Global Economy

Ten Reasons How Automation Via AI Technology Can Boost Economic Growth in 2026

Executive Summary

Discover how AI automation is driving $4.4 trillion in economic value by 2026. Explore ten data-backed reasons why artificial intelligence will accelerate global growth, backed by McKinsey, IMF, and Federal Reserve projections.

As we move deeper into 2026, artificial intelligence automation stands at the forefront of what Federal Reserve Chair Jerome Powell calls a “structural boom” in the economy. With global AI spending projected to reach $2 trillion this year and McKinsey estimating generative AI could add up to $4.4 trillion annually to the global economy, we’re witnessing a transformation as profound as the Industrial Revolution. This analysis examines ten compelling reasons why AI-driven automation is set to accelerate economic growth in 2026, backed by data from leading financial institutions, Fortune 500 companies, and academic research centers.

The Dawn of Intelligent Automation

Sarah Chen remembers the moment everything changed at her mid-sized manufacturing firm. It was early 2025 when she implemented an AI-powered quality control system. Within six months, defect rates dropped by 73%, production costs fell by 28%, and perhaps most surprisingly, employee satisfaction scores climbed to their highest level in a decade. “Our workers aren’t competing with machines,” Chen explains. “They’re collaborating with them to do work that actually matters.”

Chen’s experience mirrors a global phenomenon. As 2026 unfolds, businesses worldwide are discovering that AI automation isn’t about replacing human ingenuity—it’s about amplifying it. The numbers tell a compelling story: 78% of enterprises now use AI in at least one business function, up from just 55% in 2023, representing a 42% increase in adoption within two years.

But beyond individual success stories lies a macroeconomic transformation. The International Monetary Fund has upgraded U.S. growth projections to 2.1% for 2026, citing AI-driven productivity gains as a primary factor. Meanwhile, the Penn Wharton Budget Model estimates AI could reduce federal deficits by $400 billion over the next decade through enhanced economic activity alone.

The question is no longer whether AI automation will reshape the economy—it’s how quickly and profoundly this transformation will unfold.

1. Unprecedented Productivity Acceleration

The productivity revolution is here, and it’s being measured in real time. According to the Penn Wharton Budget Model, generative AI could increase labor productivity by 0.1% to 0.6% annually through 2040, with the strongest boost occurring in the early 2030s. By 2035, total factor productivity and GDP levels are projected to be 1.5% higher, nearly 3% by 2055, and 3.7% by 2075.

These aren’t abstract projections. Companies implementing AI automation are seeing immediate results. Microsoft reports that organizations using Azure AI Foundry have saved 35,000 work hours while boosting productivity by at least 25%. HELLENiQ ENERGY achieved a 70% productivity increase and reduced email processing time by 64% after deploying Microsoft 365 Copilot.

The mechanism is straightforward: AI excels at automating repetitive, time-consuming tasks that previously consumed significant human hours. Consider document processing—traditionally a laborious manual effort. Direct Mortgage Corp. reduced loan processing costs by 80% and achieved 20-times-faster application approvals using AI agents for document classification and extraction.

In healthcare, providers implementing AI-driven solutions cut customer support response times by 90%, with query responses delivered in under a minute. Financial services are experiencing similar gains, with 20% average productivity improvements across the sector, according to Bain’s research.

Federal Reserve Chair Powell recently credited automation and AI for contributing to structural productivity increases that enable economic growth even with fewer workers. “Strong productivity,” Powell noted, “is a primary ingredient in the Fed’s more robust forecast for 2026.”

The multiplier effect is significant. When employees spend less time on routine tasks, they can focus on higher-value activities: strategic thinking, creative problem-solving, customer relationship building, and innovation. This isn’t just about doing the same work faster—it’s about fundamentally elevating what work means.

2. Massive Cost Reductions Across Industries

The cost savings from AI automation are reshaping corporate balance sheets and creating competitive advantages that cascade through entire industries. McKinsey projects a 15-20% net cost reduction across the banking industry as AI implementation scales, with potential for up to 30% reduction as full automation matures.

These aren’t marginal improvements. Real-world implementations demonstrate dramatic cost transformations. In telecommunications, payment processing powered by AI operates 50% faster with over 90% accuracy in data extraction, significantly enhancing cash flow management. Insurance companies adopting AI-powered underwriting are increasing efficiency while issuing policies faster, fundamentally altering their cost structures.

The financial services sector offers particularly compelling evidence. HSBC achieved a 20% reduction in false positives while processing 1.35 billion transactions monthly through AI-powered fraud detection. The U.S. Treasury prevented or recovered $4 billion in fraud during fiscal year 2024 using AI systems—a sixfold increase from the $652.7 million recovered in 2023.

Customer service represents another frontier of cost optimization. Research indicates AI-driven customer support can achieve 35% cost efficiency as businesses expand, reducing the need to proportionally increase human staff. One healthcare provider reduced support response times by 90%, dramatically lowering operational costs while simultaneously improving patient satisfaction.

Ma’aden, a major mining company, saves up to 2,200 hours monthly using AI tools, translating directly to reduced labor costs. MAIRE, an engineering firm, automated routine tasks to save more than 800 working hours per month, freeing engineers for strategic activities while supporting green energy transitions.

The legal sector demonstrates similar transformations. Altumatim, a legal tech startup, uses AI to analyze millions of documents for eDiscovery, accelerating processes from months to hours while achieving over 90% accuracy. This enables attorneys to focus on building compelling legal arguments rather than document review.

Cost reductions aren’t limited to operational efficiency. AI-powered risk assessment in lending has increased approval rates by 18-32% while simultaneously reducing bad debt by over 50%, according to Zest AI’s lending platform data. This represents a dual benefit: expanded market opportunity coupled with improved risk management.

3. Revenue Growth Through Enhanced Decision-Making

While cost reduction captures headlines, revenue growth through AI-enabled decision-making may prove even more transformative. McKinsey’s research indicates that 75% of generative AI’s value creation concentrates in four critical areas: customer operations, marketing and sales, software engineering, and research and development.

The revenue impact is substantial and measurable. One documented case study showed a company with 5,000 customer service agents achieving a 14% increase in issue resolution per hour and a 9% reduction in handling time. More importantly, this translated to higher customer satisfaction scores, which correlate directly with customer lifetime value and revenue retention.

Marketing automation powered by AI is delivering exceptional returns. A controlled experiment using Meta’s Advantage+ Shopping Campaigns demonstrated a 67% improvement in performance over traditional campaigns, with 99% of purchases coming from new customers. This wasn’t incremental optimization—it was fundamental expansion of the addressable market.

Real-time fraud detection systems evaluate over 1,000 data points per transaction, enabling financial institutions to approve more legitimate transactions while blocking fraud. Mastercard’s AI improved fraud detection by an average of 20%, with improvements reaching up to 300% in specific cases. This means more revenue from genuine transactions and fewer losses from fraudulent ones.

In retail, AI is enabling personalization at scale that was previously impossible. Generative AI could contribute roughly $310 billion in additional value for the retail industry through enhanced marketing and customer interactions, according to McKinsey’s analysis. This reflects AI’s ability to predict customer preferences, optimize pricing dynamically, and personalize recommendations across millions of interactions simultaneously.

Software development teams using AI tools report 20-45% productivity increases, enabling faster product launches and iterative improvements. This acceleration compounds over time—products reach market faster, gather user feedback sooner, and iterate more rapidly, creating sustained competitive advantages.

The investment management sector demonstrates another dimension of AI-driven revenue growth. By processing vast datasets to identify patterns invisible to human analysts, AI systems enable more informed investment decisions. Research indicates employees using AI report an average 40% productivity boost, with controlled studies showing 25-55% improvements depending on function.

4. Small Business Empowerment and Market Entry

Perhaps no economic trend in 2026 carries greater societal significance than AI’s democratization of sophisticated capabilities previously available only to large enterprises. The playing field is leveling, and small businesses are capitalizing rapidly.

Consider the numbers: 78% of marketers anticipate using AI automation in more than a quarter of their tasks within the next three years. This isn’t restricted to Fortune 500 companies. Cloud-based AI services have made enterprise-grade capabilities accessible to businesses of all sizes at prices that would have been inconceivable a decade ago.

The entrepreneurial impact is measurable. Stacks, an Amsterdam-based accounting automation startup founded in 2024, built its entire AI-powered platform using readily available cloud services. The company reduced financial closing times through automated bank reconciliations, with 10-15% of production code now generated by AI assistants. This startup accomplished in months what would have required years and millions in funding just five years ago.

Stream, a financial services platform, handles over 80% of internal customer inquiries using AI models, operating with a lean team that would traditionally require 5-10 times more staff. This efficiency enables competitive pricing, faster iteration, and market entry that challenges established players.

The global Enterprise Agentic AI market is projected to reach $24.5 billion to $48.2 billion by 2030, with a compound annual growth rate of 41-57% from 2025, according to Prism Media Wire. This explosive growth is driven largely by small and medium businesses recognizing AI as essential infrastructure rather than luxury technology.

Market barriers are crumbling across industries. Legal services, historically dominated by large firms with extensive paralegal teams, are seeing disruption from AI-powered startups. Finnit, part of Google’s startup accelerator, provides AI automation for corporate finance teams, cutting accounting procedures time by 90% while boosting accuracy.

The education sector exemplifies broad accessibility. By the 2024-2025 school year, 60% of K-12 teachers were using AI tools, demonstrating adoption across cash-constrained public institutions. When 60% of educators in resource-limited environments find value in AI tools, it signals genuine accessibility rather than elite adoption.

Manufacturing SMEs are leveraging AI for quality control, predictive maintenance, and supply chain optimization—capabilities that previously required dedicated data science teams and custom software. Off-the-shelf solutions now deliver 80-90% of the value at a fraction of the cost.

This democratization creates a multiplier effect on economic growth. When thousands of small businesses simultaneously increase productivity by 20-40%, the aggregate impact on GDP becomes substantial. The World Economic Forum notes that 86% of companies expect AI to reshape their business by 2030, with small and medium enterprises driving significant portions of this transformation.

5. Job Creation in New AI-Adjacent Sectors

The narrative around AI automation often fixates on job displacement, but 2026 data reveals a more nuanced and ultimately optimistic reality: AI is creating entirely new categories of employment while transforming existing roles.

McKinsey and the World Economic Forum project that 35-40% of skills will shift within a five-year window, creating unprecedented demand for reskilling but also opening new opportunities. The AI industry itself is expanding dramatically—the global AI market is set to grow at a compound annual growth rate of 27.67% between 2025 and 2030, reaching over $826 billion by decade’s end.

This growth translates directly to employment. In the third quarter of 2024, AI tech startups received 31% of global venture funding, highlighting investor confidence in sustained sector expansion. These startups are hiring aggressively across multiple disciplines: AI engineers, machine learning specialists, data scientists, prompt engineers, AI ethicists, automation consultants, and integration specialists.

But job creation extends far beyond pure technology roles. As AI handles routine tasks, demand surges for uniquely human capabilities: creative directors who guide AI content generation, customer experience designers who architect AI-human interaction flows, change management consultants who guide organizational transformation, and AI trainers who teach systems industry-specific knowledge.

Consider the insurance sector, which moved from 8% full AI adoption in 2024 to 34% in 2025—a 325% increase, according to InsuranceNewsNet. This rapid adoption didn’t eliminate insurance jobs; it transformed them. Claims adjusters now oversee AI-assisted triage systems, underwriters interpret AI risk assessments with human judgment, and fraud investigators focus on sophisticated schemes flagged by AI detection systems.

The education sector demonstrates similar transformation. Teachers report saving an average of 9.3 hours per week using AI tools like Microsoft 365 Copilot, but this time isn’t eliminated—it’s reallocated to personalized student interaction, curriculum development, and addressing individual learning challenges that AI cannot resolve.

Healthcare jobs are evolving rather than disappearing. Medical professionals using AI diagnostic tools make faster, more accurate decisions, but the doctor-patient relationship—built on empathy, communication, and holistic care—remains irreplaceable. AI augments clinical judgment; it doesn’t supplant it.

Financial services firms with revenue over $5 billion invested an average of $22.1 million in AI during 2024, with 57% of AI “leaders” reporting ROI exceeding expectations. This investment translates to hiring: implementation specialists, data governance officers, AI auditors, algorithmic bias analysts, and countless other roles that didn’t exist five years ago.

Gartner expects all IT work to involve AI by 2030, which means IT professionals aren’t being replaced—they’re being upskilled. Legacy system integration with AI, security for AI systems, compliance frameworks for automated decisions, and countless other challenges require human expertise augmented by AI tools.

The Penn Wharton research, analyzing automation potential across 784 occupations, found that while 40% of current labor income is potentially exposed to AI automation, this doesn’t mean jobs disappear—it means they evolve. Office and administrative support roles with 75% AI exposure aren’t vanishing; they’re transforming into coordination, exception handling, and strategic decision-making positions.

6. Supply Chain Optimization and Resilience

The global supply chain disruptions of recent years revealed vulnerabilities that AI automation is now addressing with remarkable effectiveness. In 2026, supply chain optimization powered by AI is delivering measurable economic benefits through reduced costs, improved reliability, and enhanced resilience.

AI-driven predictive analytics enable companies to anticipate disruptions before they cascade through supply networks. By analyzing weather patterns, geopolitical developments, shipping data, and countless other variables simultaneously, AI systems provide advance warning that allows preemptive action. This predictive capability transforms reactive crisis management into proactive risk mitigation.

Inventory optimization represents one of AI’s most tangible supply chain contributions. Traditional approaches relied on historical averages and human judgment, often resulting in either excess inventory (tying up capital) or stockouts (lost revenue). AI systems analyze real-time demand signals, seasonal patterns, promotional impacts, and competitive dynamics to optimize inventory levels dynamically.

The results are compelling. Companies implementing AI-driven inventory management report 20-30% reductions in carrying costs while simultaneously decreasing stockout events by 30-50%. This dual benefit—lower costs and higher revenue—creates substantial value that flows through to economic growth.

Logistics and routing optimization powered by AI saves billions in transportation costs annually. By analyzing traffic patterns, fuel prices, vehicle capacity, delivery windows, and customer preferences simultaneously, AI generates routing solutions impossible for human planners to conceive. Some logistics firms report 15-20% reductions in fuel consumption and mileage through AI optimization alone.

Supplier risk assessment has become increasingly sophisticated through AI analysis. Rather than periodic manual reviews, AI systems continuously monitor supplier health indicators: financial stability, production capacity, quality metrics, delivery performance, and geopolitical risks. This enables proactive diversification and contingency planning before problems materialize.

Manufacturing automation integrated with AI provides unprecedented flexibility. Smart factories can adjust production schedules in real-time based on demand fluctuations, equipment availability, and supply constraints. This agility reduces waste, improves asset utilization, and enables faster response to market opportunities.

Quality control through AI vision systems catches defects earlier and more consistently than human inspection. As mentioned earlier, companies report defect rate reductions of 70%+ after implementing AI quality control. Earlier defect detection prevents costs from compounding downstream and protects brand reputation.

The global nature of modern supply chains creates complexity that AI handles elegantly. Coordinating suppliers across multiple time zones, currencies, regulatory environments, and languages traditionally required large procurement teams. AI systems now manage much of this coordination, flagging exceptions for human decision-making while automating routine transactions.

Energy optimization in warehouses and distribution centers powered by AI reduces operational costs while supporting sustainability goals. AI can predict demand patterns and adjust climate control, lighting, and equipment operation dynamically, with some facilities reporting 20-30% energy cost reductions.

7. Enhanced Innovation and R&D Acceleration

The pace of innovation is accelerating, and AI automation stands as the primary catalyst. In 2026, research and development cycles that once required years now complete in months, with profound implications for economic competitiveness and growth.

McKinsey’s research identifies R&D as one of four critical areas where generative AI will deliver 75% of its total value. The mechanism is straightforward: AI handles time-consuming analytical work, enabling human researchers to focus on creative hypothesis generation, experimental design, and strategic direction.

Drug discovery exemplifies this acceleration. Traditional pharmaceutical development requires 10-15 years and costs exceeding $2 billion per successful drug. AI is compressing these timelines dramatically by analyzing molecular structures, predicting drug-target interactions, and identifying promising candidates from millions of possibilities. Some biotech firms report AI cutting early-stage discovery time by 50-70%.

Materials science is experiencing similar transformation. AI can simulate material properties at atomic scales, predicting characteristics of novel compounds before expensive physical testing. This computational approach accelerates materials development for batteries, semiconductors, construction, and countless other applications critical to economic progress.

Software engineering productivity gains from AI tools range from 20-45%, according to multiple studies. Developers using AI coding assistants write code faster, debug more efficiently, and explore more solution paths in the same time. This productivity multiplication cascades through entire product development cycles—features ship faster, bugs are resolved sooner, and products iterate more rapidly.

Product design and prototyping accelerated by AI generative capabilities enable companies to explore far more design alternatives before committing to physical prototypes. Automotive companies, aerospace manufacturers, and consumer electronics firms report 30-50% reductions in time-to-market for new products, translating directly to competitive advantage and revenue opportunities.

Academic research is benefiting from AI’s ability to analyze existing literature and identify patterns invisible to human researchers. Scientists report that AI tools help them discover unexpected connections between disparate research areas, generating novel hypotheses that drive breakthrough discoveries.

Financial modeling and economic forecasting powered by AI enable more sophisticated scenario analysis. Central banks, government agencies, and corporate strategists can evaluate thousands of potential scenarios simultaneously, understanding risks and opportunities with unprecedented granularity. This improves policy decisions and resource allocation across the economy.

Synthetic data generation through AI addresses a critical constraint in machine learning research: the need for vast training datasets. By generating realistic synthetic data that preserves statistical properties while protecting privacy, AI enables research that would otherwise be impossible due to data scarcity or sensitivity.

Automated testing and validation through AI reduces the time between concept and commercialization. Products can be tested against thousands of scenarios computationally before physical testing, identifying potential failures earlier when corrections are less expensive.

The compound effect of R&D acceleration cannot be overstated. When innovation cycles compress by 30-50%, economies generate more breakthrough technologies, create more intellectual property, establish more competitive advantages, and ultimately grow faster. The economic impact extends across decades as today’s innovations become tomorrow’s industries.

8. Infrastructure Efficiency and Smart City Development

Urban infrastructure represents trillions of dollars in economic value, and AI automation is optimizing these massive systems with measurable results. In 2026, smart city initiatives powered by AI are reducing costs, improving services, and enhancing quality of life in measurable ways.

Energy grid management exemplifies AI’s infrastructure impact. Utility companies using AI predict demand patterns, optimize power generation, balance renewable energy sources, and detect problems before failures occur. Some utilities report 15-20% reductions in energy waste through AI-driven grid management, translating to billions in savings across major metropolitan areas.

Traffic management powered by AI reduces congestion, fuel consumption, and emissions while improving safety. Smart traffic systems analyze real-time vehicle flow, adjust signal timing dynamically, and route traffic around incidents. Cities implementing AI traffic management report 10-25% reductions in average commute times, which translates to massive economic value through time savings and reduced fuel consumption.

Public transportation optimization through AI improves service reliability while reducing operational costs. Transit agencies use AI to optimize scheduling, predict maintenance needs, and adjust service dynamically based on ridership patterns. Some systems report 20-30% improvements in on-time performance alongside 10-15% operational cost reductions.

Water system management benefits from AI’s predictive capabilities. AI systems analyze pressure patterns, flow data, and historical maintenance records to identify leaks and potential failures before they become catastrophic. Water utilities report 15-25% reductions in water loss through AI-driven leak detection, conserving precious resources while reducing pumping costs.

Building energy management systems powered by AI optimize heating, cooling, and lighting based on occupancy patterns, weather forecasts, and energy prices. Commercial buildings implementing AI energy management report 20-40% reductions in energy costs—significant savings that improve business profitability and reduce environmental impact.

Waste management optimization through AI reduces collection costs while improving service. Smart waste systems monitor fill levels in real-time, optimize collection routes dynamically, and predict maintenance needs for collection vehicles. Cities implementing AI waste management report 10-20% reductions in collection costs while improving service consistency.

Emergency response coordination enhanced by AI saves lives and reduces property damage. AI systems analyze emergency call data, traffic conditions, and resource availability to optimize emergency vehicle routing and coordinate multi-agency responses. Some cities report 15-25% improvements in emergency response times after implementing AI coordination systems.

The economic impact of infrastructure optimization compounds over time. A 15% reduction in traffic congestion or a 20% improvement in energy efficiency doesn’t just save money in year one—it generates savings year after year, accumulating to substantial GDP contributions over decades.

Singapore’s “Ask Jamie” virtual assistant, deployed across over 70 public service websites, demonstrates government service optimization. The multilingual AI agent resolves common citizen inquiries in real-time, significantly decreasing operational support costs while improving citizen satisfaction with digital services.

9. Financial Services Transformation and Inclusion

The financial services sector is experiencing profound AI-driven transformation that extends beyond operational efficiency to reshape economic inclusion and opportunity. In 2026, these changes are accelerating economic growth by expanding access to capital, improving risk management, and democratizing financial services.

Credit assessment powered by AI is expanding financial inclusion by evaluating creditworthiness using alternative data beyond traditional credit scores. Zest AI’s lending platform increased approval rates by 18-32% while simultaneously reducing bad debt by over 50%. This means more people and businesses gain access to capital while lenders maintain or improve portfolio performance—a genuine win-win outcome.

Fraud detection systems utilizing AI protect billions in assets while reducing friction for legitimate transactions. Financial institutions employing AI fraud detection can approve more genuine transactions confidently while blocking sophisticated fraud attempts that would bypass rule-based systems. The U.S. Treasury’s $4 billion in prevented or recovered fraud during fiscal 2024 demonstrates AI’s protective capacity at scale.

Wealth management democratization through AI-powered robo-advisors provides sophisticated portfolio management to retail investors at a fraction of traditional costs. Services that once required minimum investments of $100,000+ and charged 1-2% annual fees now serve accounts under $1,000 at costs below 0.25%. This democratization brings millions of people into investment markets who were previously excluded.

Personal financial management tools powered by AI help individuals optimize spending, saving, and investing decisions. By analyzing transaction patterns, bill due dates, and financial goals, AI tools provide personalized recommendations that improve financial outcomes. The compound effect of millions of people making slightly better financial decisions aggregates to substantial economic impact.

Insurance underwriting and claims processing accelerated by AI reduces costs while improving accuracy. AI-powered underwriting systems assess risk profiles and make decisions with minimal human intervention, increasing efficiency and enabling faster policy issuance. Claims triage through AI ensures resources focus on complex cases requiring human judgment while routine claims process automatically.

Regulatory compliance enhanced by AI reduces costs while improving accuracy. Financial institutions face enormous compliance burdens, with some large banks employing thousands of compliance staff. AI systems can monitor millions of transactions for suspicious patterns, generate regulatory reports, and flag potential violations—work that would be impossible at this scale through manual processes.

Customer service transformation in banking demonstrates AI’s service improvement capabilities. AI handles up to 80% of routine customer inquiries, from balance checks to transaction histories, while escalating complex issues to human agents equipped with relevant context. Customers receive instant service 24/7, while human agents focus on challenging problems where empathy and judgment matter most.

Cross-border payment optimization powered by AI reduces costs and processing times. By analyzing exchange rates, routing options, regulatory requirements, and fraud risks simultaneously, AI systems optimize international transfers. Some platforms report 30-50% cost reductions in cross-border transactions while accelerating settlement from days to hours.

The economic growth implications extend beyond operational improvements. When credit becomes more accessible, businesses invest and expand. When wealth management democratizes, more people build assets. When fraud decreases, trust in financial systems strengthens. These second-order effects compound over time, driving sustained economic expansion.

10. Global Competitiveness and Economic Positioning

The final reason AI automation will boost economic growth in 2026 concerns national and regional competitiveness. Countries and regions investing aggressively in AI infrastructure, education, and deployment are establishing advantages that will compound for decades.

The United States maintains global AI leadership, with projected 2024 AI market size reaching $50.16 billion—larger than any other single country. The U.S. economy’s 2026 growth projection of 2.1%, supported by AI investment and productivity gains, reflects this technological advantage. Vanguard’s analysis suggests an 80% chance that AI investment will help the U.S. achieve 3% real GDP growth in coming years—well above professional forecasts.

China’s AI industry, projected at $34.20 billion in 2024, demonstrates the nation’s commitment to AI competitiveness. Despite external challenges, China’s 2026 GDP growth forecast of 4.2% reflects AI-driven manufacturing efficiency, smart city infrastructure, and digital services expansion. The geopolitical dimension of AI competition is reshaping global economic dynamics, with early AI adopters gaining substantial advantages in trade and industry.

Europe faces a different competitive reality. While demonstrating economic resilience—growing near trend despite energy crises and trade tensions—the region’s limited AI investment compared to the U.S. and China raises concerns about falling further behind. The euro area’s 2026 growth projection of approximately 1% reflects this technology gap. As Barclays Research notes, Europe’s avoidance of tech-driven volatility may also mean missing the upside that AI investment delivers.

Emerging markets present a diverse picture. Regions investing in AI infrastructure and education are positioning for leapfrog growth, bypassing legacy systems to implement AI-native solutions. Countries that fail to invest risk increasing divergence from more technologically advanced economies.

The wage premium for AI expertise has increased by over 50%, creating a global talent competition. Nations attracting and retaining AI talent strengthen their economic foundations while those losing talent face brain drain that undermines competitiveness. Immigration policies balancing security concerns with talent attraction will significantly impact national AI capabilities and economic outcomes.

AI-driven trade advantages are emerging across industries. Manufacturing operations optimized through AI achieve cost and quality advantages that reshape global supply chains. Financial services firms leveraging AI for risk assessment and customer service gain market share from less technologically sophisticated competitors. Technology companies with advanced AI capabilities establish platform dominance that generates winner-take-most dynamics.

National security dimensions of AI competitiveness extend to economic security. Countries dependent on foreign AI technology for critical infrastructure face strategic vulnerabilities. Conversely, nations developing indigenous AI capabilities gain economic resilience alongside security advantages.

The compound annual growth rate of 36.89% for the global AI market through 2031, reaching $1.68 trillion, creates enormous opportunity for economies positioned to capture this growth. Countries establishing AI research centers, training AI talent, building supporting infrastructure, and creating regulatory frameworks that balance innovation with appropriate oversight are positioning themselves for decades of competitive advantage.

Corporate competitiveness within nations follows similar patterns. Bain’s Executive AI Survey shows AI climbing to a top-three strategic priority for 14% more leaders within one year. Early corporate adopters are capturing market share, attracting talent, and establishing competitive moats through AI capabilities that late movers will struggle to replicate.

The IMF notes that countries investing early in AI will gain significant advantages, reshaping trade and industry dynamics. This isn’t speculation—it’s already observable in productivity statistics, patent filings, venture capital flows, and economic growth differentials. The nations and regions leading in 2026 are establishing advantages that will define economic leadership for generations.

Conclusion: Navigating the AI-Driven Economic Transition

The evidence is compelling and the trajectory clear: AI automation is fundamentally reshaping economic growth in 2026 and beyond. From McKinsey’s projection of $4.4 trillion in annual productivity gains to the Federal Reserve’s attribution of “structural boom” dynamics to automation and AI, the macroeconomic impact is measurable and accelerating.

Yet this transformation brings challenges alongside opportunities. The Penn Wharton Budget Model estimates that 40% of current employment faces potential AI exposure, necessitating massive reskilling efforts. The World Economic Forum projects that 35-40% of skills will shift within five years, creating an imperative for education systems, employers, and workers to adapt rapidly.

The digital divide threatens to become an AI divide. While 78% of enterprises use AI in at least one business function, only 6% qualify as “AI high performers” generating over 5% EBIT impact. This gap between experimentation and implementation reveals that simply adopting AI doesn’t guarantee success—strategic deployment, organizational change management, and cultural transformation prove equally essential.

Ethical considerations demand ongoing attention. As AI systems make consequential decisions affecting credit access, employment, healthcare, and justice, ensuring fairness, transparency, and accountability becomes critical. The 77% of businesses worried about AI hallucinations and the 70-85% AI project failure rate underscore implementation challenges that cannot be ignored.

The economic opportunity, however, substantially outweighs the risks for societies willing to manage this transition thoughtfully. Global AI spending reaching $2 trillion in 2026 represents investment in productivity, competitiveness, and innovation that will compound over decades. The projected $22.3 trillion cumulative GDP impact by 2030 from AI investments demonstrates the transformation’s scale.

For business leaders, the message is clear: AI adoption has moved past experimental to strategic imperative. Organizations getting meaningful results share common patterns: committing over 20% of digital budgets to AI, investing 70% of AI resources in people and processes rather than just technology, implementing appropriate human oversight, and maintaining realistic 2-4 year ROI timelines.

For policymakers, the challenge involves balancing innovation encouragement with appropriate guardrails. Supporting AI education and reskilling programs, fostering AI research and development, building supporting digital infrastructure, and establishing regulatory frameworks that protect citizens while enabling progress will determine national competitiveness and shared prosperity.

For workers, the opportunity lies in embracing AI as a tool that amplifies human capabilities rather than replaces them. The most successful professionals in 2026 are those who leverage AI to handle routine work while focusing human creativity, judgment, empathy, and strategic thinking on challenges machines cannot address.

The AI-driven economic transformation of 2026 recalls previous technological revolutions—the steam engine, electricity, the internet—each of which fundamentally reshaped society while generating enormous prosperity. As with those transitions, the path forward requires bold vision tempered by practical wisdom, rapid innovation balanced by thoughtful governance, and unwavering focus on ensuring benefits extend broadly rather than accumulating narrowly.

The structural boom Federal Reserve Chair Powell identified isn’t guaranteed—it requires deliberate choices by businesses, governments, and individuals to invest wisely, adapt continuously, and ensure this technological revolution serves humanity’s broader flourishing. The economic prize is substantial: trillions in productivity gains, millions of new opportunities, and sustained growth that raises living standards globally.

The question facing us isn’t whether AI automation will transform the economy—that’s already happening. The question is whether we’ll navigate this transformation with sufficient wisdom to maximize benefits while minimizing disruption, to distribute gains broadly while spurring innovation, and to build an AI-augmented future that works for everyone.

As 2026 unfolds, the answer to that question will be written not in algorithms and data centers, but in boardrooms, classrooms, legislative chambers, and workplaces around the world. The potential is vast, the challenges real, and the opportunity historic. How we respond will define economic growth not just for 2026, but for decades to come.

Sources and Further Reading

- McKinsey Global Institute. “The Economic Potential of Generative AI: The Next Productivity Frontier” (2023)

- Penn Wharton Budget Model. “The Projected Impact of Generative AI on Future Productivity Growth” (September 2025)

- International Monetary Fund. “World Economic Outlook” (October 2025)

- Federal Reserve Economic Data and Chair Powell’s testimony (December 2025)

- Vanguard. “How Will AI Shape the Economy and Markets in 2026?” (November 2025)

- Bain & Company. “Executive AI Survey” (2025)

- Gartner IT Spending Forecasts and AI Predictions (2024-2025)

- World Economic Forum. Reports on AI adoption and workforce transformation

- InsuranceNewsNet. “2025 Industry Analysis on AI Adoption”

- Multiple case studies from Microsoft, Google Cloud, and enterprise technology providers

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

China Plays the Long Game: What Beijing’s Measured Response to Trump’s New Tariffs Means for US-China Trade Talks 2026

As a Supreme Court ruling strips Washington of its most powerful tariff weapon, Beijing signals strategic patience ahead of a high-stakes presidential summit — and the world’s markets are watching.

China vows to decide on US tariff countermeasures “in due course” while welcoming the sixth round of US-China trade consultations. Here’s what the Supreme Court ruling, Trump’s China visit, and Beijing’s record trade surplus mean for global markets in 2026.

There is an old Chinese proverb that patience is power. In the escalating theater of US-China trade tensions, Beijing appears to have taken that maxim as official policy. On Tuesday, China’s Ministry of Commerce signaled it would respond to President Donald Trump’s newly announced 15% blanket tariff on all US imports — not with an immediate salvo, but with carefully calibrated restraint, pledging to decide on countermeasures “in due course.” That phrase, deceptively simple, conceals a sophisticated geopolitical calculation made infinitely more complex by a landmark US Supreme Court ruling that has fundamentally altered the architecture of the trade war.

Welcome to the newest chapter of US-China trade talks 2026 — and it may be the most consequential one yet.

The Supreme Court Ruling That Changed Everything

To understand Beijing’s composure, you first have to understand what happened in Washington last Friday. The US Supreme Court struck down tariffs imposed under the International Emergency Economic Powers Act (IEEPA), the legal scaffolding Trump had used to levy sweeping duties on Chinese goods. Those tariffs had subjected Chinese imports to an additional 20% charge. With that authority now invalidated, Trump announced a substitute measure: a 15% temporary tariff on imports from all countries, a blunter instrument that legal scholars and trade analysts immediately flagged as constitutionally fragile.

For Beijing, the ruling was not merely a legal technicality — it was a strategic windfall. As the Council on Foreign Relations has noted, the Supreme Court’s decision meaningfully constrains the executive branch’s ability to deploy emergency tariff authority unilaterally, weakening the credibility of future tariff threats and handing China’s trade negotiators a structural advantage at the bargaining table. The impact of the Supreme Court ruling on US-China tariffs in 2026 cannot be overstated: Washington’s tariff weapon has been legally blunted, and Beijing knows it.

China’s commerce ministry official was measured but unmistakably pointed in response. “China has consistently opposed all forms of unilateral tariff measures,” the official said Tuesday, “and urges the US side to cancel unilateral tariffs and refrain from further imposing such tariffs.” Translation: China is not going to blink — and it no longer has to.

China’s Negotiating Position: Stronger Than the Headlines Suggest

Analysts assessing China’s response to new US tariffs in the post-IEEPA era should resist the temptation to read Beijing’s patience as weakness. The data tells a different story.

Despite the full weight of US tariff pressure across 2025, China’s economy grew at 5% in 2025, meeting its official target and confounding forecasters who predicted a more severe slowdown. Yes, US imports from China fell sharply — by approximately 29% over the year — but Chinese exporters demonstrated remarkable adaptability, pivoting aggressively toward Southeast Asia, Japan, and India. The result: a record trade surplus of roughly $1 trillion in the first eleven months of 2025, according to Chinese customs data. That figure is not just an economic statistic; it is a geopolitical statement.

Global supply chain shifts from the US-China trade war have, paradoxically, expanded China’s trade network rather than isolated it. Vietnamese factories now process Chinese intermediate goods before export to the United States. Indian manufacturers source Chinese components at scale. The diversification that Washington hoped would weaken Beijing has instead made Chinese trade flows more resilient and more globally embedded.

Key data points underpinning China’s leverage:

- GDP growth of 5% in 2025 despite sustained US tariff pressure

- US imports from China down 29%, but export diversification to Asia offsets losses

- Record $1 trillion trade surplus in the first 11 months of 2025

- Supreme Court ruling invalidating IEEPA tariffs, limiting Trump’s unilateral authority

- Sixth round of US-China economic and trade consultations on the near-term horizon

The Sixth Round: “Frank Consultations” in a Charged Atmosphere

The commerce ministry’s announcement that China is willing to hold frank consultations during the upcoming sixth round of US-China economic and trade talks is diplomatically significant. In the lexicon of Chinese official communication, “frank” is a carefully chosen word. It signals both seriousness of purpose and a willingness to engage on difficult issues — without promising concessions.

What should the sixth round US-China trade consultations analysis account for? First, the structural asymmetry created by the Supreme Court ruling means the US arrives at the table with reduced coercive leverage. Second, China’s domestic economic performance insulates Beijing from the urgency that might otherwise force hasty compromise. Third, the approaching Trump-Xi summit creates a diplomatic deadline that cuts both ways: both sides have incentives to show progress, but neither wants to appear to have capitulated.

The Wall Street Journal has reported that Beijing views the court ruling as an opening — a chance to reframe negotiations on more equitable terms rather than under the shadow of maximalist tariff threats. That reframing will likely define the sixth round’s tone.

Trump’s China Visit: Summit Diplomacy Under a New Tariff Reality

Perhaps the most dramatic element of this unfolding story is the announcement that President Trump is scheduled to visit China from March 31 to April 2 for direct talks with President Xi Jinping. The economic implications of the Trump-Xi summit in April 2026 are substantial, and they extend well beyond bilateral trade.

Markets have already taken note — and not optimistically. US stocks stumbled following Trump’s 15% tariff announcement, with investors recalibrating expectations for a near-term trade resolution. The prospect of a presidential summit offers hope for de-escalation, but the diplomatic road between now and April is strewn with obstacles.

Taiwan remains a structural irritant in any trade discussion. Beijing has consistently insisted that its “one China” position is non-negotiable, and any US moves on Taiwan arms sales or official contacts risk derailing economic negotiations entirely. Meanwhile, Trump’s domestic political constituency demands visible toughness on China — a constraint that limits his negotiating flexibility even as the courts limit his tariff authority.

As CNBC has observed, China’s leverage before this high-stakes summit has materially increased since the Supreme Court’s ruling. The question is whether Trump can construct a face-saving framework that satisfies his base while offering Beijing enough substantive concessions to justify Xi Jinping’s engagement.

What Does China’s Stance Mean for Global Markets?

For investors and policymakers monitoring the situation, China’s “in due course” posture on countermeasures to US tariffs carries a specific signal: Beijing is in no hurry to escalate, because it doesn’t need to. The current trajectory favors strategic patience.

But patience has limits. If the 15% blanket tariff survives legal challenge and takes full effect, China’s commerce ministry has both the rhetorical justification and economic capacity to respond — whether through targeted duties on US agricultural exports, restrictions on rare earth materials critical to American technology supply chains, or regulatory pressure on US companies operating in China.

The global implications are equally consequential. The WTO’s dispute resolution mechanisms, already strained by years of US unilateralism, face further stress as both sides maneuver outside established multilateral frameworks. Emerging economies caught between Washington and Beijing — particularly in Southeast Asia — face mounting pressure to choose sides in a bifurcating trade architecture.

China’s trade surplus amid US tariffs in 2026 also raises uncomfortable questions for the European Union and other trading partners. A flood of Chinese goods diverted from the US market is already generating trade friction in Europe and Asia, creating pressure for their own defensive measures and complicating the global supply chain shifts from the US-China trade war.

Looking Ahead: Three Scenarios for the Summit

Scenario One: Managed De-escalation. The sixth round of talks produces a face-saving framework — a pause on new tariffs, renewed market access commitments from Beijing, and a summit declaration emphasizing “strategic communication.” Markets rally, tensions simmer but stabilize. Probability: moderate, contingent on domestic political constraints on both sides.

Scenario Two: Symbolic Summit, Structural Stalemate. Trump and Xi meet, photos are taken, statements are issued. But the fundamental disagreements over technology decoupling, Taiwan, and trade imbalances remain unresolved. The 15% tariff stays. China holds its countermeasures in reserve. The trade war continues by other means. Probability: high, reflecting the structural depth of the conflict.

Scenario Three: Escalatory Breakdown. Legal challenges to the 15% tariff succeed, Trump seeks new legislative authority, and China responds to a hardened US position with targeted countermeasures on agriculture and rare earths. The summit is postponed or canceled. Global markets reprice risk sharply downward. Probability: lower but non-trivial, especially if Taiwan developments intervene.

The Bottom Line

The phrase “in due course” may sound like bureaucratic evasion, but in the context of US-China trade talks in 2026, it represents a sophisticated strategic posture. China is not reacting — it is calibrating. The Supreme Court’s ruling has handed Beijing a structural advantage at precisely the moment a presidential summit demands careful choreography. China’s economic resilience, its record trade surplus, and its expanding export network have all strengthened its hand.

As the New York Times has noted, Trump arrives at this summit with both an opportunity and a liability: the chance for a landmark diplomatic achievement, burdened by reduced legal leverage and an electorate expecting visible wins. For Xi Jinping, the calculus is simpler — wait, negotiate with clarity, and let Washington’s internal contradictions do some of the work.

In a trade war that has reshaped global supply chains and tested the limits of economic statecraft, Beijing’s patience may prove to be its most effective weapon of all.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

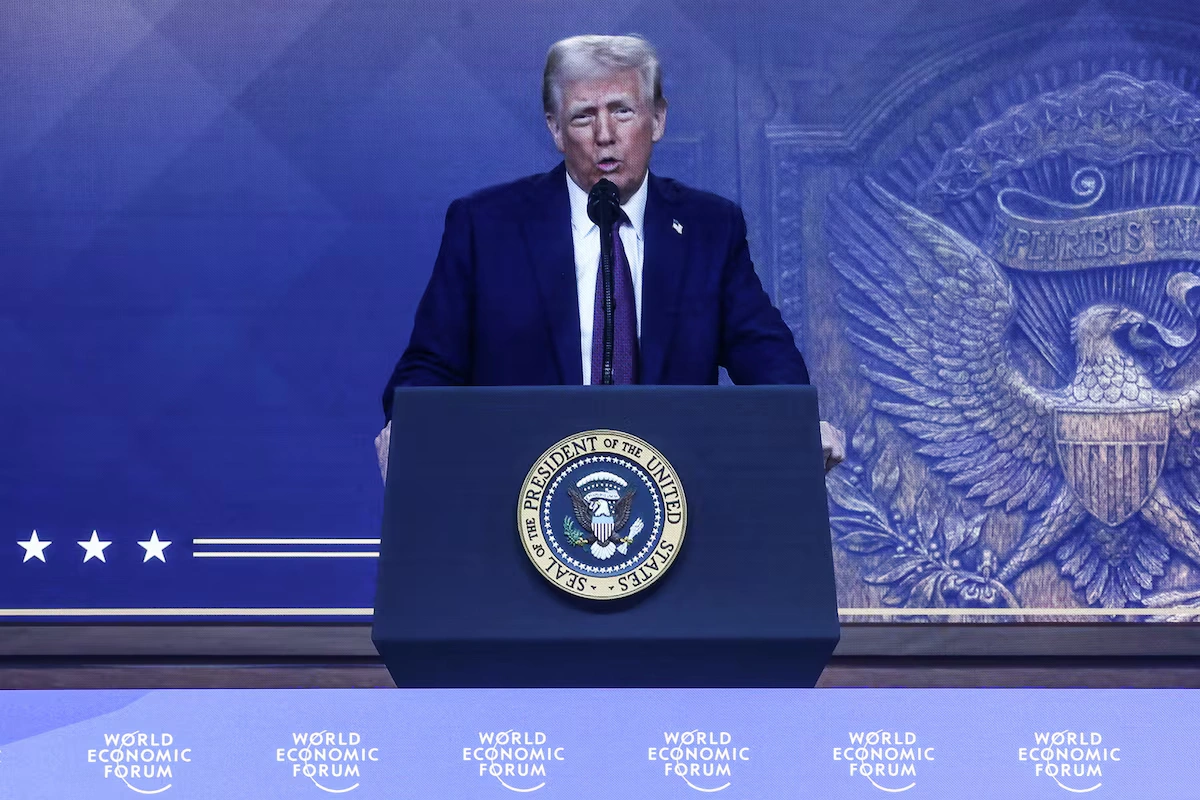

Trump’s 2026 State of the Union: Navigating Low Polls, Shutdowns, and Divisions in a Fractured America

Explore President Trump’s upcoming 2026 SOTU address amid record-low approval and political turmoil—insights on the US economy, immigration, and foreign policy shifts.

A year after reclaiming the White House in a historic political comeback, President Donald Trump will step up to the House rostrum on Tuesday at 9 p.m. ET to deliver his State of the Union address. The political climate he faces, however, is one of unusual fragility. Midway between his inauguration and the critical November midterm elections, this 2026 SOTU preview reveals a commander-in-chief confronting a partial government shutdown, rare judicial rebukes, and deep fractures within his own coalition.

When Trump last addressed Congress in March 2025, his approval rating hovered near a career high, buoyed by the momentum of his return to power. Today, he faces an electorate thoroughly fatigued by persistent inflation and systemic gridlock. Tuesday’s address is intended to showcase a leader who has unapologetically reshaped the federal government. Yet, as the Trump State of the Union amid low polls approaches, the spectacle will inevitably be weighed against the stark economic and political realities defining his second act.

Sagging Polls and Economic Realities

Historically, Trump has leveraged economic metrics as his strongest political shield. But the US economy under Trump 2026 presents a complicated picture for international economist researchers and everyday voters alike. According to recent data from the Bureau of Economic Analysis, while the stock market has seen notable rallies, 2025 marked the slowest year for job and economic growth since the pandemic-induced recession of 2020.

A recent Gallup tracking poll places his overall approval rating near record lows. Furthermore, roughly two-thirds of Americans currently describe the nation’s economy as “poor”—a sentiment that mirrors the frustrations felt during the latter half of the Biden administration. Grocery, housing, and utility costs remain stubbornly high. Analysts at The Economist note that the US labor market has settled into a stagnant “low-hire, low-fire” equilibrium, heavily exacerbated by sweeping trade restrictions.

| Economic & Polling Indicator | March 2025 (Inauguration Era) | February 2026 (Current) |

| Overall Approval Rating | 48% | 39% |

| Immigration Handling Approval | 51% | 38% |

| GDP Growth (Quarterly) | 4.4% (Q3 ’25) | 1.4% (Q4 ’25 Advance) |

| Economic Sentiment (“Poor”) | 45% | 66% |

Trump has vehemently defended his record, insisting last week that he has “won” on affordability. In his address, he is widely expected to blame his predecessor, Joe Biden, for lingering systemic economic pain while claiming unilateral credit for recent Wall Street highs.

Immigration Backlash and Shutdown Stalemate

Adding to the drama of the evening, Tuesday will mark the first time in modern US history that a president delivers the annual joint address amid a funding lapse. The partial government shutdown, now in its second week, centers entirely on the Department of Homeland Security.

Funding for DHS remains frozen as Democratic lawmakers demand stringent guardrails on the administration’s sweeping immigration crackdown. The standoff reached a boiling point following the deaths of two American citizens by federal agents during border protests in January. This tragic incident sparked nationwide outrage and eroded what was once a core political advantage for the President. An AP-NORC poll recently revealed that approval of Trump’s handling of immigration has plummeted to just 38%. The political capital he once commanded on border security is now deeply contested territory.

The Supreme Court Rebuke and Congressional Dynamics

Trump will be speaking to a Republican-led Congress that he has frequently bypassed. While he secured the passage of his signature tax legislation last summer—dubbed the “Big, Beautiful Bill,” which combined corporate tax cuts and immigration enforcement funding with deep reductions to Medicaid—he has largely governed via executive order.

This aggressive use of executive authority recently hit a massive judicial roadblock. Last week, the Supreme Court struck down many of Trump’s sweeping global tariffs, a central pillar of his economic agenda. In a pointed majority opinion, Trump-nominated Justice Neil Gorsuch warned against the “permanent accretion of power in the hands of one man.”

This ruling has massive implications for global trade. Financial analysts at The Financial Times suggest that the removal of these tariffs could ease some inflationary pressures, though Trump has already vowed to pursue alternative legal mechanisms to keep import taxes active, promising prolonged uncertainty for international markets.

Simultaneously, Trump’s coalition is showing signs of fraying:

- Demographic Shifts: Americans under 45 have sharply turned against the administration.

- Latino Voters: A demographic that shifted rightward in 2024 has seen steep drops in approval following January’s border violence.

- Intra-Party Apathy: Nearly three in 10 Republicans report that the administration is failing to focus on the country’s most pressing structural problems.

Trump Foreign Policy Shifts and Global Tensions

Foreign policy is expected to feature heavily in the address, highlighting one of the most unpredictable evolutions of his second term. Candidate Trump campaigned heavily on an “America First” platform, promising to extract the US from costly foreign entanglements. However, Trump foreign policy shifts over the last twelve months have alarmed both critics and isolationist allies.

The administration has dramatically expanded US military involvement abroad. Operations have ranged from seizing Venezuela’s president and bolstering forces around Iran to authorizing a lethal campaign of strikes on alleged drug-smuggling vessels—operations that have resulted in scores of casualties. For global observers and defense analysts at The Washington Post, this muscular, interventionist approach contradicts his earlier populist rhetoric, creating unease among voters who favored a pullback from global policing.

What to Expect: A Trump Midterm Rally Speech

Despite the mounting pressures, Trump is unlikely to strike a chastened or conciliatory tone. Observers should expect a classic Trump midterm rally speech.

“It’s going to be a long speech because we have a lot to talk about,” Trump teased on Monday.

Key themes to watch for include:

- Defending the First Year: Aggressive framing of the “Big, Beautiful Bill” and an insistence that manufacturing is successfully reshoring.

- Attacking the Courts and Democrats: Expect pointed rhetoric regarding the Supreme Court’s tariff ruling and the ongoing DHS shutdown.

- Political Theater: Democratic leader Hakeem Jeffries has urged his caucus to maintain a “strong, determined and dignified presence,” but several progressive members have already announced plans to boycott the speech in silent protest. For details on streaming the event, see our guide on How to Watch Trump’s State of the Union.

Conclusion: A Test of Presidential Leverage

For a president who has built a global brand on dominance and disruption, Tuesday’s State of the Union represents a profoundly different kind of test. The visual of Trump speaking from the dais while parts of his own government remain shuttered and his signature tariffs sit dismantled by his own judicial appointees is a potent symbol of his current vulnerability.

The core question for international markets and domestic voters alike is no longer whether Trump can shock the system, but whether he can stabilize it. To regain his footing ahead of the November midterms, he must persuade a highly skeptical public that his combative priorities align with their economic needs—and prove that his second act in the White House is anchored by strategy rather than adrift in grievance.

Discover more from The Economy

Subscribe to get the latest posts sent to your email.

Analysis

Transforming Karachi into a Livable and Competitive Megacity

A comprehensive analysis of governance, fiscal policy, and urban transformation in South Asia’s most complex megacity

Based on World Bank Diagnostic Report | Policy Roadmap 2025–2035 | $10 Billion Transformation Framework

PART 1: EXECUTIVE SUMMARY & DIAGNOSTIC FRAMEWORK

Karachi is a city in contradiction. The financial capital of the world’s fifth-most populous nation, it contributes between 12 and 15 percent of Pakistan’s entire GDP while remaining home to some of the most acute urban deprivation in South Asia. A landmark World Bank diagnostic, the foundation of this expanded analysis, structures its findings around three interconnected “Pathways” of reform and four operational “Pillars” for transformation. Together, they constitute a $10 billion roadmap to rescue a city that is quietly—but measurably—losing its economic crown.

The Three Pathways: A Diagnostic Overview

Pathway 1 — City Growth & Prosperity

The central paradox driving the entire World Bank report is one that satellite imagery has made impossible to ignore. While Karachi officially generates between 12 and 15 percent of Pakistan’s national GDP—an extraordinary concentration of economic output in a single metropolitan area—the character and location of that wealth is shifting in troubling ways. Nighttime luminosity data, a reliable proxy for economic intensity, shows a measurable dimming of the city’s historic core. High-value enterprises, anchor firms, and knowledge-economy businesses are quietly relocating to the unmanaged periphery, where land is cheaper, regulatory friction is lower, and the absence of coordinated planning perversely functions as a freedom.

This is not simply a real estate story. It is a harbinger of long-term structural decline. When economic activity migrates from dense, serviced urban centers to sprawling, infrastructure-poor peripheries, the fiscal returns per unit of land diminish, commute times lengthen, productivity suffers, and the social fabric of mixed-use neighborhoods frays. Karachi is not alone in this dynamic—it mirrors patterns seen in Lagos, Dhaka, and pre-reform Johannesburg—but the speed and scale of its centrifugal drift are alarming.

Yet the picture is not uniformly bleak. One of the report’s most striking findings is the city’s quiet success in poverty reduction. Between 2005 and 2015, the share of Karachi’s population living in poverty fell from 23 percent to just 9 percent, making it one of the least poor districts anywhere in Pakistan. This achievement, largely the product of informal economic dynamism, remittance flows, and the resilience of its entrepreneurial working class, stands as proof that Karachi’s underlying human capital remains formidable. The governance challenge is not to create prosperity from nothing—it is to stop squandering the prosperity that already exists.

“Karachi’s economy is like a powerful engine running on a broken chassis. The horsepower is there. The infrastructure to harness it is not.”

Pathway 2 — City Livability

By global benchmarks, Karachi is a city in crisis. It consistently ranks in the bottom decile of international livability indices, a fact that reflects not mere inconvenience but a fundamental failure of urban governance to provide the basic services that allow residents to live healthy, productive, and dignified lives.

Water and sanitation constitute the most acute dimension of this failure. The city’s non-revenue water losses—water that enters the distribution system but never reaches a paying consumer due to leakage, illegal connections, and metering failures—are among the highest recorded for any city of comparable size globally. In a megacity of 16 to 20 million people, depending on the methodology used to define its boundaries, these losses translate into hundreds of millions of liters of treated water wasted daily while residents in katchi abadis pay informal vendors a price per liter that is many multiples of what wealthier households in serviced areas pay through formal utilities. This regressive dynamic—where the urban poor subsidize systemic dysfunction—is one of the defining injustices of Karachi’s service delivery crisis.

Green space presents a related but distinct vulnerability. At just 4 percent of total urban area, Karachi’s parks, tree canopy, and public open spaces are a fraction of the 15 to 20 percent benchmarks recommended by urban health organizations. In a coastal city where summer temperatures routinely exceed 40 degrees Celsius and where the Arabian Sea’s humidity compounds heat stress, this deficit is not merely aesthetic. It is a public health emergency waiting to erupt. The urban heat island effect—whereby dense built environments trap and re-radiate solar energy, raising local temperatures by several degrees above surrounding rural areas—disproportionately affects the informal settlements that house half the city’s population and where air conditioning is a luxury few can afford.

Underlying both crises is the governance fragmentation that the report identifies as the structural root cause of virtually every livability failure. Karachi is currently administered by a patchwork of more than 20 federal, provincial, and local agencies. These bodies collectively control approximately 90 percent of the city’s land. They include the Defence Housing Authority, the Karachi Port Trust, the Karachi Development Authority, the Malir Development Authority, and a constellation of cantonment boards, each operating according to its own mandate, budget cycle, and institutional incentive structure. The result is what urban economists call a “tragedy of the commons” applied to governance: because no single entity bears comprehensive responsibility for the city’s functioning, no single entity has the authority—or the accountability—to coordinate a systemic response to its failures.

“In Karachi, everyone owns the problem and no one owns the solution. That is not governance; it is organized irresponsibility.”

Pathway 3 — City Sustainability & Inclusiveness

The fiscal dimension of Karachi’s crisis is perhaps the most analytically tractable, because it is the most directly measurable. Property taxation—the foundational revenue instrument of urban government worldwide, and the mechanism by which cities convert the value of land and improvements into public services—is dramatically underperforming in Sindh relative to every comparable benchmark.

The International Monetary Fund’s cross-country data confirms that property tax yields in Sindh are significantly below those achieved in Punjab, Pakistan’s other major province, and far below those recorded in comparable Indian metropolitan areas such as Mumbai, Pune, or Hyderabad. The gap is not marginal. Whereas a well-functioning urban property tax system should generate revenues equivalent to 0.5 to 1.0 percent of local GDP, Karachi’s yields fall well short of this range. The consequences are compounding: underfunded maintenance leads to asset deterioration, which reduces the assessed value of the property base, which further constrains tax revenues, which deepens the maintenance deficit. This is a fiscal death spiral, and Karachi is caught within it.

Social exclusion compounds the fiscal crisis in ways that resist easy quantification. Approximately 50 percent of Karachi’s population—somewhere between 8 and 10 million people—lives in katchi abadis, the informal settlements that have grown organically on land not formally designated for residential use, often lacking title, rarely connected to formal utility networks, and perpetually vulnerable to eviction or demolition. The rapid growth of these settlements, driven by both natural population increase and sustained rural-to-urban migration, has increased what sociologists describe as social polarization: the geographic and economic distance between the formal, serviced city and the informal, unserviced one.

This polarization is not merely a social concern. It has direct economic consequences. Informal settlement residents who lack property rights cannot use their homes as collateral for business loans. Children who spend excessive time collecting water or navigating unsafe streets have less time for education. Workers who cannot afford reliable transport face constrained labor market options. The informal city subsidizes the formal one through its labor, while receiving little of the infrastructure investment that makes formal urban life possible.

The Four Transformation Pillars

The World Bank’s $10 billion roadmap does not limit itself to diagnosis. It proposes four operational pillars through which the three pathways of reform can be pursued simultaneously. These pillars are not sequential—they are interdependent, and progress on one without the others is unlikely to prove durable.

Pillar 1 — Accountable Institutions

The first and arguably most foundational pillar concerns governance architecture. The report argues, persuasively, that no amount of infrastructure investment will generate sustainable improvement so long as 20-plus agencies continue to operate in silos across a fragmented land ownership landscape. The solution it proposes is a transition from the current provincial-led, agency-fragmented model to an empowered, elected local government with genuine fiscal authority over the metropolitan area.

This is not a technical recommendation. It is a political one. The devolution of meaningful power to an elected metropolitan authority would require the Sindh provincial government—which has historically resisted any erosion of its control over Karachi’s lucrative land assets—to accept a substantial redistribution of authority. It would require federal agencies to cede operational jurisdiction over land parcels they have controlled for decades. And it would require the creation of new coordination mechanisms: inter-agency land-use committees, joint infrastructure planning bodies, and unified development authorities with the mandate and resources to enforce coherent spatial plans.

International precedents for such transitions are encouraging. Greater Manchester’s devolution deal in the United Kingdom, Metropolitan Seoul’s governance reforms in the 1990s, and the creation of the Greater London Authority all demonstrate that consolidating fragmented metropolitan governance into accountable elected structures can unlock significant improvements in both service delivery and economic performance.

Pillar 2 — Greening for Resilience

The climate dimension of Karachi’s transformation cannot be treated as a luxury add-on to more “practical” infrastructure priorities. A city with 4 percent green space in a warming coastal environment is a city accumulating climate risk at an accelerating rate. The 2015 Karachi heat wave, which killed more than 1,200 people in a single week, was a preview of what routine summers will look like within a decade if the urban heat island effect is not actively countered.

The greening pillar encompasses multiple overlapping interventions: expanding parks and urban forests to absorb heat and manage stormwater; restoring the mangrove ecosystems along Karachi’s coastline that serve as natural buffers against storm surges and coastal erosion; redesigning road networks to incorporate permeable surfaces, street trees, and bioswales; and integrating green infrastructure standards into building codes for new development.

These investments are not merely environmental. They are economic. The World Health Organization estimates that urban green space reduces healthcare costs, increases property values in surrounding areas, and improves labor productivity by reducing heat stress. In a city where informal settlement residents have no access to air conditioning, every degree reduction in ambient temperature achievable through urban greening has a direct, measurable impact on human welfare.

Pillar 3 — Leveraging Assets

Karachi possesses one asset in extraordinary abundance: prime urban land controlled by public agencies. The Defence Housing Authority alone controls thousands of hectares in locations that, by any market measure, represent some of the most valuable real estate on the subcontinent. The Karachi Port Trust, the railways, and various federal ministries hold additional parcels of commercially significant land that are either underdeveloped, misused, or lying fallow.

The asset monetization pillar proposes to unlock this latent value through structured Public-Private Partnerships (PPPs) that use land as the primary input for financing major infrastructure projects. The model is well-established: a government agency contributes land at concessional rates to a joint venture, a private developer finances and constructs mixed-use development on a portion of the parcel, and the revenue generated—whether through commercial rents, residential sales, or transit-adjacent development premiums—is used to cross-subsidize the public infrastructure component of the project.

This model has been successfully deployed for mass transit financing in Hong Kong (through the MTR Corporation’s property development strategy), in Singapore (through integrated transit-oriented development), and more recently in Indian cities like Ahmedabad (through the BRTS land value capture mechanism). Karachi’s $10 billion infrastructure gap—encompassing mass transit, water treatment, wastewater management, and flood resilience—is too large for public budgets alone. Asset monetization is not optional; it is the essential bridge between fiscal reality and infrastructure ambition.

Pillar 4 — Smart Karachi

The fourth pillar recognizes that technological capacity is both a multiplier of the other three pillars and a reform agenda in its own right. A city that cannot accurately map its land parcels, track its utility consumption, monitor its traffic flows, or measure its air quality in real time is a city flying blind. Karachi’s current data infrastructure is fragmented, inconsistently maintained, and largely inaccessible to the policymakers who most need it.

The Smart Karachi pillar envisions a comprehensive digital layer over the city’s physical fabric: GIS-based land registries that reduce the scope for fraudulent title claims and agency disputes; smart metering for water and electricity that reduces non-revenue losses; integrated traffic management systems that improve the efficiency of Karachi’s chronically congested road network; and citizen-facing digital platforms that allow residents to pay utility bills, register property transactions, and report service failures without navigating physical bureaucracies that historically reward connection over competence.

Beyond service delivery, digital infrastructure enables a new quality of fiscal accountability. When every property transaction is recorded on a unified digital platform, the scope for tax evasion narrows. When utility consumption is metered and billed accurately, the implicit subsidies that currently flow to well-connected large users are exposed and can be redirected to the residents who actually need them.

PART 2: OPINION ARTICLE

The Megacity Paradox: Can Karachi Reclaim Its Crown?

Originally conceived for The Economist / Financial Times | Policy & Economics Desk

I. The Lights Are Going Out

There is a satellite image that haunts Pakistan’s urban planners. Taken at night, it shows the Indian subcontinent as a constellation of light—Mumbai’s sprawl blazing across the Arabian Sea coast, Delhi’s agglomeration pulsing outward in every direction, Lahore’s core radiating upward into Punjab’s flat horizon. And then there is Karachi.

Karachi is visible, certainly. It is not a dark city. But look closely at the World Bank’s time-series nighttime luminosity analysis, and something disturbing emerges: the city center—the historic financial district that once justified Karachi’s sobriquet as the “City of Lights”—is getting dimmer, not brighter. The economic heartbeat of Pakistan’s largest city is weakening at its core while its periphery sprawls outward in an unlit, unplanned, ungovernable direction.

This is not poetry. It is data. And the data tells a story that no government in Islamabad or Karachi seems to want to confront directly: Pakistan’s financial capital is slowly but measurably losing the competition for economic intensity. While Karachi still accounts for an extraordinary 12 to 15 percent of national GDP—more than any other Pakistani city by an enormous margin—the character of that contribution is shifting from high-value, knowledge-intensive activity to lower-productivity, sprawl-dependent commerce. The lights are going out in the places that matter most.

“A city that cannot govern its center cannot grow its future. Karachi is learning this lesson the hard way.”

II. The Governance Trap: Twenty Agencies and No Captain

To understand why Karachi is losing its economic edge, it is necessary to understand something about how the city is actually governed—which is to say, how it is catastrophically not governed.

More than 20 federal, provincial, and local agencies currently exercise jurisdiction over some portion of Karachi’s land, infrastructure, or services. The Defence Housing Authority controls some of the most commercially prime real estate on the subcontinent. The Karachi Development Authority nominally plans land use for the broader metropolitan area. The Malir Development Authority manages a separate zone. Cantonment boards exercise authority over military-adjacent districts. The Sindh government retains overarching provincial jurisdiction. The federal government maintains control of the port, the railways, and various strategic assets.