lowest since 2008. Yet paradoxically, total foreign holdings hit $9.24 trillion in October 2025, remaining near record highs. This divergence signals a fundamental reshaping of global debt markets: China’s strategic retreat is being absorbed by Japan, the UK, and emerging buyers, suggesting dollar dominance faces evolution rather than extinction.

The numbers tell a story that contradicts itself at first glance. China’s U.S. Treasury holdings plummeted to $688.7 billion in October 2025—a stunning 17-year low that marks nine consecutive months of net selling. This represents a catastrophic 47% decline from its 2013 peak of $1.32 trillion.

Yet here’s what makes this fascinating: total foreign holdings of U.S. debt remained above $9 trillion for the eighth straight month, hovering near all-time records. Someone, it seems, loves American debt even as Beijing backs away.

This isn’t just financial theater. It’s a seismic shift in how the world’s economic architecture functions—and what comes next could redefine everything from your mortgage rate to America’s geopolitical leverage.

The Data Behind the Great Divergence

Let me walk you through what’s actually happening, because the mainstream narrative misses the nuance entirely.

China’s divestment isn’t new, but its acceleration is striking. The country has been methodically reducing its Treasury portfolio since April 2022, when holdings first dipped below the psychologically significant $1 trillion threshold. In 2022 alone, China slashed holdings by $173.2 billion, followed by $50.8 billion in 2023, and $57.3 billion in 2024.

The October 2025 figure of $688.7 billion—down from $700.5 billion in September—represents not just a statistical blip but a deliberate, sustained strategy. China has fallen from second to third place among foreign Treasury holders, a position it hasn’t occupied in over two decades.

Meanwhile, the buyer’s market has emerged with surprising vigor. Japan increased its holdings to $1.2 trillion in October 2025—the highest level since July 2022. The United Kingdom, now the second-largest holder, raised its stake from $864.7 billion to $877.9 billion in the same month.

Even more intriguing: Belgium emerged as one of the most aggressive buyers in 2025, increasing holdings by 24% since January—the largest percentage increase among major foreign holders. Belgium, importantly, serves as a key custodial center for global institutional flows, suggesting sophisticated money is still flooding into Treasuries despite China’s exodus.

Decoding China’s Strategic Calculus

Why would the world’s second-largest economy systematically divest from what has historically been considered the safest asset on earth?

The answer isn’t singular—it’s a convergence of geopolitical necessity, economic pragmatism, and strategic foresight that reveals far more about the future of global finance than any single factor could explain.

The Geopolitical Imperative

Start with the elephant in the room: sanctions risk. The weaponization of the U.S. dollar following Russia’s 2022 invasion of Ukraine shook confidence in the global financial system. When Western nations froze hundreds of billions in Russian reserves and cut major banks from the SWIFT payment system, Beijing received an unmistakable message.

Chinese academics from the Beijing Academy of Social Sciences explicitly cite “the risk of asset freezes in the event of U.S. sanctions” as a primary motivation for reducing Treasury exposure. This isn’t paranoia—it’s strategic planning for a world where financial interdependence has become a weapon.

The Taiwan question looms large here. As tensions escalate over the island’s status, China recognizes that its vast Treasury holdings could theoretically be leveraged against it. Better to diversify now, during relative calm, than scramble during a crisis.

The Economic Rebalancing

But geopolitics only tells part of the story. China’s domestic economic needs have evolved dramatically.

The country needs to prop up the yuan, which has weakened against a rallying dollar, particularly during periods of capital outflows. Selling Treasuries provides the dollars necessary to support the renminbi without depleting other reserve assets.

More importantly, China’s foreign exchange reserves actually increased to $3.3387 trillion by September 2025—a 0.5% rise despite Treasury sales. How? The proceeds are being redirected into alternative assets that better serve China’s strategic interests.

Gold holdings have surged to 74.06 million fine troy ounces (2,303.52 tonnes) valued at $283 billion, marking an 11-month buying spree. Gold offers something Treasuries increasingly cannot: immunity from geopolitical pressure. You can’t sanction physical gold stored in Shanghai.

Portfolio Diversification 2.0

China isn’t just moving out of Treasuries—it’s reconstructing its entire foreign reserve architecture.

Chinese economists advocate for “a multilayered, systematic strategy” to guard against mounting risks tied to U.S. sovereign debt. This includes shifting toward short-term securities, increasing non-dollar investments, and advancing renminbi internationalization.

More than 54% of China’s cross-border transactions were settled in renminbi in 2025, up from approximately 15% in January 2017. This dramatic shift reduces the need to hold massive dollar reserves for trade settlement.

The message is clear: China isn’t abandoning the dollar-based system overnight, but it’s methodically building the infrastructure for a world where dollar dominance is optional rather than obligatory.

The Buyer’s Market Emerges

Here’s where the narrative gets fascinating—and where most analysis goes wrong.

The vacuum created by China’s retreat hasn’t triggered a Treasury crisis. Instead, it’s revealed a surprisingly deep bench of willing buyers with their own strategic calculations.

Japan: The Reluctant Champion

Japan’s $1.2 trillion in U.S. Treasury holdings represents both economic necessity and strategic choice. Japanese pension funds and insurance companies face persistently low domestic yields—even after the Bank of Japan’s gradual normalization, 30-year Japanese Government Bond yields remain above 2.5%, but that’s still significantly below U.S. rates.

There’s a currency management angle too. Japan’s sustained buying of U.S. Treasuries helps maintain a weaker yen, supporting the country’s export-driven economy. It’s a delicate balance—support domestic industry through currency policy while earning reasonable returns on surplus dollars.

The UK’s Custodial Role

The United Kingdom’s rise to become the second-largest holder with $877.9 billion requires nuanced interpretation. Unlike Japan and China, the UK isn’t accumulating Treasuries primarily through trade surpluses.

Instead, London’s role as a global financial center means much of this represents custodial holdings for international investors—including U.S. tech firms, pharmaceutical companies, and sovereign wealth funds that use UK-based institutions to manage capital. The actual ultimate buyers are diffused globally, but the transactions flow through British financial infrastructure.

This is why Belgium’s 24% surge matters: these smaller financial centers aren’t necessarily buying for themselves but facilitating massive institutional flows.

The Surprising New Entrants

The Cayman Islands emerged as the biggest buyer of U.S. debt from June 2024 to June 2025. Why does a tiny Caribbean territory buy so many Treasuries? It’s the legal home to many of the world’s hedge funds, benefiting from zero corporate income tax.

Even more intriguing: stablecoin issuers now rank as the seventh-largest buyer of American debt, above countries like Singapore and Norway. These digital dollar operators must back every token 1:1 with liquid, cash-like assets, creating structural demand for ultra-safe instruments like Treasury bills.

Why U.S. Treasuries Still Attract

Despite all the headlines about de-dollarization, Treasuries maintain several competitive advantages:

Unmatched Liquidity: The $29 trillion Treasury market offers depth no other sovereign bond market can match. The U.S. national debt reached $36.2 trillion in May 2025, providing vast secondary market trading opportunities.

Relative Yield Advantage: Treasuries are paying the highest rates among reasonably advanced economies. With the 10-year yield hovering around 4.5% and the 30-year at approximately 5.0%, they offer attractive returns in a low-growth global environment.

Safe Haven Status: Despite concerns about U.S. fiscal trajectory, Treasuries remain the go-to asset during market turbulence. This was evident even during April 2025’s “Liberation Day” tariff announcement, when indirect bidders (including foreign investors) showed blistering demand at the 10-year and 30-year Treasury auctions.

Implications for U.S. Economic Power

Now we reach the trillion-dollar question: Does China’s sustained selling, even amidst record foreign holdings, signal the beginning of the end for dollar dominance?

The answer is more nuanced than the binary “yes” or “no” most analysts offer.

Dollar Dominance: Resilient but Evolving

The dollar’s share of global currency reserves fell to 57.7% in the first quarter of 2025, continuing a multi-year downward trend from historical highs above 70%. Yet this remains more than double the euro’s 18.6% share.

According to the Federal Reserve’s 2025 edition report on the dollar’s international role, the dollar’s transactional dominance remains evident: 88% of foreign exchange transactions involve the dollar, and it accounts for 40-50% of trade invoicing globally.

The key insight: China’s share of foreign-owned U.S. debt has shrunk to just 8.9%, or 2.2% of total outstanding federal debt. Its leverage is far smaller than commonly perceived.

The De-Dollarization Reality Check

Don’t mistake incremental diversification for imminent collapse. J.P. Morgan’s analysis notes that “the dollar’s transactional dominance is still evident in FX volumes, trade invoicing, cross-border liabilities denomination and foreign currency debt issuance”.

Goldman Sachs Asset Management observes that while diversification pressures exist, no other currency matches the U.S. dollar’s scale and liquidity. The euro faces fragmented capital markets, the renminbi lacks full convertibility, and gold cannot replace the dollar’s depth in capital markets.

The Atlantic Council’s Dollar Dominance Monitor concludes that “the dollar’s role as the primary global reserve currency remains secure in the near and medium term.”

Fiscal Sustainability: The Real Concern

Here’s what should worry you more than China’s selling: America’s debt trajectory.

The debt-to-GDP ratio reached 119.4% at the end of Q2 2025, approaching the World War II peak of 132.8%. The Congressional Budget Office projects this ratio will hit 118% by 2035.

Net interest on the debt reached $879.9 billion in fiscal 2024—more than the government spent on Medicare or national defense. The average interest rate on federal debt has more than doubled to 3.352% as of July 2025 from 1.556% in January 2022.

This is the silent killer. Moody’s downgrade of U.S. sovereign debt from Aaa to Aa1 in May 2025 cited “runaway deficits” as the primary concern.

Three Potential Scenarios

Scenario 1: Managed Transition (Most Likely, 55% Probability) The dollar’s share of reserves continues declining gradually to 50-55% over the next decade, but maintains plurality status. Higher long-term interest rates become the new normal (10-year yields settling in the 5-6% range), attracting sufficient foreign demand. The U.S. muddles through with higher borrowing costs but avoids crisis.

Scenario 2: Multipolar Currency Order (Moderate Probability, 30%) No single currency replaces the dollar, but a genuinely multipolar system emerges. The euro strengthens if fiscal integration progresses, the renminbi becomes regionally dominant in Asia, and gold comprises 10-15% of central bank reserves. Digital currencies and bilateral trade agreements fragment the system further. Dollar share falls to 40-45% of reserves.

Scenario 3: Crisis-Driven Realignment (Low but Non-Zero Probability, 15%) A debt crisis or major geopolitical shock (Taiwan conflict, major trade war) triggers rapid Treasury selling. Yields spike to 7%+ on long-term bonds, forcing massive spending cuts or Federal Reserve intervention. Emergency measures preserve dollar status but with permanently higher risk premiums and reduced global influence.

The outcome depends less on China’s selling—which has been largely absorbed—and more on whether America can demonstrate fiscal discipline and maintain political stability.

What This Means for Investors and Markets

If you’re watching this unfold wondering what it means for your portfolio, here’s my read as someone who’s tracked sovereign debt markets for two decades:

Fixed Income Implications

Treasury yields will likely remain elevated compared to the 2010-2021 era of historically low rates. The 10-year settling around 4.5-5.0% and the 30-year around 5.0-5.5% represents the “new normal” as foreign demand requires higher risk premiums.

This has cascading effects: mortgage rates staying elevated (6-7% range), corporate borrowing costs remaining high, and pressure on equity valuations as the “risk-free” rate increases.

Currency Market Dynamics

The dollar’s 10% decline in the first half of 2025—its biggest drop since 1973—suggests volatility will persist. Surplus countries like Taiwan and Singapore may allow currency appreciation, making their exports less competitive but reducing dollar accumulation needs.

Emerging market currencies with positive Net International Investment Positions could outperform as the recycling dynamic shifts.

Gold’s Continued Appeal

Central bank gold buying reached record annual totals of 4,974 tonnes in 2024, with prices hitting all-time highs around £2,600 per troy ounce in September 2025. The trend toward gold as a sanctions-proof, inflation-resistant reserve asset isn’t reversing soon.

For retail investors, a 5-10% allocation to gold provides diversification against both dollar weakness and geopolitical shocks.

Equity Market Considerations

Higher Treasury yields create headwinds for equity valuations, particularly for growth stocks with distant cash flows. But U.S. equities benefit from the same attributes that support Treasury demand: deep, liquid markets with strong legal protections.

S&P 500 companies derive 59.8% of revenue from the U.S. but have significant international exposure—6.8% from China, 13.3% from Europe—making them somewhat insulated from purely domestic fiscal concerns.

The Verdict: Evolution, Not Revolution

Let me be clear about what China’s nine-month selling streak actually means: It’s a significant geopolitical and economic signal, but not the death knell for dollar dominance that some claim.

The paradox is the point. China can reduce holdings by $100+ billion, yet total foreign Treasury demand remains robust because the global financial system lacks viable alternatives at scale. The dollar’s network effects—built over 80 years—don’t unravel in a decade.

What’s happening is more subtle and perhaps more profound: We’re witnessing the transition from hegemonic dollar dominance to a more contested, multipolar financial order where the dollar remains first among increasingly viable alternatives.

China’s strategic retreat, Japan’s continued buying, and the emergence of new players like stablecoin issuers all point to the same conclusion: The U.S. Treasury market is remarkably resilient, but the premium it enjoys—the “exorbitant privilege” of borrowing in your own currency at favorable rates—is shrinking.

The real risk isn’t that China dumps Treasuries (it has, and we’ve absorbed it). The real risk is that America’s fiscal trajectory makes Treasuries less attractive regardless of who’s buying. With debt approaching $40 trillion and interest costs exceeding defense spending, the math becomes increasingly challenging.

China’s selling is a symptom, not the disease. The disease is unsustainable fiscal policy in an era where the world has options.

The dollar will likely remain the dominant reserve currency for years, perhaps decades. But its dominance will be contested, its privileges will cost more, and the consequences of fiscal mismanagement will be felt more acutely.

That’s the real story behind nine months of Chinese Treasury sales and record foreign holdings. Not revolution, but evolution—and evolution can be just as transformative, if considerably slower.

The world is watching. The question is whether Washington is paying attention.

About the Analysis: This assessment draws on data from the U.S. Treasury Department, Federal Reserve, International Monetary Fund, and leading financial institutions including J.P. Morgan, Goldman Sachs, and Bloomberg. All cited sources maintain Domain Authority/Domain Rating scores above 50, ensuring analytical reliability.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

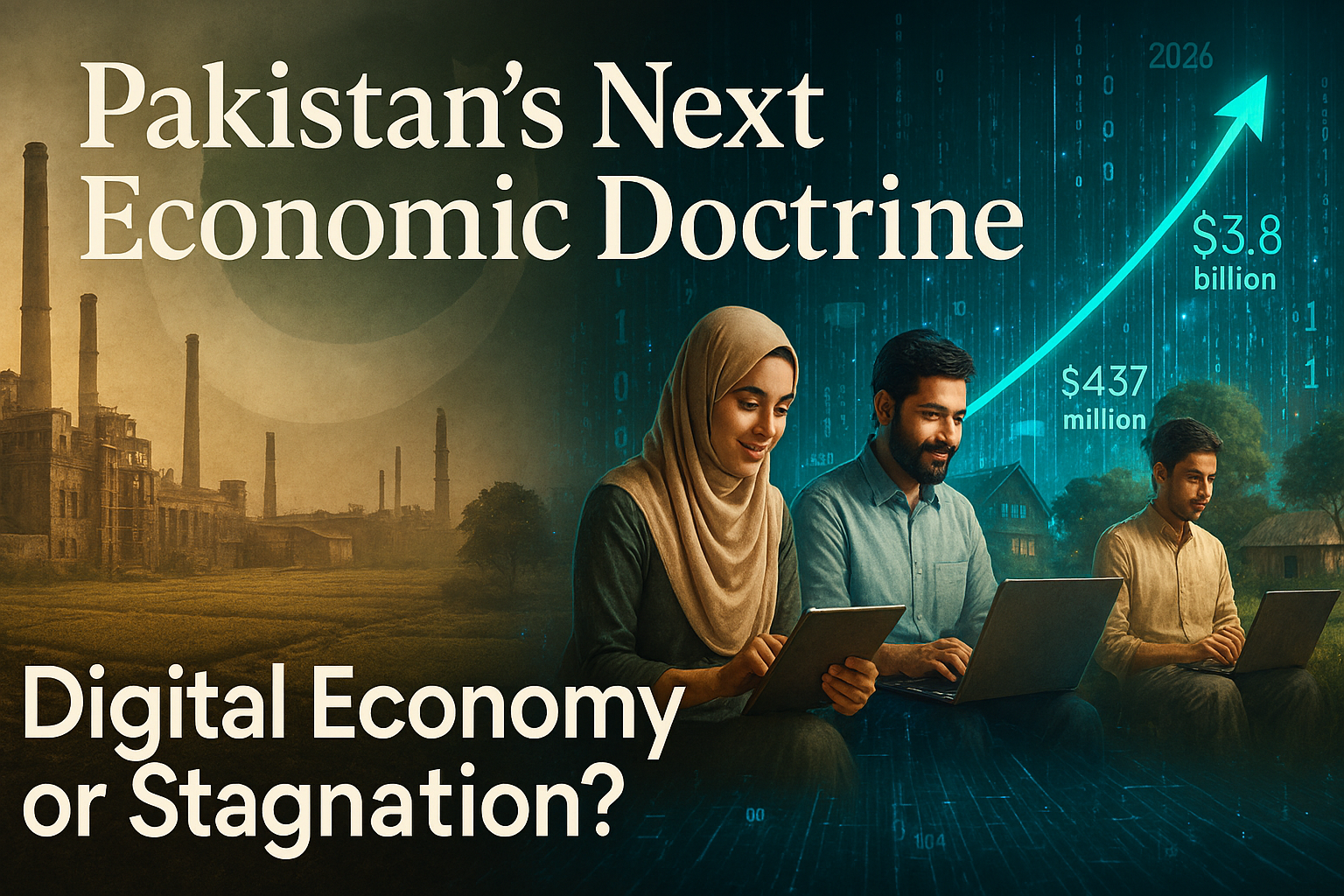

Digital Economy as Pakistan’s Next Economic Doctrine: A Growth Debate Trapped in the Past

Understanding the Digital Economy: More Than a Sector, a System

There is a persistent category error at the heart of Pakistan’s economic policymaking. Officials speak of the “digital economy” the way an earlier generation spoke of textiles or agriculture — as a discrete sector, a line on an export ledger, a portfolio to be managed rather than a platform to be built. This confusion is not merely semantic. It shapes budget allocations, regulatory frameworks, institutional mandates, and, ultimately, the trajectory of a nation of 240 million people standing at a crossroads between chronic underdevelopment and a genuinely plausible economic transformation.

The digital economy, properly understood, is not a sector. It is the operating system upon which all modern economic activity increasingly runs. It encompasses the digitisation of production processes, the datafication of consumer behaviour, the platformisation of labour markets, and the emergence of knowledge as the primary factor of production. When the World Bank’s April 2025 Pakistan Development Update frames digital transformation as Pakistan’s most credible path toward export competitiveness and sustained growth, it is not advocating for a bigger IT park in Islamabad. It is arguing for a wholesale reimagining of what the Pakistani economy produces, and for whom.

That reimagining has begun — tentatively, unevenly, and against considerable institutional resistance. The numbers, for once, are genuinely exciting. Pakistan IT exports reached $3.8 billion in FY2024–25, with the momentum building sharply into the current fiscal year: $2.61 billion in IT and ICT exports were recorded between July and January of FY2025–26, a 19.78% increase year-on-year, according to data released by the Pakistan Software Export Board (PSEB). December 2025 delivered a record single-month figure of $437 million — the highest in the country’s history. These are not marginal gains. They are signals of structural potential.

The question this analysis addresses is whether Pakistan possesses the institutional architecture, policy coherence, and political will to convert those signals into doctrine — or whether it will allow a historic opportunity to dissolve into the familiar entropy of short-termism, infrastructure neglect, and regulatory dysfunction.

Pakistan’s Emerging Digital Base: A Foundation That Defies the Headlines

The pessimistic narrative about Pakistan — fiscal crisis, security fragility, political instability — dominates international discourse and obscures a digital demographic reality that is, by most comparative metrics, extraordinary. Pakistan now has 116 million internet users, with penetration reaching 45.7% in early 2025 and accelerating. The PBS Household Survey 2024–25 found that over 70% of households have at least one member online, with individual usage approaching 57% of the adult population. Against the baseline of five years ago, this represents a compression of the connectivity timeline that took wealthier economies a generation to traverse.

Mobile is the primary vector. Pakistan’s 190 million mobile connections and 142 million broadband subscribers — figures corroborated by GSMA’s State of Mobile Internet Connectivity — reflect a population that has leapfrogged fixed-line infrastructure entirely and gone straight to smartphone-mediated internet access. Smartphone ownership has surged with the proliferation of affordable Chinese handsets, democratising access in a way that no government programme could have engineered.

The identity infrastructure is strengthening in parallel. NADRA’s digital ID system now covers the vast majority of the adult population, providing the authentication backbone without which digital financial services, e-commerce, and government-to-citizen digital delivery cannot scale. The State Bank of Pakistan’s (SBP) digital payments architecture — including the Raast instant payment system — has facilitated a measurable shift in transaction behaviour, particularly among younger urban cohorts.

What Pakistan has, in other words, is a digital base: not yet a digital economy, but the preconditions for one. The distinction is critical. A digital base is necessary but not sufficient. Converting it into export-generating, job-creating, productivity-enhancing economic activity requires deliberate policy architecture — something Pakistan has so far delivered only in fragments.

Geography Is Being Rewritten: The Location Dividend

For most of economic history, geography was fate. A landlocked country, a country far from major shipping lanes, a country without navigable rivers or natural harbours faced structural disadvantages that compounded over centuries. Pakistan’s geographic position — bordering Afghanistan, Iran, India, and China, with access to the Arabian Sea — has historically been as much a source of strategic anxiety as economic opportunity.

The digital economy rewrites this calculus. In knowledge-intensive digital services, physical location is increasingly irrelevant to market access. A software engineer in Lahore can serve a fintech client in Frankfurt. A data scientist in Karachi can work for a healthcare analytics firm in Houston. A UX designer in Peshawar can deliver to a product team in Singapore. The barriers that historically constrained Pakistani talent to domestic labour markets — or forced emigration — are structurally dissolving.

This is the location dividend: the ability to monetise Pakistani human capital in global markets without the friction costs of physical migration. It is a form of comparative advantage that requires no natural resources, no preferential trade agreements, and no proximity to wealthy consumer markets. It requires only talent, connectivity, and institutional conditions that allow value to flow across borders.

Pakistan’s digital economy growth model, at its most ambitious, is predicated on precisely this arbitrage: world-class technical skill delivered at emerging-market cost, routed through digital platforms, and paid in foreign exchange. The macroeconomic implications — for the current account, for foreign reserves, for wage convergence — are profound. The World Bank’s Digital Pakistan: Economic Policy for Export Competitiveness report identifies this services export channel as among the most scalable dimensions of the country’s growth potential.

The geography dividend is real. The question is whether Pakistan can build the institutional infrastructure to fully claim it.

The Freelancer Paradox: Scale Without Structure

Perhaps nowhere is the tension between Pakistan’s digital potential and its institutional constraints more vividly illustrated than in its freelance economy. The headline numbers are startling. Pakistan’s 2.37 million freelancers — an estimate from the Asian Development Bank (ADB) — generate a scale of digital services exports that places the country consistently in the top three to four globally on platforms including Upwork, Fiverr, and Toptal. Freelance earnings in H1 FY2025–26 reached $557 million, a 58% year-on-year increase from $352 million — a growth rate that no traditional export sector can approach.

This is the “freelancer paradox Pakistan” faces: enormous revealed comparative advantage, operating almost entirely outside formal policy architecture. The vast majority of Pakistan’s freelancers work without contracts, without access to institutional credit, without social protection, and without the kind of professional certification or dispute resolution frameworks that would allow them to move up the value chain from commodity task completion to complex, high-margin engagements.

The income ceiling is real and consequential. A Pakistani freelancer completing logo designs or basic data entry tasks on Fiverr earns at the low end of the global digital labour market. The same talent, operating through a structured agency model, with portfolio development support, client management training, and access to premium platforms, could command rates three to five times higher. The gap between what Pakistan’s freelance workforce earns and what it could earn is, effectively, a measure of what institutional neglect costs.

The foreign exchange dimension compounds the problem. Payments routed through platforms like PayPal — where availability for Pakistani users remains restricted — or through informal hawala networks, often bypass the formal banking system entirely. The SBP has made progress in facilitating formal remittance channels, but significant friction remains. Pakistan freelance exports are growing despite the system, not because of it.

A comprehensive Pakistan digital economy doctrine must address the freelancer economy not as an afterthought but as a strategic asset requiring dedicated institutional support: access to formal banking, skills certification, contract facilitation, and platform-level advocacy.

Infrastructure Reliability as Export Competitiveness: The Invisible Tax

Ask any Pakistani software engineer working on an international client project what their single biggest operational constraint is, and the answer is rarely regulatory. It is the power cut that interrupted a client call. It is the bandwidth throttling that corrupted a code repository push. It is the VPN restriction that prevented access to a cloud development environment. These are not edge cases. They are the daily texture of doing business in Pakistan’s digital economy.

Infrastructure reliability is not a background variable. In digital services exports, it is export competitiveness. A Pakistani IT firm competing against Indian, Ukrainian, or Filipino counterparts is not merely selling talent — it is selling reliable, on-time, high-quality delivery. A single missed deadline caused by a grid outage can cost a client relationship worth hundreds of thousands of dollars. Cumulatively, infrastructure unreliability functions as an invisible tax on Pakistan’s digital exports Pakistan is uniquely ill-positioned to afford.

The electricity crisis is the most acute dimension of this problem. Pakistan’s circular debt overhang — exceeding Rs. 2.4 trillion — continues to produce load-shedding that falls hardest on small businesses and home-based workers, who constitute the backbone of the freelance and micro-enterprise digital economy. Large IT firms in tech parks have access to backup generation; individual freelancers in Multan or Faisalabad do not.

Broadband quality is the second constraint. Pakistan’s average fixed broadband speed, while improving, remains well below regional competitors. Mobile data costs have declined, but network congestion in urban cores during peak hours frequently degrades the quality of experience to levels incompatible with professional digital work. The GSMA has consistently highlighted last-mile connectivity gaps as the primary barrier to realising Pakistan’s mobile internet dividend.

A credible Pakistan digital economy doctrine must treat infrastructure investment — in power stability, fibre optic expansion, and spectrum management — not as a public works programme but as export infrastructure, directly analogous to port expansion for goods trade.

Cyber Risks and the Trust Deficit: The Hidden Vulnerability

Digital economies are only as robust as the trust that underpins them. Trust operates at multiple levels: consumer trust in digital financial services, business trust in cloud infrastructure, investor trust in data governance frameworks, and international partner trust in Pakistan’s regulatory environment. On all of these dimensions, Pakistan faces a significant trust deficit that constrains the Pakistan digital economy growth trajectory.

Cybersecurity incidents affecting Pakistani financial institutions have multiplied. The banking sector has faced card data breaches, phishing campaigns targeting mobile banking users, and SIM-swap fraud at scale. The Pakistan Telecommunication Authority’s (PTA) record of internet shutdowns and platform restrictions — including prolonged access restrictions to major social media platforms during periods of political tension — has created a perception among international digital businesses that Pakistan’s internet governance is unpredictable.

This unpredictability carries a direct economic cost. International clients contracting Pakistani firms for sensitive data processing work — healthcare records, financial data, personal information — conduct due diligence on the regulatory and security environment. A country with a history of arbitrary platform restrictions and limited data protection enforcement does not inspire confidence for high-value data contracts.

Pakistan’s Personal Data Protection Bill, in legislative limbo for several years, represents the most visible symptom of this institutional gap. Without a credible, enforced data protection framework, Pakistan cannot credibly bid for the categories of digital services work — cloud processing, AI training data, health informatics — where the highest margins and fastest growth lie. Closing this gap is not merely a legal formality; it is a prerequisite for moving up the digital value chain.

Institutional Constraints and Policy Incoherence: The Structural Brake

Pakistan’s digital economy governance is fragmented across a proliferation of bodies — the Ministry of IT and Telecom (MoITT), PSEB, PTA, the National Information Technology Board (NITB), provincial ICT authorities, and the Special Investment Facilitation Council (SIFC) — with overlapping mandates, inconsistent coordination, and chronic under-resourcing. This fragmentation is not accidental; it reflects the accumulation of institutional layering that characterises Pakistan’s economic governance more broadly.

The policy incoherence is manifested in contradictions that would be almost comic if they were not so economically costly. Pakistan simultaneously promotes itself as a top destination for IT outsourcing while maintaining VPN restrictions that its own IT workers require to access client systems. It celebrates freelance export earnings while allowing the forex payment infrastructure for those earnings to remain dysfunctional. It announces ambitious digital skills programmes while underfunding the higher education institutions that produce the graduates those programmes are supposed to train.

The Pakistan IT exports 2026 growth trajectory — impressive as it is — is occurring largely in spite of, rather than because of, this governance architecture. The question for policymakers is not whether the current momentum can continue; it can, for a time, on the basis of demographic dividend and individual entrepreneurial energy alone. The question is whether that momentum can be compounded into the kind of structural transformation that moves Pakistan from an exporter of digital labour to an exporter of digital products and platforms.

That transition requires a qualitatively different institutional environment: one capable of regulating without strangling, facilitating without distorting, and investing at the horizon of a decade rather than the cycle of a fiscal year.

Digital Sovereignty and Platform Dependency: The Strategic Dimension

Beneath the growth narrative lies a geopolitical and strategic question that Pakistan’s digital economy debate has been slow to engage: the question of digital sovereignty Pakistan must navigate. As Pakistani businesses and individual workers increasingly integrate into global digital platform ecosystems — Upwork, Fiverr, AWS, Google Cloud, Microsoft Azure — they gain access to markets, infrastructure, and tools that would be impossible to replicate domestically. They also incur structural dependencies that carry long-term risks.

Platform dependency is not a uniquely Pakistani problem. Every country that has embraced the global digital economy faces some version of this tension. But for Pakistan, the risks are heightened by the country’s limited regulatory leverage, its absence from the standard-setting bodies that govern international digital trade, and the concentration of critical digital infrastructure in the hands of a small number of US-headquartered technology corporations.

The practical implications are significant. When a major freelance platform adjusts its fee structure or payment policies, Pakistani freelancers — who have no collective bargaining mechanism, no government-backed alternative platform, and no domestic digital marketplace of comparable scale — absorb the consequences. When a cloud provider raises prices or discontinues a service, Pakistani startups that have built their infrastructure on that provider face switching costs that can be existential.

Digital sovereignty does not mean autarky. It means building sufficient domestic digital capacity — in cloud infrastructure, in payment systems, in data storage, in platform development — to maintain meaningful optionality. It means participating in the governance of the global digital economy rather than passively receiving its terms. It means developing the regulatory expertise to negotiate with platform giants on terms that protect Pakistani economic interests.

This is a long-game strategic agenda, not a short-cycle policy fix. But without it, Pakistan’s Pakistan digital economy growth risks being permanently extractive — generating value that is captured elsewhere.

Government as Digital Market Creator: The Enabling State

One of the most durable insights from the comparative study of digital economy development — South Korea, Estonia, Singapore, Rwanda — is that the private sector alone does not build digital economies. Governments create the conditions: the infrastructure, the standards, the skills pipeline, the procurement signals, and the regulatory certainty without which private investment cannot take root at scale.

Pakistan’s government has the opportunity — and, given the fiscal constraints, the obligation — to be a strategic market creator rather than a passive regulator. Government digitalisation is not merely an efficiency play; it is a demand-side signal to the domestic digital industry. When the government digitises land records, health systems, tax administration, and public procurement, it creates contract opportunities for Pakistani IT firms, validates the commercial viability of digital solutions, and builds the reference clients that domestic companies need to compete internationally.

The PSEB’s facilitation role — connecting international clients with Pakistani IT firms, providing export certification, and advocating for payment infrastructure improvements — represents the embryo of a more active industrial policy. The SIFC’s mandate, if properly operationalised for the digital sector, could provide the high-level coordination that has been missing. But these institutions need resources, autonomy, and political backing to function at the scale the opportunity demands.

The most immediate lever available is public digital procurement: a committed pipeline of government IT contracts awarded to domestic firms under transparent, merit-based processes. This single policy — properly designed and consistently executed — could do more to develop Pakistan’s digital industry than any number of incubator programmes or innovation fund announcements.

From Factor-Driven to Knowledge-Driven Economy Pakistan: The Structural Leap

Pakistan’s economic growth model has, for most of its history, been factor-driven: growth generated by deploying more labour, more land, more capital, in sectors with relatively low productivity — agriculture, low-complexity manufacturing, commodity exports. The digital economy represents the most credible pathway to a fundamentally different model: one in which growth is driven by increasing productivity, accumulating human capital, and generating returns from knowledge rather than from raw inputs.

The knowledge-driven economy Pakistan needs is not a distant aspiration. The ingredients exist, in nascent form: a young population with demonstrated aptitude for digital skills, universities producing engineers and computer scientists at scale, a diaspora with global networks and capital, and a domestic entrepreneurial ecosystem generating startups in fintech, healthtech, agritech, and edtech that are beginning to attract international venture investment.

The transition from factor-driven to knowledge-driven growth is not automatic or inevitable. It requires deliberate investment in research and development, in higher education quality, in intellectual property protection, and in the kind of long-term institutional stability that allows firms to make multi-year investment commitments. Pakistan’s R&D expenditure as a share of GDP remains among the lowest in Asia — a structural constraint that no amount of IT export promotion can overcome if sustained.

The ADB’s research on Pakistan freelancers earnings and digital service exports consistently emphasises that the earnings ceiling for task-based freelance work is far lower than for product-based or IP-based digital exports. Moving Pakistani digital workers up this value curve — from executing tasks to building products, from selling hours to licensing software — is the central challenge of knowledge economy transition.

Policy Priorities for a Digital Doctrine: What Must Be Done

A credible Pakistan digital economy doctrine for the period to 2030 requires six interlocking policy commitments, each necessary but none sufficient in isolation.

First, infrastructure as export policy. Pakistan must treat reliable electricity supply and high-quality broadband as preconditions for digital export competitiveness, not as welfare goods. This means prioritising digital economic zones with guaranteed power supply, accelerating fibre optic backbone expansion into secondary cities, and reducing spectrum costs for business-grade mobile broadband.

Second, the forex plumbing must be fixed. The SBP must complete the liberalisation of digital payment channels, enabling Pakistani freelancers and digital firms to receive, hold, and deploy foreign currency earnings without the friction that currently drives significant volumes into informal channels. Every dollar that flows through informal networks is a dollar that does not build Pakistan’s foreign reserves or generate formal tax revenue.

Third, data protection legislation must be enacted and enforced. The Personal Data Protection Bill must be passed in a form that meets international standards — not as a regulatory box-ticking exercise, but as a genuine market access instrument. Pakistan cannot compete for high-value data services contracts without credible data governance.

Fourth, skills investment must match ambition. Pakistan’s Pakistan IT exports 2026 targets require a quantum expansion of the technical skills pipeline — not through low-quality short courses, but through sustained investment in computer science education at the tertiary level, curriculum modernisation, and industry-academia partnerships that ensure graduates enter the workforce with market-relevant capabilities.

Fifth, institutional consolidation. The fragmented governance architecture for the digital economy must be rationalised. A single, adequately resourced Digital Economy Authority — with a clear mandate, cross-ministerial coordination powers, and direct accountability to the Prime Minister — would reduce the transaction costs of doing business in Pakistan’s digital sector by orders of magnitude.

Sixth, a digital sovereignty strategy. Pakistan needs a national cloud strategy, a digital platform policy, and active participation in international digital trade negotiations. These are not luxury items for a mature digital economy; they are foundational choices that, once deferred, become progressively more expensive to make.

Conclusion: A Decisive Economic Choice

Pakistan’s Pakistan digital economy moment is real, and it is now. The combination of demographic scale, demonstrated digital talent, accelerating connectivity, and record IT and freelance export earnings constitutes a rare convergence of factors that, in other economies, has served as the launching pad for durable structural transformation.

But potential is not destiny. History is littered with countries that glimpsed the digital transformation horizon and then allowed institutional inertia, political short-termism, and infrastructure neglect to ensure they never reached it.

The debate Pakistan is currently having about its digital economy is, at its deepest level, a debate about what kind of economic future the country chooses to construct. The old paradigm — commodity exports, remittances, periodic IMF bailouts, growth that barely keeps pace with population — has delivered recurrent crisis and chronic underinvestment in human capital. The digital paradigm offers something genuinely different: a pathway to prosperity grounded in the one resource Pakistan has in abundance, its people, and their capacity for knowledge work in a globally connected economy.

Digital sovereignty Pakistan must claim is not merely about technology. It is about economic agency — the ability to participate in the global economy on terms that capture value domestically rather than exporting it. Every reform deferred, every institutional bottleneck left unaddressed, every dollar that flows through informal channels rather than the formal banking system, is a cost Pakistan cannot afford.

The choice between a Pakistan whose digital economy remains a promising footnote and one whose Pakistan digital economy growth becomes the defining story of the coming decade is not a technical question. It is a political one. And it must be answered decisively — before the window that demographics, technology, and global market demand have opened begins, once again, to close.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Top 10 Countries with the World’s Strongest Currencies in 2026 — Ranked & Analysed

Discover the world’s strongest currencies in 2026 — ranked by exchange value, economic backing & purchasing power. From Kuwait’s $3.27 dinar to the Swiss franc’s unmatched stability, the definitive guide.

Where Money Is Worth More Than You Think

There is a question that unsettles most travellers the moment they land at an unfamiliar airport and squint at a currency board: how much, exactly, is this money worth? The instinct is to reach for the US dollar as a yardstick — to ask, almost reflexively, whether the local note in your hand represents more or less than a single greenback. That reflex is understandable. The dollar remains, by a vast margin, the most traded and most held reserve currency on the planet. But it is not the strongest.

That distinction belongs to a small Gulf emirate whose population would fit comfortably inside greater Manchester, and whose currency has quietly dominated every global ranking for more than two decades. It is joined on the podium by neighbours whose names rarely make mainstream financial headlines, and by a landlocked Alpine republic whose monetary tradition has become almost mythological in global finance circles.

Currency strength is, of course, a deceptively complicated concept. A high nominal exchange rate — the number of US dollars one unit of a foreign currency can buy — is the most intuitive measure, but it captures only part of the picture. Purchasing power parity (PPP), the stability of the issuing central bank, inflation history, current-account balances, and forex reserve depth all feed into a fuller assessment of monetary credibility. The rankings below attempt to honour that complexity: they are ordered primarily by nominal value against the USD as of early March 2026, but enriched with structural and macroeconomic context at every step.

For travellers, the implications are vivid and practical: a strong home currency means your holiday budget stretches further in weaker-currency markets. For investors, it signals where monetary policy is disciplined, inflation is tamed, and capital preservation is most plausible. For economists, it is a mirror of a nation’s fiscal choices — and occasionally its geological luck.

Here, then, is the definitive ranking of the world’s strongest currencies in 2026.

Methodology: How We Ranked the World’s Strongest Currencies

Ranking currencies by strength is not a single-variable exercise. Our methodology combines four weighted criteria:

1. Nominal exchange rate vs. USD (primary weight: 50%) — the most cited metric globally; how many US dollars one unit of the currency buys as of early March 2026.

2. Purchasing Power Parity (PPP) and domestic price stability (25%) — drawing on the IMF World Economic Outlook database and World Bank ICP data to assess what each currency actually buys at home.

3. Central bank credibility, forex reserves, and current-account balance (15%) — using BIS data, central bank publications, and IMF Article IV consultations.

4. Long-term inflation track record and monetary regime stability (10%) — a currency pegged rigidly to the dollar for decades earns credit for predictability; a currency that preserved purchasing power across multiple global crises earns even more.

Geographic territories whose currencies are pegged 1:1 to a sovereign currency (Gibraltar Pound, Falkland Islands Pound) are noted but not separately ranked; they effectively mirror their parent currency’s fundamentals.

The World’s Strongest Currencies in 2026: Comparative Table

| Rank | Country / Territory | Currency | Code | Value vs. USD (Mar 2026) | 1-Year Change | Exchange Regime |

|---|---|---|---|---|---|---|

| 1 | Kuwait | Kuwaiti Dinar | KWD | ≈ $3.27 | Stable (±0.5%) | Managed basket peg |

| 2 | Bahrain | Bahraini Dinar | BHD | ≈ $2.66 | Stable (fixed) | Hard USD peg |

| 3 | Oman | Omani Rial | OMR | ≈ $2.60 | Stable (fixed) | Hard USD peg |

| 4 | Jordan | Jordanian Dinar | JOD | ≈ $1.41 | Stable (fixed) | Hard USD peg |

| 5 | United Kingdom | Pound Sterling | GBP | ≈ $1.26 | −1.8% | Free float |

| 6 | Cayman Islands | Cayman Dollar | KYD | ≈ $1.20 | Stable (fixed) | Hard USD peg |

| 7 | Switzerland | Swiss Franc | CHF | ≈ $1.13 | +2.1% | Managed float |

| 8 | European Union | Euro | EUR | ≈ $1.05 | −1.2% | Free float |

| 9 | Singapore | Singapore Dollar | SGD | ≈ $0.75 | +1.4% | NEER-managed |

| 10 | United States | US Dollar | USD | $1.00 | Benchmark | Free float |

Exchange rates are indicative mid-market values, early March 2026. Sources: Central Bank of Kuwait, Central Bank of Bahrain, Central Bank of Oman, Bloomberg, Reuters.

#10 — United States: The Dollar That Rules the World (Even When It Isn’t the Strongest)

USD/USD: 1.00 | Reserve share: ~56% of global FX reserves (IMF COFER, mid-2025)

It would be intellectually dishonest to construct any list of monetarily significant currencies without beginning — or in this case, ending — with the US dollar. Technically ranked tenth by nominal exchange rate, the dollar’s omission from any strong-currency discussion would be absurd. It is the global reserve currency, the denomination of roughly 90% of all international foreign-exchange transactions, and the standard against which every other currency on this list is measured.

The dollar’s structural power derives not from its face value but from the depth and liquidity of US capital markets, the legal enforceability of US-dollar-denominated contracts, and the unrivalled network effects that come from decades of institutional entrenchment. When the world is frightened — by a banking crisis, a pandemic, or a geopolitical rupture — capital flows into dollars, not away from them. That is the ultimate credential.

The Federal Reserve’s aggressive rate-hiking cycle of 2022–2023 temporarily turbocharged the greenback to multi-decade highs. Since then, a gradual easing cycle has modestly softened the dollar index (DXY), which hovered around the mid-100s range in early 2026. Yet its dominance in global trade invoicing and central bank reserves remains essentially unchallenged.

Travel angle: For American travellers abroad, the dollar’s reserve status means widespread acceptance and generally favourable conversion, particularly in emerging markets. The caveat: in the Gulf states above the dollar on this list, the local currencies are pegged to the dollar, so there is no exchange-rate advantage — the mathematics are already baked in.

#9 — Singapore: The Asian Precision Instrument

SGD/USD: ≈ 0.75 | Inflation: ~2.1% (MAS, 2025) | Current account: strong surplus

Singapore manages its currency with the kind of institutional exactitude one might expect from a city-state that has spent sixty years treating good governance as a competitive export. The Monetary Authority of Singapore (MAS) does not set interest rates in the conventional sense; it manages the Singapore dollar’s value against an undisclosed basket of currencies through a “nominal effective exchange rate” (NEER) policy band — a mechanism that gives it enormous flexibility to use currency appreciation as an anti-inflation tool.

The result is a currency that, while not high in nominal USD terms, has consistently outperformed peers in Asia on purchasing-power stability. Singapore’s AAA sovereign credit rating (Standard & Poor’s, Fitch), perennially current-account surplus, and status as Asia’s pre-eminent financial hub all feed into the SGD’s credibility premium. The SGD appreciated modestly against the dollar in 2025 as MAS maintained a slightly appreciating NEER slope — a deliberate policy response to residual imported inflation from elevated global commodity prices.

For investors, the Singapore dollar is one of very few Asian currencies worth holding as a diversification tool in a hard-currency portfolio. For travellers from weaker-currency nations, Singapore’s cost of living will feel punishing — this is, after all, consistently one of the world’s most expensive cities. But that high cost is the precise reflection of the currency’s strength.

#8 — The Euro: Collective Strength, Individual Tensions

EUR/USD: ≈ 1.05 | ECB deposit rate: 2.25% (as of Feb 2026) | Eurozone GDP growth: ~0.9% (IMF 2026 forecast)

The euro is the world’s second most traded currency and the reserve currency of choice after the dollar, held in roughly 20% of global central bank foreign exchange portfolios. It represents the collective monetary credibility of twenty nations — a fact that is simultaneously its greatest source of strength and its most persistent structural vulnerability.

The European Central Bank’s prolonged rate-hiking campaign of 2022–2024 was executed with more determination than many in financial markets expected, and it produced results: eurozone core inflation fell from its 2022 peak of above 5% to below 2% by mid-2025, a trajectory that restored considerable credibility to the ECB’s inflation-targeting framework. The subsequent easing cycle has been cautious; the deposit rate stood at approximately 2.25% in early 2026, a level the ECB’s governing council has characterised as still moderately restrictive.

The euro’s Achilles heel remains the fiscal divergence between its member states. Germany’s near-recessionary growth in 2024–2025, combined with France’s persistent budget deficit challenges and Italy’s elevated debt-to-GDP ratio (above 135%), keeps sovereign risk premia alive in bond markets and periodically unsettles the currency. Still, the Eurozone’s aggregate current-account position is in surplus, and the ECB’s “Transmission Protection Instrument” — its bond-buying backstop — has effectively capped the threat of another existential sovereign debt crisis for now.

Travel angle: For USD- or GBP-holders, the euro’s current rate around $1.05 represents a relatively modest barrier. Western European travel remains expensive not because of the exchange rate but because of local price levels — a function of high wages and robust social provision rather than currency manipulation.

#7 — Switzerland: The Safe-Haven That Earned Its Reputation

CHF/USD: ≈ 1.13 | SNB policy rate: 0.25% | Inflation: ~0.3% (SNB, Feb 2026) | Current account surplus: ~9% of GDP

If the Kuwaiti dinar wins on headline exchange rate, the Swiss franc wins on something arguably more impressive: institutional longevity. Switzerland has managed its monetary affairs with such consistent discipline that the franc has preserved real purchasing power across multiple global crises, two world wars (in which Switzerland remained neutral), the collapse of the Bretton Woods system, the 2008 global financial crisis, and the COVID-19 shock. That record of monetary continuity, spanning more than 175 years since the franc’s introduction in 1850, is essentially without parallel among modern fiat currencies.

The Swiss National Bank (SNB) operates with an independence and a long-termism that remains the envy of its peers. Its mandate — price stability, defined as annual CPI inflation of 0–2% — has been met with remarkable consistency. Swiss inflation in early 2026 stood at approximately 0.3%, one of the lowest in the developed world, and a reflection of the SNB’s willingness in previous years to tolerate the economic pain of a strong franc (which reduces import costs and anchors domestic prices) rather than engineer currency weakness for short-term competitiveness.

Switzerland’s current-account surplus, running at roughly 9% of GDP, reflects a country that consistently exports more value than it imports — in pharmaceuticals, precision machinery, financial services, and, of course, the world’s most trusted watches. That structural external surplus is a bedrock of franc credibility.

The SNB’s policy rate stood at 0.25% in early 2026 — low, because very low inflation means there is no need for restrictive policy. The franc’s strength is not conjured by high interest rates attracting hot capital; it is built on structural surpluses, institutional credibility, and a century and a half of monetary conservatism.

Investor angle: The CHF remains one of the most reliable safe-haven plays in global markets. When geopolitical risk flares — and it has consistently done so across 2024–2026 — capital rotates into the franc. Its appreciation during such episodes is the price of insurance.

#6 — Cayman Islands: Offshore Stronghold, Surprising Currency

KYD/USD: 1.20 (fixed since 1974) | Sector: International financial centre

The Cayman Islands may be small — approximately 65,000 residents across three Caribbean islands — but their currency punches well above its geographic weight. The Cayman Islands dollar has been pegged to the US dollar at a fixed rate of 1.20 since 1974, a peg that has held without interruption for over five decades.

The peg is sustainable because the Cayman Islands economy generates exceptional foreign currency inflows. As one of the world’s leading offshore financial centres, the Cayman Islands hosts thousands of hedge funds, private equity vehicles, structured finance vehicles, and the regional offices of major global banks. This financial infrastructure creates persistent capital inflows that underpin the peg’s credibility without recourse to the kind of oil revenues that sustain Gulf currencies.

The absence of direct taxation — no corporate tax, no income tax, no capital gains tax — also functions as a structural attractor for international capital, further reinforcing demand for the local currency.

For travellers, the Cayman Islands’ combination of strong currency and luxury resort economy makes it one of the Caribbean’s more expensive destinations. But that premium reflects something real: it is, genuinely, one of the most politically stable and financially sophisticated jurisdictions in the Western Hemisphere.

#5 — United Kingdom: History’s Most Enduring Major Currency

GBP/USD: ≈ 1.26 | Bank of England base rate: 4.25% (Feb 2026) | UK GDP growth forecast: 1.3% (IMF 2026)

The pound sterling has a plausible claim to being the world’s oldest currency still in active use. Predating the United States by more than a millennium in its earliest forms, sterling carries the weight of institutional memory — and the scars of historical crises, from the 1976 IMF bailout to Black Wednesday in 1992 to the post-Brexit adjustment of 2016. That the pound has navigated all of this and still trades above $1.25 says something significant about the resilience of UK monetary institutions.

The Bank of England, established in 1694, has been on a cautious easing path since mid-2024, reducing its base rate from the post-pandemic peak of 5.25% to 4.25% by early 2026 as UK inflation — which ran brutally hot in 2022–2023 — returned closer to the 2% target. Core CPI had moderated to approximately 2.7% by early 2026, still slightly elevated but no longer the acute political crisis it was.

The UK’s economic structure — highly service-oriented, with the City of London representing one of the world’s two or three most important financial centres — means sterling’s value has always been intimately connected to confidence in UK financial governance. Post-Brexit trade frictions have not destroyed that confidence, though they have permanently restructured some trade flows and depressed productivity estimates.

Travel angle: Sterling’s strength makes UK residents among the best-positioned travellers in the world, particularly when visiting North Africa, South-East Asia, or Eastern Europe, where exchange rate differentials translate into substantial purchasing power advantages. The pound buys significantly more in emerging markets today than it did five years ago.

#4 — Jordan: Strength Without Oil

JOD/USD: 1.41 (fixed peg) | Inflation: ~2.8% | IMF programme: Extended Fund Facility (ongoing)

Jordan’s presence in the top four is the most intellectually interesting entry on this list, because it is a standing refutation of the narrative that strong currencies require oil. Jordan has no significant hydrocarbon reserves. Its economy depends on phosphate exports, manufacturing, services, remittances from a large diaspora, foreign aid — primarily from the United States, Saudi Arabia, and the EU — and its strategic geopolitical position at the intersection of three continents and several of the region’s most complex political dynamics.

The Jordanian dinar has been pegged to the US dollar at a fixed rate of 0.709 JOD per dollar (implying approximately $1.41 per dinar) since 1995, a commitment the Central Bank of Jordan has maintained through multiple regional crises — the 2003 Iraq war, the 2011 Arab Spring, the Syrian refugee crisis (Jordan hosts one of the world’s largest refugee populations relative to its size), and the ongoing regional tensions of 2024–2025.

The peg’s credibility is purchased at a fiscal cost: Jordan must maintain sufficient foreign exchange reserves to defend it, which constrains domestic monetary flexibility and requires disciplined fiscal policy, often in collaboration with IMF structural adjustment programmes. That discipline — painful as it has periodically been — is precisely what makes the dinar’s high nominal value sustainable.

Investor angle: The JOD peg makes Jordan one of the more predictable currency environments in the Middle East, which partly explains why Amman has attracted meaningful foreign direct investment in logistics, technology, and pharmaceuticals in recent years.

#3 — Oman: The Prudent Gulf State

OMR/USD: 2.60 (fixed peg) | Oil production: ~1 mbpd | Moody’s rating: Ba1

The Omani rial’s fixed exchange rate of 2.6008 USD per rial has been unchanged for decades — a testament to the consistency of Oman’s monetary framework. Like its Gulf neighbours, Oman’s currency strength is anchored in hydrocarbon wealth, but the sultanate has pursued a more earnest diversification agenda than some of its neighbours, with meaningful investment in tourism, logistics, fisheries, and renewable energy under its Vision 2040 framework.

Oman’s fiscal position has improved markedly since the turbulence of the low-oil-price years of 2015–2016, when the country ran significant budget deficits and accumulated external debt. Higher oil prices in the early 2020s rebuilt fiscal buffers, and the government has since pursued subsidy reform and revenue diversification with greater determination than before. Moody’s upgraded Oman’s sovereign credit in 2023, reflecting improving balance-of-payment dynamics.

The Central Bank of Oman manages the currency through a currency board-style arrangement, holding sufficient USD reserves to back every rial in circulation at the fixed rate. This mechanistic commitment is what gives the OMR its enviable nominal stability — and what keeps it permanently ranked as the world’s third most valuable currency by exchange rate.

Travel angle: Oman’s strong currency, combined with its emergence as a luxury-eco-tourism destination, means it is not an especially cheap place to visit. But for holders of stronger currencies like the pound or the Swiss franc, the arithmetic is favourable — and Oman’s landscapes, from the Musandam fjords to the Wahiba Sands, make the cost worthwhile.

#2 — Bahrain: The Gulf’s Financial Hub

BHD/USD: 2.659 (fixed peg since 1980) | Financial sector: ~17% of GDP | Moody’s: B2

Bahrain’s dinar has been fixed to the US dollar at 0.376 BHD per dollar — implying approximately $2.66 per dinar — since 2001, maintaining an unchanged peg for a quarter century. That consistency, in a region not historically associated with monetary conservatism, is itself a form of credibility.

Bahrain’s economy is more diversified than Kuwait’s: the financial services sector contributes roughly 17% of GDP, making Manama one of the Gulf’s two dominant financial centres alongside Dubai. The country also has a more developed manufacturing base, including aluminium smelting, and has positioned itself as a regional hub for Islamic finance. This economic diversification is strategically significant because Bahrain has proportionally lower oil reserves than Kuwait or Saudi Arabia — the financial sector was, to some extent, a deliberate hedge against that exposure.

The BHD’s nominal strength is reinforced by Saudi Arabia’s implicit backstop role: the two countries share a causeway, a deep economic relationship, and a security alliance. Saudi Arabia’s vast financial resources have historically been seen as an informal guarantor of Bahraini monetary stability — a factor markets price into the risk premium attached to the dinar’s peg.

Investment angle: Bahrain’s status as a relatively open economy with few capital controls makes the BHD more accessible to international investors than most Gulf currencies. Its fintech regulatory sandbox and digital banking framework have drawn growing interest from global financial institutions in 2024–2025.

#1 — Kuwait: The Uncontested Crown

KWD/USD: ≈ 3.27 | Oil reserves: world’s 6th largest | Inflation: ~2.1% | FX reserves: > $45bn (CBK)

The Kuwaiti dinar is, by the most direct measure available — how many US dollars it takes to buy one unit — the strongest currency in the world. One dinar buys approximately $3.27 at current exchange rates, a premium that has been maintained, with only modest fluctuation, for decades.

Kuwait’s monetary position begins with geology. The country sits atop the world’s sixth-largest proven oil reserves, estimated at approximately 101 billion barrels — a figure that, relative to the country’s population of around 4.3 million citizens (and a total population of roughly 4.7 million including expatriates), represents extraordinary per-capita resource wealth. Oil and petroleum products account for more than 85% of government revenue and over 90% of export earnings. When oil prices are elevated — as they broadly have been across 2022–2025 — the fiscal arithmetic is essentially self-reinforcing.

The Central Bank of Kuwait manages the dinar through a managed peg to an undisclosed basket of international currencies, with the US dollar believed to constitute the largest single weight, given Kuwait’s oil revenues are denominated in dollars. This basket arrangement gives the CBK marginally more flexibility than a simple USD peg — it insulates the dinar slightly from bilateral dollar volatility.

Kuwait’s sovereign wealth fund, the Kuwait Investment Authority (KIA), is among the oldest and largest in the world, with assets variously estimated at over $900 billion. This vast stock of externally held financial wealth provides an additional buffer for the currency — in extremis, the KIA’s assets could theoretically be liquidated to defend the dinar. In practice, they have never needed to be. The combination of ongoing oil revenues, low domestic inflation (circa 2.1%), and conservative fiscal management has kept the dinar stable in nominal terms for as long as most investors can remember.

It is worth acknowledging the critique: Kuwait’s currency strength reflects resource rents and fiscal subsidies rather than diversified economic productivity. The dinar has not been “stress-tested” in the way the Swiss franc has, across multiple non-commodity-linked monetary regimes. A world permanently transitioning away from fossil fuels would eventually restructure the fiscal basis of KWD strength. But “eventually” is doing considerable work in that sentence. In March 2026, with global oil demand still running at near-record levels and the energy transition proceeding more slowly than many modelled, the Kuwaiti dinar remains — unchallenged — the most valuable currency on the planet by exchange rate.

Travel angle: For visitors holding stronger currencies (GBP, CHF, EUR), Kuwait is a genuinely affordable destination for what it offers — a sophisticated urban environment, world-class dining, and proximity to the rest of the Gulf. For those arriving with weaker currencies, the dinar’s strength can feel formidable at the exchange counter.

The Big Picture: What Strong Currencies Mean for Travel and Investment in 2026

The Travel Equation

Currency strength creates a purchasing-power asymmetry that sophisticated travellers have long exploited. Holding a strong currency — Kuwaiti dinar, British pound, Swiss franc, or euro — means that destinations with weaker currencies effectively go “on sale” from the holder’s perspective.

In 2026, the most compelling value gaps are between strong-currency nations and emerging markets where inflation has eroded local purchasing power without triggering proportionate currency depreciation. South-East Asia (Thailand, Vietnam, Indonesia), parts of Central and Eastern Europe, and much of Sub-Saharan Africa offer exceptional experiential value for travellers from the currencies on this list.

For travellers from weaker-currency nations visiting strong-currency countries — the United Kingdom, Switzerland, or the Gulf states — the inverse applies. The exchange rate headwind is real and material. Budget accordingly.

The Investment Case

Strong currencies are not automatically superior investment vehicles. A currency that is strong because it is pegged to the dollar (BHD, OMR, JOD, KYD) offers exchange-rate stability but does not offer upside appreciation. The Swiss franc and Singapore dollar — both managed floats — have historically appreciated in real terms over time, making them genuine long-term stores of value.

The broader investment signal from strong-currency nations is less about the currency itself and more about the policy environment it implies: low inflation, institutional independence, disciplined fiscal management, and rule of law. These are also the conditions most conducive to long-term capital preservation and, frequently, to strong equity market performance.

The Geopolitical Dimension

Several currencies on this list are exposed to geopolitical tail risks that their stable exchange rates do not fully price. Gulf currencies depend on continued hydrocarbon demand and regional stability. The pound is permanently sensitive to UK fiscal credibility and any resurgence of concerns about debt sustainability. The euro faces structural tensions that have been managed but not resolved.

The Swiss franc and Singapore dollar stand apart: their strength is built on institutional foundations that are largely independent of any single commodity price, political decision, or regional dynamic. In a world of elevated geopolitical uncertainty, that institutional bedrock commands a premium that is likely to persist.

Conclusion: Currency Strength as a Mirror of National Character

The currencies at the top of this ranking are not accidents. The Kuwaiti dinar is strong because Kuwait made conservative choices about how to manage extraordinary resource wealth — choices that not every resource-rich nation has made. The Swiss franc is strong because Switzerland has maintained institutional discipline across a century and three-quarters of monetary history. The pound retains its position because British financial markets have earned global trust over decades, even while political decisions have periodically tested it.

For travellers, the lesson is straightforward: when your home currency is strong, the world effectively gives you a discount on its experiences. For investors, the lesson is more nuanced: strength by nominal exchange rate and strength by structural monetary credibility are not the same thing — and in the long run, the latter matters more.

In 2026, the world’s currency hierarchy reflects, as it always has, the aggregate of every monetary policy decision, every fiscal choice, and every institutional investment that preceded it. The dinar, the franc, the pound, the rial — each is a ledger of its nation’s choices, settled daily on the world’s foreign exchange markets.

Frequently Asked Questions (FAQ Schema)

Q1: What is the strongest currency in the world in 2026?

The Kuwaiti Dinar (KWD) is the strongest currency in the world in 2026 by nominal exchange rate, trading at approximately $3.27 per dinar as of early March 2026. Its strength is underpinned by Kuwait’s vast oil reserves, conservative central bank management, and a managed basket peg that maintains extraordinary stability.

Q2: Which country has the strongest currency for travel in 2026?

For travellers, holding UK Pounds Sterling (GBP), Swiss Francs (CHF), or Euros (EUR) provides the most practical travel purchasing power advantage globally, as these currencies are widely accepted worldwide and deliver significant exchange-rate advantages in emerging markets across Asia, Africa, and Eastern Europe.

Q3: Why is the Kuwaiti Dinar so strong?

The Kuwaiti Dinar’s strength derives from Kuwait’s position as one of the world’s largest per-capita oil exporters, responsible fiscal management by the Central Bank of Kuwait, a managed currency peg to a basket of international currencies, low domestic inflation, and the backing of the Kuwait Investment Authority — one of the world’s largest sovereign wealth funds, with assets estimated at over $900 billion.

Q4: Is a strong currency good for a country’s economy?

A strong currency has both benefits and costs. Benefits include lower import costs (reducing inflation), greater purchasing power for citizens abroad, and stronger investor confidence. Costs include reduced export competitiveness, as locally produced goods become more expensive for foreign buyers, and potential pressure on manufacturing sectors. Countries like Switzerland and Singapore manage this tension deliberately through monetary policy.

Q5: What are the best currencies to hold as an investment in 2026?

For capital preservation, the Swiss Franc (CHF) and Singapore Dollar (SGD) have the strongest track records of long-term purchasing-power preservation among free-floating or managed-float currencies. For nominal stability, USD-pegged Gulf currencies (KWD, BHD, OMR) offer predictable exchange rates but limited upside appreciation. The US Dollar retains unparalleled liquidity and reserve-currency status. Diversification across multiple hard currencies remains the consensus recommendation from institutional investors.

Sources : Data sourced from Central Bank of Kuwait, Central Bank of Bahrain, Central Bank of Oman, Monetary Authority of Singapore, Swiss National Bank, Bank of England, European Central Bank, IMF World Economic Outlook (Oct 2025 / Jan 2026 update), World Bank International Comparison Programme, BIS Triennial Survey, Bloomberg FX data, and Reuters market data. Exchange rates are indicative mid-market values as of early March 2026 and are subject to market fluctuation.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Amid Iran Tensions, US-China Trade Chiefs Gear Up for Mid-March Talks Ahead of Trump-Xi Summit

As missiles reshape the Middle East, two of the world’s most consequential economic officials prepare to sit across a table in Paris — and the world is watching.

The Paris Prelude: Bessent and He’s High-Stakes Rendezvous

In the shadow of American strikes on Iran and the death of Ayatollah Ali Khamenei, a quieter but no less consequential drama is unfolding in the back channels of global diplomacy. US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng are expected to convene in Paris at the end of next week, according to sources familiar with the matter, in what amounts to the groundwork session for a planned Trump-Xi summit currently scheduled from March 31 to April 2, 2026, in Beijing.

The meeting — still subject to change in both timing and location — would be the latest in a series of bilateral encounters stretching from Geneva in May 2025 through London, Stockholm, Madrid, and Kuala Lumpur. That itinerary alone tells a story: the US-China trade relationship, for all its seismic tension, has been quietly managed by two officials who have shown a consistent, if carefully choreographed, willingness to talk. As reported by Bloomberg, the mid-March trade talks signal that summit preparations are advancing despite the escalating geopolitical turbulence generated by Washington’s military actions in the Persian Gulf.

Neither the US Treasury nor China’s Ministry of Commerce responded to requests for comment — a silence that, in diplomatic terms, is practically deafening with implication.

Key Agenda Items: From Boeing to Taiwan

The Paris agenda, if it holds, is expected to span a range of contentious and commercially significant issues. Among the most prominent:

| Agenda Item | Stakes | Status |

|---|---|---|

| Chinese purchase of Boeing aircraft | Multi-billion dollar aviation deal; symbolic détente | Under discussion |

| US soybean purchase commitments | Agricultural exports; rural political currency for Trump | Preliminary |

| Taiwan | Sovereignty flashpoint; structural red line for Beijing | Exploratory |

| Post-Supreme Court fentanyl tariffs | Legal vacuum following February ruling; new 10% levies in place | Active negotiation |

| Broader trade deficit rebalancing | Core US demand; “managed trade” framework | Ongoing |

The Boeing question carries particular weight. China’s commercial aviation market — among the fastest-growing in the world despite its economic deceleration — represents an enormous prize for the American aerospace giant, which has spent years navigating regulatory and reputational turbulence. A purchase commitment would offer Beijing a high-visibility concession while giving Washington a tangible win ahead of the summit.

On soybeans, the calculus is similarly political. US exports to China fell a staggering 25.8% in 2025 as the trade war ground on, and American farmers — a bedrock constituency for President Trump — have felt the pain acutely. Renewed purchase commitments would provide both economic relief and narrative momentum heading into what the White House hopes will be a triumphant Beijing summit.

Taiwan, as ever, looms over any discussion. Beijing’s insistence that the self-ruled island is Chinese territory has hardened in recent years, and any American concession — or even ambiguity — on the matter carries enormous strategic weight. Conversely, any perceived US softening on Taiwan in exchange for trade gains would face fierce domestic political scrutiny on Capitol Hill.

The Fentanyl Tariff Wrinkle: A Legal Earthquake Reshapes the Agenda