Exports

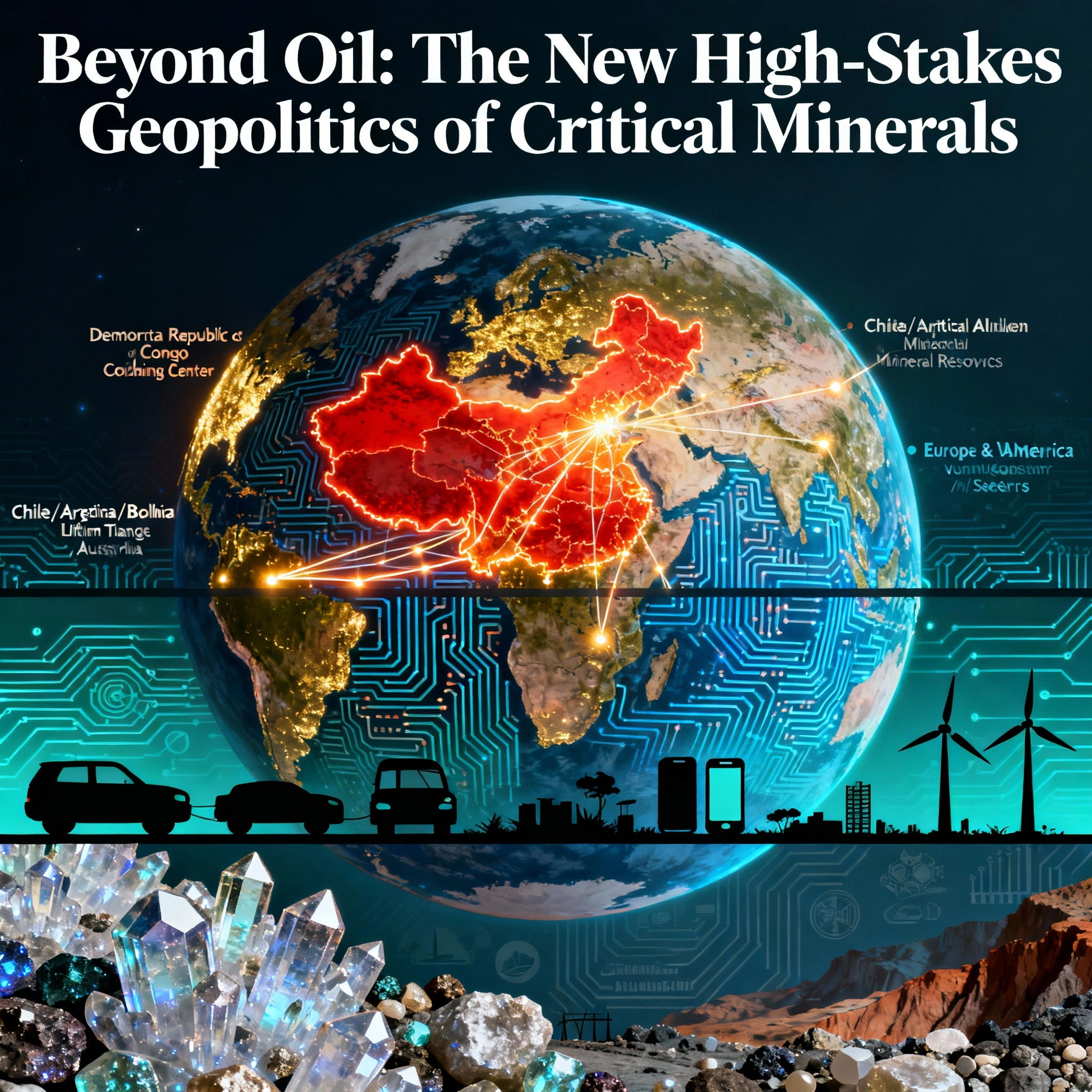

Beyond Oil: The New High-Stakes Geopolitics of Critical Minerals

The 21st century will not be defined by the Cold War’s ideological battles, but by what historians may call the “Resource Race”—a scramble for the building blocks of our technological future that makes the old oil wars seem almost quaint by comparison. While Russia’s invasion of Ukraine triggered an immediate energy crisis that sent shockwaves through European economies, it simultaneously revealed a far more systemic and enduring vulnerability: the West’s precarious dependence on a small number of nations for the critical minerals that underpin everything from electric vehicles to defense systems.

This awakening arrives at a pivotal moment. Three converging forces—climate change, the energy transition, and intensifying geo-economic rivalry—are reshaping the global power structure in ways that will determine which nations thrive and which falter in the decades ahead. The question is no longer whether the world will transition away from fossil fuels, but who will control the minerals that make that transition possible.

The Lesson from Europe: Ending the Russian Reliance

The shock of February 2022 reverberated far beyond Ukraine’s borders. As Russian tanks crossed into Ukrainian territory, European leaders confronted an uncomfortable truth that energy experts had warned about for years: Russia’s systematic weaponization of energy supplies had created a vulnerability that threatened the continent’s economic security and political sovereignty.

What followed was remarkable. Europe, which had relied on Russia for 45% of its gas imports before 2022, moved with unprecedented speed to dismantle this dependence. By 2025, Russian gas accounted for just 13% of EU imports, worth approximately €15 billion annually—still substantial, but dramatically reduced from pre-war levels.

The Roadmap: Europe’s Definitive Break

In December 2025, the European Union struck a landmark agreement that establishes legally binding timelines for completely severing energy ties with Russia. The precision of these deadlines signals a fundamental shift from incremental policy adjustments to strategic decoupling:

2026: The End of Russian LNG Spot-market Russian liquefied natural gas will be banned from the EU in early 2026, with short-term contracts terminated by April 25, 2026, and long-term LNG contracts prohibited from January 1, 2027. This aggressive timeline was accelerated during negotiations, reflecting the European Parliament’s determination to move faster than the European Commission’s original proposal.

2027: The Final Severance Pipeline gas imports will cease by September 30, 2027, with a possible one-month extension only if member states face difficulties meeting storage targets. The legislation also commits the European Commission to presenting proposals for a complete Russian oil ban in early 2026, with implementation targeted for late 2027.

The Mechanism: Regulatory Rigor as Blueprint

Europe’s approach offers lessons far beyond energy policy. The legislation doesn’t rely on voluntary compliance or market signals—it establishes effective, proportionate and dissuasive penalties for companies and individuals who violate the ban, with maximum thresholds calibrated to ensure meaningful deterrence.

The mechanism includes sophisticated enforcement provisions:

- Prior Authorization Regime: All gas imports must be pre-approved, with requirements for importers to present “stricter and more detailed proof of the country of production” before storage or import.

- Shadow Fleet Monitoring: Enhanced surveillance of vessels attempting to circumvent sanctions.

- Contract Amendment Restrictions: Changes to existing contracts permitted only for narrowly defined operational purposes, explicitly prohibiting volume or price increases.

- National Diversification Plans: Member states must submit detailed strategies by March 1, 2026, outlining how they will replace Russian supplies.

Dr. Fatih Birol, Executive Director of the International Energy Agency, called it “a historic moment,” noting that “in the energy world, overreliance can quickly turn into major geopolitical vulnerabilities. My number one golden rule for energy security is diversification.”

The Takeaway: A Template for Resource Security

This legislative rigor establishes a blueprint for how democracies might approach resource security in other domains. The structured timelines, enforcement mechanisms, and diplomatic coordination required to execute this transition demonstrate that determined political will—catalyzed by crisis—can break even the most deeply entrenched dependencies.

Yet energy represents the relatively straightforward challenge. Natural gas has multiple potential suppliers; LNG terminals can be rapidly constructed; renewable alternatives are increasingly cost-competitive. The battle for critical minerals presents far more complex obstacles, with concentration risks that make Russian gas dependence look almost manageable by comparison.

The New Battleground: Critical Minerals

If the 20th century was powered by oil, the 21st will run on an array of obscure elements most people have never heard of: neodymium for electric vehicle motors, dysprosium for wind turbines, gallium for semiconductors, lithium for batteries, cobalt for energy storage. These are the building blocks of the green economy, and their supply chains present vulnerabilities that dwarf those of fossil fuels.

The International Energy Agency projects that global demand for 37 critical minerals needed for clean energy transitions will surge dramatically in coming decades. The consumption of minerals like lithium, cobalt, and rare earth elements could increase sixfold by 2050, with their market value reaching $400 billion—exceeding the value of all coal extracted in 2020. To meet Paris Agreement goals, more than three billion tonnes of energy transition minerals and metals will be needed to deploy wind, solar, and energy storage infrastructure.

The Supply Chain Problem: Concentration as Weapon

The challenge isn’t merely geological scarcity. While mining concentration creates concern, the true chokepoint lies in processing and refining—the sophisticated chemical processes that transform raw ore into usable materials. This midstream bottleneck represents where genuine strategic leverage resides.

Consider rare earth elements, a group of 17 metallic elements essential for high-performance magnets used in everything from consumer electronics to the F-35 fighter jet. China currently accounts for approximately 60-70% of global rare earth mining, a dominant but not insurmountable position.

The processing stage tells a different story entirely. China controls approximately 85-90% of global rare earth refining capacity and a staggering 94% of sintered permanent magnet production—magnets that retain their magnetic properties indefinitely and are critical for the most powerful motors used in cutting-edge applications. Two decades ago, China’s share of permanent magnet production stood at just 50%. Today, it manufactures virtually all of them.

This dominance stems from deliberate strategic choices made over decades. From 1950 to 2018, China filed 25,000 patents for rare earths, nearly tripling the 10,000 filed within the United States. For 19 out of 20 important strategic minerals, China is the leading refiner, with an average market share of 70%.

The pattern extends across the critical mineral spectrum:

- Lithium: China dominates midstream processing despite not being the primary mining source

- Cobalt: While the Democratic Republic of Congo mines over 60% of global supply, Chinese companies control much of the processing

- Graphite: China accounts for approximately 70% of global production

- Silicon: China’s share leapt from 30% in 2012 to 80% by 2025

Economic Stakes: The Manufacturing Chain Reaction

A bottleneck in critical mineral supply threatens entire manufacturing sectors. The automotive industry provides a stark illustration. When China unveiled export restrictions on heavy rare earth elements in mid-2025, Western automotive supply chains faced immediate shortages, delays, and production pauses.

In 2024, China exported 58,000 tonnes of rare earth magnets—enough to manufacture components for millions of cars, industrial motors, or aircraft, or to build thousands of strategic military systems, data centers, or wind turbines. The disruption potential is immense.

The ripple effects extend to defense capabilities. By 2030, China will control 51% of rare earth element production and 76% of their refining, according to IEA projections. Defense systems—from precision-guided missiles to advanced radar—depend on these materials. Supply disruptions don’t merely inconvenience manufacturers; they compromise national security.

China’s Strategic Calculus: Weaponizing Processing

Beijing has demonstrated willingness to leverage its dominant position. In December 2023, China implemented export controls on gallium, germanium, antimony, and graphite. In April 2025, China expanded restrictions to include scandium, yttrium, samarium, gadolinium, terbium, dysprosium, and lutetium, requiring exporters to apply for licenses—a move widely interpreted as strategic maneuvering.

Most significantly, China applied the Foreign Direct Product Rule to rare earth magnets, claiming jurisdictional control over foreign defense and technology supply chains. This isn’t merely about trade policy—it’s about exerting influence over the technological infrastructure of rival nations.

Following U.S.-China trade negotiations in late 2025, China suspended enhanced licensing requirements until late 2026, a calculated tactical de-escalation. However, high-leverage strategic controls—including restrictions on magnet-related technology and explicit military end-use prohibitions—remain fully operational.

This pattern follows historical precedent. China halted rare earth exports to Japan in 2010 during a territorial dispute, demonstrating early on that economic interdependence could be weaponized for geopolitical objectives.

Strategic Maneuvering: The West’s Response

The concentration risks are no longer theoretical concerns relegated to think tank reports. They have materialized as supply shocks, price volatility, and strategic vulnerabilities that demand coordinated responses. Western nations and allies are pursuing multifaceted strategies to reduce dependence, though the path forward presents formidable challenges.

European Strategy: Diversification Through Diplomacy

Europe approaches critical mineral security through its Critical Raw Materials Act, which establishes targets for domestic sourcing, processing, and recycling. The regulation prioritizes minerals based on economic importance and supply risk, designating certain materials as “strategic raw materials” even if they don’t meet traditional criticality thresholds.

The strategy emphasizes diplomatic engagement and trade agreements designed to secure diversified supply chains:

Mercosur and Latin America: Trade negotiations with South American nations aim to tap into lithium reserves in Argentina, Bolivia, and Chile—the so-called “lithium triangle” holding the world’s largest deposits. Brazil represents a key alternative source for heavy rare earth elements, particularly as the United States builds processing capabilities in Texas and California, with Brazil geographically closer than China.

India Trade Agreements: Deepening economic ties with India creates opportunities to collaborate on critical mineral supply chains, though India faces acute vulnerability, depending on China for 82% of its lithium imports.

African Partnerships: The EU has designated Greenland’s Amitsoq graphite project as a Strategic Project under its Critical Raw Materials Act. Additionally, Europe pursues partnerships across the “African Graphite Triangle” (Madagascar, Mozambique, Tanzania) to diversify graphite supply chains critical for battery production.

The European Union’s rearmament initiative—including Germany’s suspension of the debt brake for defense spending above 1% of GDP and the European Commission’s Rearm plan allocating €150 billion for defense investment—will significantly increase demand for metals feeding military supply chains. This creates additional urgency for securing independent sources.

American Strategy: National Security Framework

Under the second Trump administration, critical minerals have been elevated to a national security imperative. The March 2025 Executive Order on Immediate Measures to Increase American Mineral Production established the National Energy Dominance Council, broadened the critical minerals list to include uranium, copper, potash, and gold, and directed agencies to expedite permits and mobilize financing.

A second Executive Order in April 2025 launched an offshore minerals strategy, directing federal agencies to inventory seabed deposits and fast-track permits for exploration and mining on the U.S. Outer Continental Shelf. This represents a recognition that domestic reserves alone cannot meet projected demand.

The strategy centers on bringing mineral-rich nations into the U.S. diplomatic orbit:

Bilateral Agreements: The United States signed an $8.5 billion rare earths agreement with Australia in October 2025, though President Trump’s comment that rare earths would soon be so abundant “you won’t know what to do with them” and “they’ll be worth $2” reflects optimistic expectations that contradict market realities. As Patrick Schröder of Chatham House notes, rare earths are becoming more expensive as countries seek to diversify, with prices needing to factor in “the geopolitical premium that governments and industrial buyers are increasingly willing to pay.”

Indonesian Minerals Deals: Efforts to complete agreements allowing U.S. firms to access Indonesian nickel aim to break Chinese oligopsony power in the nickel market, which has significant implications for electric vehicle battery supply chains.

Democratic Republic of Congo: Focus on building value-added processing infrastructure in the DRC represents an attempt to establish an alternative pillar of critical minerals processing, reducing Chinese midstream dominance. The DRC accounts for over 60% of global cobalt ore extraction but struggles to capitalize on this resource due to political instability, weak governance, and inadequate infrastructure.

Greenland’s Strategic Importance: The U.S. Export-Import Bank sent a letter of interest for a $120 million loan to fund Critical Metals Corp’s Tanbreez rare earth mine in Greenland. If approved, this would be the Trump administration’s first overseas investment in a mining project. However, significant challenges inhibit commercial mining ventures including infrastructure limitations, energy constraints, regulatory barriers, and the need for social license to operate.

Defense Production Act Investments: Since 2020, the U.S. Department of Defense has awarded over $439 million to companies like MP Materials, Lynas USA, and Noveon Magnetics for building rare earth separation, processing, and permanent magnet manufacturing capabilities. The DOD announced its goal of securing a complete mine-to-magnet supply chain by 2027.

Protective Tariffs: A planned 50% tariff on copper announced for summer 2025 exemplifies the administration’s protectionist approach. However, tariffs alone constitute dangerous industrial policy—protecting a sector without coordination, innovation support, or technology standards leads to sclerotic, uncompetitive industry.

The Goal: Preventing Mirror Overreliance

The overarching objective is avoiding what analysts call “mirror overreliance”—trading dependence on Russia for dependence on another single entity. The G7 Critical Minerals Action Plan presents the right conceptual framework, though success requires strategic targeting and policy alignment that previous G7 initiatives have struggled to demonstrate.

As noted in analysis, the United States should provide investor certainty to Canada by negotiating a longer duration term for the USMCA in the upcoming 2026 renegotiations. Working with allies in the G7 to create price contracts with shared upside in Canada and Brazil could stabilize investment while ensuring supply security.

International initiatives like the Minerals Security Partnership and the IEA Critical Minerals Security Programme bring together like-minded nations (U.S., EU, Australia, Canada, Japan, South Korea) to coordinate investments in sustainable supply chains. Yet coordination alone proves insufficient without addressing the fundamental challenge: building processing capacity from scratch takes time.

The Reality Check: Multi-Decadal Timelines

As Morgan Bazilian, director of the Payne Institute at the Colorado School of Mines, observes, “The reality is that mining is complex and difficult,” describing supply chain establishment as a “multi-decadal situation.”

Rebuilding U.S. rare earth processing capacity will take 5-10 years minimum due to severe knowledge gaps, environmental permitting challenges, and the time needed to construct and optimize complex chemical facilities at scale. Even countries that mine rare earth ores—such as the United States and Australia—still send most output to China for refining due to lack of local processing facilities.

China’s advantage isn’t merely financial—it’s technological and experiential. Chinese companies have mastered technologies needed to separate, refine, and produce rare earth metal, accumulated through decades of deliberate investment. Though rest-of-world efforts have accelerated since the 2010 embargo, they remain unable to compete economically.

This creates a strategic dilemma: genuine diversification requires sustained commitment measured in decades, not election cycles. Political will must endure long enough for alternative supply chains to mature—a tall order in democratic systems where administrations change and priorities shift.

The Development & Ethical Imperative

The race for critical minerals presents developing nations with both extraordinary opportunity and profound risk. Resource-rich countries in Africa, Latin America, and Southeast Asia hold the geological key to the energy transition. Whether this translates into sustainable prosperity or repeats historical patterns of exploitation depends on policy frameworks, governance capacity, and the willingness of global actors to prioritize shared benefit over narrow advantage.

Infrastructure Gap: The Fundamental Barrier

Mining projects don’t exist in isolation. They require basic infrastructure—water, power, transport networks, and digital connectivity—that many mineral-rich regions lack. For least developed countries, basic infrastructure represents the crucial first step in leveraging critical mineral endowments. For those expanding into processing, reliable and sufficient energy becomes particularly important.

Consider the Democratic Republic of Congo, which accounts for over 60% of global cobalt ore extraction. Despite this geological advantage, the DRC struggles to capitalize on resources due to political instability, weak governance, and inadequate infrastructure. Without foundational systems, mineral wealth becomes a curse rather than catalyst.

Landlocked developing countries face additional challenges: lack of sea access increases dependence on transit countries and inflates logistical and investment costs, often limiting the benefits of extraction. Mongolia, endowed with copper, lithium, and rare earths, exemplifies both promise and peril—past mining practices reveal dangers of resource dependency, while geography underscores the need for resilient infrastructure and regional cooperation.

Mining projects, because they are capital-intensive and require specialized imported equipment, tend to function as “enclaves”, limiting positive economic spillovers for nearby communities. Without deliberate policy intervention, mineral extraction can occur for decades while surrounding regions remain impoverished.

Win-Win Scenarios: The Responsible Mining Framework

Responsible mining isn’t merely an ethical aspiration—it’s strategic necessity. Without the right policy framework and participatory decision-making, mining activity can displace communities, fuel insecurity, threaten critical habitats, and scar landscapes long after mines close.

The framework for sustainable development encompasses several pillars:

Local Economic Benefit:

- Job Creation: Direct employment in mining operations, plus indirect opportunities in service industries

- Skills Training: Capacity-building and workforce development programs that provide transferable skills beyond mining

- Revenue Sharing: Benefit-sharing arrangements that foster infrastructure improvements, building trust between companies and communities

- Local Value Addition: Developing processing capabilities rather than merely exporting raw ore

Environmental Sustainability:

- Circular Economy Practices: Metals can be recycled almost indefinitely, making them essential for circular economies where resources are reused rather than discarded

- Water Management: Mining companies operating in water-scarce areas are increasingly required to develop desalination plants to avoid pressuring limited freshwater supplies

- Carbon Footprint Reduction: Focusing on reducing GHG emissions of mining operations through renewable energy and improved efficiency

- Biodiversity Protection: Minimizing habitat disruption and implementing restoration plans

Governance and Transparency:

- Transparent Legal Frameworks: Countries must put in place robust and sustainable legal and tax frameworks with meaningful participation

- EITI Standards: Through groups like the Extractive Industries Transparency Initiative, countries can commit to disclosing information along mineral value chains

- Anti-Corruption Measures: Preventing corruption and political capture ensures policy credibility and success

- Free, Prior, and Informed Consent: Policies must mandate free, prior, and informed consent of Indigenous Peoples, integrating this requirement into decision-making processes

Social License to Operate:

- Community Engagement: Community engagement, infrastructure initiatives, and capacity-building are all key to ensuring stakeholders share in extraction benefits

- Human Rights Protections: Governments must enforce strong protections for people and the environment by upholding human rights and implementing adequate labor standards

- Gender Inclusion: Ensuring women have opportunities and protections in mining-related employment

- Health and Safety: Rigorous standards protecting worker wellbeing

The Stakeholders: Multi-Actor Cooperation

Governments cannot achieve these outcomes alone. Success requires cooperation across multiple stakeholder groups, each bringing essential capabilities:

Government Role:

- Establishing regulatory frameworks and enforcement mechanisms

- Negotiating investment terms that protect national interests

- Channeling revenues into long-term investments in education, healthcare, and infrastructure

- Aligning strategies with UN Sustainable Development Goals

Private Sector Responsibilities:

- Adhering to high standards for responsible mining and ensuring transparent supply chains

- Technology transfer and knowledge sharing

- Long-term commitment beyond initial extraction phases

- Large buyers can exert influence through green procurement, committing to purchase only responsibly mined critical minerals

Civil Society Functions:

- Monitoring compliance and holding actors accountable through organizations like the Accountability Accelerator

- Representing community interests in negotiations

- Providing independent assessment of environmental and social impacts

- Facilitating dialogue between stakeholders

International Organizations:

- The Asian Development Bank supports development of diversified, responsible, and sustainable critical mineral value chains through investments, policy advice, and financing solutions

- The World Bank’s Climate-Smart Mining initiative provides thought leadership to advance private sector adoption of climate-smart principles

- UN agencies work with producer and consumer countries to build trust, reliability, resilience, and benefit sharing in critical mineral supply chains

Market-Based Incentives and Certification

Beyond regulation, market mechanisms can drive responsible practices:

ESG-Certified Minerals: Countries could increase demand for responsibly sourced materials by implementing import quotas for ESG-certified critical minerals. A critical minerals certification scheme should be established to ensure environmental, social, and governance compliance, attracting responsible investment.

Corporate Buyers’ Clubs: Companies can join forces through corporate buyers’ clubs and opt to pay a green premium for products meeting specific environmental, social, and governance targets.

Transparency Platforms: Digital platforms enabling traceability from mine to manufacturer, allowing consumers and investors to verify ethical sourcing claims.

The Resource Curse Risk

Resource booms carry inherent dangers. Without proper frameworks, they risk dependency-driven development, environmental damage, human rights abuses, political destabilization, corruption and illicit financial flows, insecurity and fragility, and concentrated harm in specific communities.

Historical patterns offer cautionary tales. Oil-rich nations that failed to diversify their economies suffered catastrophic consequences when prices collapsed. Mineral-dependent states that neglected education and infrastructure saw wealth concentrate in elite hands while populations remained impoverished. The challenge for today’s critical mineral producers is learning from these failures while operating under accelerated timelines driven by climate urgency.

Indonesia provides an instructive case study. The nation implemented a policy requiring local processing before export, aiming to capture more value from its nickel resources. While this created domestic jobs, it also triggered Chinese investment that now controls significant portions of the processing sector—potentially substituting one form of dependence for another.

The path forward requires what development economists call “linkage creation”—deliberately building connections between mining activities and broader economic development. This means:

- Forward Linkages: Developing downstream industries that use minerals domestically

- Backward Linkages: Building local supply chains for mining inputs

- Fiscal Linkages: Transforming mineral revenues into investments in human capital and infrastructure

- Knowledge Linkages: Building research capacity and technological expertise that outlasts individual mining operations

As noted in UN policy briefs, the critical minerals boom provides an opening for transformative change, but seizing this opportunity requires strong governance, international cooperation, targeted support, and long-term vision that extends beyond immediate extraction.

Financing the Transition: Bridging the Investment Gap

The scale of investment required to build responsible mining operations with supporting infrastructure is enormous. Mobilizing private and public funding is crucial for leveraging the critical minerals boom sustainably. Traditional financing mechanisms often prove inadequate for the risk profiles and extended timelines of mining in frontier markets.

Innovative financing approaches include:

Blended Finance: Combining concessional public finance with private capital to improve risk-return profiles for investors while maintaining development objectives.

Climate Finance Integration: The IFC’s commitment to provide $3 billion in support for Africa’s battery mineral value chains by 2030 exemplifies targeted financing that connects climate goals with development needs.

Sovereign Wealth Funds: Countries with mineral wealth should consider establishing funds that invest revenues for future generations, following models like Norway’s Government Pension Fund.

Development Finance Institutions: The Asian Development Bank’s critical minerals financing solutions provide patient capital with technical assistance to ensure projects meet sustainability standards.

Risk Mitigation Instruments: Insurance products and guarantees that protect investors against political risk while holding them accountable to ESG standards.

China’s Counter-Strategy: Strategic Patience and Market Power

Understanding China’s approach to critical minerals requires recognizing that Beijing operates on timelines measured in decades, not quarters. While Western nations rush to build alternative supply chains, China simultaneously deepens its advantages and positions itself as the indispensable partner for the energy transition.

The Three-Pronged Chinese Strategy

1. Downstream Integration and Technology Control

China isn’t simply hoarding raw materials—it’s systematically controlling the entire value chain. Chinese companies have made strategic investments in mining operations globally, particularly in Africa and Latin America, ensuring access to raw materials while building processing capacity domestically.

The technological dimension proves even more significant. China’s 25,000 rare earth patents don’t merely represent incremental improvements—they cover fundamental processes that any competitor attempting to build processing facilities will likely need to license. This creates a structural advantage that persists even if other nations develop their own processing capacity.

2. Calibrated Export Controls as Diplomatic Leverage

China’s approach to export restrictions demonstrates sophisticated strategic thinking. Rather than implementing permanent, comprehensive bans that would drive accelerated diversification, Beijing applies targeted, temporary restrictions that:

- Signal China’s willingness to use its mineral leverage

- Create uncertainty that increases the cost of capital for alternative projects

- Provide negotiating leverage in bilateral discussions

- Maintain just enough supply to keep alternative projects economically unviable

As resources economists note, permanent export restrictions would be counterproductive for China, as they would accelerate the exact diversification Beijing seeks to prevent. Temporary restrictions create dependency without triggering the sustained political will needed for genuine alternatives.

**3. Positioning as the “Responsible” Supplier

Perhaps most strategically, China positions itself not as a threat but as a solution. Through initiatives like the Belt and Road, China offers financing, technical expertise, and market access to developing nations—creating relationships that make future supply disruptions less likely while expanding Chinese influence.

This approach recognizes a fundamental reality: the world needs Chinese processing capacity for the energy transition. Even as Western nations build alternatives, the sheer scale of demand means Chinese supply remains essential for decades. Beijing’s strategy isn’t to prevent all diversification—it’s to ensure that diversification remains partial, expensive, and dependent on Chinese technology.

The Vulnerability in China’s Position

Yet China faces its own vulnerabilities. As IEA analysis indicates, China’s near-monopoly creates reputational risk. Aggressive use of export controls damages trust and provides political ammunition for those advocating decoupling.

More fundamentally, China’s domestic reserves of certain critical minerals remain limited. The country imports significant quantities of lithium, nickel, and other materials essential for its own manufacturing sector. A global market disruption would impact Chinese supply chains alongside Western ones.

Environmental pressures also constrain China’s options. Rare earth processing generates significant pollution, and domestic environmental regulations have tightened considerably. The closure of polluting facilities in Inner Mongolia and Jiangxi province demonstrates that even authoritarian governance faces limits on environmental externalities.

Technology and Innovation: The Wild Cards

While geopolitics dominates headlines, technological innovation could fundamentally reshape the critical minerals landscape in ways that render current assumptions obsolete. Several technological pathways deserve attention:

Substitution and Material Science Breakthroughs

Next-Generation Battery Chemistry: Sodium-ion batteries, which use abundant sodium rather than scarce lithium, are reaching commercial viability. While currently offering lower energy density than lithium-ion alternatives, continued development could dramatically reduce lithium demand.

Rare-Earth-Free Motors: Engineers are developing electric vehicle motors that eliminate rare earth permanent magnets, using induction motors or alternative magnet technologies. Tesla’s shift toward rare-earth-free motors in some models demonstrates commercial feasibility, though performance trade-offs remain.

Material Efficiency Improvements: Reducing the quantity of critical minerals required per unit of output—through better motor designs, battery management systems, or manufacturing processes—effectively increases available supply without additional mining.

Recycling and Circular Economy

Metals can be recycled almost indefinitely, making them foundational to circular economies. As the installed base of batteries, solar panels, and electric vehicles grows, end-of-life recycling will increasingly supplement primary mining.

Current recycling rates for many critical minerals remain low—often below 1% for rare earths. However, technological improvements in separation processes and economic incentives from higher mineral prices are driving rapid progress. By 2040, recycling could supply 20% or more of certain critical minerals, reducing pressure on primary extraction.

The challenge lies in collection logistics and economic viability. Batteries and electronics are distributed globally, making collection difficult. Processing technologies must handle complex, heterogeneous feedstocks. And recycling only becomes economically attractive when virgin material prices reach certain thresholds.

Deep-Sea Mining: The Frontier Debate

Ocean floors contain vast deposits of polymetallic nodules rich in nickel, cobalt, copper, and rare earths. Companies are developing technologies to extract these nodules from depths of 4,000-6,000 meters, potentially unlocking enormous resources.

However, deep-sea mining presents profound environmental uncertainties. Scientists warn that disrupting deep-ocean ecosystems—about which we know remarkably little—could trigger irreversible damage to biodiversity and carbon sequestration processes. The International Seabed Authority, which regulates mining in international waters, faces pressure from both industry proponents and environmental advocates as it develops regulatory frameworks.

The debate encapsulates broader tensions in the energy transition: Is the climate imperative sufficiently urgent to justify environmental risks in pursuit of critical minerals? Or do we risk solving one environmental crisis by creating another?

Asteroid Mining: The Long-Term Vision

While currently science fiction rather than policy, several companies are seriously pursuing asteroid mining. Near-Earth asteroids contain potentially vast quantities of platinum group metals and other valuable materials. The technological and economic barriers remain immense, but the timeline for viability may be measured in decades rather than centuries.

The geopolitical implications are intriguing. If space-based mining becomes feasible, it could render terrestrial mineral monopolies obsolete—or create entirely new forms of strategic competition as nations race to secure claims and develop technologies.

The Domestic Policy Dimension: Mining in the West

While much focus centers on securing overseas supplies, both the United States and Europe possess significant domestic mineral deposits. Yet bringing these resources online faces formidable obstacles that reveal uncomfortable truths about Western priorities and trade-offs.

The Permitting Paradox

In the United States, obtaining permits for a new mine takes an average of 7-10 years—among the longest timelines in the world. Environmental reviews, legal challenges, and bureaucratic processes create extended delays that make projects financially unviable or render them obsolete before production begins.

The Trump administration’s Executive Orders directing expedited permitting represent attempts to accelerate timelines, but they face immediate legal challenges from environmental groups and encounter fundamental tensions between development and conservation.

Europe faces similar challenges. Even projects designated as “Strategic” under the Critical Raw Materials Act must navigate complex environmental regulations, local opposition, and regulatory approval processes that can extend for years.

The NIMBY Dilemma

Public support for the energy transition is strong in abstract terms. Support evaporates when specific projects are proposed in specific locations. Communities near proposed mines worry about:

- Environmental Impacts: Water contamination, air quality, habitat destruction

- Community Disruption: Traffic, noise, visual impacts, demographic changes

- Property Values: Concerns about declining real estate prices

- Health Risks: Both real and perceived dangers to public health

These concerns are often legitimate. Historical mining practices left legacies of environmental destruction and community harm that shape contemporary attitudes. Yet the energy transition requires mining—the only questions are where and under what conditions.

The proposed Thacker Pass lithium mine in Nevada illustrates these tensions. Despite receiving federal approvals and promises of significant domestic lithium production, the project faces ongoing legal challenges from environmental groups and Native American tribes whose traditional lands would be affected.

Political Alignment and Consistency

Mining projects require 15-20 years from discovery to production. Securing financing demands confidence that regulatory frameworks will remain stable throughout this period. Yet political systems produce policy volatility that creates investment uncertainty.

A Democratic administration might prioritize environmental protections that Republican successors weaken—or vice versa regarding labor standards. As mining executives frequently note, this unpredictability makes Western jurisdictions less attractive than authoritarian systems offering regulatory certainty (even if environmental and social standards are lower).

The Social License Challenge

Beyond regulatory approval, projects require social license—genuine community acceptance. This demands:

- Transparent Communication: Honest discussion of risks and benefits

- Benefit Sharing: Ensuring local communities capture economic value

- Environmental Excellence: Demonstrating practices that genuinely minimize harm

- Ongoing Engagement: Sustained dialogue rather than one-time consultation

Companies increasingly recognize that social license isn’t a box to check but an ongoing relationship. Projects that treat communities as obstacles to overcome rather than partners to engage face extended delays, cost overruns, and potential failure.

Regional Spotlight: Key Geographies in the Mineral Competition

Latin America: The Lithium Triangle

Argentina, Bolivia, and Chile possess the world’s largest lithium reserves, concentrated in salt flats of the Atacama Desert. Yet each nation approaches development differently, reflecting distinct political economies and governance philosophies.

Chile has traditionally maintained state control over lithium extraction, granting licenses to a limited number of companies. Recent political shifts toward resource nationalism suggest Chile may tighten terms for foreign investors, potentially slowing production expansion.

Argentina offers a more liberal investment climate, with numerous projects in development. However, macroeconomic instability, currency volatility, and changing political leadership create uncertainty for long-term investments.

Bolivia possesses the world’s largest identified lithium reserves but has struggled to develop them due to technological challenges, political instability, and insistence on state-led development that has deterred private investment.

Water scarcity presents a common challenge. Lithium extraction from salt flats requires significant quantities of water in already-arid regions, creating conflicts with agricultural communities and environmental groups concerned about ecosystem impacts.

Africa: The Cobalt Conundrum and Broader Potential

The Democratic Republic of Congo’s dominance in cobalt extraction creates acute vulnerability for battery supply chains. Yet cobalt mining in the DRC involves significant concerns regarding human rights, particularly child labor, environmental standards, and governance.

Chinese companies control approximately 80% of DRC cobalt refining, having made substantial investments during periods when Western companies avoided the region due to instability and reputational risk. This creates a situation where addressing ethical concerns conflicts with diversification objectives.

Beyond cobalt, Africa possesses substantial deposits of graphite (Mozambique, Madagascar, Tanzania), copper (Zambia, DRC), manganese (South Africa, Gabon), and rare earths (South Africa, Malawi). Yet infrastructure deficits, governance challenges, and political instability limit development.

The African Union’s 2021 Africa Mining Vision seeks to leverage mineral wealth for transformative development, emphasizing value addition, linkage creation, and revenue management. Implementation varies dramatically across the continent.

Australia: The Democratic Mining Alternative

Australia offers what Western nations desperately need: a democratic ally with substantial critical mineral deposits, strong rule of law, and advanced mining expertise. The country possesses significant reserves of lithium, rare earths, nickel, cobalt, and other strategic materials.

Yet Australian development faces its own constraints. Environmental regulations (particularly regarding water and Indigenous heritage sites), labor costs, and geographical remoteness from processing facilities create economic challenges. The $8.5 billion U.S.-Australia rare earths agreement attempts to address some obstacles, but significant investment remains needed.

Australia’s strategy emphasizes becoming a “rare earth processing hub”, moving beyond raw material extraction to capture more value through refining and manufacturing. Success would provide Western supply chains with a genuine alternative to Chinese processing.

Southeast Asia: Indonesia’s Strategic Pivot

Indonesia’s decision to ban exports of unprocessed nickel ore forced buyers to invest in domestic smelting and refining. This created thousands of jobs and positioned Indonesia as a critical node in battery supply chains. However, rapid expansion of nickel processing has created significant environmental concerns, including deforestation, water pollution, and impacts on Indigenous communities.

The strategy’s success demonstrates that resource-rich nations can capture more value through local processing. Yet it also reveals the challenge of balancing rapid industrialization with environmental and social sustainability.

Greenland: Arctic Geopolitics and Development Tensions

Greenland possesses significant rare earth deposits, particularly at the Kvanefjeld and Tanbreez projects. As Arctic ice melts, access to these resources improves, raising strategic interest from major powers.

Denmark (which maintains sovereignty over Greenland) and Greenland’s autonomous government face delicate balancing acts between economic development opportunities, environmental protection, and maintaining political autonomy. U.S. interest—including Trump administration overtures about purchasing Greenland—underscores the territory’s strategic importance.

However, Greenland’s extreme environment, limited infrastructure, energy constraints, and small population create formidable development challenges. Projects require enormous capital investment in basic infrastructure before mining can begin, and harsh Arctic conditions dramatically increase operational costs.

Conclusion: The Long Game Ahead

The move away from Russian oil and gas represents just the opening chapter in a longer, more complex story of resource security. Europe’s disciplined timeline for ending energy dependence—LNG by 2026, pipeline gas and oil by 2027—demonstrates that determined political will can break even deeply entrenched dependencies. The legislative framework Europe has constructed, with its enforcement mechanisms and diversification requirements, offers a template that could be applied to other strategic vulnerabilities.

Yet the challenge of critical minerals presents far more formidable obstacles than the energy transition. Russia was one supplier among many potential alternatives for oil and gas. For critical minerals, China’s processing dominance approaches monopoly in multiple strategic materials, built over decades through deliberate industrial policy, technological investment, and strategic positioning across global supply chains.

The arithmetic is sobering. China controls approximately 85-90% of rare earth refining, 94% of permanent magnet production, and an average 70% market share across 19 of 20 strategic minerals. This isn’t merely extraction dominance—it’s control over the specialized knowledge, processing infrastructure, and manufacturing capacity that transforms raw materials into usable products.

Western efforts to build alternative supply chains face multi-decadal timelines. Establishing rare earth processing facilities requires 5-10 years minimum, assuming permitting approvals, capital availability, and technical expertise can be secured. As mining experts note, the path forward represents a “multi-decadal situation” requiring sustained political commitment across multiple election cycles—something democratic systems struggle to provide.

The stakes extend beyond economics into fundamental questions of sovereignty and security. Defense systems from precision-guided missiles to advanced radar depend on rare earth elements. Electric vehicle production, renewable energy deployment, and digital infrastructure all require materials where supply concentration creates leverage that could be weaponized during geopolitical crises.

The Developing Nation Dimension

For mineral-rich developing countries, this competition presents both extraordinary opportunity and profound risk. The critical minerals boom could provide resources for transformative development—financing infrastructure, building industrial capacity, and creating prosperity for future generations.

Yet history teaches caution. Resource booms have too often produced corruption, environmental devastation, and concentrated wealth that leaves surrounding communities impoverished. Without robust governance frameworks, transparent legal systems, and genuine benefit-sharing mechanisms, mineral wealth risks becoming a curse rather than blessing.

The international community faces a moral and strategic imperative to ensure this outcome differs from past patterns. Responsible mining frameworks, infrastructure investment, capacity building, and genuine partnership—rather than neo-colonial extraction—must characterize this era.

Technology as Potential Disruptor

While geopolitics dominates current discussion, technological innovation could fundamentally reshape the landscape. Sodium-ion batteries, rare-earth-free motors, advanced recycling technologies, and material efficiency improvements all offer pathways to reduce critical mineral intensity. By 2040, recycling could supply 20% or more of certain materials, substantially easing supply pressures.

Yet even optimistic technological scenarios don’t eliminate the need for primary extraction. Global demand for lithium, cobalt, and rare earths could increase sixfold by 2050 even with aggressive efficiency improvements and recycling. Technology might mitigate but cannot eliminate the fundamental challenge of securing diverse, reliable supplies.

Strategic Imperatives Moving Forward

Success in the critical minerals competition requires Western nations and allies to:

Maintain Political Will: The 5-10 year timelines for processing facilities and 15-20 year timelines for new mines demand commitment that outlasts individual administrations. Investment requires confidence in regulatory stability, something democratic systems struggle to provide.

Coordinate Internationally: Initiatives like the Minerals Security Partnership and the G7 Critical Minerals Action Plan provide frameworks for collaboration. Yet coordination must translate into concrete investments, not merely aspirational statements.

Balance Speed with Sustainability: The urgency of climate goals creates pressure to accelerate mining. Yet shortcuts on environmental and social standards risk creating new crises while solving old ones. Responsible mining frameworks must be non-negotiable, even when they slow development.

Invest in Innovation: Research funding for material substitution, efficiency improvements, and recycling technologies offers high-return opportunities to reduce mineral intensity and extend available supplies.

Accept Trade-offs Honestly: Western publics demand action on climate while often opposing specific mining projects in specific locations. This contradiction must be confronted through honest dialogue about where extraction occurs and under what conditions.

Engage China Strategically: Complete decoupling is neither feasible nor desirable. China’s processing capacity remains essential for the energy transition. The goal should be reducing vulnerability through diversification rather than eliminating all interdependence.

Final Reflection

The resource race of the 21st century differs fundamentally from 20th-century oil geopolitics. Oil created dependencies but remained fungible—a barrel from Venezuela substituted for a barrel from Saudi Arabia. Critical minerals involve complex processing technologies, specialized knowledge, and capital-intensive infrastructure that create dependencies far harder to break.

Europe’s success in ending Russian energy dependence demonstrates that political will catalyzed by crisis can achieve remarkable results on compressed timelines. The critical minerals challenge offers no such crisis-driven urgency—at least not yet. The vulnerabilities remain mostly latent, with supply disruptions limited and temporary.

This creates a dangerous complacency. By the time crisis forces action—perhaps triggered by China using its rare earth leverage during a Taiwan crisis, or supply disruptions caused by climate-driven instability in mineral-rich regions—the timeline to build alternatives will extend years or decades. The moment to act is before the crisis, when choices remain broader and costs are lower.

The diversification of critical mineral supply chains will be harder and take longer than the energy pivot. It will require sustained diplomatic effort, massive capital investment, technological innovation, and uncomfortable conversations about trade-offs between environmental protection and resource security. Success is far from guaranteed.

Yet the alternative—accepting permanent vulnerability in the foundational materials of the modern economy—is strategically untenable. The resource race will define which nations thrive in the remainder of this century. The question is whether democracies can summon the long-term strategic thinking and sustained commitment that success demands.

The clock is ticking. The race has begun. And unlike the sprint away from Russian gas, this will be a marathon requiring endurance, coordination, and strategic patience that Western political systems have rarely demonstrated. Whether they can rise to this challenge will determine not just economic prosperity but national sovereignty itself in the post-carbon world.

Further Reading and Resources

Policy and Strategy Documents:

- IEA Global Critical Minerals Outlook 2025

- Carnegie Endowment: Securing America’s Critical Minerals Supply

- Belfer Center Explainer: What Are Critical Minerals?

- UN DESA Policy Brief: Leveraging Critical Energy Transition Minerals

Research and Analysis:

- CSIS: Developing Rare Earth Processing Hubs – An Analytical Approach

- RFF: The Strategic Game of Rare Earths

- Foreign Policy: The New Critical Minerals Geopolitics

- WRI: Critical Minerals Explained

Responsible Mining and Development:

- OECD: Sustainable Mining for Development

- ICMM: Critical Minerals and Mining

- UNEP: Critical Energy Transition Minerals

- World Bank: Climate-Smart Mining Initiative

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Shared Vision Fueling the Saudi-Turkish Economic Surge: Beyond Trade to Strategic Alliance

Turkish President Recep Tayyip Erdogan and Saudi Crown Prince Mohammed bin Salman shook hands in early February 2026. It wasn’t just a photo op; it was a symbol of a seismic shift in Middle Eastern dynamics. After years of frosty relations marked by ideological clashes and proxy rivalries, Saudi Arabia and Turkey are now charting a course toward a robust strategic alliance, driven by shared economic visions and pragmatic geopolitics. This surge in Saudi-Turkish economic ties isn’t merely about boosting trade figures—it’s about reshaping regional stability in an era of global uncertainty, much like how the U.S. and China navigate their tense interdependence.

As someone who’s tracked international affairs from the corridors of power in Washington to the bustling souks of Istanbul, I’ve seen alliances form and fracture. But this one feels different: a blend of ambition and necessity. With bilateral trade already hitting $8 billion in 2025, the duo aims for $10 billion by the end of 2026 and a staggering $30 billion in the long term. It’s a narrative of renewal, where Vision 2030 meets Turkey’s Century, promising jobs, innovation, and a counterweight to chaos in places like Syria and Yemen.

The Thaw: From Rivals to Partners in a Post-Pandemic World

To understand this economic momentum, let’s rewind a bit. Relations between Riyadh and Ankara hit rock bottom after the 2018 murder of journalist Jamal Khashoggi in Istanbul, which Turkey blamed on Saudi operatives. Add to that diverging stances on the Muslim Brotherhood and the Qatar blockade, and you had a recipe for estrangement. But economics has a way of healing wounds. By 2021, both nations began mending fences, accelerated by Turkey’s currency crisis and Saudi Arabia’s push to diversify beyond oil.

Fast-forward to 2026: Erdogan’s Riyadh visit on February 3 marked his first overseas trip of the year, underscoring the priority. Accompanied by a delegation of ministers and business leaders, Erdogan met Crown Prince Mohammed to ink deals that go beyond handshakes. The talks zeroed in on renewable energy, defense, and trade, with Ankara pushing to finalize a free trade agreement with the Gulf Cooperation Council (GCC).

What sparked this turnaround? For Turkey, reeling from inflation and a need for foreign investment, Saudi capital is a lifeline. Riyadh, meanwhile, sees Turkey as a gateway to European markets and a partner in tech-savvy industries. As Dr. Sinem Cengiz, a noted Turkey-Gulf expert, has observed in her analyses, this isn’t just opportunism—it’s a convergence of visions where Saudi Arabia’s Vision 2030 (aiming for a post-oil economy) aligns with Turkey’s “Turkey Century” blueprint for global influence through trade and tech.

Real-time data paints a vivid picture. Bilateral trade surged 14% in the past year alone, fueled by Turkish exports of machinery and textiles, and Saudi inflows of petrochemicals. At the Saudi-Turkish Investment Forum in Riyadh, attended by over 700 executives, officials hailed the “unprecedented level” of ties. For everyday people, this means tangible benefits: more jobs in Istanbul’s factories and Riyadh’s megaprojects.

Key Economic Deals: Solar Power, Trade Targets, and Beyond

At the heart of this surge are concrete agreements that blend ambition with execution. Take the headline-grabbing Turkey-Saudi solar deal: Saudi Arabia committed $2 billion to build two solar farms in Turkey with a combined 2,000 MW capacity, the first phase of a potential 5 GW rollout. This isn’t just green energy—it’s a strategic pivot. For Saudi Arabia, it diversifies investments away from hydrocarbons; for Turkey, it bolsters renewable goals amid energy import dependencies.

But the deals don’t stop there. Discussions on oil, petroleum products, and petrochemicals aim to stabilize supply chains in a volatile market. And then there’s defense: Erdogan revealed potential Saudi investment in Turkey’s KAAN fighter jet program, a fifth-generation stealth aircraft that’s drawn global buzz. If realized, this could see Riyadh acquiring up to 100 jets, cementing a defense pact that rivals U.S.-led alliances.

To put this in perspective, here’s a timeline of recent milestones in Saudi-Turkish economic ties:

| Year | Key Development | Impact |

|---|---|---|

| 2021 | Initial reconciliation talks post-Khashoggi fallout | Laid groundwork for trust-building |

| 2023 | Erdogan’s Gulf tour secures $50B+ in deals (including UAE) | Boosted Turkish reserves amid economic crisis |

| 2024 | Trade hits $8B; Turkey returns $5B Saudi deposit as confidence sign | Symbolized financial stability |

| 2025 | Defense agreements signed for drones and warships | Elevated ties to strategic level |

| 2026 | Erdogan’s Riyadh visit; $2B solar investment; KAAN talks | Targets $10B trade by year-end, $30B long-term |

This table highlights the steady build-up, with 2026 as a potential inflection point. Saudi investment in Turkey has already topped $2 billion, while Turkish firms eye Vision 2030 projects like NEOM and the Red Sea developments. It’s a win-win: Turkey offers manufacturing prowess; Saudi Arabia provides capital.

Shared Visions: Vision 2030 and Turkey Century in Harmony

What truly fuels this alliance is ideological synergy. Saudi Arabia’s Vision 2030, launched in 2016, seeks to transform the kingdom into a hub for tourism, tech, and entertainment—shedding oil reliance. Turkey’s “Turkey Century,” Erdogan’s post-2023 election mantra, emphasizes self-reliance through innovation and regional leadership.

The overlap is striking. Both visions prioritize diversification: Riyadh invests in AI and renewables; Ankara pushes for advanced manufacturing and defense tech. Compare this to U.S.-China dynamics, where economic interdependence tempers rivalry—Saudi-Turkey ties could similarly stabilize the Middle East. As Erdogan noted post-visit, “We have deep-rooted relations with cultural and historical dimensions.”

On the ground, this means joint ventures. In energy, the solar pact aligns with both nations’ net-zero ambitions. In defense, KAAN collaboration could foster knowledge transfer, helping Saudi localize production. Regionally, they’re syncing on stability: Cooperating on Syria’s reconstruction, where Turkey’s military presence meets Saudi funding, could rebuild infrastructure and curb extremism. In Yemen, aligned efforts support dialogue, easing humanitarian crises.

Yet, it’s not all rosy. Challenges loom, from currency fluctuations to differing views on Iran. But the shared vision—economic resilience amid global headwinds—provides a sturdy foundation.

Navigating Challenges: Geopolitical Risks and the Path Ahead

No alliance is without hurdles. Geopolitical instability remains a wildcard. Syria’s fragile post-Assad landscape could spark tensions if Turkish and Saudi interests diverge—Ankara prioritizes border security, Riyadh focuses on anti-Iran influence. Yemen’s conflict, though de-escalating, could flare up. And broader Mideast chaos, like the Gaza crisis, tests unity.

Economically, predictability is key. Turkey’s inflation battles and Saudi’s oil price vulnerabilities could derail targets. Falling global oil demand might strain Riyadh’s investments, while Turkey’s lira woes deter long-term commitments.

Still, the forward-looking outlook is optimistic. Experts like those at the Arab Gulf States Institute see this as a “game changer,” potentially shifting power balances. If sustained, it could foster a MENA economic bloc, rivaling EU models. For businesses, opportunities abound: Saudi firms in Turkish health and tourism; Turkish contractors in Riyadh’s megacities.

In a world where superpowers like China and the U.S. jostle for influence, this alliance offers a regional antidote—pragmatic, vision-driven, and human-centered. As one Saudi official put it at the forum, “We aspire to become the largest economic partners in the region.”

Conclusion: A Blueprint for Regional Renaissance

The Saudi-Turkish economic surge is more than numbers—it’s a story of reinvention. From $8 billion in trade today to $30 billion tomorrow, fueled by solar deals, KAAN jets, and shared visions, this partnership could redefine the Middle East. But success hinges on navigating risks with the same pragmatism that birthed it.

Looking ahead, 2026 could be the year it all crystallizes: Free trade pacts sealed, investments flowing, stability spreading. For millions across the region, this means hope—cleaner air from solar panels, jobs from joint projects, peace from aligned diplomacy. In an unpredictable world, Saudi-Turkey ties remind us that shared ambition can turn rivals into allies. Watch this space; the surge is just beginning.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Global Economy

Pakistan’s Export Goldmine: 10 Game-Changing Markets Where Pakistani Businesses Are Winning Big in 2025

A data-driven roadmap to Pakistan’s most lucrative export destinations, backed by official trade statistics and strategic insights

When Karachi-based textile exporter Asim Raza signed his first €2 million contract with a German retailer in early 2024, he didn’t realize he was riding a wave that would define Pakistan’s economic transformation. His company’s exports to Germany grew by 33% that year—a microcosm of Pakistan’s surging global competitiveness in strategic markets.

Pakistan’s exports reached $32.34 billion in 2024, with goods and services exports climbing to $16.56 billion in the first half of fiscal year 2024-25—a robust 10.52% year-over-year increase. But here’s what the headlines miss: Pakistan isn’t just exporting more. It’s exporting smarter, targeting high-value markets with precision and diversifying beyond its traditional textile stronghold.

This analysis reveals the 10 most promising export destinations for Pakistani goods and services in 2025, backed by data from Pakistan’s State Bank, Bureau of Statistics, international trade databases, and insights from the IMF and World Bank. Whether you’re a seasoned exporter or an entrepreneur eyeing global markets, these destinations represent Pakistan’s best opportunities for sustainable, profitable growth.

Executive Summary: The $50 Billion Opportunity

Pakistan stands at an economic inflection point. The IT sector alone hit a record $4.6 billion in exports for FY 2024-25, marking 26.4% growth, while traditional textiles maintained their dominance despite global headwinds. The 10 markets analyzed here collectively account for over 67% of Pakistan’s total exports and represent combined annual trade potential exceeding $50 billion by 2027.

Key Findings:

- The United States remains Pakistan’s largest export market at $5.6 billion annually, offering unparalleled stability

- UAE trade surged to $10.9 billion in FY 2023-24, with Pakistani exports jumping 41% to $2.08 billion

- European Union markets absorbed $9.0 billion in Pakistani exports in 2024, representing 27.6% of total exports

- Saudi Arabia’s IT imports from Pakistan increased 48% to $47.09 million in FY24

- Emerging opportunities in GCC markets, driven by Vision 2030 initiatives

Methodology: How We Identified These Markets

This analysis combines quantitative trade data with qualitative assessments across five critical dimensions:

- Market Size & Growth Trajectory: Current export volumes and 3-year growth rates

- Trade Policy Environment: Tariff structures, free trade agreements, and preferential access

- Sector Diversification Potential: Opportunities beyond Pakistan’s core exports

- Payment Security & Stability: Currency strength, political risk, and ease of doing business

- Infrastructure & Logistics: Shipping costs, trade corridors, and connectivity

Data sources include Pakistan Bureau of Statistics, State Bank of Pakistan, IMF World Economic Outlook, World Bank Trade Statistics, UN COMTRADE, and official government portals including pc.gov.pk, finance.gov.pk, and invest.gov.pk.

1. United States: The $5.6 Billion Anchor Market

Why America Matters

The United States purchased $5.6 billion worth of Pakistani goods in 2024, representing 17.3% of Pakistan’s total exports. More remarkably, exports to the US reached $1.46 billion in Q1 FY 2024-25 alone, up 6.18% year-over-year, demonstrating resilient demand despite global economic uncertainty.

The US market offers Pakistani exporters something invaluable: predictability. With established payment mechanisms, minimal political risk, and strong rule of law, American buyers provide the stable cash flows that enable Pakistani businesses to scale.

What Pakistan Exports to America

Textiles dominate with bed linens, home textiles, and cotton apparel leading shipments. However, diversification is accelerating. Pakistani surgical instruments from Sialkot, basmati rice, leather goods, and an emerging wave of IT services are gaining traction.

IT services to the United States accounted for 54.5% of Pakistan’s total IT exports in FY 2023, signaling a critical shift toward high-value service exports. Pakistani software houses, freelance platforms, and tech startups are tapping into America’s insatiable demand for affordable, skilled digital talent.

Competitive Edge

Pakistan benefits from preferential treatment under various US trade programs and decades-old procurement relationships. American retailers seeking ethical, cost-effective sourcing alternatives to China increasingly view Pakistan as a strategic partner.

The US Generalized System of Preferences historically provided duty-free access for many Pakistani products, though its reinstatement remains under policy review. Regardless, Pakistan’s competitive pricing—often 15-20% below alternatives—ensures market access.

Entry Strategy

Start with established channels: Partner with US import-export houses that understand compliance requirements (FDA for food, CPSIA for consumer goods). Attend trade shows like NY Textile Week, the Magic Las Vegas fashion trade show, or specialty exhibitions in target sectors.

Focus on certifications: US buyers demand compliance. GOTS (Global Organic Textile Standard), WRAP (Worldwide Responsible Accredited Production), and ISO certifications open doors that pricing alone cannot.

For IT exporters: Leverage Pakistan Software Export Board (PSEB) resources, join Upwork Enterprise or Toptal platforms, and target mid-market US companies seeking dedicated offshore teams.

2. United Arab Emirates: The $10.9 Billion Gateway to Global Markets

Why UAE is Pakistan’s Strategic Hub

Bilateral trade between Pakistan and the UAE hit $10.9 billion in FY 2023-24, with goods trade at $8.41 billion and services at $2.56 billion. Pakistani exports surged by 41.06% to $2.08 billion, making UAE one of Pakistan’s fastest-growing export destinations.

But here’s the real story: UAE’s Pakistani expatriate community sent home $6.7 billion in remittances in 2024, expected to surpass $7 billion in 2025. This creates natural demand channels for Pakistani consumer goods while establishing financial corridors that reduce transaction costs for exporters.

What Thrives in UAE Markets

Food & Agriculture: Pakistani Basmati rice enjoys significant reputation in UAE markets, alongside mangoes, citrus fruits, and halal meat products. UAE’s reliance on food imports—the country imports over 90% of its food—creates perpetual demand.

Textiles & Home Goods: Pakistani fabrics, garments, and home textiles flow through Dubai’s re-export channels to Africa, Central Asia, and Europe.

IT Services: Pakistan aims to double IT exports to Saudi Arabia from $50 million to $100 million, with UAE serving as a regional IT hub connecting to broader GCC markets.

Construction Materials: Pakistan’s cement and marble industries supply UAE’s perpetual infrastructure boom.

Strategic Advantages

- Geographical proximity: Shipping costs 40-50% lower than to Europe or Americas

- Cultural affinity: 1.5 million Pakistani diaspora creates built-in market knowledge

- Re-export platform: UAE’s world-class logistics turn Dubai into a springboard for African and Central Asian markets

- Investment flows: Over $10 billion in Emirati investments in Pakistan over two decades facilitate two-way trade

Market Entry Tactics

Establish presence in Dubai’s Jebel Ali Free Zone or DAFZA (Dubai Aviation Free Zone) for tax advantages and simplified customs. Participate in major trade exhibitions like GULFOOD (food sector), INDEX (interior design/home textiles), and GITEX (technology).

Partner with established UAE trading houses that manage distribution across GCC markets. For smaller exporters, UAE’s growing e-commerce infrastructure (Noon, Amazon.ae) offers direct-to-consumer channels.

3. United Kingdom: The $2.1 Billion Legacy Market with Modern Potential

The UK Advantage

The UK absorbed $2.1 billion in Pakistani exports in 2024, making it the third-largest destination with 6.6% of total export share. More importantly, Q1 FY 2024-25 exports to UK grew to $562.75 million from $519.14 million year-over-year, demonstrating sustained momentum post-Brexit.

The UK represents more than just trade numbers—it’s Pakistan’s gateway to Commonwealth markets and English-speaking channels. A 1.6 million-strong British Pakistani community creates unmatched market intelligence and distribution networks.

What Britain Buys from Pakistan

Textiles reign supreme: Pakistani cotton, knitwear, and home textiles meet Britain’s insatiable fast-fashion and home goods demand. Major retailers like Marks & Spencer, Tesco, and ASDA source extensively from Pakistani manufacturers.

Food products: Basmati rice, halal meat, and spices cater to both ethnic markets and mainstream British consumers increasingly embracing diverse cuisines.

Leather goods: Pakistan’s leather jackets, bags, and footwear compete effectively on quality and price in UK’s mid-to-premium segments.

Post-Brexit Opportunities

Brexit created complexity but also opportunity. Pakistan and the UK are negotiating an enhanced trade agreement that could provide preferential access beyond the UK’s standard GSP arrangements. Pakistani exporters should position for these emerging frameworks.

The UK’s “Global Britain” strategy actively seeks non-EU trade partnerships, creating openings for Pakistani businesses willing to meet British standards (UKCA marking replacing CE, enhanced traceability).

Action Plan

Quality is non-negotiable: British consumers and regulators demand high standards. Invest in UK Accreditation Service (UKAS) recognized certifications.

Tap into ethnic channels: British Pakistani-owned wholesalers and retailers provide market entry points with lower barriers. Birmingham, Manchester, and London’s ethnic business districts are goldmines for first-time exporters.

Digital commerce: UK online shopping penetration exceeds 80%. Pakistani brands can sell directly via Amazon UK, eBay, or specialized platforms like Not On The High Street (artisan goods).

4. Germany: The $1.72 Billion European Manufacturing Powerhouse

Germany: Quality Meets Scale

Germany imported $1.72 billion worth of Pakistani goods in 2024, making it Pakistan’s fifth-largest export market and the most significant European Union destination. Germany accounts for 19.2% of Pakistan’s total EU exports, driven by industrial demand and consumer purchasing power.

German exports to Pakistan reached €400.1 million in H1 2024, while imports from Pakistan hit €1.19 billion, revealing a favorable trade balance for Pakistan and German appetite for Pakistani products.

What German Buyers Want

Technical textiles: Germany’s automotive and industrial sectors import Pakistani technical fabrics, nonwovens, and specialized textiles that meet rigorous specifications.

Home textiles & fashion: Textiles and garments comprise 85.4% of German imports from Pakistan, supplying retailers from discount chains (Aldi, Lidl) to premium brands.

Surgical instruments: Sialkot’s surgical instrument cluster exports precision tools to German medical suppliers, renowned for quality matching European standards.

Leather goods: Pakistani leather jackets, gloves, and accessories compete in Germany’s price-conscious yet quality-demanding market.

The GSP+ Advantage

Pakistan benefits from EU’s GSP+ status, providing duty-free or reduced tariffs on over 66% of product categories. Approximately 78.7% of EU imports from Pakistan utilize GSP+ preferential tariffs, creating substantial cost advantages over non-GSP+ competitors.

Germany views Pakistan favorably under GSP+, granting full tariff removal on most Pakistani exports, making it one of the most profitable European markets for Pakistani goods.

The “Made in Germany” Connection

Germany’s reputation for quality creates opportunities for Pakistani manufacturers willing to meet exacting standards. “Made in Germany” products enjoy strong reputation, and Pakistani suppliers providing components or finished goods to German brands can leverage this halo effect.

Breaking into Germany

Attend trade fairs: Germany hosts world-leading B2B exhibitions including Heimtextil (home textiles, Frankfurt), Texprocess (textile processing, Frankfurt), and MEDICA (medical equipment, Düsseldorf).

Partner with German Mittelstand: Germany’s medium-sized companies (Mittelstand) seek reliable, cost-effective suppliers. These family-owned firms value long-term relationships over transactional deals.

Emphasize sustainability: German buyers increasingly demand environmental certifications (GOTS, OEKO-TEX, FSC). Investment in green manufacturing pays dividends in German markets.

5. China: The $2.4 Billion Two-Way Opportunity

The Dragon’s Appetite

China imported $2.4 billion of Pakistani goods in 2024, representing 7.3% of total Pakistani exports. However, exports to China declined 10.54% in recent reporting periods, revealing a complex, evolving trade relationship that demands strategic navigation.

China represents Pakistan’s second-largest trading partner and the anchor of the China-Pakistan Economic Corridor (CPEC), but the relationship is asymmetric—Pakistan imports far more from China than it exports, creating persistent trade deficits.

What China Actually Buys

Agricultural products dominate: Chinese consumers prize Pakistani basmati rice, seafood (especially shrimp and fish), and increasingly, premium fruits like mangoes and kinnows (citrus).

Raw materials: Cotton, copper, and minerals flow from Pakistan to feed China’s manufacturing machine.

Textiles (surprisingly): While China produces textiles globally, it imports specialty Pakistani fabrics, particularly high-quality cotton yarns and home textiles that Chinese manufacturers re-export as finished products.

The CPEC Multiplier Effect

CPEC infrastructure—Gwadar Port, transportation corridors, Special Economic Zones—theoretically positions Pakistan as China’s gateway to Middle Eastern and African markets. The promise: Pakistani manufacturers using Chinese investment to produce goods for re-export through improved logistics networks.

Reality check: This vision remains partially unfulfilled, but opportunities are materializing. Pakistani businesses should focus on becoming component suppliers in Chinese value chains rather than competing head-to-head with Chinese manufacturers.

Strategic Positioning

Target Chinese consumers directly: Pakistan’s premium food products (organic rice, Himalayan salt, mangoes) appeal to China’s rising middle class seeking healthy, exotic imports. Exports to China totaled $559 million in Q1 FY 2024-25, suggesting continued relevance despite year-over-year declines.

E-commerce platforms: Alibaba’s Tmall Global, JD Worldwide, and cross-border e-commerce platforms allow Pakistani brands to reach Chinese consumers without traditional import channels.

Focus on differentiation: Pakistan cannot compete with China on price for manufactured goods. Instead, emphasize authenticity (premium basmati), sustainability (organic products), and quality craftsmanship (surgical instruments, leather goods).

Entry Tactics

Attend Canton Fair (Guangzhou) for market research and relationship building. Partner with Chinese import-export houses that understand Chinese regulatory requirements (CIQ certifications, customs processes).